Fundamental Forecast for the US Dollar: Neutral

- Fed policymakers will be on the lecture circuit all week long, saturating the economic calendar in a month without a Fed rate decision.

- No data release matters more this week – and perhaps this month – than the September US consumer price index on Thursday.

- According to the IG Client Sentiment Index, the US Dollar has a bullish bias heading into the middle of October.

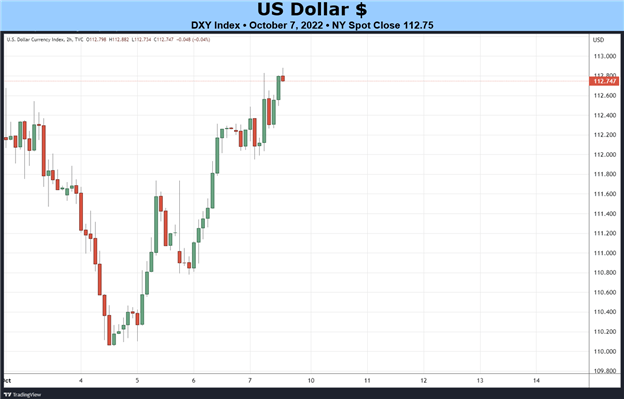

US Dollar Week in Review

The US Dollar (via the DXY Index) recouped early-week losses and turned in a positive performance for the first week of October, closing up by +0.51%. The price action was driven by the top three components of the DXY Index, which each moved modestly in favor of the US Dollar: EUR/USD rates fell by -0.62%; GBP/USD rates dropped by -0.57%; and USD/JPY rates added +0.45%. The late-week rise in US Treasury yields on the back of another impressive US jobs report helped the DXY Index close higher for the third time in four weeks and the sixth time in the past eight weeks overall.

Recommended by Christopher Vecchio, CFA

Get Your Free USD Forecast

All Eyes on Inflation Data

Fed speakers will be out in full force over the coming days, saturating the US economic calendar in absence of a Fed rate decision this month. But the tone of the comments made by Fed policymakers could change dramatically depending upon the upcoming September US inflation report, easily the most important event of the week.

- On Monday, October 10, Chicago Fed President Evans will speak at 13 GMT while Fed Vice-Chair Brainard will give remarks at 17:35 GMT.

- On Tuesday, October 11, Philadelphia Fed President Harker is set to talk at 15:30 GMT followed by Cleveland Fed President Mester at 16 GMT.

- On Wednesday, October 12, weekly US mortgage applications data are due at 11 GMT. The September US producer price index will be released at 12:30 GMT. The September FOMC meeting minutes are scheduled for publication at 18 GMT. Fed Governor Bowman will speak at 22:30 GMT.

- On Thursday, October 13, weekly US jobless claims figures are due at 12:30 GMT, as is the September US inflation report (consumer price index).

- On Friday, October 14, September US retail sales data will be released at 12:30 GMT. August US business inventories and the preliminary October US Michigan consumer sentiment report are scheduled for 14 GMT.

Recommended by Christopher Vecchio, CFA

Trading Forex News: The Strategy

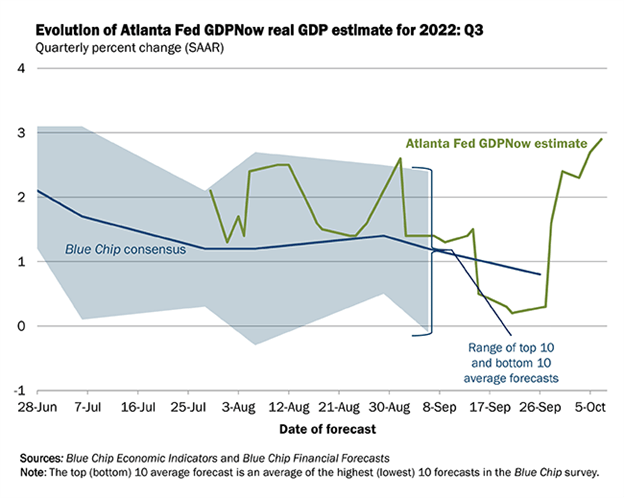

Atlanta Fed GDPNow 3Q’22 Growth Estimate (October 7, 2022) (Chart 1)

Based on the data received thus far about 3Q’22, the Atlanta Fed GDPNow growth forecast is now at +2.9% annualized. The upgrade resulted from “the nowcasts of third-quarter real personal consumption expenditures growth and third-quarter real gross private domestic investment growth increased from 1.1% and -3.6%, respectively, to 1.3% and -3.4%, respectively.”

For full US economic data forecasts, view the DailyFX economic calendar.

Rate Hike Odds Stay Elevated

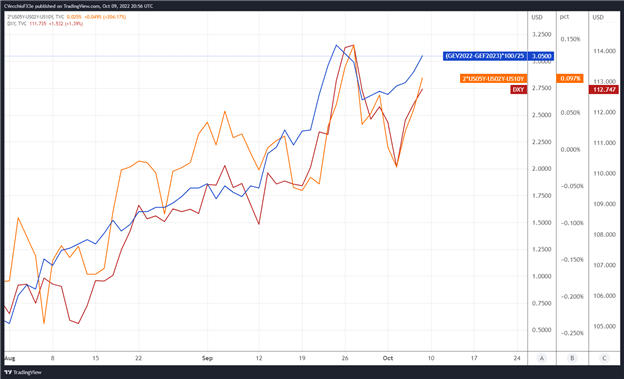

We can measure whether a Fed rate hike is being priced-in using Eurodollar contracts by examining the difference in borrowing costs for commercial banks over a specific time horizon in the future. Chart 1 below showcases the difference in borrowing costs – the spread – for the front month and January 2023 contracts, in order to gauge where interest rates are headed through the end of this year.

Eurodollar Futures Contract Spread (October 2022-January 2023) [BLUE], US 2s5s10s Butterfly [ORANGE], DXY Index [RED]: Daily Timeframe (August to October 2022) (Chart 2)

The past two months have seen a tight relationship among the DXY Index, the shape of the US Treasury yield curve, and Fed rate hike odds. After another strong US labor market report, Eurodollar spreads are still pricing a full 75-bps rate hike for the next Fed meeting in November. At present time, a rate hike in December is not yet discounted via Eurodollar spreads (but is via Fed funds futures); this is a discrepancy that could ultimate favor more US Dollar strength.

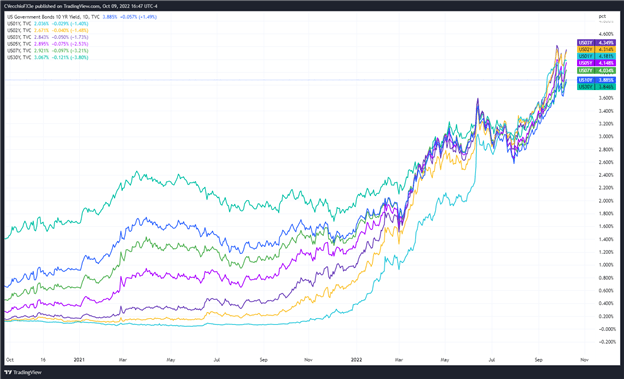

US Treasury Yield Curve (1-year to 30-years) (October 2020 to October 2022) (Chart 3)

The shape of the US Treasury yield curve – remaining inverted near -50-bps – alongside rising Fed rate hike odds continues to be a tailwind for the US Dollar. US real rates (nominal less inflation expectations) are lingering near yearly and multi-decade highs, reinforcing the rally. Resilient Fed rate hike expectations are still a source of organic strength for the US Dollar, and problems abroad, for the British Pound, the Euro, and the Japanese Yen, are providing a meaningful cushion on pullbacks.

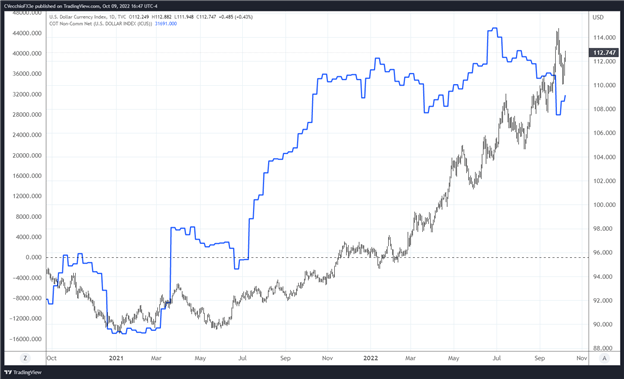

CFTC COT US Dollar Futures Positioning (October 2020 to October 2022) (Chart 4)

Finally, looking at positioning, according to the CFTC’s COT for the week ended October 4, speculators slightly increased their net-long US Dollar positions to 31,691 contracts from 30,609 contracts. A more significant rise in net-long positioning should be anticipated moving forward, given the rally by the US Dollar after the reporting period ended. Overall, US Dollar positioning remains near its most net-long levels in over five years; the long US Dollar trade is still overcrowded.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

— Written by Christopher Vecchio, CFA, Senior Strategist