Euro Rate Talking Points

EUR/USD trades to a fresh weekly low (0.9726) following the larger-than-expected rise in US Non-Farm Payrolls (NFP), and data prints coming out the US may continue to sway the exchange rate as the Consumer Price Index (CPI) is anticipated to show sticky inflation.

Recommended by David Song

Get Your Free EUR Forecast

Fundamental Forecast for Euro: Bearish

EUR/USD carves a series of lower highs and lows after failing to test the 50-Day SMA (0.9996), and the exchange rate may continue to depreciate over the coming days as it appears to be tracking the negative in the moving average.

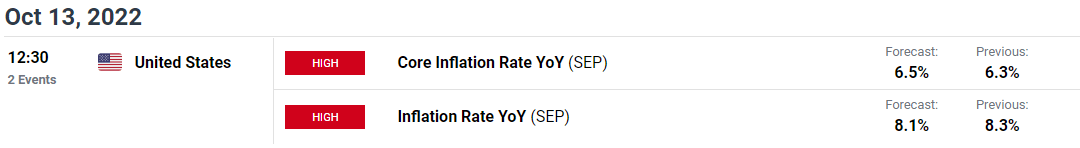

As a result, EUR/USD may struggle to retain the advance from the yearly low (0.9536) as evidence of a resilient labor market allows the Federal Reserve to pursue a restrictive policy, and the update to the US CPI may encourage the central bank to retain its current approach in combating inflation as the core rate, which strips out volatile items such as food and energy prices, is expected to increase to 6.5% in September from 6.3% per annum the month prior.

Another rise in the core CPI may drag on EUR/USD as the Federal Open Market Committee (FOMC) retains a hawkish forward guidance for monetary policy, and the US Dollar may continue to outperform against its major counterparts ahead of the next Fed interest rate decision on November 2 as evidence of sticky inflation fuels speculation for another 75bp Fed rate hike.

Until then, developments coming out of the US may continue to sway EUR/USD as the European Central Bank (ECB) shows little interest in carrying out a restrictive policy, and it remains to be seen if the Governing Council will implement a smaller rate hike at next meeting on October 27 as the actions taken at the September meeting “frontloads the transition from the prevailing highly accommodative level of policy rates towards levels that will ensure the timely return of inflation to our two per cent medium-term target.”

With that said, an uptick in the US CPI report may keep EUR/USD under pressure as the Fed’s Summary of Economic Projections (SEP) reflect a steeper path for US interest rates, and the exchange rate may continue to track the negative slope in the 50-Day SMA (0.9996) as it reverses ahead of the moving average.

Recommended by David Song

Forex for Beginners

— Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong