US EQUITIES TALKING POINTS:

FORECAST: NEUTRAL

- US Equities Finished the Week Positive with Gains Across the Board.

- Nasdaq 100 Leads the Way as Increased Liquidity, Potential for Lower Rates and Technicals all Provide Support.

- Credit Market and Banking Sector Fears Remain a Concern as we Head into a New Week and Could Hinder Further Gains for US Equities.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

US INDICES WEEK IN REVIEW

US indices returns fluctuated wildly during what’s has been a rather turbulent week once more for global markets. Continuing worries around the banking industry and recessionary fears weighed on value stocks while the larger cap stocks gained benefit from falling rate expectations. The financial sectors globally remained under pressure with the US no exception of course with underlying stocks feeling the heat. We did have the Federal Reserve interest rate decision and economic projections as well which saw a notable shift in the dot plot as with officials expected to stop raising rates after one more hike in May. Fed Chair Powell did however rule out rate cuts in 2023 during his press conference with markets needing to show serious signs of deterioration for the Fed to consider such a move.

The S&P 500, Nasdaq 100 and Dow Jones saw fluctuations between gains and losses throughout the week with Wednesday candle closes in particular looking rather ominous. However, Thursday and Friday saw US indices indicate resilience to finish the week in the green despite some fear on Friday as the market mood dampened as Deutsche Bank faced challenges as insurance costs were up via the credit default swaps market (CDS) which increased some 200bps. The shares of Deutsche Bank were down as much as 14%. Following the recent fears in credit markets Global Fund Managers see the biggest tail risk as a systemic credit event rather than inflation for the first time in 9 months, according to a Bank of America survey.

Friday’s data out of the US meanwhile came in largely positive once more with S&P Global revealing that business activity improved in March. The manufacturing data remaining below the expansionary 50 level but did smash estimates as well as February’s print. The S&P 500 ended the week with gains of around 1.6% while the Nasdaq 100 and Dow Jones recorded gains of around 2.3% and 1.2% from last weeks close respectively.

Foundational Trading Knowledge

Understanding the Stock Market

Recommended by Zain Vawda

S&P 500, NASDAQ 100 AND DOW JONES FORECAST FOR THE WEEK AHEAD

Stock indices are refusing to sustain any drops at the moment with a handful of large cap stocks providing the support. It’s worth noting that two stocks (Apple and Microsoft) now account for over 13% of the S&P500 for the first time since the 1970s. Defensive and growth stocks outperformed during the recent banking crisis while cyclical sectors have suffered, and the trend is likely to continue in the short term. Another reason the S&P 500 could continue to find support in the week ahead rests in the fact that $7.3 billion flowed into the SPDR S&P 500 ETF SPY last Thursday. This represents the largest inflow since November 2020 and the 6th largest in the last decade.

Source: www.zerohedge.com

Looking at the Nasdaq 100 FAANG stocks are sharply outperforming the S&P 500 which shouldn’t be a surprise given the fall in rate hike expectations with market participants still hopeful of rate cuts from the Fed in 2023. The Nasdaq does seem to benefit from fresh liquidity as well as a lower rate environment. This continued rise in FAANG stocks comes despite the fact that fundamental factors remain a concern with many stocks trading at 22x their earnings.

However, since when have FAANG stocks risen based on logic? If the pandemic and the rise of retail investors have proven anything it’s that these stock benefit from excess liquidity and the potential for fresh innovation. The recent rise of AI development and the involvement of many FAANG companies, coupled with markets expecting rate cuts later in 2023 as well as the recent bank bailouts could lead to continued support for tech stocks and the Nasdaq 100. This is without taking into account the number of layoffs in 2023 and the announcement by some companies that further layoffs are in the offing which could boost profitability hopes moving forward.

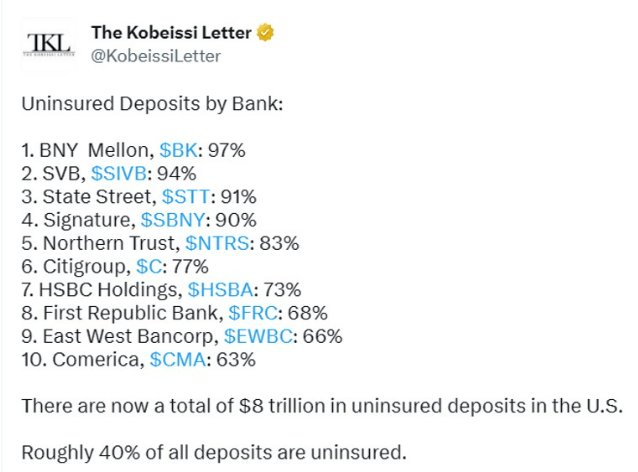

Market moves in the week ahead are likely to be largely driven by sentiment as we have a lack of significant economic event risk (Data out this week won’t have a material impact on markets in my opinion). With that in mind the banking sector situation will continue to be at the forefront as continued fallout for US regional banks remains a threat. US Treasury Secretary Janet Yellen may become a source of focus given her flip-flopping commentary on insuring deposits this past week. Treasury Secretary Janet Yellen told US lawmakers on Thursday that regulators would be prepared for further steps to protect the banking system if warranted, a day after her remarks on nationwide deposit insurance saw markets dive. Many analysts attribute stock declines on Wednesday to Yellen rather than Fed Chair Powell and the FOMC meeting.

Any further woes in the banking sector in the week ahead is likely to bring this conversation to the fore and could be a driving force for market moves. A continuation of calm in the markets however is likely to see US Indices eye further gains in the week ahead. My outlook for the week ahead remains neutral with the banking sector uncertainty still overshadowing the technicals at present.

Foundational Trading Knowledge

DailyFX Education Walkthrough

Recommended by Zain Vawda

ECONOMIC CALENDAR FOR THE WEEK AHEAD

The week ahead on the calendar is still busy out of the US with four ‘high’ rated data releases, and a host of ‘medium’ rated data releases.

Here are the four high ‘rated’ risk events for the week ahead on the economic calendar:

- On Tuesday, March 28, we have CB Consumer Confidence data due at 14h00 GMT.

- On Thursday, March 30, we have the Final GDP Growth Rate Q0Q data due at 12h30 GMT.

- On Friday, March 31, we also have the Feds preferred gauge of inflation the Core PCE Price Index due at 12h30 GMT.

- On Friday, March 31, we close out the week with the Michigan Consumer Sentiment (final) at 14h00 GMT.

For all market-moving economic releases and events, see the DailyFX Calendar

TECHNICAL OUTLOOK

S&P 500 Daily Chart

Source: TradingView, prepared by Zain Vawda

From a technical perspective the S&P has been making higher highs and higher lows since bottoming out on March 13 around the 3800 mark. On the daily timeframe we can see every bearish day since has failed to follow through with the index posting a bullish day thereafter. The pattern continued this week as the index found support at the 200-day MA, with price action suggesting a new higher high may be incoming. Should we push higher and print a fresh high the resistance level at around 4079 may come into focus with price struggling to break higher for the whole of March thus far.

NASDAQ 100 Daily Chart

Source: TradingView, prepared by Zain Vawda

The Nasdaq 100 as mentioned earlier has been the standout performer of late since printing a low around the 11686 mark on March 13 (which was also the swing high on January 18). Around that time, we had a golden cross with the 50-day MA crossing above the 200-day MA and the daily candle bouncing of the 100-day MA all hinting at the recent upside rally from a technical perspective.

This past week did see us print a fresh YTD high just shy of the psychological 13000 handle with Friday’s candle closing as a hammer hinting at further upside. A break to the upside faces resistance around the 13200 mark with a break above here seeing $13600 come into focus (which hasn’t been reached since August 2022). On the downside key support areas lie at 12567 and 12406 with a daily candle close below here indicating a change of structure in the short term and could lead to a deeper retracement. This would see the 50-day MA come into focus around the 12200 handle.

— Written by Zain Vawda for DailyFX.com

Contact and follow Zain on Twitter: @zvawda