Japanese Yen, USD/JPY, Banking Sector, Treasury Yields – Asia Pacific Market Open:

- Japanese Yen weakens as US banking sector volatility calmed

- Traders started to price out aggressive Fed rate cuts later on

- Further gains in Treasury yields may push USD/JPY higher

Asia-Pacific Market Briefing – Markets Calm After a Volatile Monday

The Japanese Yen underperformed against its major counterparts on Tuesday. This was a day when global market volatility cautiously cooled following a relief rally in banking stocks amid elevated uncertainty in the wake of last week’s collapse of Silicone Valley Bank. On Wall Street, the S&P 500 and tech-heavy Nasdaq Composite rallied 1.68% and 2.14%, respectively.

This is as the VIX market ‘fear gauge’ sharply reversed lower, dropping 10.45% and hinting that the worst of the turmoil might have passed. There was a sharp push higher in front-end Treasury yields as traders started to price out anticipated rate cuts later this year because of SVB’s collapse. In fact, over the past 24 hours, about 30 basis points in tightening wre added back into the outlook for the six-month horizon.

This is where the Japanese Yen comes in and why it underperformed. For starters, JPY is often seen as an anti-risk currency, sometimes behaving similarly to the US Dollar in times of market uncertainty. The revival in risk appetite weighed on the currency. Then there is the effect of rising Treasury yields given the still-dovish Bank of Japan. A relatively more hawkish Fed would sap the appeal of JPY versus USD.

Speaking of that front, February’s US inflation report crossed the wires. While the headline gauge clocked in as expected, the Core reading surprised higher on the month-to-month setting. This suggests that underlying inflation remains sticky, putting the Fed in a tough spot.

Looking at Wednesday’s Asia-Pacific trading session, notable economic event risk will stem from China. These include local industrial production and retail sales data. Outside of that, if markets continue to calm in the hours ahead, traders may continue adding back Fed rate hike expectations. That could be a recipe that allows USD/JPY to continue higher.

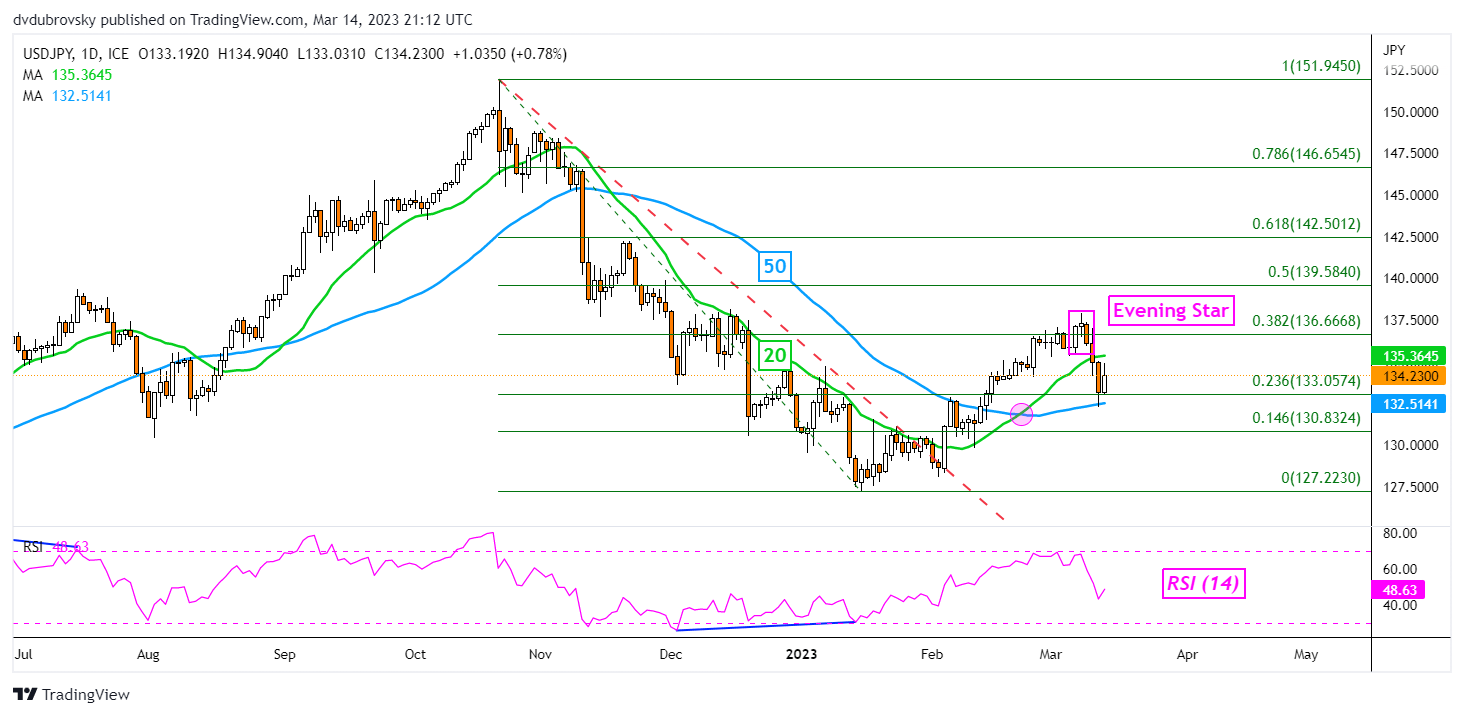

Japanese Yen Technical Analysis

On the daily chart, USD/JPY was unable to fall under the 50-day Simple Moving Average (SMA), reinforcing the line as key support. A bullish Golden Cross remains in play between the 20- and 50-day lines. Prices are also sitting on the 23.6% Fibonacci retracement level at 133.05. A turn higher would place the focus on highs from early March. Otherwise, extending lower exposes February lows.

{{NEWSLETTER}}

USD/JPY Daily Chart

Chart Created in TradingView

— Written by Daniel Dubrovsky, Senior Strategist for DailyFX.com

To contact Daniel, follow him on Twitter:@ddubrovskyFX