WTI Crude Oil News and Analysis

- The oil market trades flat this morning after a three slide as Credit Suisse secures support from the Swiss National Bank. WTI remains vulnerable as investors/traders see trouble up ahead

- A rise in crude oil stocks adds fuel to the fire of the recent sell-off

- WTI drops through key support but appears to have halted declines as Credit Suisse secures Swiss National Bank (SNB) backing

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

Recommended by Richard Snow

How to Trade Oil

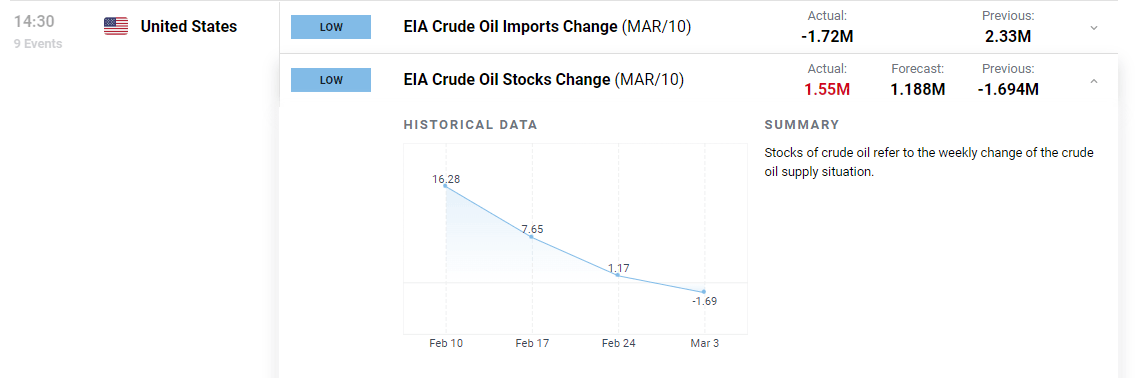

A Sharp Rise in Crude Oil Inventories adds to WTI Sell-off

The US Energy Information Agency data for the week ending March 10th revealed that weekly crude oil stocks rose a lot more than anticipated (1.55M vs 1.188M expected). This came after readings for the prior week showed a 1.69-million-barrel drop.

Customize and filter live economic data via our DailyFX economic calendar

Indicator of Future Economic Activity Sounds the Alarm

The oil market is often viewed as an indicator of future economic activity. When economies are expanding, industry and individuals use more fuel. Whether its transporting goods, increasing factory production or consumers driving to spend money, improved economic conditions have a positive correlation with oil consumption. The opposite of this occurs when investors/traders foresee economic hardship. Factories wind down production due to lower demand from individuals who are less willing to spend money due to concerns around continued employment.

In the wake of the collapse of three mid-tier US banks with Silicon Valley Bank the first domino to fall, caution and nervousness has taken over global financial markets. Speculation about a full-on banking crisis has ensued as banking stocks the world over trade lower. Major retail banks, however, have very different depositor profiles than the tech/crypto specialized banks that have fallen. The bank run on SVB was motivated by more than 90% of depositors holding funds worth more than the FDIC insured amount of $250,000 in the event of a bank failure.

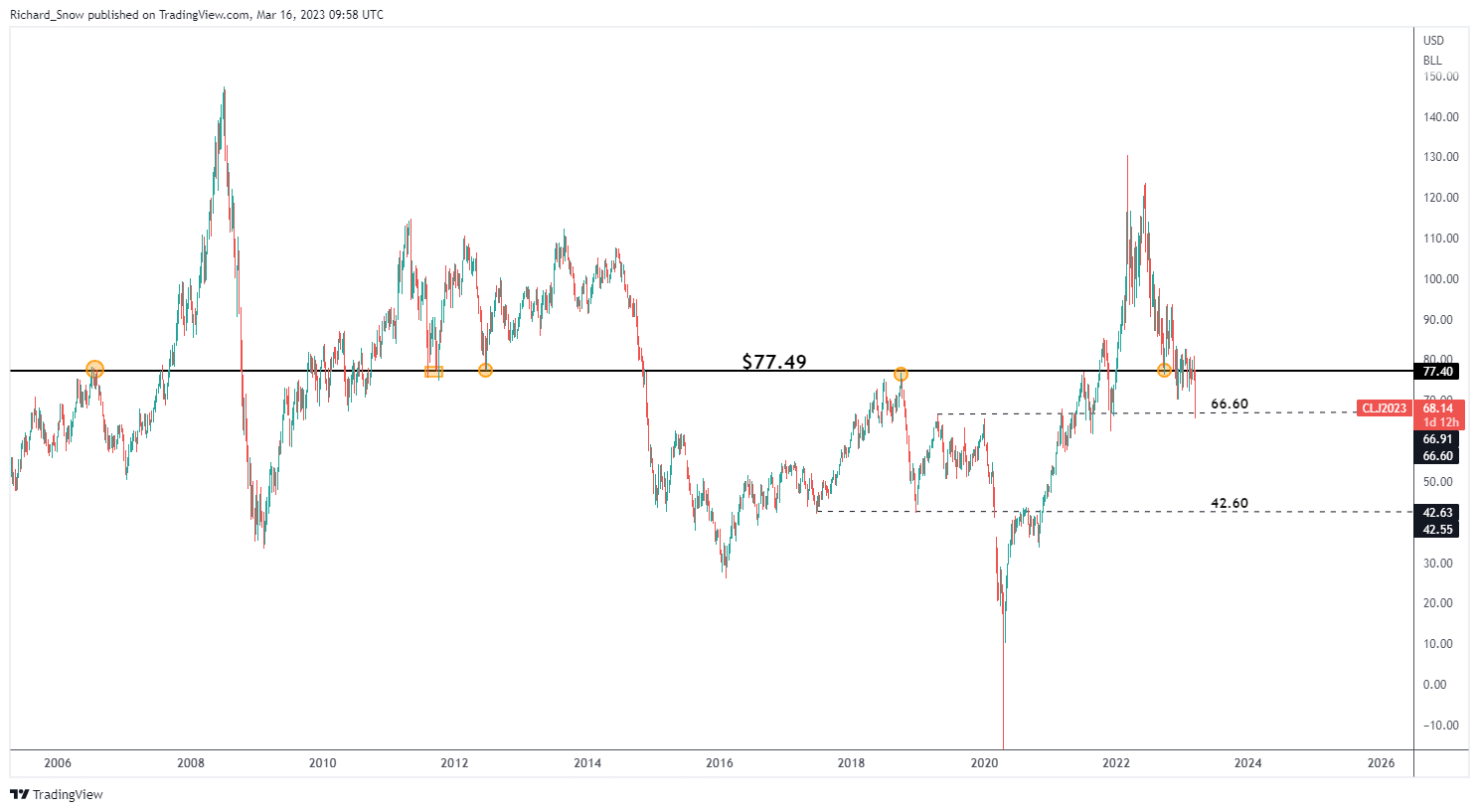

Nevertheless, caution throughout financial markets continues and oil is no different. The weekly chart shows the steady decline in oil prices ever since the Russia-Ukraine conflict began. Interesting to note is the fact that the current decline has plunged oil below a crucial long-term level of $77.50 – a level that acted as a major pivot point numerous times in the past.

From here, major technical levels, if reached, would imply a massive rout in the oil market. Something that OPEC will be motivated to avoid.

Weekly WTI Oil Chart (CL1!)

Source: TradingView, prepared by Richard Snow

Recommended by Richard Snow

Improve your trading with IG Client Sentiment Data

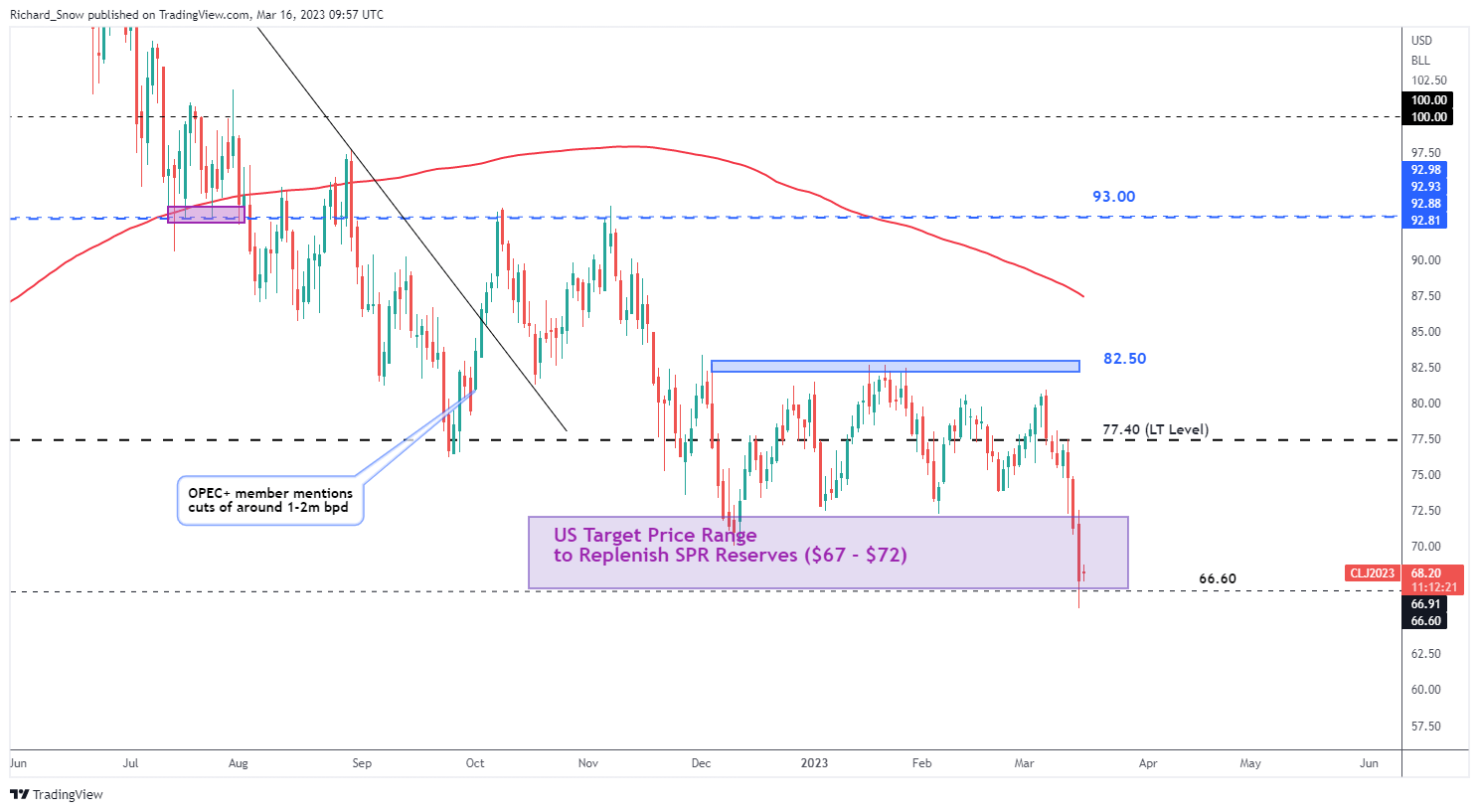

The daily oil chart highlights the recent three-day decline which has sent oil prices sharply lower – well into the range identified by the Biden administration to replenish reduced SPR stocks. Therefore, this zone has previously served as a pseudo support but would be no match for a full-on banking crisis.

Prices are currently testing support at $66.60, where there the next level of support appears around $62 before the major level of support at $42.60 becomes relevant. Should the news of support from the Swiss National Bank for Credit Suisse appease concerns, a pullback towards the upper side of the SPR replenishing range ($72) will be monitored by oil bulls. Resistance above that appears at $77.40.

Daily WTI Oil Chart (CL1!)

Source: TradingView, prepared by Richard Snow

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX