EUR/USD Price, Chart, and Analysis

- Hawkish ECB to continue raising rates to fight inflation.

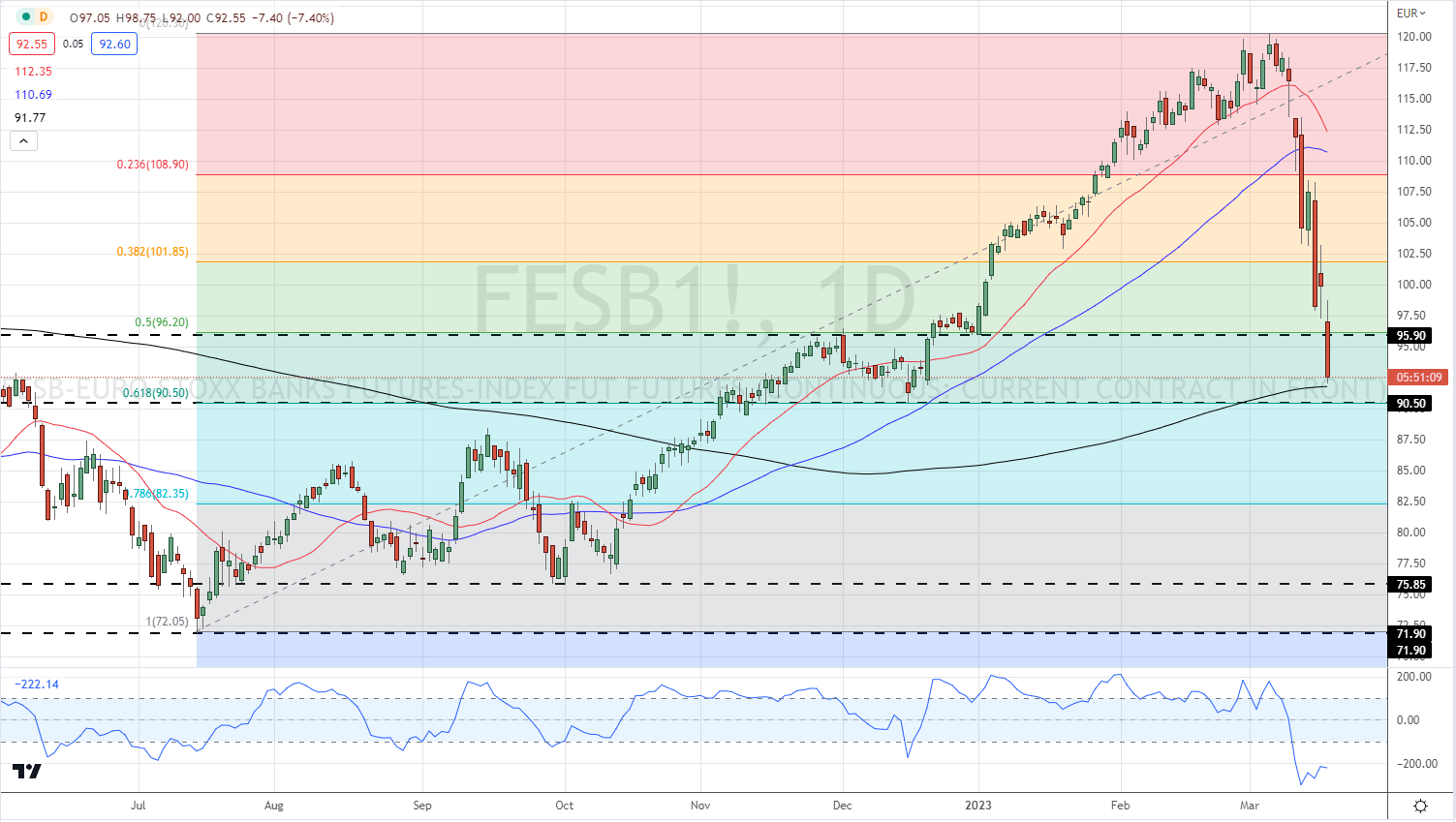

- European Bank stocks slump, further danger ahead?

- EURUSD nudges higher in nervous trade.

Recommended by Nick Cawley

Traits of Successful Traders

Most Read: Euro Latest: EUR/USD Pushes Higher on ECB Rate Hike Commentary

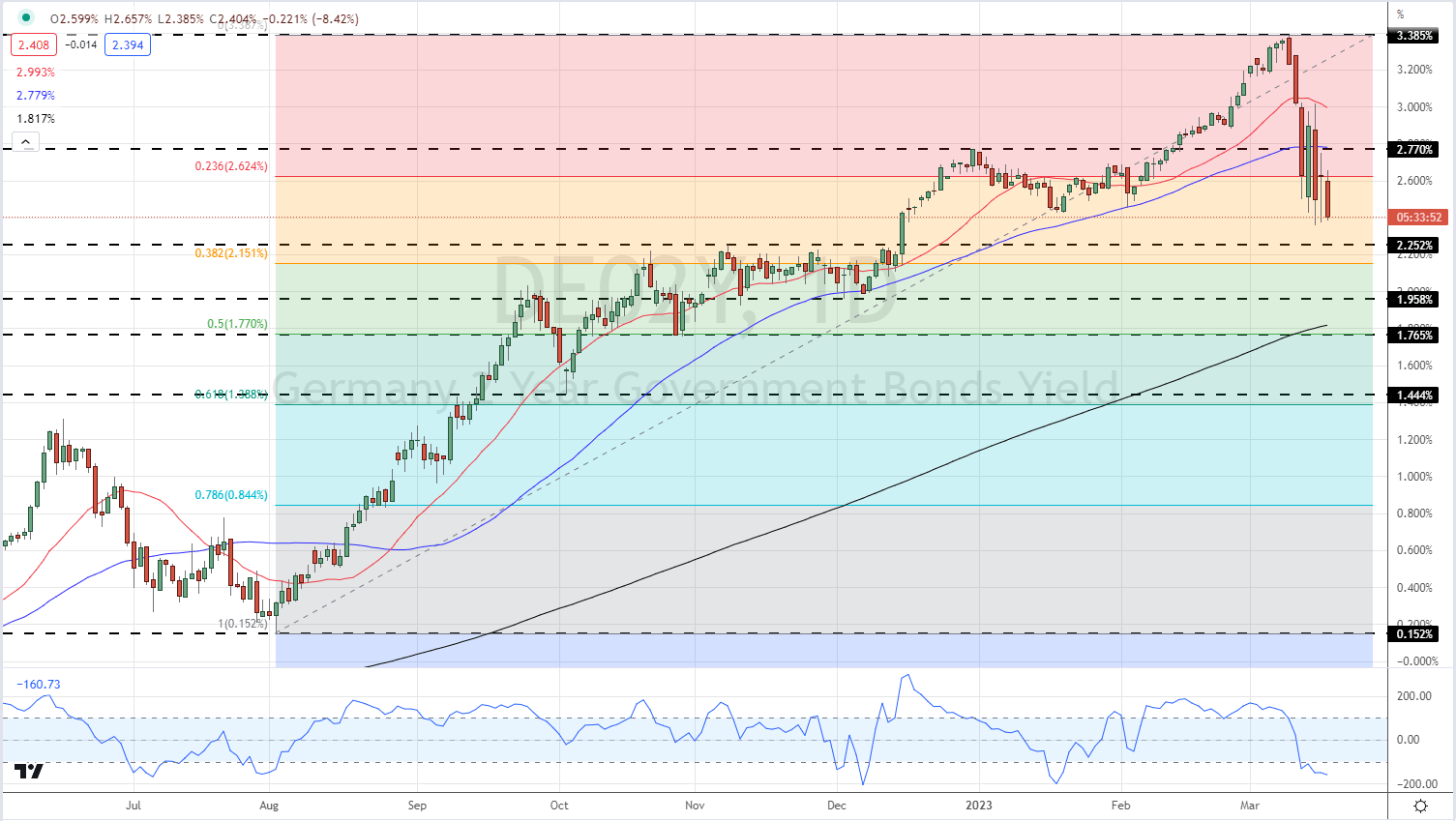

The European Central Bank hiked interest rates by a half-a-percentage point on Thursday, as expected, and reiterated that rates would continue to rise to combat uncomfortably high and sticky inflation. This move came at the same time as Credit Suisse’s share price collapsed further, sparking fears that the bank may shutter soon. The whole of the European banking sector is now under the spotlight, so a central bank hiking at the same time as a potential banking run is brewing is a gutsy call. The yield on the 2-year German bond continues to fall, despite the higher rate background, as investors pile into safe-haven assets.

E Stoxx Banking Futures

German 2-year Bond (Schatz) Yield

Recommended by Nick Cawley

How to Trade EUR/USD

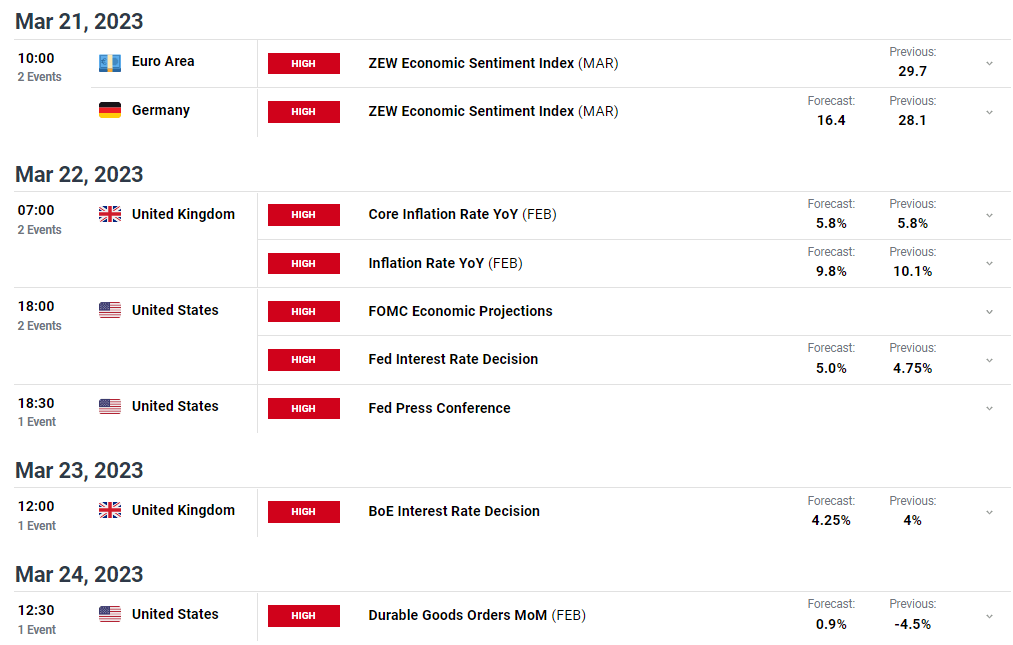

Next week’s Euro Area calendar is very sparse with just the latest ZEW economic sentiment data on Tuesday. Traders will instead be drawn to the latest FOMC policy meeting on Wednesday and the Bank of England policy decision on Thursday.

For all market-moving events and economic data releases, see the real-time DailyFX Calendar

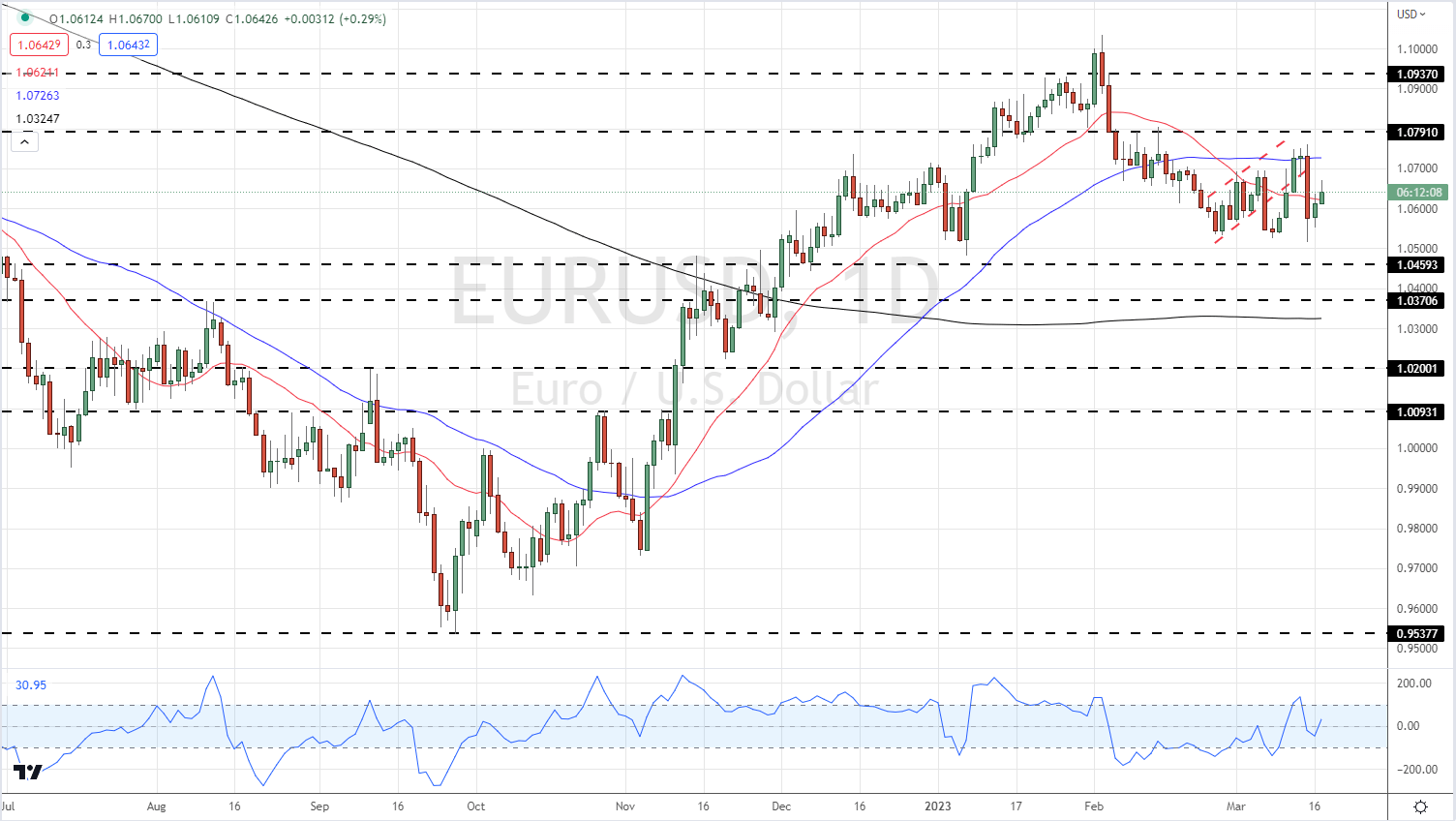

Against this backdrop, the Euro is trying to push higher but finding it difficult. While the promise of higher interest rates would normally underpin a currency, falling government bond yields are sapping the single currency’s strength. The pair remain trapped within Wednesday’s sell-off candle between 1.0516 and 1.0760 and this looks likely to remain the case for the days ahead., or at least until the FOMC meeting on Wednesday. Traders should keep an eye on overall risk sentiment, Euro Area banks and German bond yields for any directional EUR/USD clues.

EUR/USD Daily Price Chart – March 17, 2023

All Charts via TradingView

of clients are net long. of clients are net short.

| Change in | Longs | Shorts | OI |

| Daily | 4% | 0% | 2% |

| Weekly | -3% | 10% | 4% |

Retail Traders Trim Long Positions

Retail trader data show 52.32% of traders are net-long with the ratio of traders long to short at 1.10 to 1.The number of traders net-long is 14.49% lower than yesterday and 9.47% lower from last week, while the number of traders net-short is 15.72% higher than yesterday and 3.33% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EUR/USD prices may continue to fall. Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current EUR/USD price trend may soon reverse higher despite the fact traders remain net-long.

What is your view on the EURO – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.