CRUDE OIL PRICE, CHARTS AND ANALYSIS:

Recommended by Zain Vawda

Get Your Free Oil Forecast

WTI FUNDAMENTAL OUTLOOK

Crude Oil has failed to capitalize on last week’s jump in prices following the OPEC+ announcement as prices continue to range in the absence of a catalyst. Markets are digesting Fridays NFP data and demand concerns which were compounded by Chinese inflation data which came in lower than expected overnight.

Friday’s NFP data remained robust with market increasing the probability of a 25bps hike at the Federal Reserve’s May meeting. This seemed to cap any potential upside move in Oil prices to start the week. This morning however the Dollar Index has seen some weakness as it looks to snap a four-day bullish run which has helped oil prices in the early part of the European session.

The long-awaited demand surge from China has failed to gain any notable traction as the recovery post covid has been rather slow. This coupled with a slowdown in exports indicate a global trend of an easing in demand for goods as consumers tighten their belt in a rising interest rate environment. The decision by OPEC+ to cut production has also been seen by some as a sign of the current environment. Simply put if demand was high OPEC+ wouldn’t have seen the need to intervene which seems to validate the markets overall concern.

Recommended by Zain Vawda

How to Trade Oil

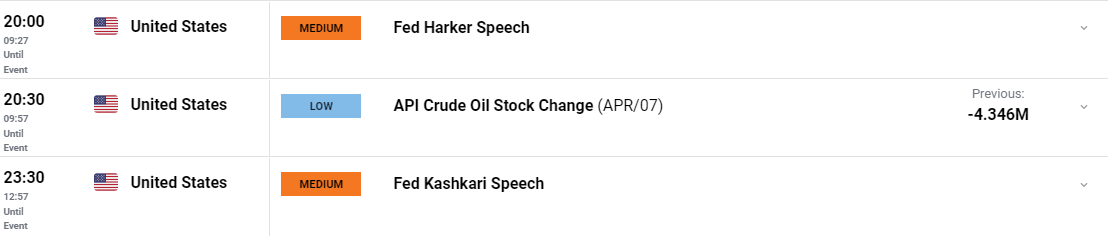

Later today we do have comments by Fed policymakers Harker and Kashkari as well as API Crude Oil Stock Change Data for the week ended April 7. The comments by Fed policymakers in particular could aid or hinder the dollar and affect Oil prices ahead of the much-anticipated US CPI print and Fed minutes due out tomorrow.

For all market-moving economic releases and events, see the DailyFX Calendar

BRENT CRUDE UPDATE

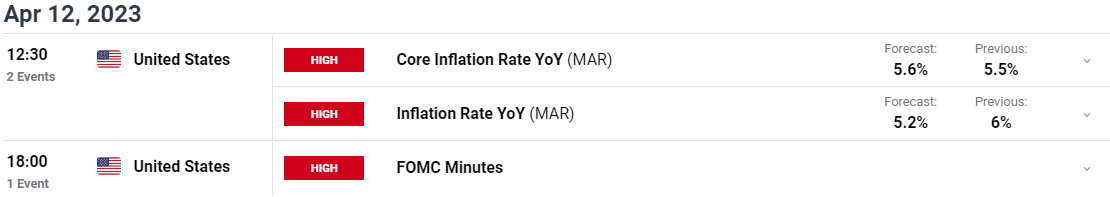

Bent Prices have been on the exact same trajectory over the past week as WTI. The gap created by the OPEC+ announcement remains with tomorrows US data eyed as a catalyst for further downside in oil prices. Brent is currently on a three-day bearish streak, albeit within a rather tight range with the 50 and 100-day MA providing support around the $82.39 and $81.43 handle respectively.

Brent Daily Chart – April 11, 2023

Source: TradingView

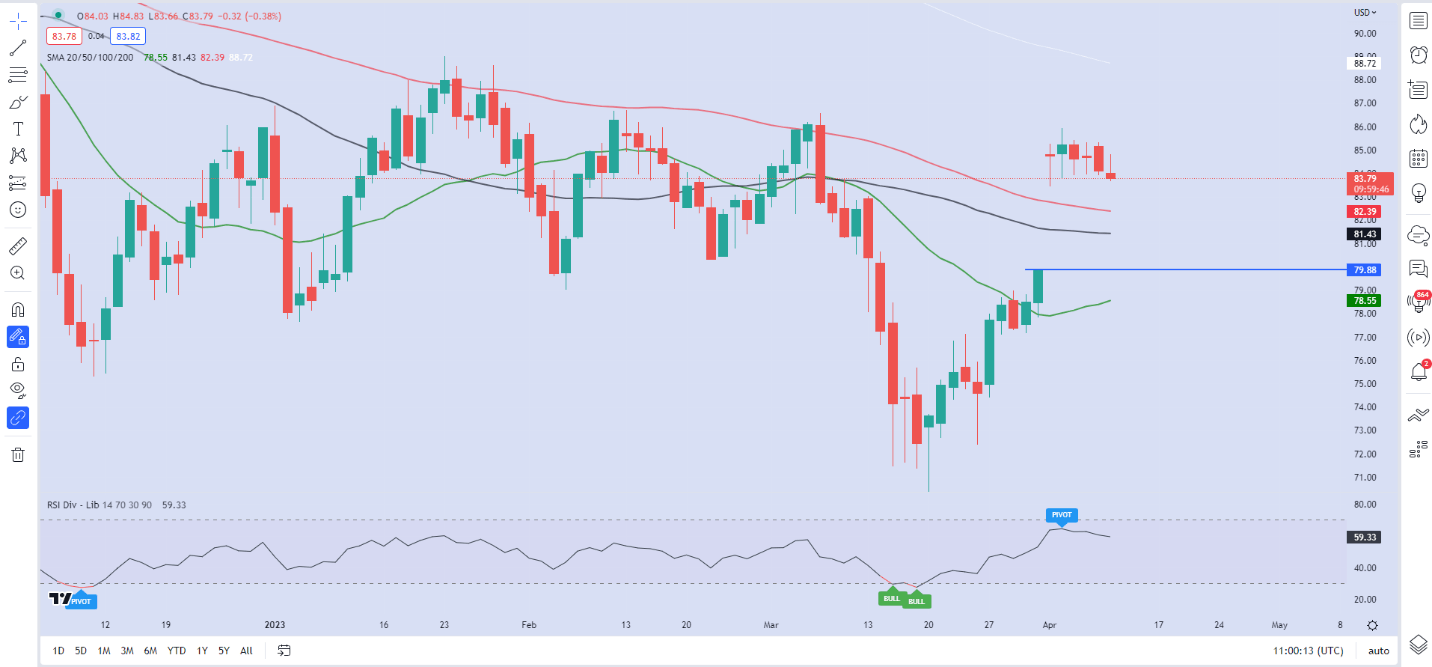

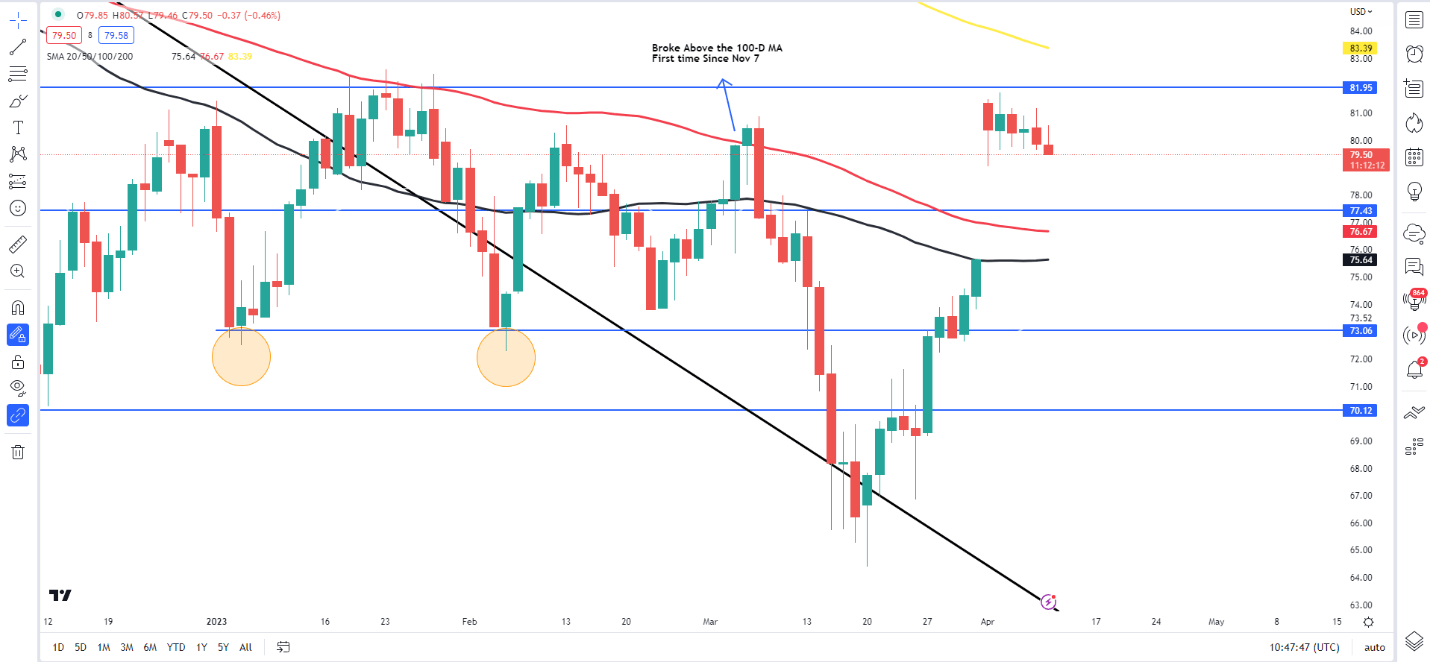

WTI TECHNICAL OUTLOOK AND FINAL THOUGHTS

Given the growing demand concern and potential for a further rate hike from the Fed in May, I would lean toward further downside for Oil prices until last weekend’s price gap is filled. A drop toward the 50-day MA which lines up with the gap created by the OPEC+ announcement currently rests at the $75.64 level. Further upside at this stage remains a stretch with a daily candle close above the April 4 high of $81.80 needed to see a potential retest of the 200-day MA around the $83.39 handle.

WTI Crude Oil Daily Chart – April 11, 2023

Source: TradingView

Introduction to Technical Analysis

Moving Averages

Recommended by Zain Vawda

Written by: Zain Vawda, Market Writer for DailyFX.com

Contact and follow Zain on Twitter: @zvawda