AUD/USD ANALYSIS & TALKING POINTS

- April’s Westpac consumer confidence echoes optimism in Australian households.

- Australian barley tariff removal could begin domino effect on other commodities.

- US Fed speakers under the spotlight today.

- AUD/USD to extend rising wedge breakout? Death cross appearing.

Recommended by Warren Venketas

Get Your Free AUD Forecast

AUSTRALIAN DOLLAR FUNDAMENTAL BACKDROP

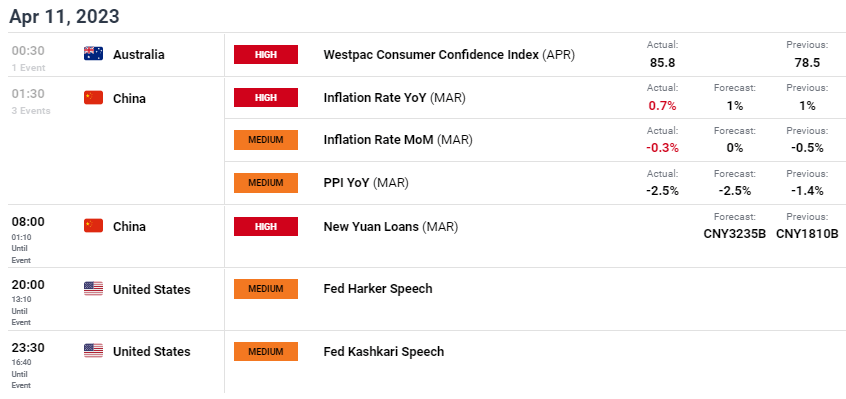

The Australian dollar hits back after the Easter weekend, up roughly 0.50% against the U.S. dollar this Tuesday. Last week’s strong US jobs data, markets ramped up bets for a higher Fed terminal rate for 2023, pricing in a 25bps interest rate hike for the May meeting. This morning, a massive uptick in Australian consumer confidence (see economic calendar below) for April that reached the highest levels since June 2022. The report is a reflection of economic strength from a households perspective.

Chinese inflation missed estimates while PPI figures slumped indicative of a struggling economy post-pandemic. Further room for easing monetary policy may be on the cards to stimulate the Chinese economy and the demand for its goods and services. Despite this, the AUD benefitted from a deal between China and Australia that could result in the removal of tariffs on Australian barley that was implemented in 2020 at the height of diplomatic tensions. Being Australia’s largest trading partner, the elimination of the roughly 80% tariff level could lead to an additional tariff retractions in other commodity spaces including coal, wine and timber.

Foundational Trading Knowledge

Commodities Trading

Recommended by Warren Venketas

Closing out the trading day, the US will come into focus via Fed speakers (Harker and Kashkari) and their response to the current labor market/inflation dynamic considering the US CPI report is due tomorrow.

ECONOMIC CALENDAR

Source: DailyFX economic calendar

TECHNICAL ANALYSIS

Introduction to Technical Analysis

Candlestick Patterns

Recommended by Warren Venketas

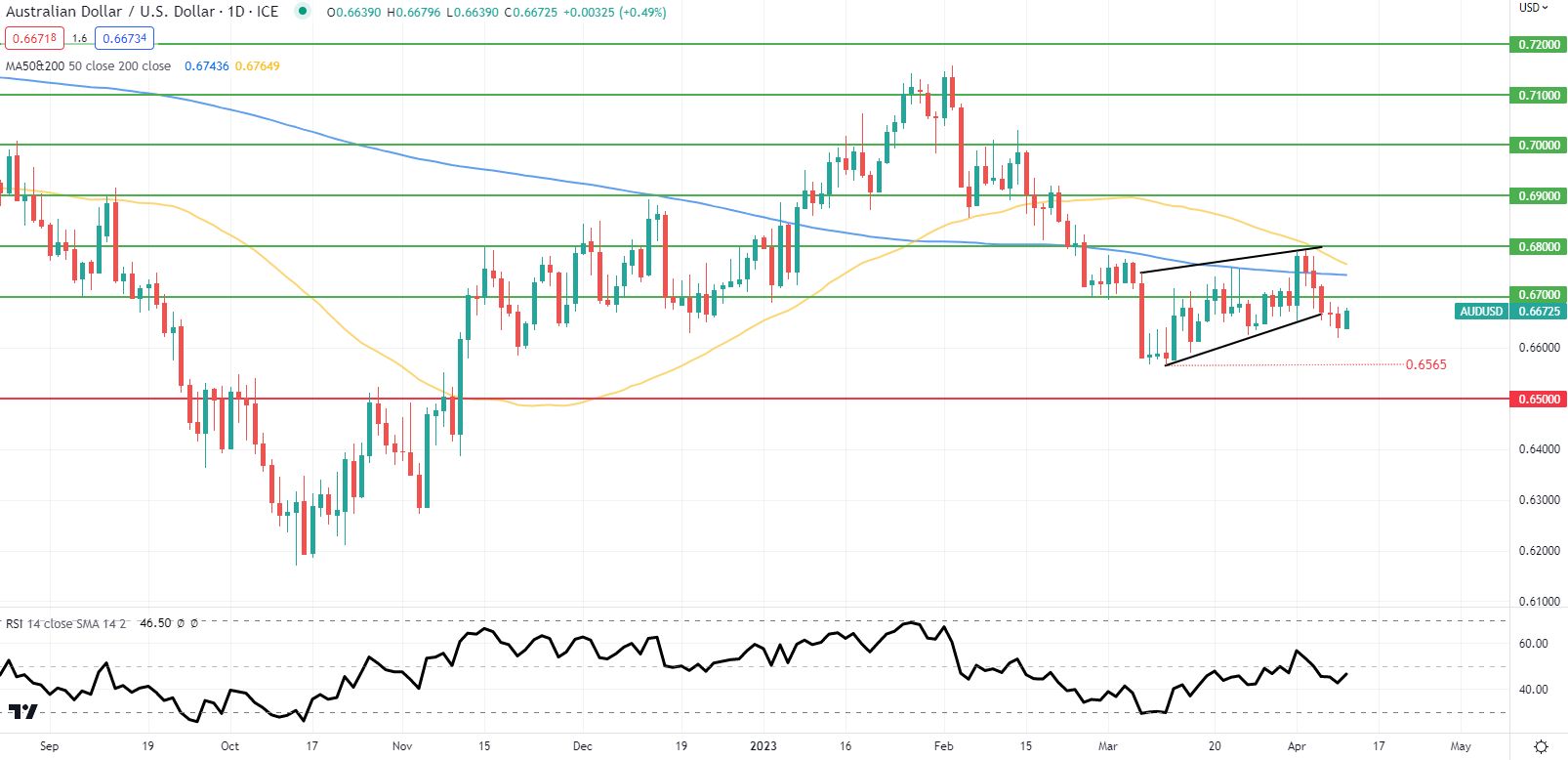

AUD/USD DAILY CHART

Chart prepared by Warren Venketas, IG

Daily AUD/USD price action stays hesitant after the rising wedge chart pattern (black) breakout that traditionally points to subsequent downside. That being said, a looming death cross could catalyze this downside move that is likely to stem from the upcoming US CPI print (elevated inflation data could heighten hawkish Fed bets leaving the Aussie dollar exposed). Looking at the Relative Strength Index (RSI), the reading around the 50 level reiterates markets uncertainty but is sure to favor some directional bias post-CPI.

Key resistance levels:

Key support levels:

IG CLIENT SENTIMENT DATA: BEARISH

IGCS shows retail traders are currently LONG on AUD/USD, with 72% of traders currently holding long positions. At DailyFX we typically take a contrarian view to crowd sentiment resulting in a short-term bearish disposition.

Contact and followWarrenon Twitter:@WVenketas