US Dollar, Durable Goods Data, DXY Golden Cross – Asia Pacific Market Open:

- US Dollar suffered its worst day on Monday since early February

- Disappointing durable goods orders data cooled hawkish Fed bets

- Still, the DXY Index is eyeing a bullish Golden Cross for direction

Recommended by Daniel Dubrovsky

Get Your Free USD Forecast

Asia-Pacific Market Briefing – US Durable Goods Orders Dent the US Dollar

The US Dollar broadly underperformed against its major counterparts on Monday, with the DXY Dollar Index sinking about 0.6 percent. That was the worst single-day performance since the beginning of this month. Still, as we will see shortly, this pullback did little to overturn the near-term upward bias that the Greenback has been seeing.

A closer look at price action during the Wall Street trading session reveals that the currency took a setback amid the latest US durable goods data. Preliminary January data showed orders falling 4.5%, worse than the -4.0% forecast and a turn from the 5.1% increase in December. This disappointing data added some contrast to recently higher-than-expected US inflationary metrics.

As a result, front-end Treasury yields turn lower. That indicated a slight dovish shift in Federal Reserve policy expectations. Equities also found some support in this data as the S&P 500 rallied. Ultimately, stock markets proceeded to trim all the gains seen after durable goods orders. Still, the S&P 500 finished the session cautiously higher, closing +0.31% for the day.

This is setting a mixed tone heading into Tuesday’s Asia-Pacific trading session. On the one hand, markets could welcome the slight improvement in risk appetite, sending regional indices, such as Japan’s Nikkei 225, higher. On the other hand, traders are also precariously balancing the threat of a US recession which would likely have broader spillovers for the global economy.

US Dollar Technical Analysis

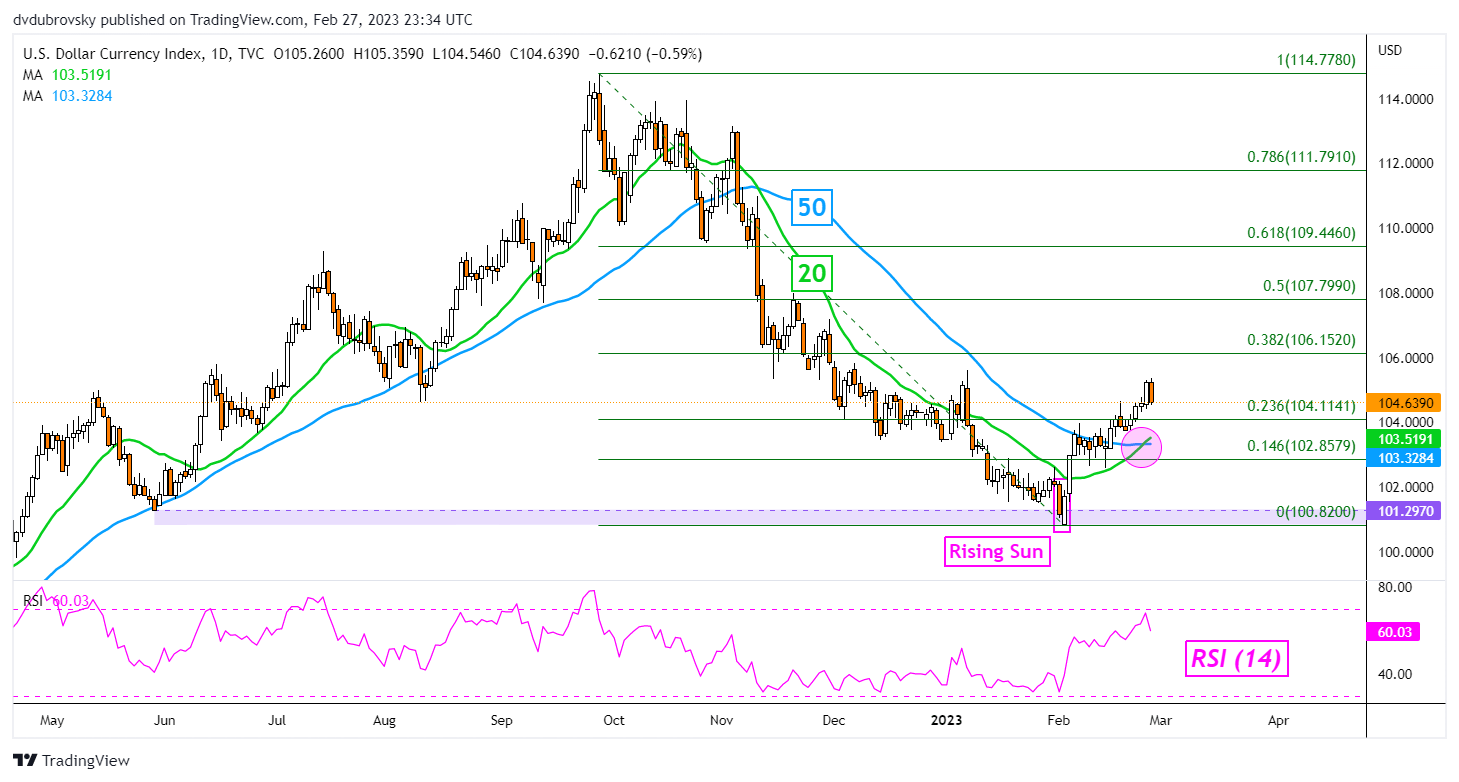

While the DXY Index turned lower on Monday, a bullish Golden Cross between the 20- and 50-day Simple Moving Averages formed recently. This is offering a near-term upside technical bias. Immediate support is the 23.6% Fibonacci retracement level at 104.11. Below that price, the moving averages would likely come into focus, offering the potential to maintain the upside focus. Immediate resistance is the 38.2% level at 106.15.

Recommended by Daniel Dubrovsky

Get Your Free Top Trading Opportunities Forecast

DXY Daily Chart

Chart Created in TradingView

— Written by Daniel Dubrovsky, Senior Strategist for DailyFX.com

To contact Daniel, follow him on Twitter:@ddubrovskyFX