Daily Technical Picture

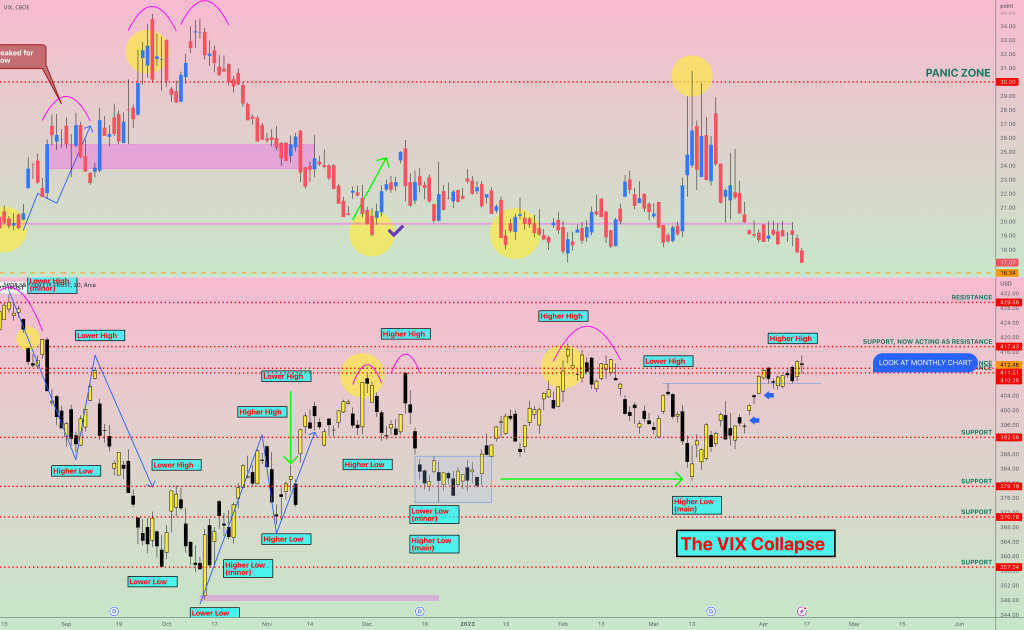

On Friday the S&P500 held above short-term support on top of the trading range although it did give up earlier gains. That is not unsurprising as I did expect the support to be tested. The major feature was the collapse of the VIX to relatively low levels. My “A Regime Shift” post (linked) delves into what this may mean.

A quick round up of other markets is warranted as we are sitting at interesting levels in many instances in their respective timeframes:

⦿ USD (daily): New low set, testing the breakdown. A successful test should see further weakening

⦿ TLT (weekly): Range bound. The bounce off the low looks corrective, the long-term downtrend is favoured

⦿ GOLD (daily): Choppy 2 steps up 1 step down but the uptrend is firmly entranched. I expect all time highs.

⦿ NATGAS (weekly): Testing resistance level. Unsuccessful so far. I expect further weakness if the test fails

⦿ OIL (3-day): Another week of gains would strengthen the bullish case with a Change of Behaviour, the first step for a true trend change

⦿ BTC (weekly): Testing long-term resistance. We may see some profit taking but the new bull trend is firmly in place.

I have reduced my long equity positioning to minimum sizing to reflect a lower conviction on the short-term price movement.

Conclusion: Big flood of earnings should provide insight into further market direction.

EQUITY TREND:

⦿ Short-term (weeks) – UP

⦿ Medium-term (< 6 months) - UP

⦿ Long-term (>6 months) – DOWN