US Dollar, DXY Index, USD, US CPI, Fed, China, Crude Oil, Gold – Talking Points

- The US Dollar took a step back today with all eyes on US CPI later

- Equity markets are also a touch fragile and are poised ahead of the data

- If the inflation outcome is outside expectations, will the DXY Index break out?

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

The US dollar drifted lower on Wednesday ahead of crucial US CPI data that may provide the impetus for the market to reposition exposure. A Bloomberg survey of economists is anticipating a headline year-on-year read of 5.0% to the end of April.

The US debt ceiling and issues around US regional banks continue to weigh on market sentiment with Wall Street finishing its cash session lower.

All the major APAC equity indices are in the red although Japan’s TOPIX index remains near 33-year highs.

Yesterday saw New York Fed President John Williams reiterate the Federal Reserve’s view that future decisions for the Federal Open Market Committee (FOMC) will be data-dependent.

Treasuries have barely moved today, while gold is a touch higher and crude oil has softened slightly. The WTI futures contract is approaching US$ 73 bbl while the Brent contract is a touch below US$ 77 bbl.

China has continued to expand its crackdown on foreign companies that it believes have been involved in espionage activities. The Middle Kingdom’s diplomatic stoush with Canada saw a Canadian diplomat expelled from Shanghai. USD/CAD is steady just under 1.3400.

While German CPI and Italian industrial production might hold some attention, US CPI will be the key economic data release today.

The full economic calendar can be viewed here.

Recommended by Daniel McCarthy

The Fundamentals of Breakout Trading

DXY(USD) INDEX TECHNICAL ANALYSIS

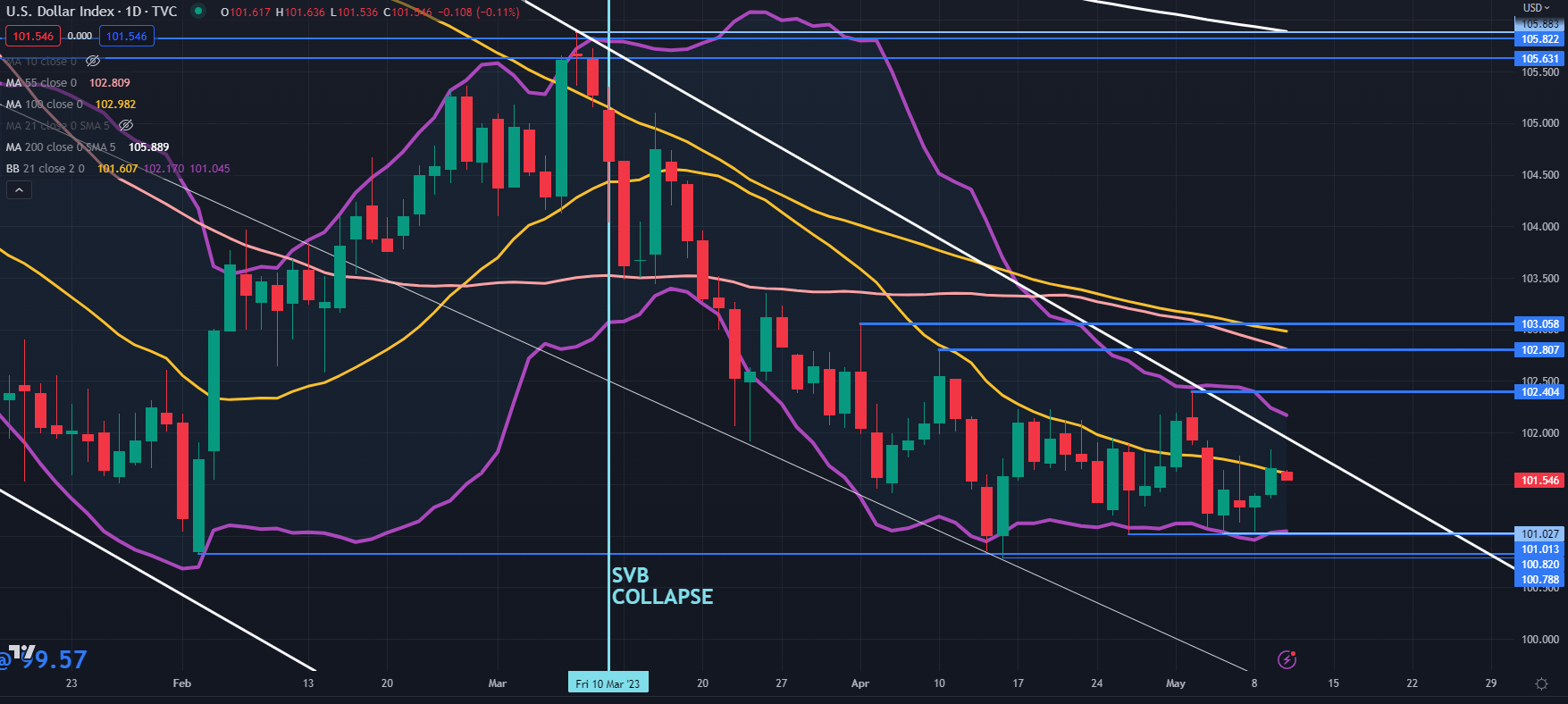

US Dollar volatility has been sliding lower as illustrated by the narrowing of the 21-day simple moving average (SMA) based Bollinger Bands.

The sideways price action has set up a range trading environment and clean a breakout on either side may see momentum unfold in that direction.

It is important to keep in mind that current market conditions have seen several false breaks. That is when the price makes a new high or low outside the existing range trading band but fails to make a close outside it.

Support could be at the prior lows of 101.03, 101.01, 100.82 and 100.79. On the topside, resistance might be offered at previous peaks of 102.40, 102.81 and 103.06.

Chart created in TradingView

— Written by Daniel McCarthy, Strategist for DailyFX.com

Please contact Daniel via @DanMcCarthyFX on Twitter