Crude Oil, WTI, API, OPEC+, US Dollar, Gold, China Trade – Talking Points

- Crude oil is claiming a recovery from a volatile run lower last week

- APAC equities appear lacklustre with underwhelming Chinese economic data

- Many asset classes have been relatively quiet ahead of US CPI. Will WTI rally?

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

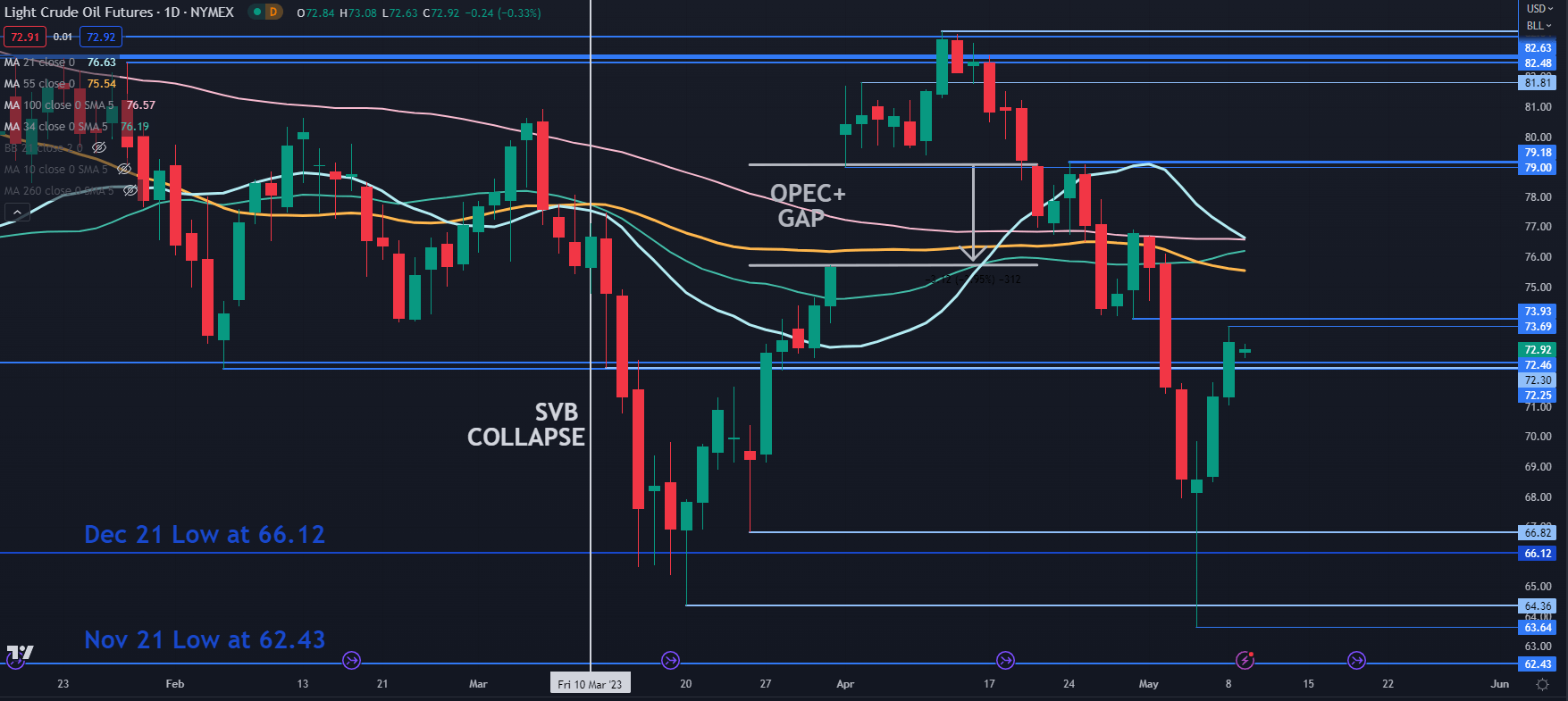

WTI crude oil steadied again today just below US$ 73 bbl after recovering from last week’s sell-off that saw it trade at its lowest level since late 2021.

The American Petroleum Institute (API) will release its weekly statistical bulletin later today, ahead of the monthly OPEC+ oil market report that is due to be released on Thursday

Between those reports, US CPI on Wednesday remains the focus for the broader market.

Spot gold continues to trade above US$ 2,025 an ounce as markets recalibrate after last week’s hike by the Fed.

Recommended by Daniel McCarthy

How to Trade Oil

Treasury yields have eased a touch so far today after adding 7 or 8 basis points across the curve yesterday. The US Dollar is little moved with currency markets in slumber mode.

Wall Street finished barely moved despite lingering concerns around the debt ceiling and regional banking concerns.

APAC equity markets are mixed with Australian, Hong Kong, Korean and New Zealand indices slightly lower while Japan and mainland China have notched some gains.

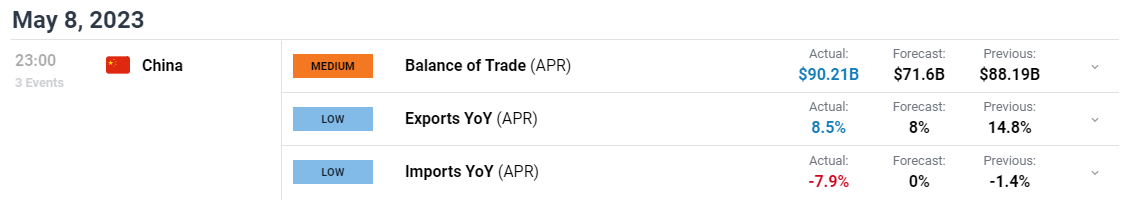

China’s trade balance came in much stronger than forecast at US$ 90.2 billion for April rather than the US$ 71.25 billion anticipated.

The devil in the detail reveals that exports were slightly stronger, but imports slumped, raising concerns about the prospects of a recovery for the world’s second-largest economy.

China also announced a crackdown on foreign companies that it alleges have been spying.

It is shaping up to be a quiet day on the data front, but the Australian Federal Government budget will be delivered, where a surplus is anticipated for the first time in 15 years.

The full economic calendar can be viewed here.

WTI CRUDE OIL TECHNICAL ANALYSIS

WTI overcame breakpoint resistance in the 72.25 – 72.45 area overnight and that zone might now provide support.

Further support might be at the previous lows of 66.82, 66.12, 64.36, 63.64 and 62.43.

On the topside, the nearby breakpoint at 73.93 may offer support ahead of a series of simple moving averages (SMA) in the 75.54 – 76.63 area. If those SMAs are vanquished, it could indicate that bearish momentum might be retreating.

Chart created in TradingView

— Written by Daniel McCarthy, Strategist for DailyFX.com

Please contact Daniel via @DanMcCarthyFX on Twitter