UK GDP Q1 ’23 (PRELIM) KEY POINTS:

Recommended by Zain Vawda

Get Your Free GBP Forecast

READ MORE: Bank of England Hikes Rates by 25 Basis Points to 4.5%, Sterling Nudges Higher

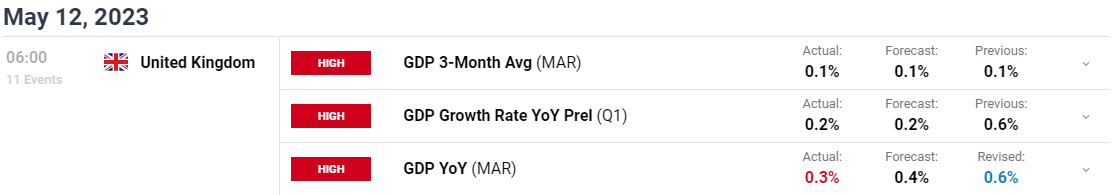

UK GDP first quarterly estimates of UK real gross domestic product (GDP) shows that the economy increased by 0.1% in Quarter 1 (Jan to Mar) 2023 while the monthly estimates show that GDP fell by 0.3% in March 2023, following an increase of 0.5% in January 2023.

Customize and filter live economic data via our DailyFX economic calendar

The services sector grew in Q1 thanks to information and communication 1.2%, and administrative and support service activities 1.3%. Looking at other sectors construction grew by 0.7% with manufacturing 0.5% and the production sector at 0.1% respectively.

On the consumption side, household spending showed no growth on the quarter as incomes continue to be squeezed by high inflation, while there was a positive contribution from gross fixed capital formation 1.3%, namely business and government investment. The UK economy remains 0.5% smaller than before the Covid-19 pandemic.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

UK GDP GROWTH PROSPECTS FOR 2023

The BoE Yesterday announced upgraded growth forecast as the UK Economy remains rather resilient despite households struggles with rising prices. UK Chancellor Hunt confirming his excitement at today report stating that its good news that the economy is growing but to reach the government’s growth priority we need to stay focused on competitive taxes, labor supply and productivity. The Chancellor was also given a nod by the BoE yesterday with the Fiscal support in Hunts Spring Budget seen as a supporting factor to the economic outlook.

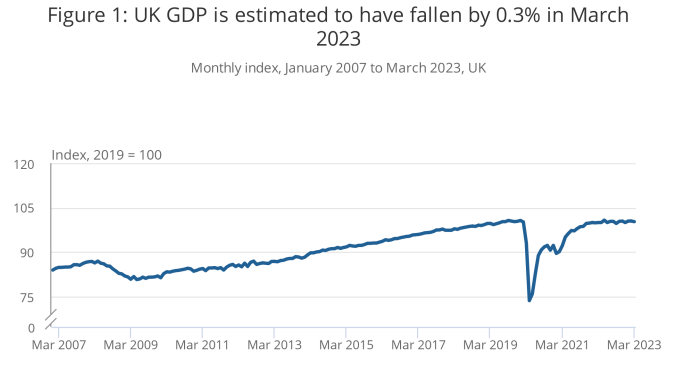

However, given all the optimism around the UK economy it’s easy to forget that the economy stalled in February and contracted in March, a sign of sluggishness and caution. The March data in particular is a cause for concern, however the Office for National Statistics (ONS) says that the UK economy suffered from the awful weather during the month. The month of March was the 6th wettest March since 1836 with this seen as a key driver of the poor data as consumers kept indoors and retail sales suffered.

Source: ONS

This will be worth keeping an eye on moving forward as the UK moves toward the summer months and whether the blip in February and March continues, or was weather really responsible for Marchs dip in particular?

MARKET REACTION

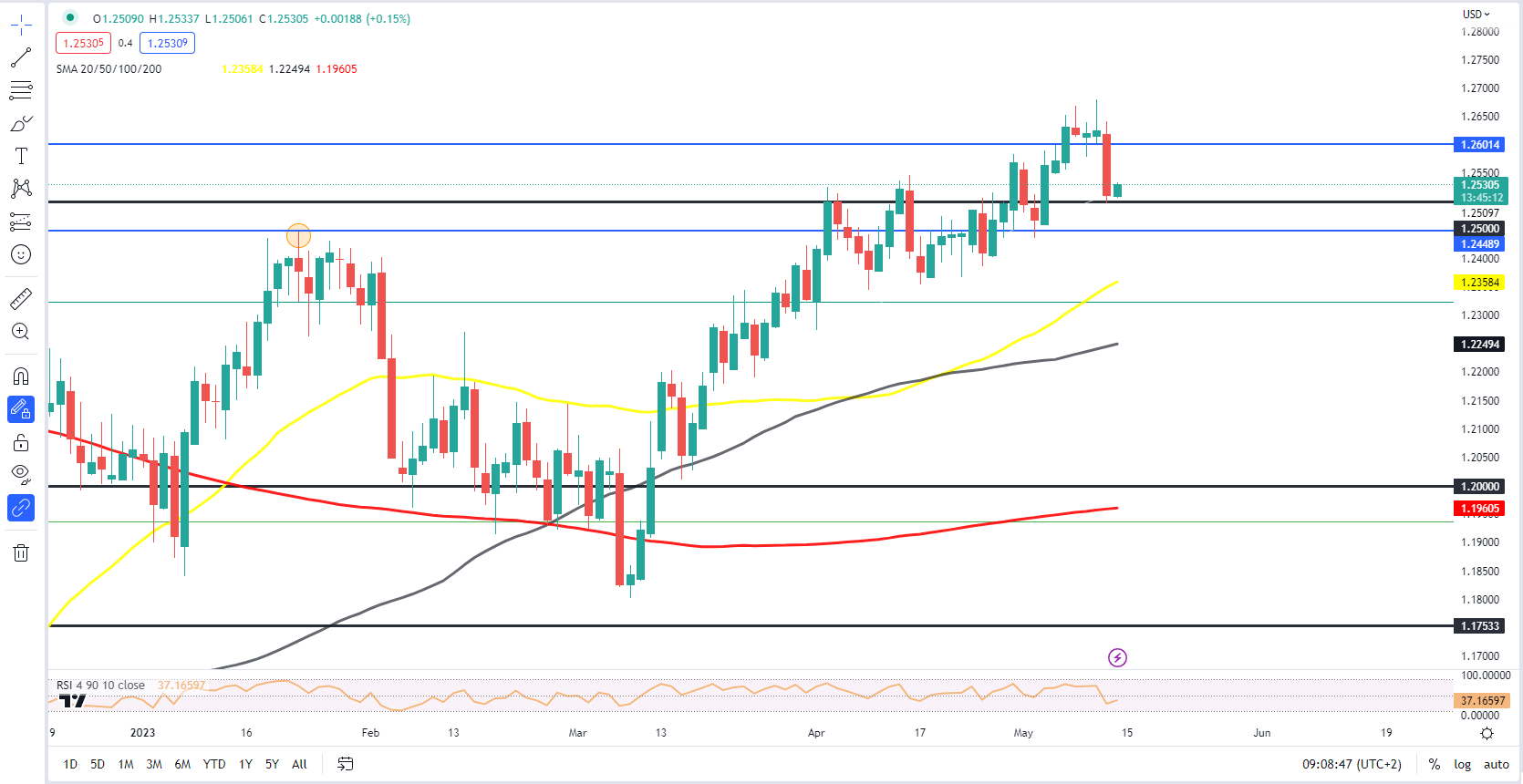

The initial market reaction following the news has seen GBPUSD decline 15 pips before rallying to trade marginally up for the day around 1.2530. Looking at the bigger picture from a technical perspective, GBPUSD price came under pressure on yesterday around recent highs and key resistance area around the 1.2660 mark. A selloff down to 1.2500 followed but the bullish structure remains intact. A daily candle close below the 1.2460 level would invalidate the bullish structure and see further downside come into play with 1.2360 support coming into focus which lines up with the 50-day MA.

A lot of this will rest on overall sentiment today as well with any haven demand likely to see the dollar continues its recent recovery. An improvement on overall sentiment could see a push toward the recent highs once more.

GBPUSD Daily Chart, May 12, 2023

Source: TradingView, prepared by Zain Vawda

— Written by Zain Vawda for DailyFX.com

Contact and follow Zain on Twitter: @zvawda