Crude Oil, WTI, US Dollar, US Jobs, US PPI, Fed, FOMC, EIA, SPR – Talking Points

- Crude oil found some respite on Friday after falling over 2% overnight

- US Jobs and PPI data led to market hopes of an easing in monetary policy

- If the Fed does decide to tilt to be accommodative, will WTI rally?

Recommended by Daniel McCarthy

How to Trade Oil

Crude oil is steady at the start of trade on Friday after retreating overnight with the US Dollar finding firmer footing with the market taking some positives from US data.

Jobless claims were above estimates at 264k for last week rather than the 245k anticipated, but PPI came in at 2.3%, instead of the 2.5% expected and 2.7% previously.

The jobs data points toward an easing in the tight labour market while the PPI figures led to hopes that consumer price pressures might be softening down the track.

Both economic data points appeared to reaffirm the view that the Federal Reserve will pause its hiking cycle at the next Federal Open Market Committee (FOMC) meeting in June.

The futures and overnight index swap (OIS) markets are pricing in a Fed cut for September despite comments overnight from Minneapolis Federal Reserve President Neel Kashkari overnight. He said that while CPI has been coming down, it remains too high.

Undermining the crude price was data released by the US Energy Information Agency (EIA) on Wednesday. It showed an inventory build of 2.951 million barrels for the week ended May 5th, rather than forecasts for a drop of 917k barrels.

Earlier in the week, the White House announced that the Strategic Petroleum Reserve (SPR) may start to replenish stock as soon as next month. It had been tapped to deal with inflationary pressures emanating from higher energy prices as a result of the Russian invasion of Ukraine.

Update crude oil prices can be found here.

Recommended by Daniel McCarthy

The Fundamentals of Range Trading

WTI CRUDE OIL TECHNICAL ANALYSIS

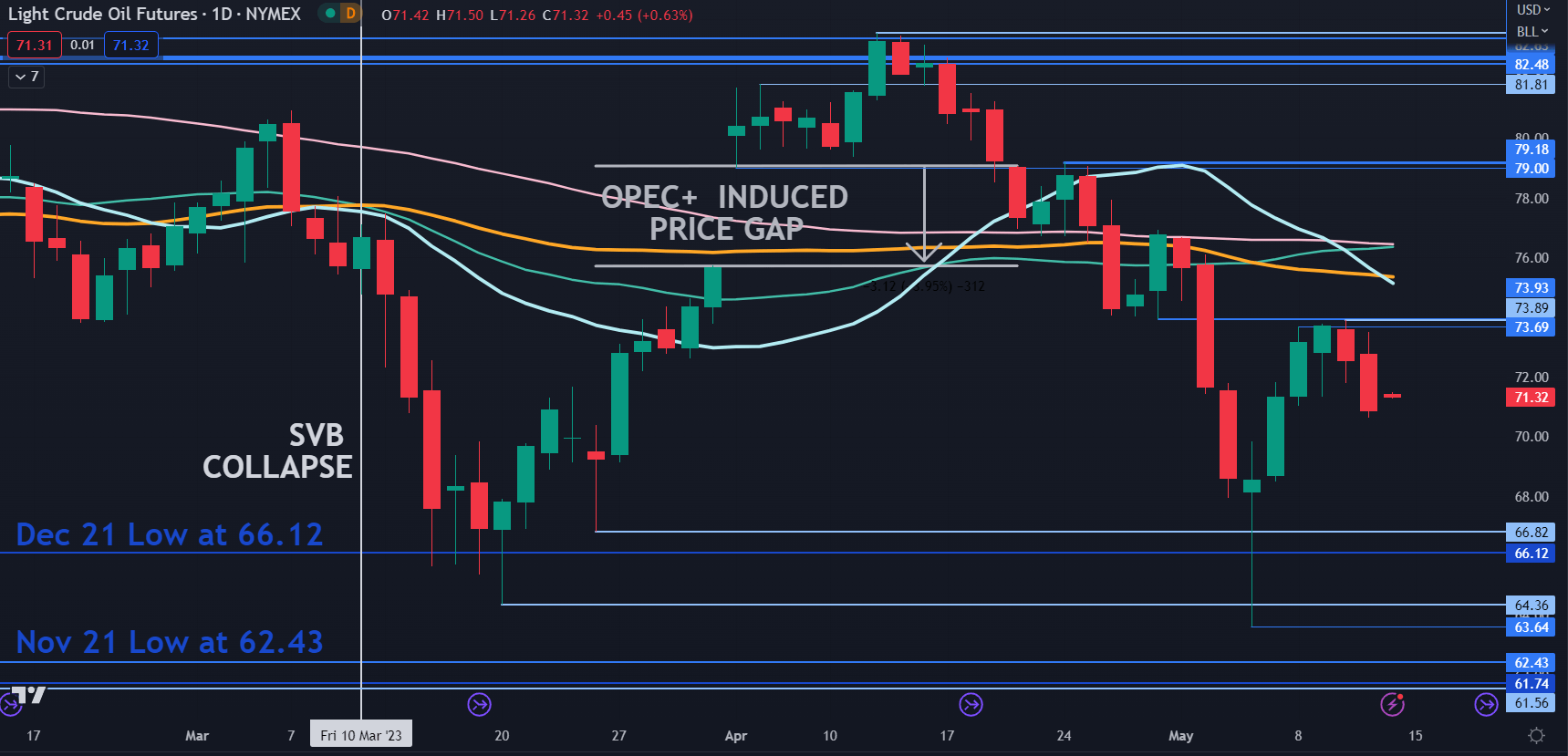

WTI failed to overcome breakpoint resistance at 73.93 this week when it made a high at 73.89 on Wednesday.

Those levels may continue to offer resistance ahead of a cluster of Simple Moving Averages (SMA). The 21-, 34-, 55- and 100-day daily SMAs all lie between 75.15 and 76.45.

The convergence of these SMAs could suggest further range trading in the near term.

On the downside, support might reside at the breakpoints of 66.82, 66.12 and 64.36 or further below at the prior lows of 63.64 and 62.43.

Chart created in TradingView

— Written by Daniel McCarthy, Strategist for DailyFX.com

Please contact Daniel via @DanMcCarthyFX on Twitter

— Written by Daniel McCarthy, Strategist for DailyFX.com

To contact Daniel, use the comments section below or @DanMcCathyFX on Twitter