RAND ANALYSIS & TALKING POINTS

- Rand eyes April 2020 highs!

- ZAR inundated by headwinds both local and global.

- Sharp rally on USD/ZAR to fade?

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

USD/ZAR FUNDAMENTAL BACKDROP

The South African rand has been at the mercy of several local and external factors causing the Emerging Market (EM) currency to fall over 4.75% just this week! Let’s breakdown some of the challenges facing the rand and what could be the ramifications moving forward:

LOADSHEDDING

Beginning with the long standing affliction by way of rolling blackouts, economic growth has suffered as a result with daily business practices being disrupted leaving many SME’s destitute. Foreign investment and confidence has as a result suffered reducing funds flowing into South Africa (lesser demand for the ZAR). Political instability and corruption go hand in hand with the electricity crisis with a lack of conviction adding to the poor outlook from an external perspective.

COMMODITY COMPLEX

South African commodity exports are now coming under pressure with today’s miss on Chinese CPI and PMI prints suggesting lesser demand (both local and global) for their products and services. Being South Africa’s main importer of goods, pessimism around the China reopening generally correlates to a weaker rand. Logistical disruptions with the local freight system have also been the bane of many exporters and local businesses causing significant amounts of lost trade.

Foundational Trading Knowledge

Commodities Trading

Recommended by Warren Venketas

US FACTORS

The US has been the dominating force in global markets of recent. Now that the Federal Reserve looks to be holding rates constant short-term, another more serious threat to the global financial system has emerged in the form of the US debt ceiling. The US is unable to pay its debts on and will require an increase in it’s borrowing capacity (debt ceiling) to meet these obligations. Until such time as there is more clarity surrounding the deadlock between Republicans and Democrats, the USD will remain supported due to its safe haven appeal and risk aversion in global markets. The ongoing banking crisis in the US is also having a systemic negative impact on the rand and contributing to the broader souring risk sentiment – reinforced by investors flocking into US government bonds.

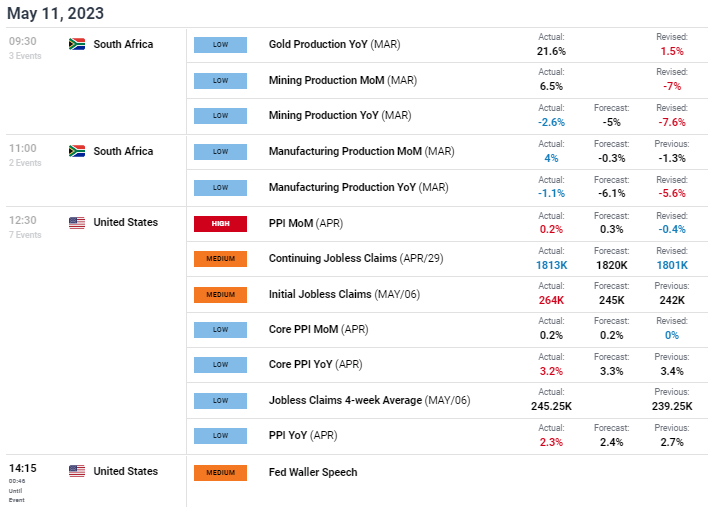

Today’s economic calendar (see below) would generally augment the rand with mining and manufacturing data for March showing noteworthy improvements while US PPI and jobless data is suggestive of a slowing US economy. Fed speak is scheduled for later in the trading day and could provide some short-term volatility for the pair; however, South African President Cyril Ramaphosa seems to be adding fuel to the ZAR fire at the National Assembly.

In summary, should the variables influencing the pair continue at their current state, the rand will find it difficult to regain any momentum against the greenback.

USD/ZAR ECONOMIC CALENDAR

Source: DailyFX Economic Calendar

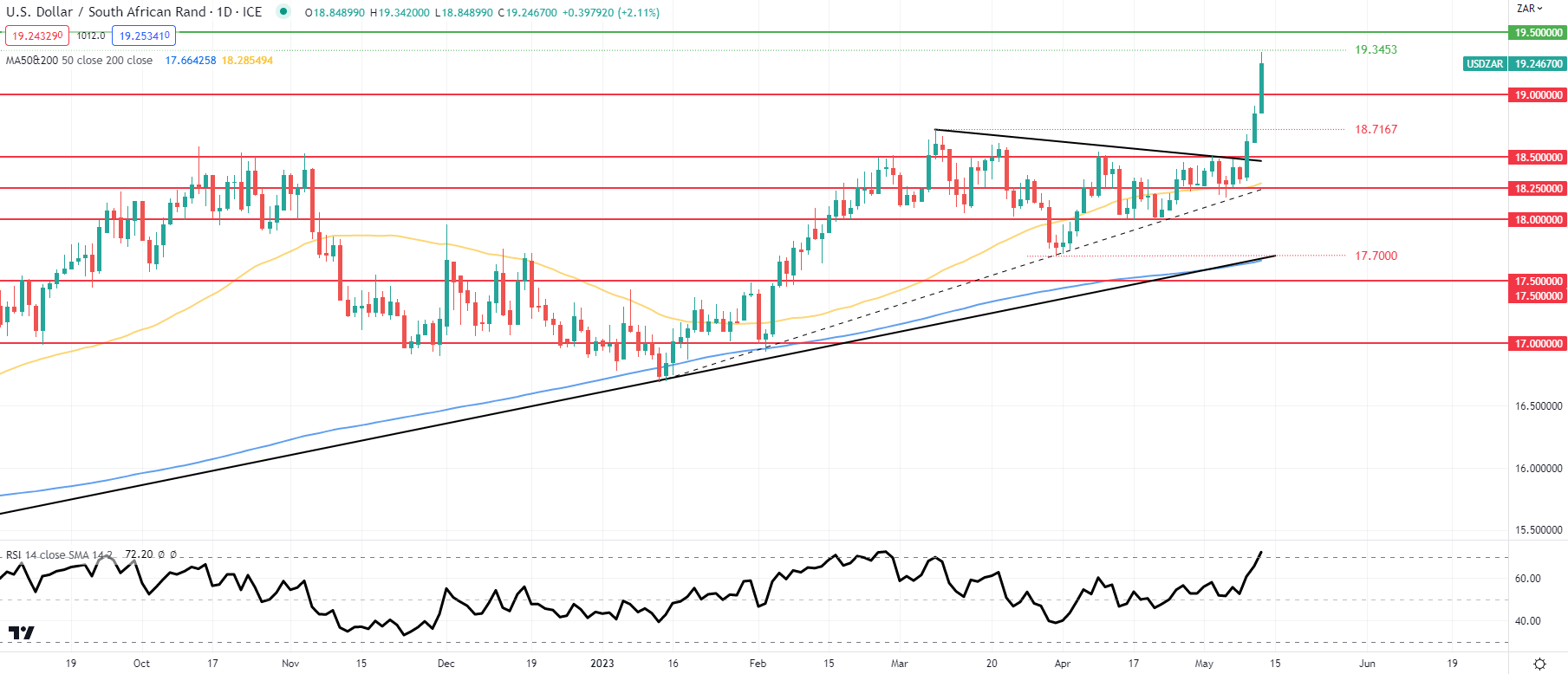

TECHNICAL ANALYSIS

USD/ZAR DAILY CHART

Chart prepared by Warren Venketas, IG

Introduction to Technical Analysis

Candlestick Patterns

Recommended by Warren Venketas

Daily USD/ZAR price action shows an extension to the recent symmetrical triangle (black) breakout, continuing the preceding bullish trend. That being said, the pair has now entered overbought territory as measured by the Relative Strength Index (RSI) and may be reaching its short-term peak. While there is still room for a push to fresh all-time-highs, this may be capped around the 19.5000 mark and I forecast a move back towards 19.0000 psychological support handle in due course.

Resistance levels:

Support levels:

Contact and followWarrenon Twitter:@WVenketas