S&P 500, SPX, NASDAQ 100, NDX – Outlook:

- Surge in upward momentum in the Nasdaq 100 index.

- The S&P 500 index appears to be gearing up for a bullish break.

- What are the signposts to watch?

Recommended by Manish Jaradi

Options for Beginners

US equities could be set for further gains as US President Joe Biden and top congressional Republican Kevin McCarthy appeared to be closing in on an agreement that would raise the government’s $31.4 trillion debt ceiling for two years.

Patrick McHenry, a top Republican negotiator, said on Friday a deal on raising the debt limit was well within reach but not agreed upon yet, saying the Congress would be able to raise the limit ahead of the new June 5 deadline. Treasury Secretary Janet Yellen said on Friday the US will likely have enough reserves to push off a potential default until June 5, compared with June 1 previously.

US equities have been climbing a wall of worry amid tightening credit conditions, declining market breadth, light investor positioning, and a solid earnings season (see “S&P 500, Nasdaq Weekly Forecast: Climbing the Wall of Worry”, published April 29). Yet as recent updates have highlighted, there is no sign of a reversal of the uptrend on technical charts. SeeMay 6,May 15, andMay 18updates.

Nasdaq Composite Index Breadth Indicators

Source Data: Bloomberg; charts prepared in excel

In the coming days, the focus will be on how talks progress in Washington as the June 5 deadline approaches. US markets are shut on Monday for the Memorial Day holiday. Hopes of a debt deal could keep equities supported, while a deadlock in Washington could keep gains in check.

Meanwhile, stronger-than-expected inflation, consumer spending, and the surprise in durable goods orders coupled with hawkish remarks from several Fed officials suggest a pause at the June FOMC meeting could be a close call. Markets are pricing in a 60% chance of a 25-basis-point hike by the Fed next month, up from 40% before Friday’s data.

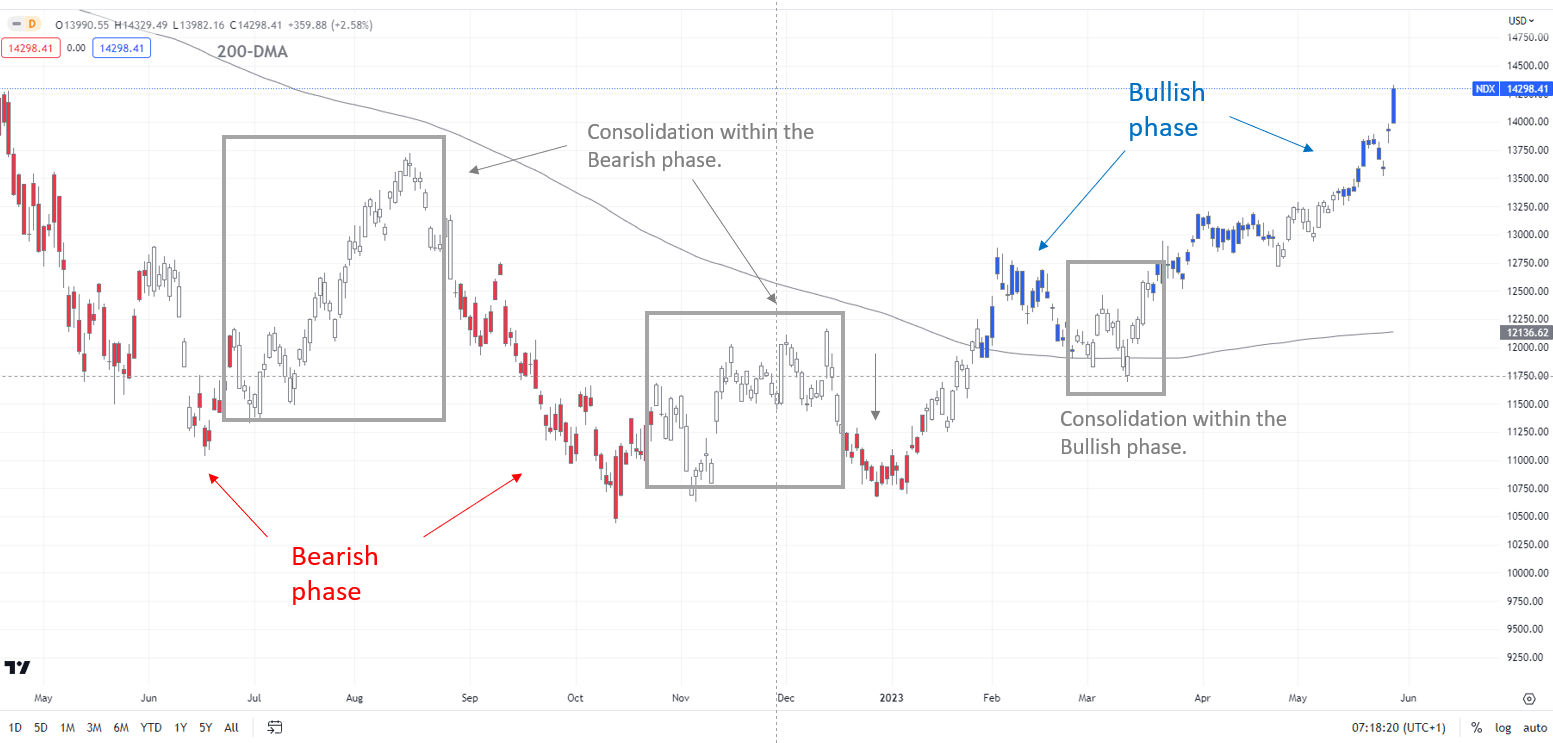

Nasdaq 100 Daily Chart

Chart Created by Manish Jaradi Using Tradingview; Notes at the bottom of the page.

Nasdaq 100: Breaks above the August high

A new 13-month high hit earlier in the week and the move above the August high of 13720 are signs that the medium-term prospects of the Nasdaq 100 index could be changing. See “Nasdaq 100 and S&P 500 to Retest August Highs – A Question of When Not If?”, published April 14, that highlighted the possibility of rise toward 13720. The colour-coded candlestick charts, based on trending/momentum indicators, show the trend remains up, potentially pushing the index toward the April 2022 high of 15265.

Nasdaq 100 Weekly Chart

Chart Created by Manish Jaradi Using Tradingview

Having said that, the recent gains have been associated with declining market breadth, including the percentage members above the 20-day moving average and percent members at new 4-week highs, pointing to some fatigue. However, there are no signs of a reversal of the bullish structure yet.

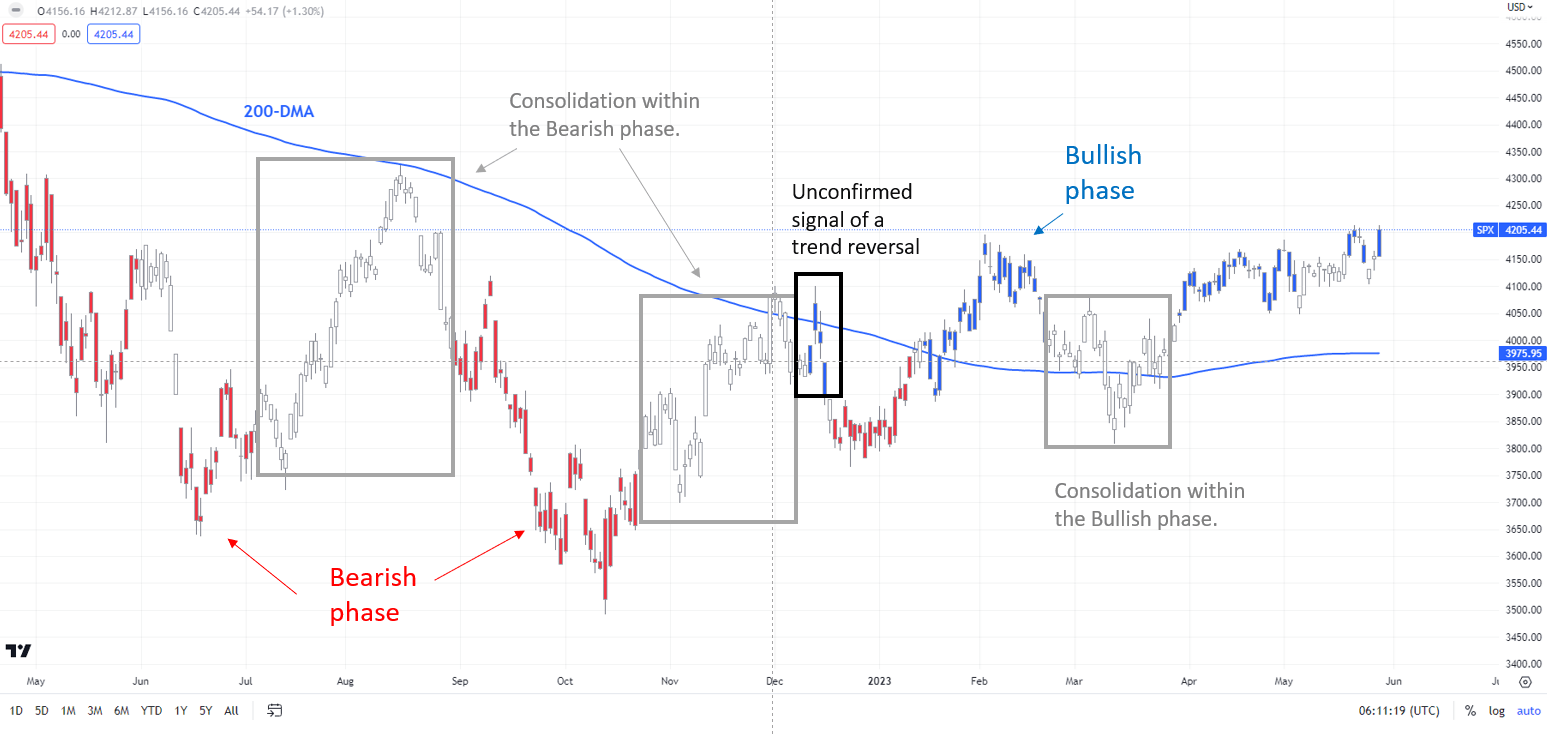

S&P 500 Daily Chart

Chart Created by Manish Jaradi Using Tradingview; Notes at the bottom of the page.

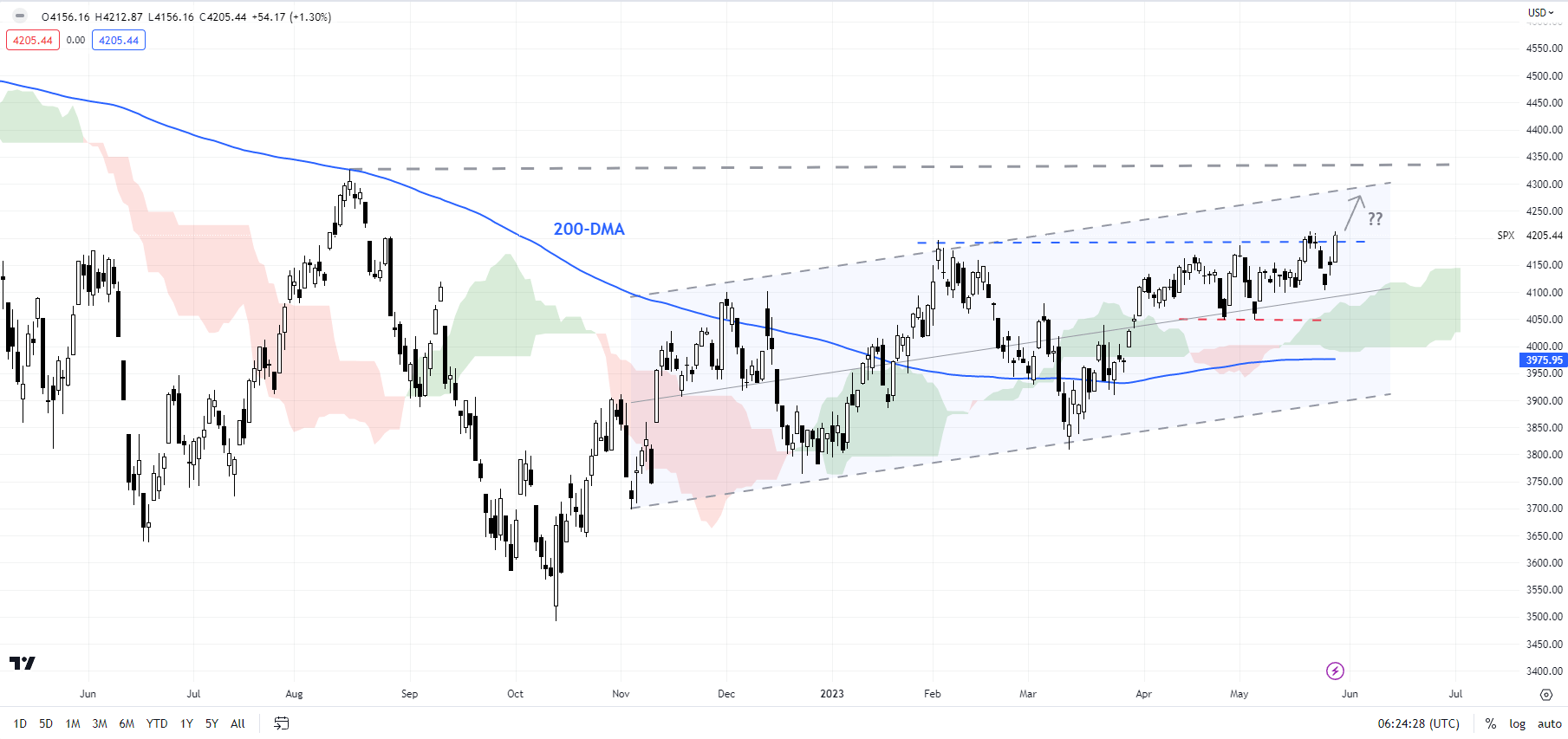

S&P 500: Ripe for a break higher?

While the Nasdaq 100 has made new highs, the S&P 500 index in recent weeks has struggled to clear past the February high of 4195. To be fair, the index hasn’t broken any support, keeping the upward pressure intact. Any break above 4195 could open the way toward the August high of 4325.

S&P 500 Daily Chart

Chart Created by Manish Jaradi Using Tradingview

Broadly, the index has been bullish since late January, as the colour-coded candlestick charts show – first highlighted in January, see “S&P 500 and Nasdaq 100 Index Technical Outlook: Turning Bullish”, published January 28.

Like the Nasdaq 100 index, market breadth hasn’t been supportive of late. However, the bullish pressure is unlikely to ease while the S&P 500 index holds above the early-May low of 4048. Indeed, there is quite a bit of cushion under 4048 all the way toward 3975 (including the 200-day moving average).

Note: In the above colour-coded chart, Blue candles represent a Bullish phase. Red candles represent a Bearish phase. Grey candles serve as Consolidation phases (within a Bullish or a Bearish phase), but sometimes they tend to form at the end of a trend. Note: Candle colors are not predictive – they merely state what the current trend is. Indeed, the candle color can change in the next bar. False patterns can occur around the 200-period moving average, or around a support/resistance and/or in sideways/choppy market. The author does not guarantee the accuracy of the information. Past performance is not indicative of future performance. Users of the information do so at their own risk.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter