US Dollar Weekly Forecast: Bullish

- The US Dollar is up 3 percent over the past 3 weeks

- Will debt ceiling deal, non-farm payrolls propel it more?

- DXY confirmed a breakout above a key moving average

Recommended by Daniel Dubrovsky

Get Your Free USD Forecast

Fundamental Analysis

The US Dollar (DXY) rallied 1 percent this past week. In fact, for the past 3 weeks, the currency is up almost 3 percent. This is speaking to the best 15-day performance since the middle of September. Let us take a closer look at what has been driving this rally and whether or not there is enough fundamental momentum for this move to continue.

The 2-year Treasury yield is up almost 14 percent this month, driven by markets pricing out rate cuts from the Federal Reserve in the near and medium term. Rate cuts were aggressively priced after the collapse of Silicon Valley Bank triggered concerns about a recession that could come sooner in the wake of the most aggressive monetary tightening in decades.

Since then, and especially in recent weeks, generally speaking, data has continued to show that the labor market remains tight. Meanwhile, this past week, the Fed’s preferred inflation gauge crossed the wires, and it surprised higher across the board. This speaks to price pressures that remain sticky and likely need more tightening for longer. Or at the very least, no signs of needed rate cuts.

Also, do not forget, quantitative tightening is still occurring in the background. The central bank continues to unwind holdings of Treasuries and mortgage-backed securities. Another full 25-basis point rate hike is fully priced for the end of July. Meanwhile, the anticipation of immediate easing this year is quickly winding. Long story short, this is what has been contributing to the dollar’s rise.

With that in mind, there are two key events to watch in the near term. The first is ongoing negotiations in Capitol Hill over raising the US debt ceiling. If this does not happen by early June, then the country risks a default.

The second is May’s non-farm payrolls report. As mentioned earlier, a tight labor market is contributing to the rather difficult fight against inflation for the Fed. Further signs that the jobs market is robust will continue cooling near-term rate-cut bets. The country is seen adding 190k non-farm positions, with the unemployment rate ticking slightly higher to 3.5% from 3.4%.

Recommended by Daniel Dubrovsky

Top Trading Lessons

Technical Analysis

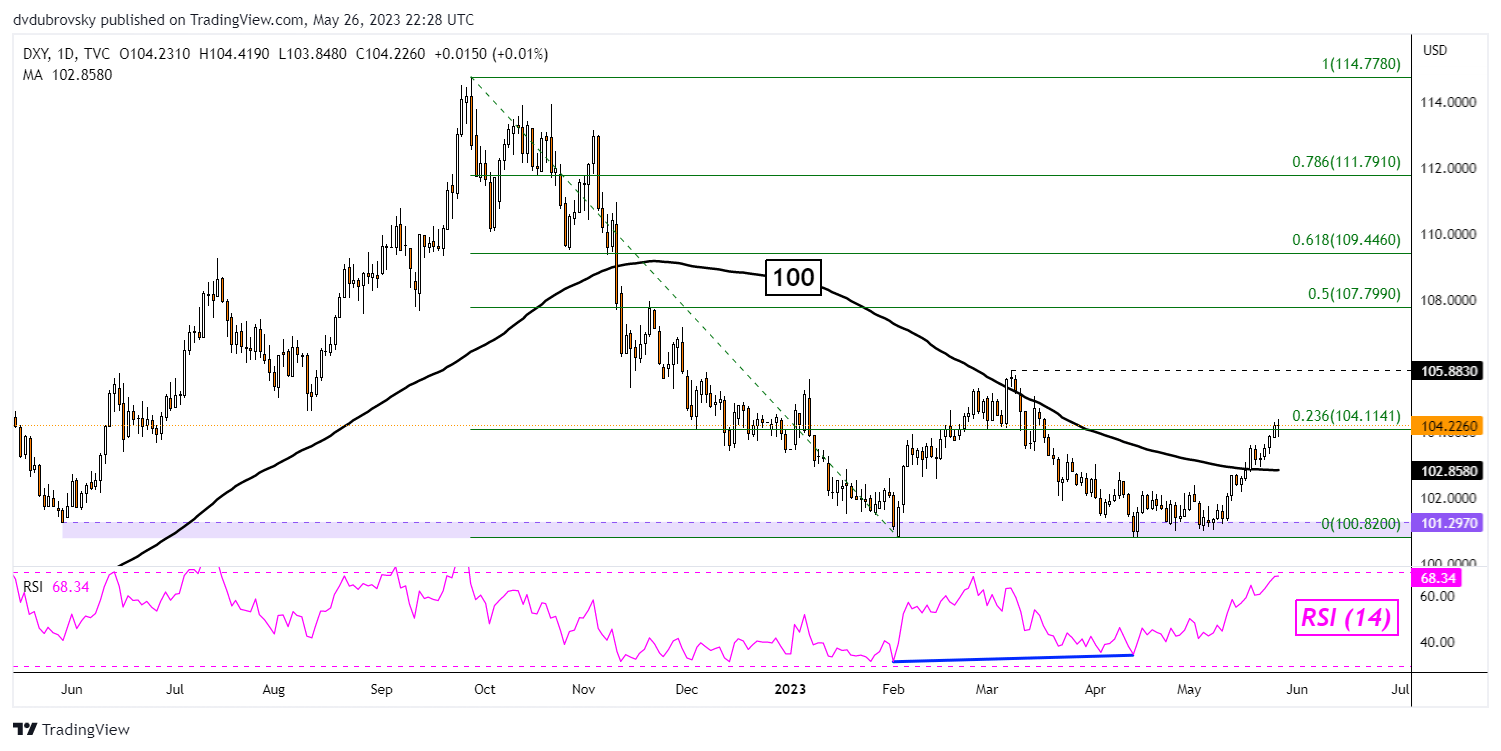

From a technical standpoint, the DXY has confirmed a breakout above the 100-day Simple Moving Average (SMA). That has been offering an increasingly bullish technical bias, complementing the fundamental outlook. Key resistance is the 23.6% Fibonacci retracement level at 104.11. Confirming a breakout above this point exposes the March high at 105.88. Otherwise, a turn lower could see the 100-day SMA holding as support.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

DXY Daily Chart

Chart Created in TradingView

— Written by Daniel Dubrovsky, Senior Strategist for DailyFX.com