USD/CAD PRICE, CHARTS AND ANALYSIS:

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

MOST READ: Gold Price Forecast: 100-Day MA Provides Support as Gold Eyes Recovery

The Loonie has put in some gains against the Greenback this morning helped by US dollar weakness. The loonie looks like it could be vulnerable to further losses as hawkish re-pricing of the Fed rate hike probabilities for June threaten to keep the US dollar supported.

WTIs STRUGGLE, OPEC MEETING AND LOOK AHEAD

WTI continues to struggle holding onto gains which has also negatively impacted the loonie. Of course, there is the all-important OPEC+ meeting in Vienna this weekend which could herald a surprise production cut. Such a move would no doubt boost oil prices and thus benefit the Canadian Dollar. This is by no means a given but rather an observation following comments by the Saudi Oil Minister last week.

Market sentiment continues to shift back and forth at present with news around a debt ceiling deal yet to fully take hold. This could in part be down to the fact that the deal still needs to be approved by both sides before President Biden Is able to sign the bill.

The raging wildfires in parts of Canada has continued into the new week with Nova Scotia having to declare a state of emergency. It is estimated that around 16000 people have had to leave their homes with more than 100 firefighters assisting in minimizing the damage and assist in rescue efforts. The devastating fires could have a negative impact on the economy, however the extent of such will be difficult to determine at this stage.

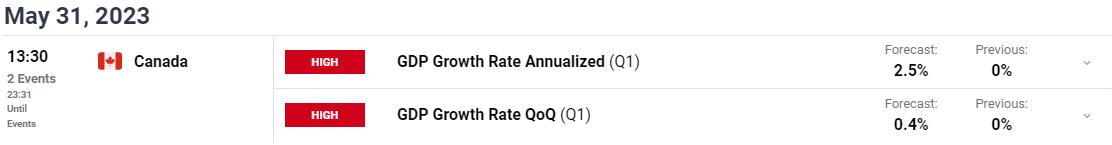

Nova Scotia Premier Tim Houston Providing an Update on Twitter

There isn’t a lot of market moving events on the calendar today with focus likely on Canadian GDP data due tomorrow. GDP thus far for Q1 has been decelerating throughout the first quarter with March GDP (flash) at -0.1%, However consensus for the QoQ figure is around 0.4% while annualized the GDP Growth Rate is estimated to come in at 2.5%. A positive QoQ and YoY print may well be overshadowed by a poor print for the month of April which could have an impact on the Bank of Canada (BoC) and the possibility of a rate hike at the Central Banks next meeting.

For all market-moving economic releases and events, see the DailyFX Calendar

TECHNICAL OUTLOOK AND FINAL THOUGHTS

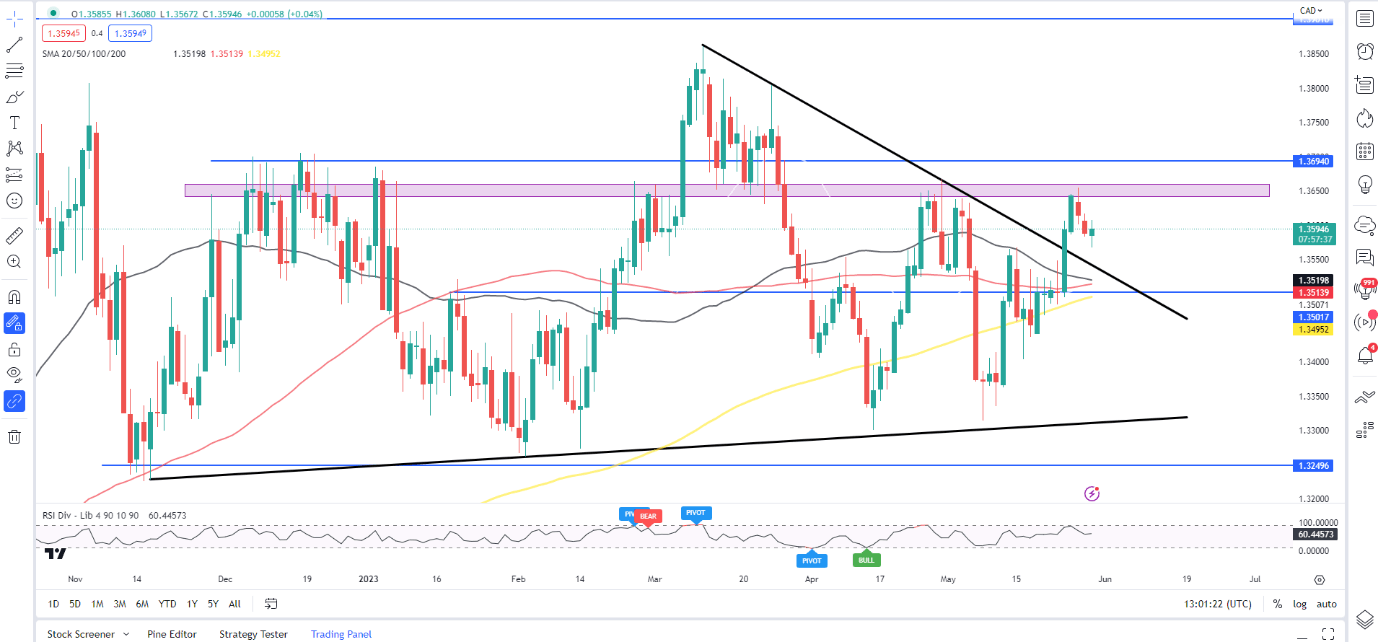

From a technical perspective, USD/CAD is displaying a great example of price action at work as we have staircased our way higher since bottoming out on May 8 around the 1.3300 handle.

Having broken the descending trendline USDCAD Rallied into key resistance around 1.3650 before pulling back over the past 3 days. We do appear poised for the next leg to the upside toward the 1.3700 mark. A deeper correction here could see a test of the 50 and 100-day MA at 1.3520 and 1.3514 respectively, providing a more appealing risk-to-reward ratio. A daily candle close below the 1.3495 handle would invalidate the bullish bias and setup.

Key Intraday Levels to Keep an Eye On

Support Levels:

- 1.3560

- 1.3500 (50 and 100-day MA)

- 1.3400

Resistance Levels:

USD/CAD Daily Chart, May 30, 2023

Source: TradingView, Prepared by Zain Vawda

IG CLIENT SENTIMENT

IG Client Sentiment Data (IGCS) shows retail traders are currently net SHORT on USD/CAD with 57% of traders holding short positions. At DailyFX we typically take a contrarian view to crowd sentiment resulting in a short-term Bullish Bias.

Recommended by Zain Vawda

The Fundamentals of Trend Trading

— Written by Zain Vawda for DailyFX.com

Contact and follow Zain on Twitter: @zvawda