Japanese Yen, USD/JPY, US Dollar, BoJ, Kanda, China PMI, Debt Deal – Talking Points

- Japanese Yen traders’ eye elevated intervention possibility

- The US Dollar is treading water on lower treasury yields ahead of the debt deal

- China PMI disappointed and growth-associated assets tumbled

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

The Japanese Yen rallied toward the end of the Asian session on Wednesday as markets recalibrate the prospect of Japanese authorities intervening in USD/JPY.

Masato Kanda, Japan’s Vice Finance Minister for international affairs, intimated late Tuesday that authorities may act to curd the sinking Yen. He said, “We will closely watch currency market moves and respond appropriately as needed.”

On the topic of intervention, he further ventured, “If necessary, we won’t rule out every option available,”

The Bank of Japan directly intervened several times last year as USD/JPY climbed. Initial buying of Yen near 137 did little to stem the flow, but the bank persisted and continued selling IUSD/JPY toward the peak near 152.

With USD/JPY above 141, the jawboning would seem inevitable in hindsight. There remains potential for more verbal entreaties toward market participants.

The BoJ’s extremely loose monetary policy remains in place for now and today’s industrial production for Japan is not seen as helpful for a tilt away from the stance. Month-on-month output for April decreased -0.4% against forecasts of a 1.4% gain and 1.1% prior.

Recommended by Daniel McCarthy

How to Trade USD/JPY

Going into Wednesday the focus for the next few sessions seems to be on the debt deal being passed. Expectations are that it will get over the line after several comments from Washington lawmakers overnight.

Aside from USD/JPY, the US Dollar is stronger across the board with the high beta AUD and NZD bearing the brunt of Chinese PMI figures missing estimates.

Chinese manufacturing PMI for May printed at 48.8 against the 49.5 anticipated and the non-manufacturing came in at 54.5, against the 55.2 forecast. This combined to give a composite PMI read of 52.9 against 54.4 previously.

APAC equities are all in the red with the perspective of slowing growth in the region becoming apparent. South Korea’s KOSDAQ is the only bright spot in today’s trade.

Treasury yields are steady going into the European session after sliding overnight. The 2-year note saw the largest declines, trading toward 4.4% today after nudging 4.64% late last week.

The slide in yields boosted gold with the front-month COMEX futures contract now trading back near US$ 1,980, after bouncing off support at US$ 1,936 yesterday.

Crude oil remains under pressure after yesterday’s collapse. The WTI futures contract is under US$ 69.50 bbl while the Brent contract is below US$ 73.50 bbl.

The full economic calendar can be viewed here.

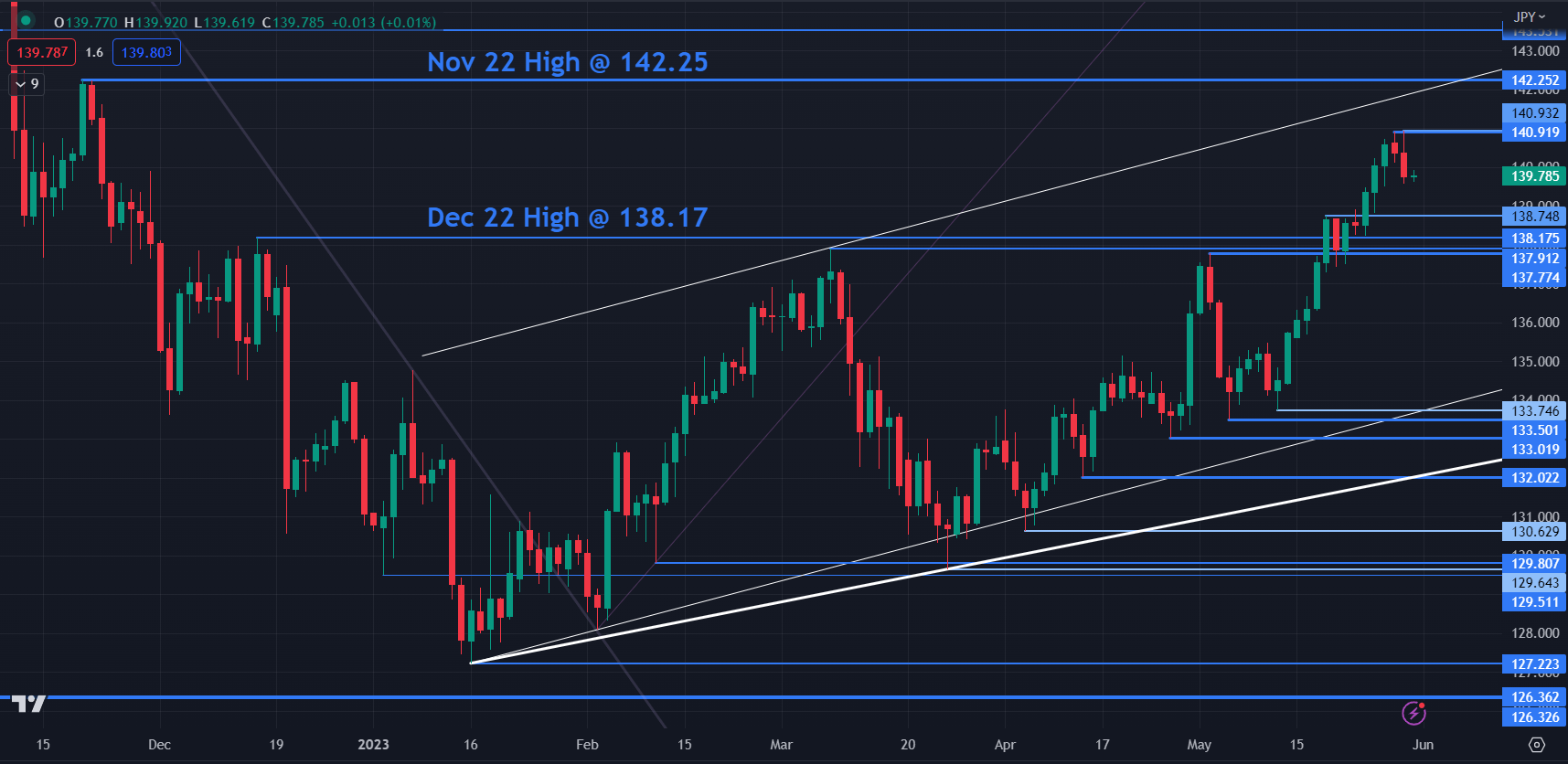

USD/JPY LEVLES TO WATCH

USD/JPY made a six-month high yesterday at 140.93 and that level may offer resistance ahead of November 2022 peak at 142.25. and a breakpoint near 143.50.

On the downside, support may lie at the breakpoints of 138.75, 138.18, 137.91 and 137.77.

Chart created in TradingView

— Written by Daniel McCarthy, Strategist for DailyFX.com

Please contact Daniel via @DanMcCarthyFX on Twitter