Gold, XAU/USD, US Dollar, Fed, Hang Seng, Nikkei 225, RBA, BoC, VIX – Talking Points

- The gold price remains in an ascending channel for now

- Markets might be pivoting toward observing the macroeconomic factors

- Volatility has been drifting lower as range trading becomes fashionable

Recommended by Daniel McCarthy

How to Trade Gold

The gold price is oscillating around US$ 1,980 again today as markets reassess the landscape with China looking to stoke some growth and next week’s Fed meeting coming into view.

It is being reported that China wants the domestic big banks to lower deposit rates for the second time in a year. It appears to be a move designed to encourage consumer spending to boost the domestic economy.

The market is now fretting about what other measures Beijing might take. In any case, Hong Kong’s Hang Seng Index (HSI) has added to recent gains today as it eclipsed 19,400 for the first time in 2-weeks before pulling back.

Japan’s Nikkei 225 index initially opened to yet another fresh 23-year high before pulling back as traders took profit and the Yen strengthened.

The Australian Dollar is eying off 67 cents despite 1Q quarter-on-quarter GDP coming in at 0.2% rather than the 0.3% forecast. The latest read was probably offset with the previous print of 0.5% being revised up to 0.6%.

The crypto world has been turned on its head after the Securities Exchange Commission (SEC announced a crackdown. Coinbase and Binance are in the sights with allegations of an illegal exchange being run.

Elsewhere, Crude oil has had a quiet session to start Wednesday with the WTI futures contract languishing under US$ 72 bbl and the Brent contract nearing US$ 76 bbl at the time of going to print.

Recommended by Daniel McCarthy

The Fundamentals of Range Trading

Perhaps indicative of the current trading regime, volatilities have continued lower today across asset classes. The VIX index is under 14% for the first time since February 2020. The VIX is a measure of implied volatility across a series of maturities on the S&P 500.

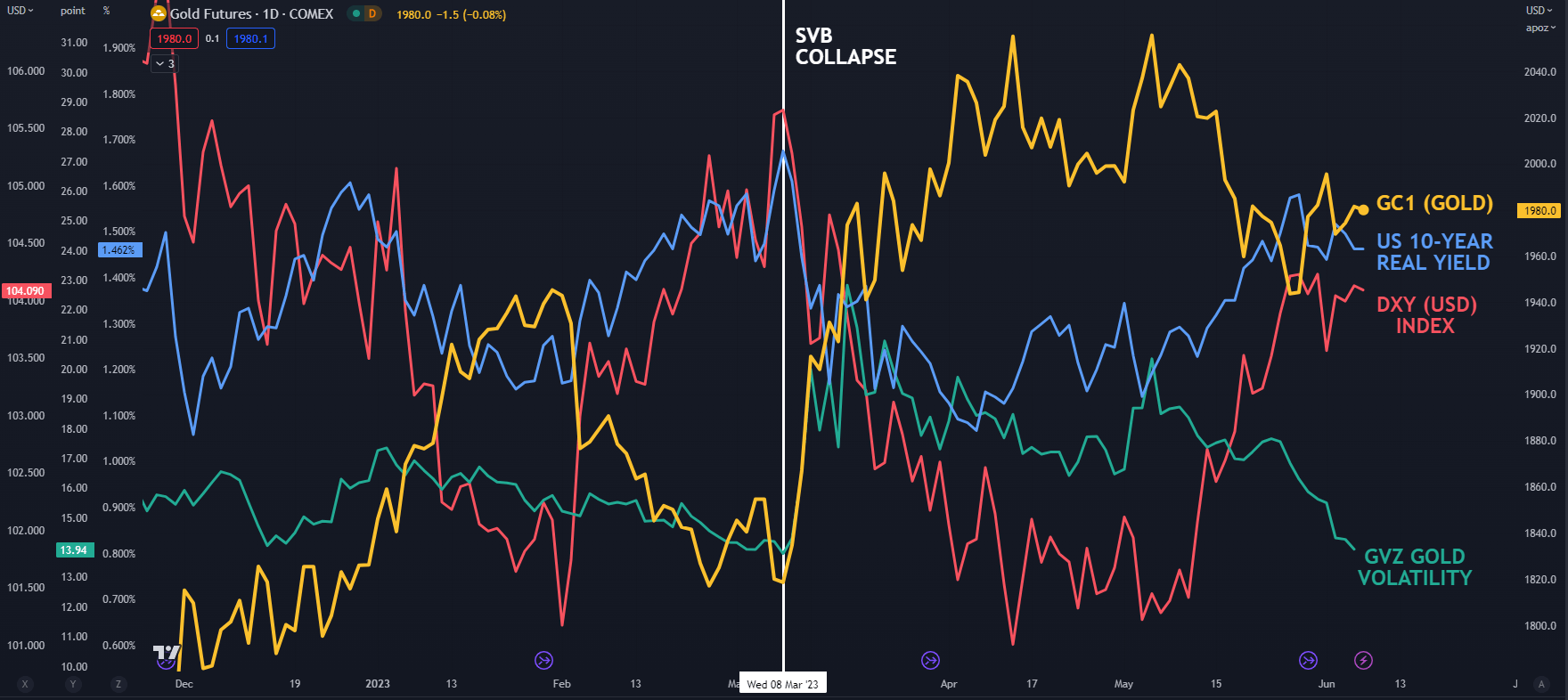

Gold volatility has also continued lower with the GVZ index also nudging under 14%. The GVZ index uses a similar methodology to the VIX index to calculate expected volatility for the next 30 days for gold.

The US 10-year real yield has also continued to move sideways as well as the DXY (USD) index over the last few days.

This brings into the spectre of what the Federal Reserve will be doing at its next Federal Open Market Committee (FOMC) meeting on June 14th.

The RBA lifted rates yesterday and the Bank of Canada (BoC) are set to make their decision later today. The interest market is undecided on the outcome with less than a 50% probability of a 25 basis point hike.

If the BoC decides to raise rates, it might create a new conversation about the potential of the Fed’s rate path. The market has currently priced a ‘no change’ scenario for this time next week.

The full economic calendar can be viewed here.

GOLD, US 10-YEAR REAL YIELD, DXY INDEX, GVZ INDEX

Chart created in TradingView

— Written by Daniel McCarthy, Strategist for DailyFX.com

Please contact Daniel via @DanMcCarthyFX on Twitter