Hey traders,

There is no need to over complicate things. Keep it down to the very basics, which involves, first and foremost, always make sure you spot in whichever timeframe preference you choose, what’s the current environment or as I like to call it, the situational awareness.

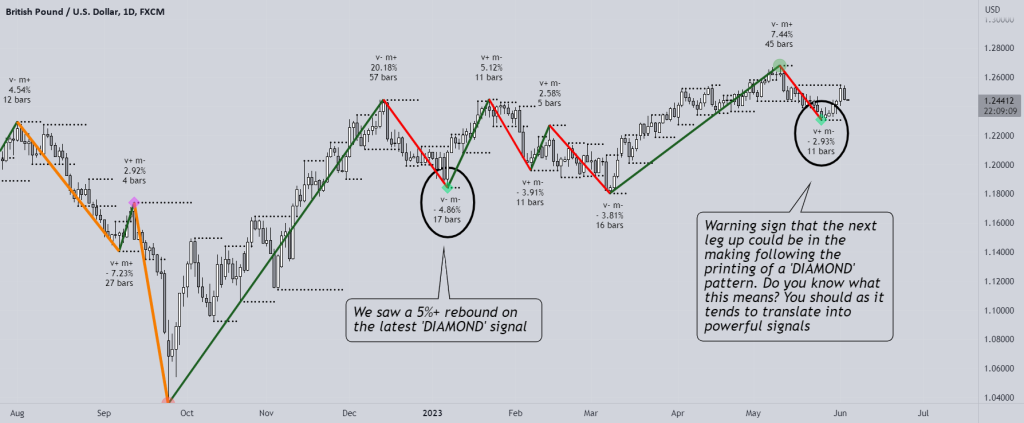

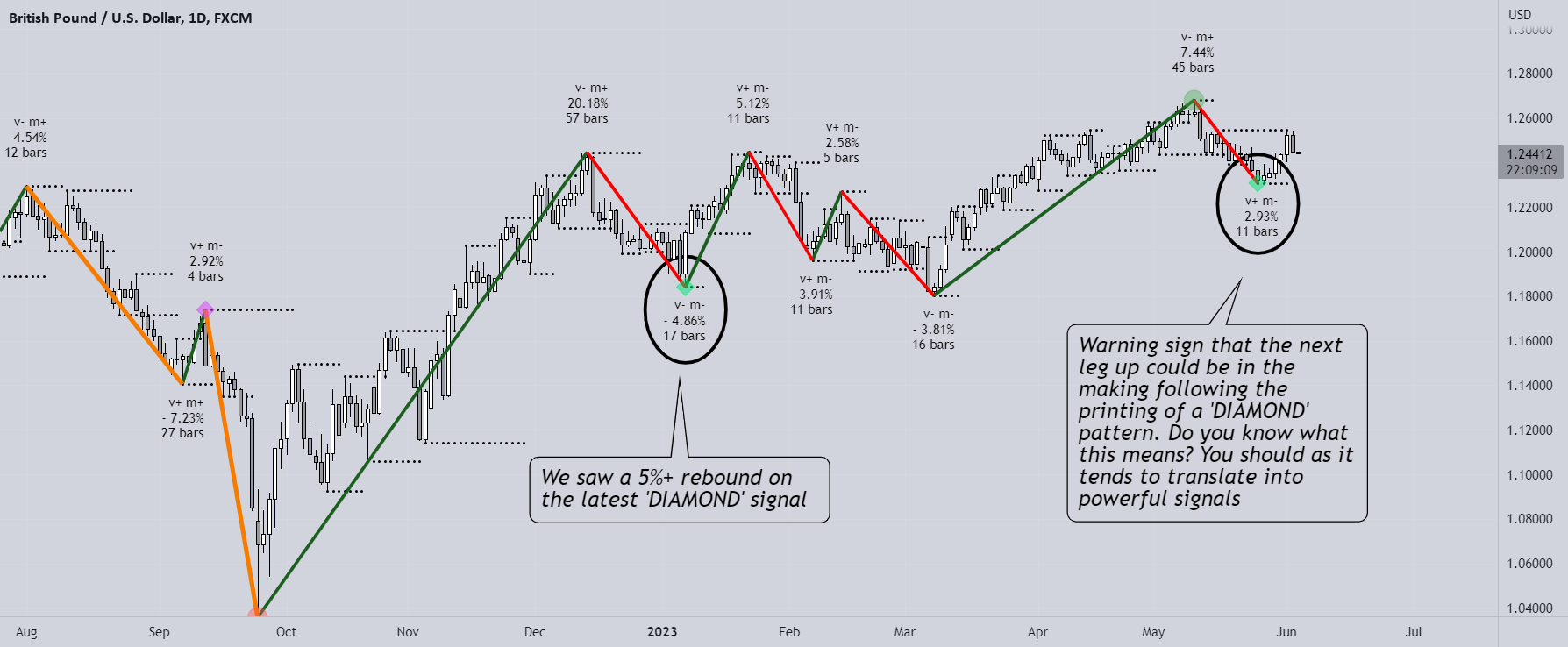

In the GBPUSD in particular, we have a trending market off the daily timeframe, with a short-term price retracement that is firing a DIAMOND pattern. This makes us build the thesis that this location would be ideal to find a bottom in price.

Now the question is… is this the trigger that makes us go back into long positions? Here is where order flow in lower timeframes comes in handy, and through the aggregation of flows via the OFA script, we can visualize the dynamic waves forming to get more precise triggers…

How these waves or cycles are constructed in lower timeframes tend to provide the ultimate clues… as said, in the case of the GBPUSD, we are on the verge of a long entry…

Remember the two key main features of the OFA script:

Magnitude: A major clue that will help determine the health of a trend is the type of progress by the dominant side in control of the trend. We need to ask the following question: Are the new legs in the active buy-sell side campaign as identified by the script increasing or decreasing in magnitude?

Velocity: When it comes to the distance the price moves, the magnitude is only ½ the equation. The other ½ has to do with the velocity of the move or the speed. Was the new leg created after a fast and impulsive move? Or did price make a new low or high with the movement being sluggish, compressive and taking too long to form? A good rule of thumb is to count the number of candles it took to achieve a new leg.

DISCLAIMER: This post contains commentary published solely for educational and informational purposes. This post’s content (and any content available through links in this post) and its views do not constitute financial advice or an investment or trading recommendation, and they do not account for readers’ personal financial circumstances, or their investing or trading objectives, time frame, and risk tolerance. Readers should perform their own due diligence, and consult a qualified financial adviser or other investment / financial professional before entering any trade, investment or other transaction.