Market Recap

Fed Chair Jerome Powell reiterated his hawkish tone in his testimony to the Senate Banking Committee overnight, but Wall Street seems to be taking it in stride this time (DJIA -0.01%; S&P 500 +0.37%; Nasdaq +0.95%), with the S&P 500 and Nasdaq overturning their three-day losing streak.

Overnight economic data saw little surprise in US initial jobless claims, but the Conference Board Leading Economic Index may warrant some attention with its 14th straight month of decline. The steeper pace of decline over the six-month period between November 2022-May 2023 reflected that tighter policies are working its way through economic conditions, which kept rate expectations well-anchored for an impending end to the Fed’s hiking cycle. The upcoming economic challenges presented from the data put value sectors on the backfoot overnight, while the more economically-resilient megacap tech shined.

Further Fedspeak are lined up on the economic calendar ahead, but could be largely a non-event with market participants accustomed to the Fed’s hawkish but data-dependent tone. A series of flash Purchasing Managers’ Index (PMI) figures will be on the radar as well, with any signs of a soft landing on the lookout.

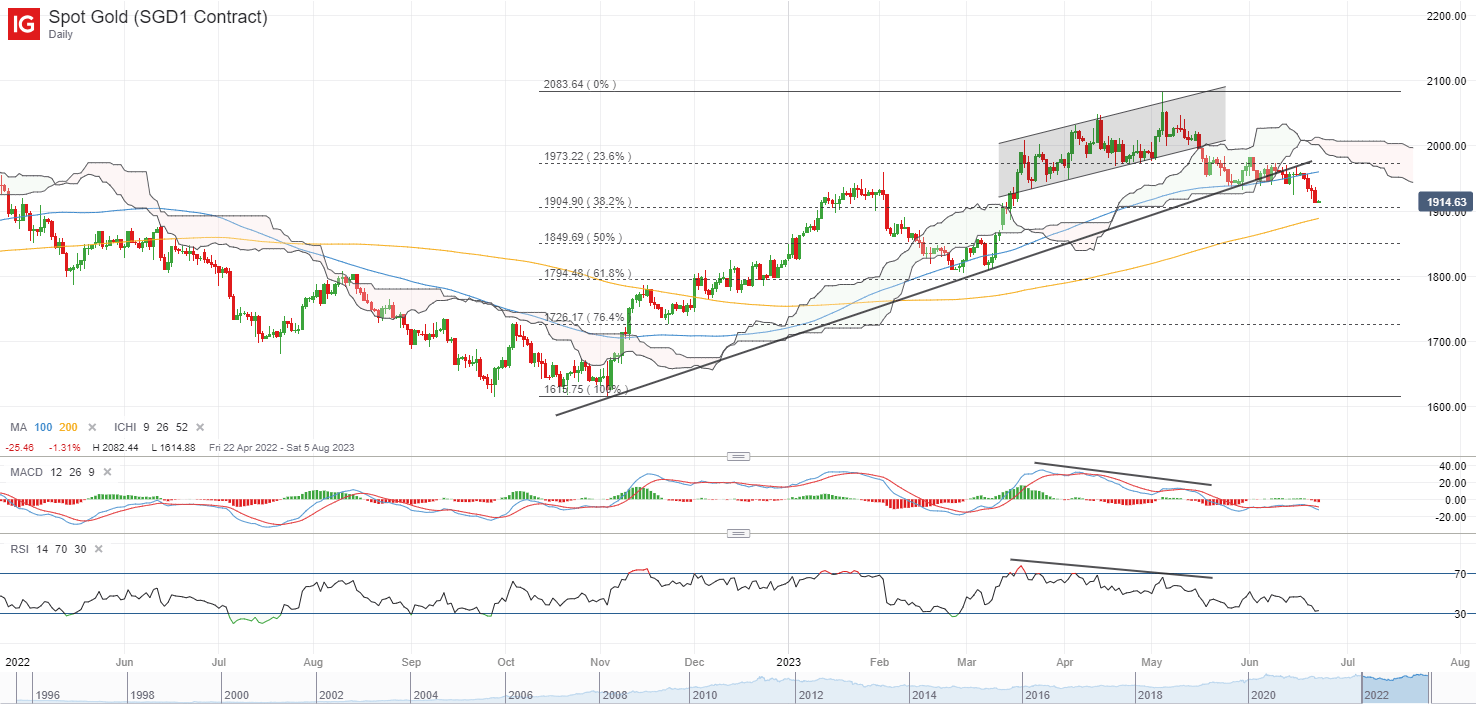

Treasury yields moved higher overnight, which aided to firm up the US dollar (+0.4%) but weighed on gold prices (-1.0%). The yellow metal has pushed to a new three-month low, failing to hold above a key support confluence (upward trendline, Ichimoku cloud, 100-day MA). The formation of near-term lower highs and lower lows put a downward trend in place for now, with any subsequent break below the US$1,900 level potentially paving the way towards the US$1,868 level next.

Source: IG charts

Asia Open

Asian stocks look set for a mixed open, with Nikkei +0.29%, ASX -0.56% and KOSPI -0.38% at the time of writing. Hong Kong markets will be back online today, while Mainland China share market remain closed for the Dragon Boat Festival.

The economic calendar this morning saw a significant downside surprise in Japan’s headline inflation (3.2% versus 4.1% expected), but the core-core aspect continues to head higher to 4.3% from previous 4.1%, with the mixed data likely to put the Bank of Japan (BoJ) on more wait-and-see in its policy-pivot plans. That is further supported by the downside growth risks presented in the au Jibun Bank PMI readings, with the manufacturing sector in contraction territory while lower-than-expected services PMI put some dampener on reopening optimism.

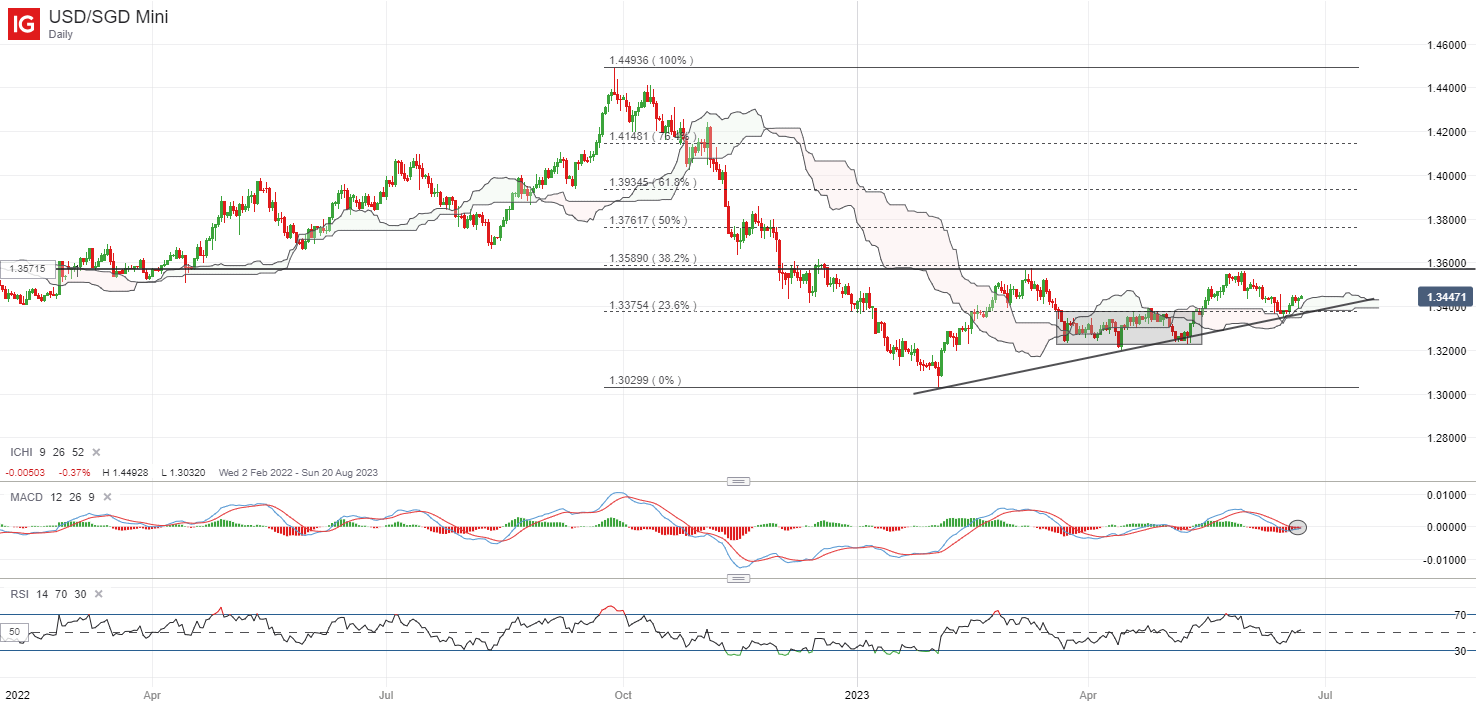

The day ahead will leave Singapore’s consumer price index (CPI) in focus. With the Monetary Authority of Singapore (MAS) leaning towards a pause in its tightening stance since April this year, more evidence of moderating inflation will be needed to provide the conviction that a reinstatement in tighter policies is not needed. A downside surprise on that front may weigh on the SGD.

The USD/SGD has been trading within an ascending triangle pattern over the past months, with the near-term higher lows revealing greater control from buyers. The flat upper trendline resistance may be in focus, with any subsequent move above 1.360 potentially paving the way to the 1.375 level next. The upward bias may remain, with a bullish crossover on moving average convergence/divergence (MACD), along with a steady sit above its Ichimoku cloud on the daily chart.

Source: IG charts

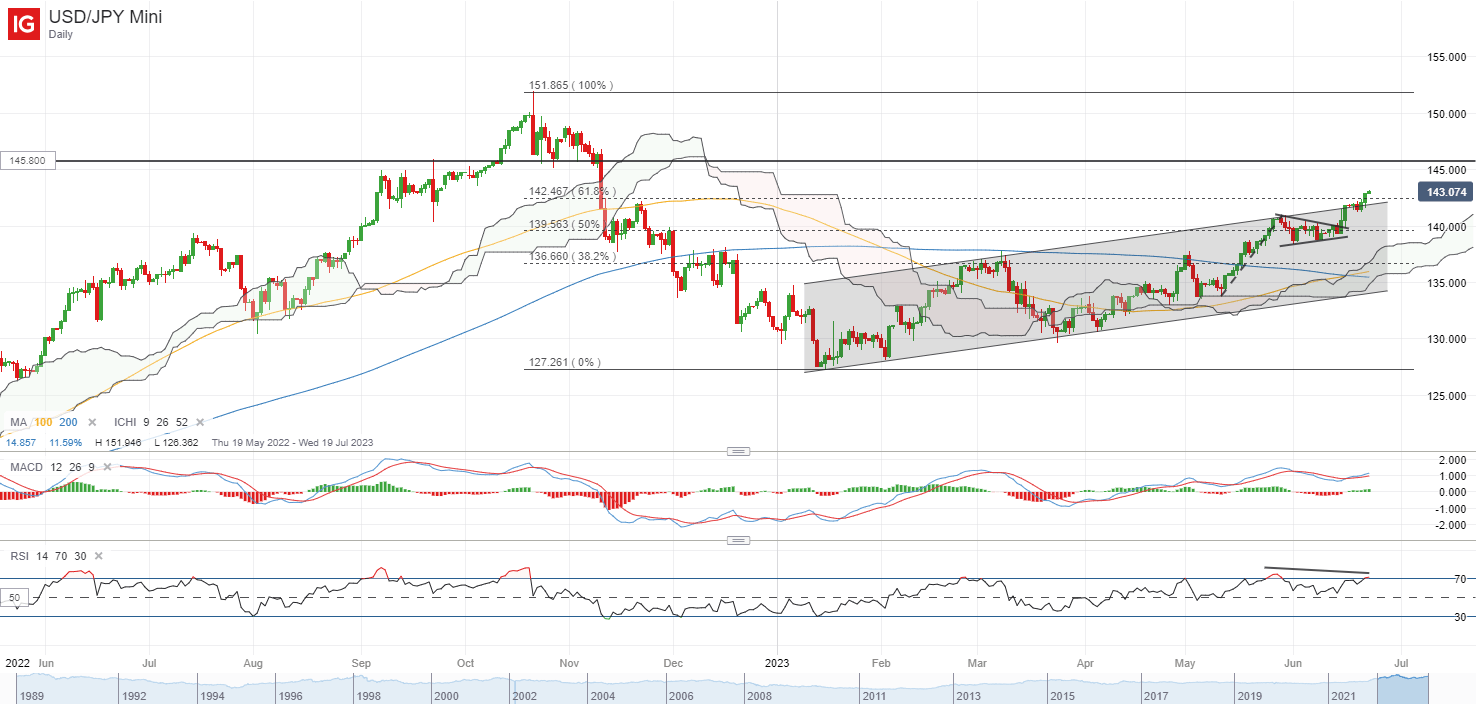

On the watchlist: USD/JPY heads above ascending channel pattern

Having traded within an ascending channel pattern since the start of the year, a firmer US dollar overnight has allowed the USD/JPY to overcome its upper channel resistance, with a bullish crossover formed between its 100-day and 200-day moving average (MA). Widening yield differential between the US Treasuries and the Japanese Government Bonds (JGBs) remains a key driving force, with recent central banks’ updates continue to reinforce a Fed-BoJ policy divergence.

The next level in focus may be the 145.00-145.80 range, as one may recall how the BoJ has intervened in the currency market at this level back in September 2022 by buying 2.8 trillion yen. Reaching that level may reignite some speculations that the central bank may step in once more, although past intervention attempts have not been always successful in supporting the yen over the longer term. On the downside, the 142.00 level will serve as an immediate support to hold, where the upper channel trendline stands.

Source: IG charts

Thursday: DJIA -0.01%; S&P 500 +0.37%; Nasdaq +0.95%, DAX -0.22%, FTSE -0.76%