The spectacular run in US equities looks set to spill over in the third quarter, thanks to improving overall sentiment after the raising of the US debt ceiling, reduced stress in the banking system, the resilience of the US economy, and hopes that global interest rates are peaking.

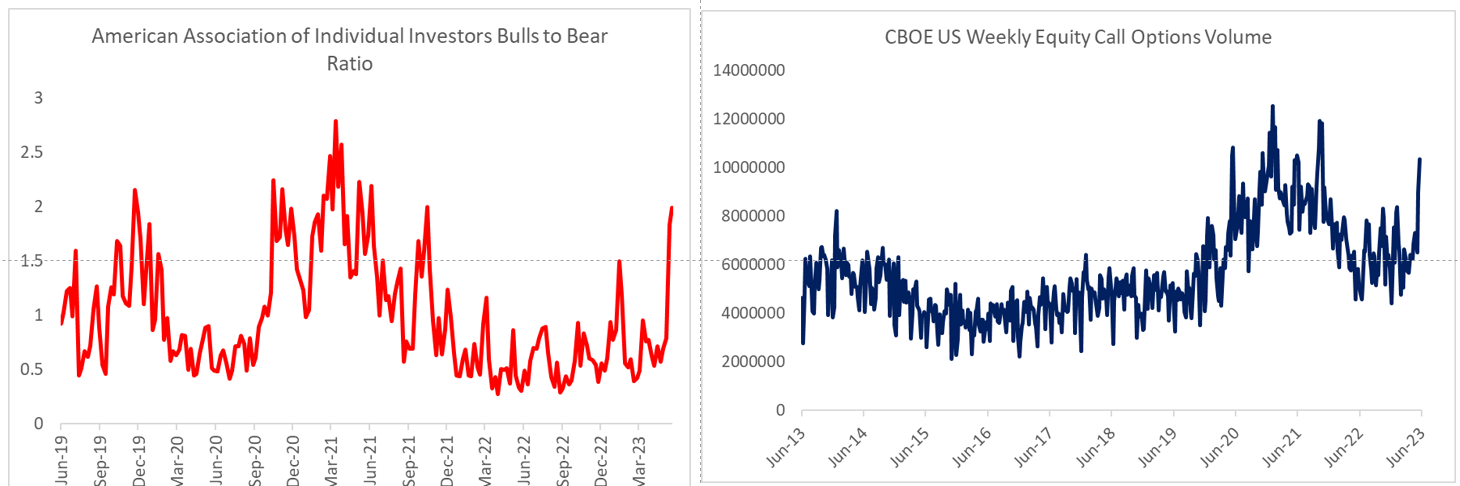

The passage of the uncertainties, including a potentially catastrophic US default and limited contagion from the regional bank failures, has led to a dramatic improvement in sentiment as reflected in the surge in demand for S&P 500 index call options, generally a way to express a bullish view.

Dramatic turnaround in sentiment

Source data: Bloomberg; chart prepared in Microsoft Excel.

Resilient economic growth and earnings

Moreover, much of the slowdown in the economy is pronounced in the manufacturing sector. The services sector has been surprisingly resilient, which to some extent has reduced the tail risk of a hard landing. Still, the central scenario for consensus seems to indicate a mild US recession, as reflected in the upgrades to the economic assessment for the current year and downgrades in the growth outlook for 2024 on tightened financial conditions.

Price pressures have moderated in recent months, but only slowly and remain well above the central bank’s target. The US Federal Reserve is projecting two additional rate hikes in 2023 given the disappointingly slow decline in inflation, with rate cuts not seen for a couple of years. In contrast, the market is pricing in a less than 100% chance of one rate hike this year, with rate cuts starting as soon as next year.

Growth outlook and inflation trend

Source data: Bloomberg; chart prepared in Microsoft Excel.

The market’s dovish pricing seems to be based on the perception that Fed’s inflation forecasts have lagged realized inflation, and producer price inflation and import prices are already pointing to softness in activity. Regardless, the general perception is that the bulk of rate hikes are done, enough for equity markets to cheer.

The S&P 500 index is up about 15% year-to-date, while the tech-heavy Nasdaq 100 index is up nearly 40%. As a result, valuations are no longer cheap – both relative to history and relative to bonds (equity risk premium). According to FactSet, the forward 12-month P/E ratio for the S&P 500 is 18.5, above the 10-year average of 17.3. The bulls, however, argue that as long as company profits stay resilient and rates don’t go through the roof, equities could grind higher.

Risks

Having said that, risks remain. (i) Over-tightening, raising the risk of a hard landing; (ii) The market’s dovish pricing converges with hawkish Fed projections, prompting a sizeable correction in asset prices; (iii) Optimistic earnings trajectory, leaving scope for disappointment – analysts expect earnings for the S&P 500 to decline in Q2-2023, but expect a rebound in Q3-2023 to 0.8% and jump to 8.2% in Q4-2023, according to FactSet; (iv) From a seasonality perspective, historically the July-September quarter tends to be the weakest for US equities.

— Written by Manish Jaradi, Strategist for DailyFX.com

— Contact and follow Jaradi on Twitter: @JaradiManish