Crude Oil, EIA, API, Federal Reserve, Non-farm Payrolls, AUD, CAD, NZD, Gold – Talking Points

- Crude oil has been buoyed by shrinking stockpiles and solid US data

- The extent of Fed hawkishness has been reappraised by the market

- If today’s US non-farm payrolls beat estimates, will WTI break higher?

Recommended by Daniel McCarthy

Get Your Free Oil Forecast

Crude oil is bumping up against the top end of the recent range going into Friday’s session as robust US data lifted the outlook for economic activity in the world’s largest economy.

Stockpiles of crude reported by the US Energy Information Agency (IEA) revealed a drop of 1.508 million barrels for the week ended June 30th against 983k barrels anticipated and 9.603 fewer barrels in the prior week.

Earlier in the week, the American Petroleum Institute (API) inventory report showed a decrease of 4.382 million barrels for the same week. The shrinking reserves may hint toward a US economy continuing to thrive in the face of the Federal Reserve’s tightening measures.

Compounding this perspective was the ADP National Employment Report that showed 497k non-farm private jobs were added in June, well above estimates of 228k.

Later today, the market will be focussing on the US Bureau of Labour Statistics non-farm payroll figures. A Bloomberg survey of economists estimates that 230k jobs were added last month.

All this positive news saw Treasury yields marching higher again with the benchmark 10-year bond trading back above 4%.

The vigour in the labour market lifted the prospect of a more hawkish Fed at their meeting on the 26th of July. Wall Street finished lower in its cash session and APAC equity indices followed the lead with a sea of red across the region.

The growth-linked currencies of AUD, CAD and NZD are struggling going into the end of the week. Spot gold is also eyeing a 4-month low, trading near US$ 1,910 at the time of going to print.

After US non-farm payrolls data, ECB President Christine Lagarde will be speaking.

The full economic calendar can be viewed here.

Recommended by Daniel McCarthy

How to Trade AUD/USD

WTI CRUDE OIL TECHNICAL ANALYSIS

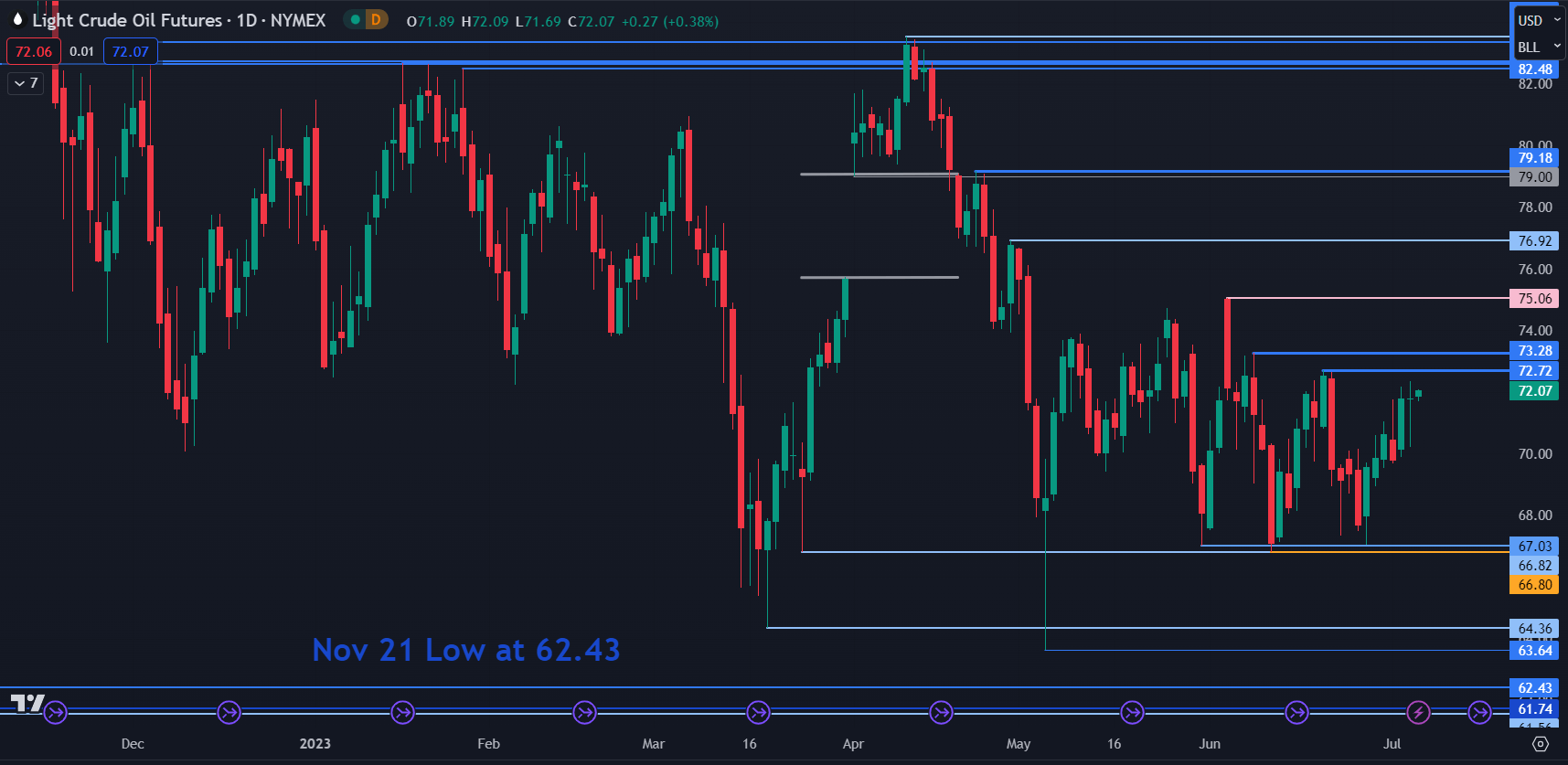

WTI crude continues to see range trading conditions with the price contained within 66.80 – 75.06 for more than 2 months. More broadly, it has traded between 63.64 and 83.53 since last November.

With this in mind, previous highs and lows might provide resistance and support respectively.

On the downside, support may lie at 67.03, 66.82, 66.80, 64.36, 63.64 or at the November 2021 low of 62.43.

On the topside, resistance could be at 72.72, 73.28, 75.06, 76.92 and 79.18 ahead of a cluster of breakpoints and prior peaks in the 82.50 – 83.50 area.

Chart created in TradingView

— Written by Daniel McCarthy, Strategist for DailyFX.com

Please contact Daniel via @DanMcCarthyFX on Twitter