Recommended by Diego Colman

Get Your Free JPY Forecast

Japanese Yen Recap

Japanese yen has been stuck in a sustained depreciatory trend in recent months, caused primarily by Bank of Japan’s ultra-dovish monetary policy stance. While major central banks around the world have launched aggressive tightening campaigns to curb inflationary pressures, the Japanese institution has remained unmoved, keeping its short-term interest rate steady at -0.1% and its yield curve scheme intact.

There is little reason to believe that things will change significantly heading into the third quarter. If the BoJ intended to veer off course soon, it would have laid the groundwork for that move at its June meeting, but no such thing happened. Instead, the bank retained the status quo, signaling continuity in the stimulus program.

Although many analysts believe a policy exit is imminent, key officials, including Governor Kazuo Ueda, have indicated that they will remain committed to the strategy to achieve more durable demand-driven inflation after decades of deflation, noting that a premature shift to a tighter stance could have a detrimental impact on employment and compromise the sustainability of wage growth.

Recommended by Diego Colman

How to Trade USD/JPY

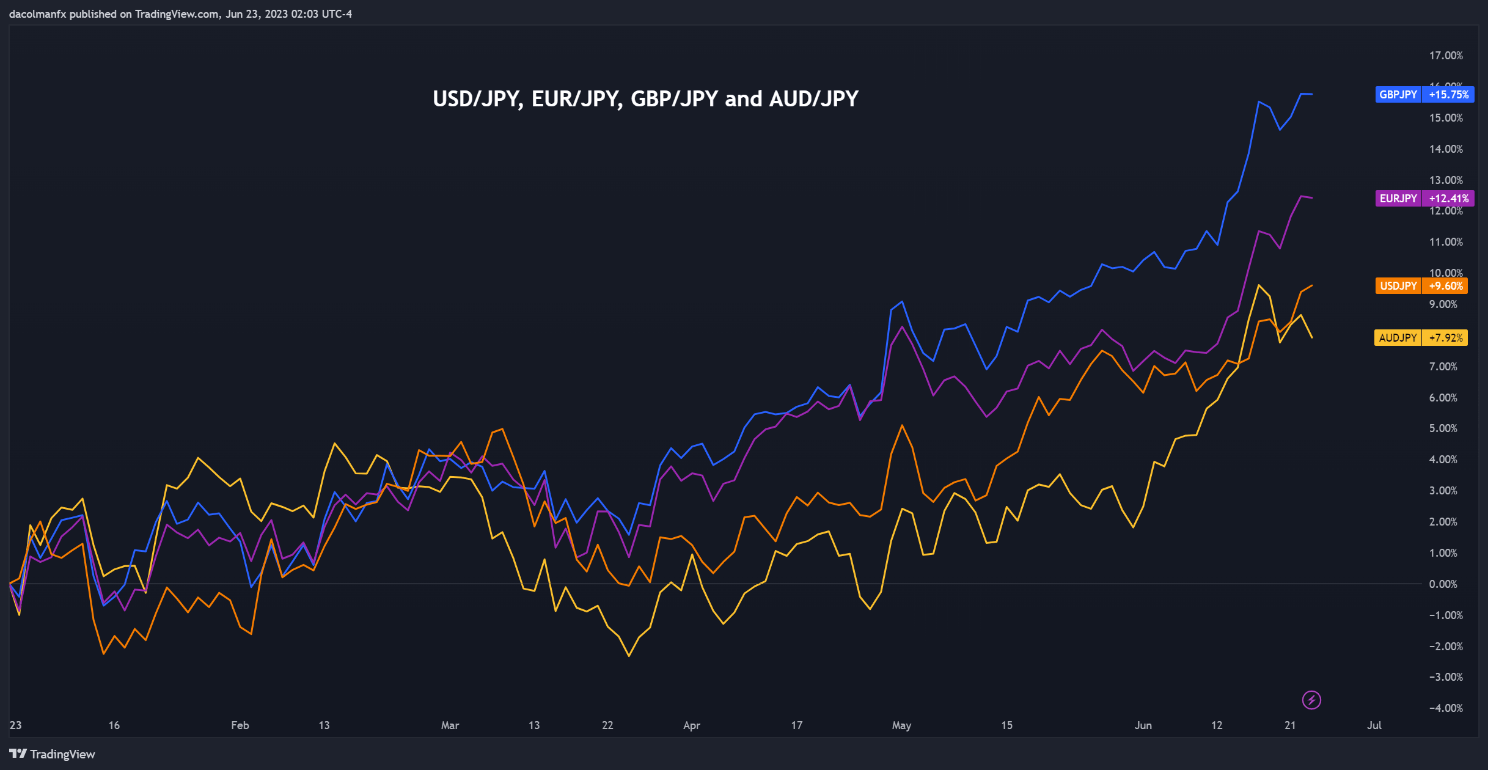

Bank of Japan’s dovish stance is in stark contrast with its global peers. The Federal Reserve, for instance, has embarked on one of the most forceful normalization cycles in decades, delivering 500 bp of hikes since March 2022 and signaling 50 bp of additional tightening through year’s end. It is therefore not surprising the USD/JPY has appreciated nearly 8% during the second quarter.

With key central banks such as the Fed, the ECB and the Bank of England expected to raise borrowing costs further in the coming month, while the BoJ remains on hold, the Japanese yen will continue to display weakness in global currency markets, at least in the short term.

While it is too soon to take an optimistic view on the yen, bearish bets should be kept in check given stretched markets. To expand on this point, the last few times the yen weakened too much, and too fast, Japanese authorities stepped in to prop up the domestic currency and rein in rampant speculative activity in the FX space, burning countless traders who got caught on the wrong side of the trade.

Last year, Japan’s Ministry of Finance intervened by selling U.S. dollars (about $68 billion in total) when the USD/JPY exchange rate moved too fast first towards ¥145.00 and then towards ¥150.00. These thresholds, especially the second one, should be taken into account when assessing the risk-reward profile of a potential trade in this pair.

Recommended by Diego Colman

Improve your trading with IG Client Sentiment Data

USD/JPY, EUR/JPY, GBP/JPY & AUD/JPY Chart

Source: TradingView, Prepared by Diego Colman

This article only covers the yen’s fundamental forecast. If you would like to learn about the technical outlook for USD/JPY and EUR/JPY as well as key price levels to watch in the near term, download the complete third-quarter trading guide by clicking the link below. It’s free!

Recommended by Diego Colman

Get Your Free JPY Forecast