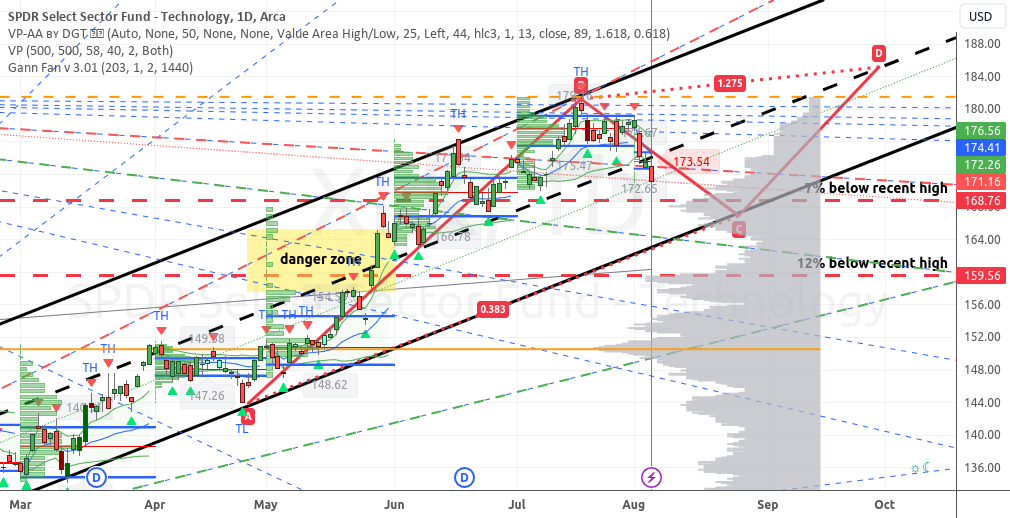

Likely further selling, 7% off the most recent high of 181.46, to 168.76. This would take XLK to the lower part of the bullish forward Ichimoku cloud (not shown), and below the 50 day exponential moving average (not shown). There is still bull here, should it reverse back upward, since it would be inside the upward regression channel drawn from 10/13/22 low (black lines). Target in this scenario would be a new high around 185.12, or 1.27 Gartley extension.

Another scenario would be a break of the 7 % line and the regression channel — a further decline into a dangerous area with little support (yellow rectangle). In this case, we are looking at a 12% decline and a low of 159.56, and a reversal in the making off the regression channel.