Euro (EUR/USD, EUR/GBP) Analysis

Recommended by Richard Snow

Get Your Free EUR Forecast

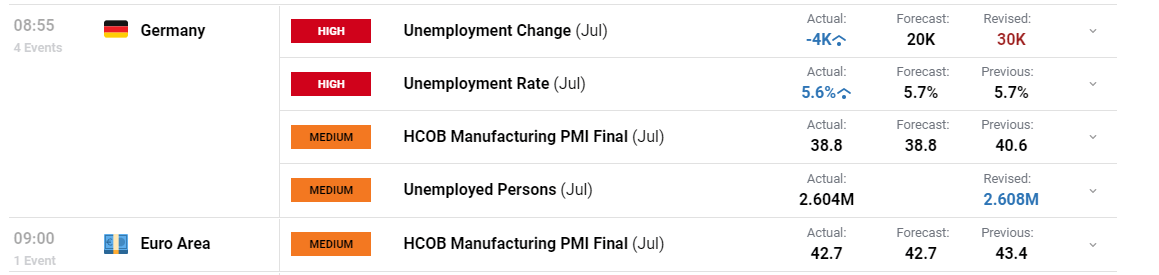

European Data Set the Bearish Tone Earlier in the Week

The euro has experienced a sizeable selloff which only continued as the week progressed as EU data softened and US data remained relatively strong. On Monday we saw core inflation edge higher in July but the same could be said for Q2 GDP – surprising the market with a 0.3% QoQ rise after Q1 ended flat.

That’s about as good as the data got because German and EU manufacturing PMI reported disappointing figures as new orders slowed despite rapidly declining prices.

Customize and filter live economic data via our DailyFX economic calendar

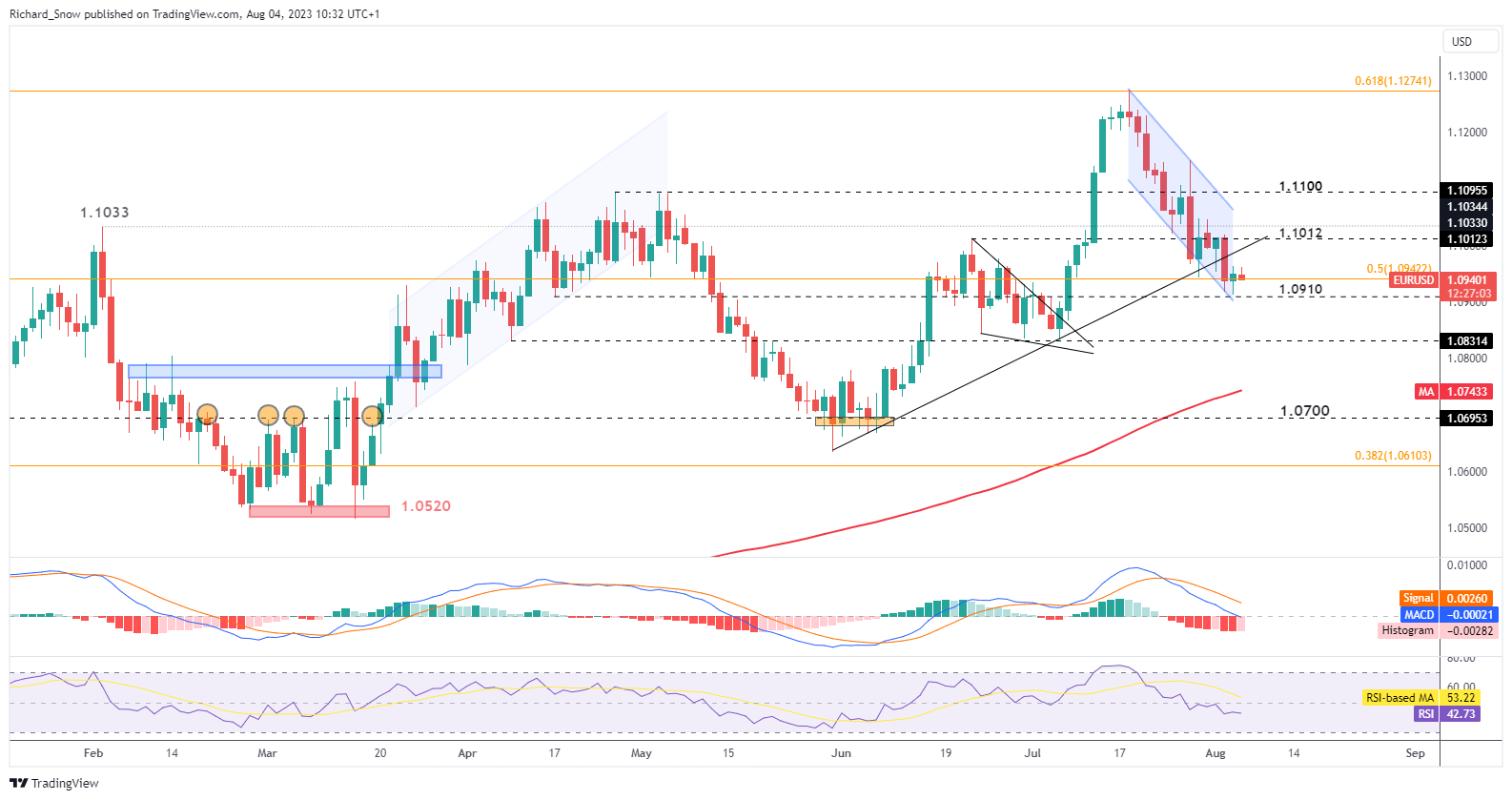

EUR/USD Breakout Watch

EUR/USD continues to selloff after reaching the 61.8% Fibonacci retracement of the 2021 – 2022 move (1.1275). Now, price action remains below the trendline support which began on the 31st of May and saw the first touch on the 6th of July. Wednesday’s upward surprise in the ADP jobs report added further momentum to the move.

1.0910 is the nearest level of support followed by 1.0832 with the MACD indicator suggesting that bearish momentum is building. Data is very light next week, apart from US inflation data where if we see cooler prices, EUR/USD may find some reprieve to recent selling. Those eying breakdown setups, it would not be unusual to see a retest of the prior trendline support – this time as resistance – before assessing further bearish continuation upon a bounce lower.

EUR/USD Daily Chart

Source: TradingView, prepared by Richard Snow

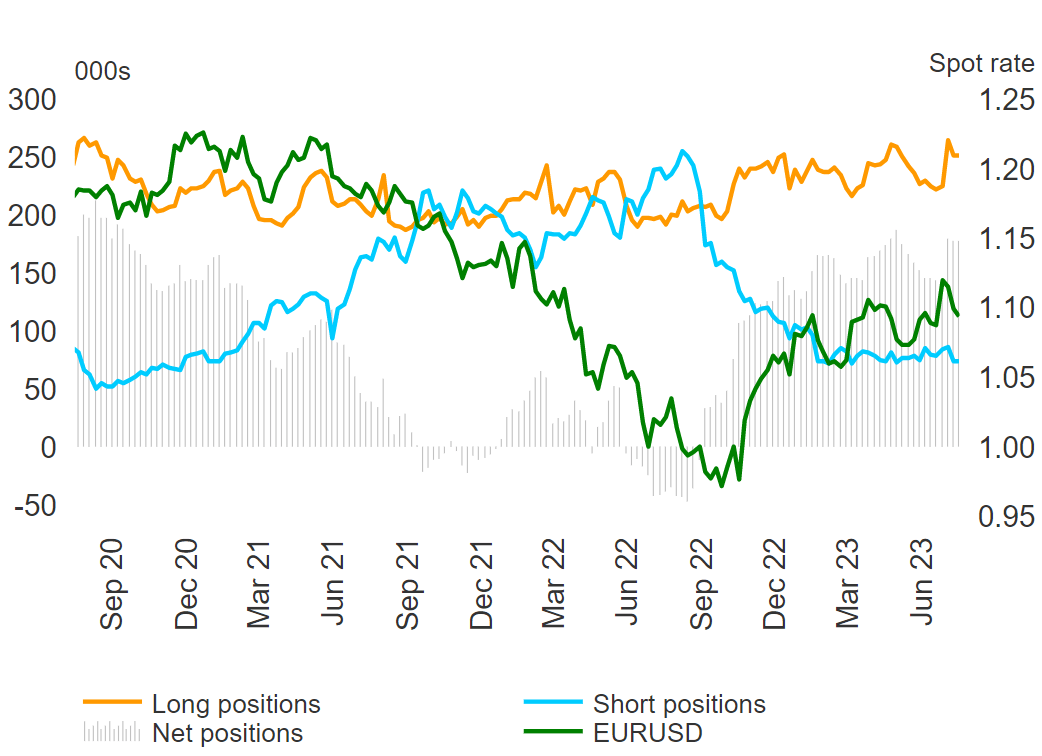

Speculative Traders Appear Hopeful – Updated Data Later This Afternoon

Speculative traders like hedge funds and other large institutions have not reported a drastic drop off in euro longs or an uptick in shorts. This would suggests a resurgence in EUR/USD but more information can be gleaned via the updated data out later today.

Speculative Positioning According to CFTC CoT Report

Source: Refinitiv, prepared by Richard Snow

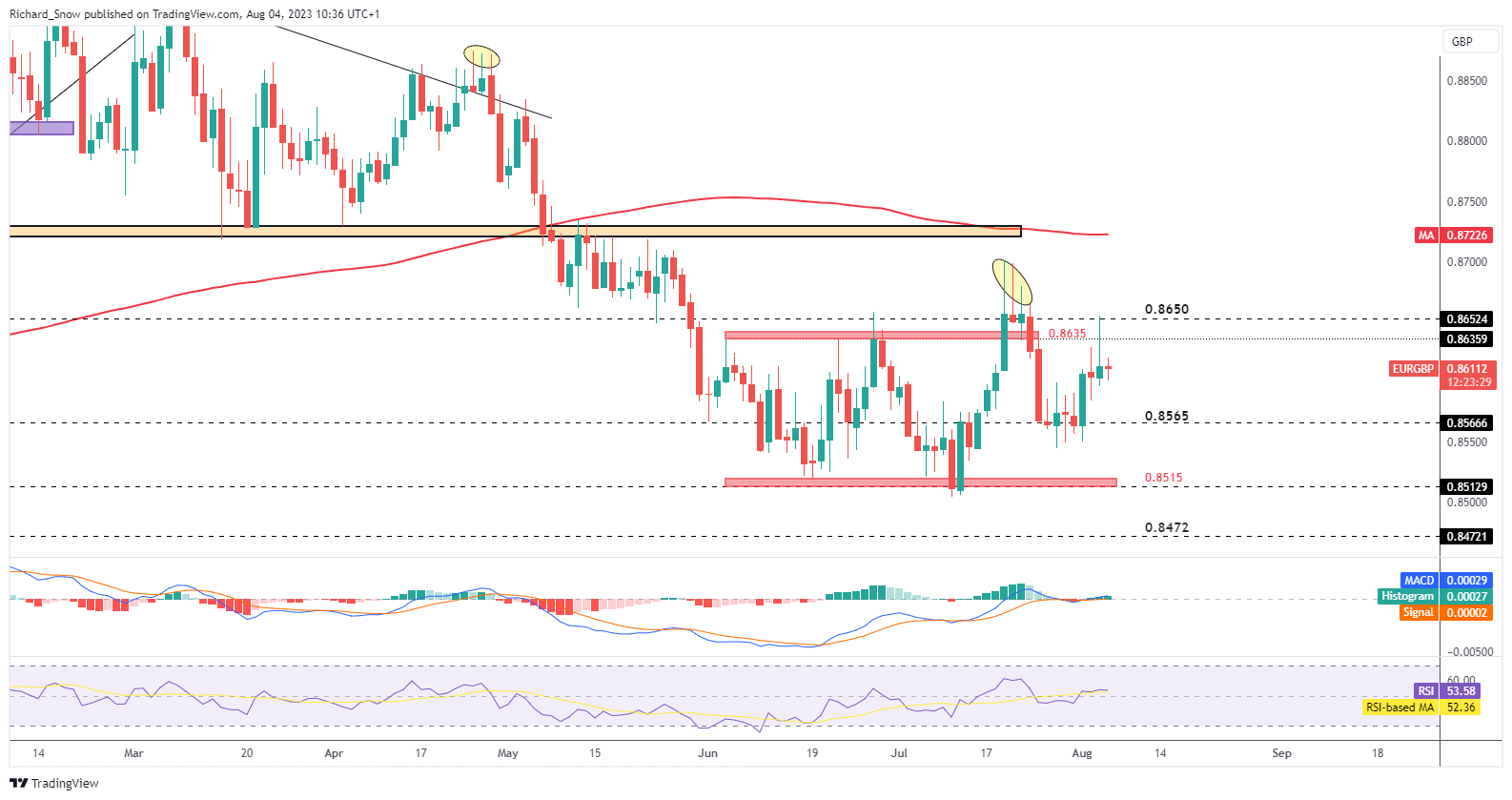

EUR/GBP Respects Prior Support as Sterling Prospects Dwindle

EUR/GBP attempts to trade within the predefined range once more. BoE driven volatility yesterday saw the pair trade right up to 0.8650 (the upper bound of the broader trading range) before sharply pulling back.

With the ECB easing its hawkish language – anticipating one final hike in September while communicating the possibility of a no hike scenario too – markets appear to be revising rate hike odds lower. There are now doubts that the peak rate in Europe will be 4%, representing a sizeable difference to the US and potential peak in UK rates.

Nevertheless, pessimistic sentiment around the UK coupled with the fact that the Bank of England is slowing down its rate hike trajectory, means that the pound appears vulnerable.

Resistance remains back at 0.8650 before the 200 SMA comes into focus, while support rests at 0.8565. With a lack of direction in the pair, range trading appears the prudent approach until price action indicates otherwise.

EUR/GBP Daily Chart

Source: TradingView, prepared by Richard Snow

Learn the ins and outs of range trading by reading our dedicated guide below:

Recommended by Richard Snow

The Fundamentals of Range Trading

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX