Article by IG Chief Market Analyst Chris Beauchamp

FTSE 100, DAX 40, Nasdaq 100, Prices, Analysis and Charts

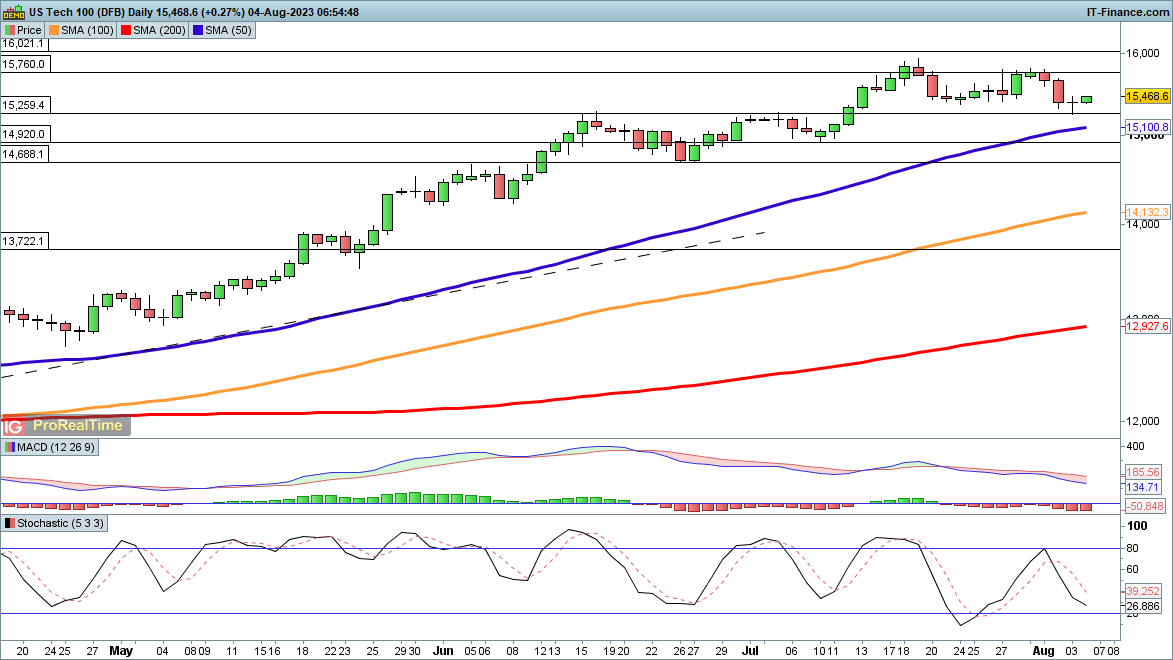

FTSE 100 claws its way back from Thursday lows

Thursday witnessed an impressive recovery from the lows of the session for the index. Having slumped briefly to a three-week low the price has now rebounded. A follow-through back above 7600 would add to the bullish view and suggest that a recovery is in play once more. This then opens the way to 7700 and then to the May highs around 7800.

Sellers will need a drop back below 7500 and then below 7400 to provide a resurgent bearish view.

FTSE 100 Daily Price Chart

Recommended by IG

Traits of Successful Traders

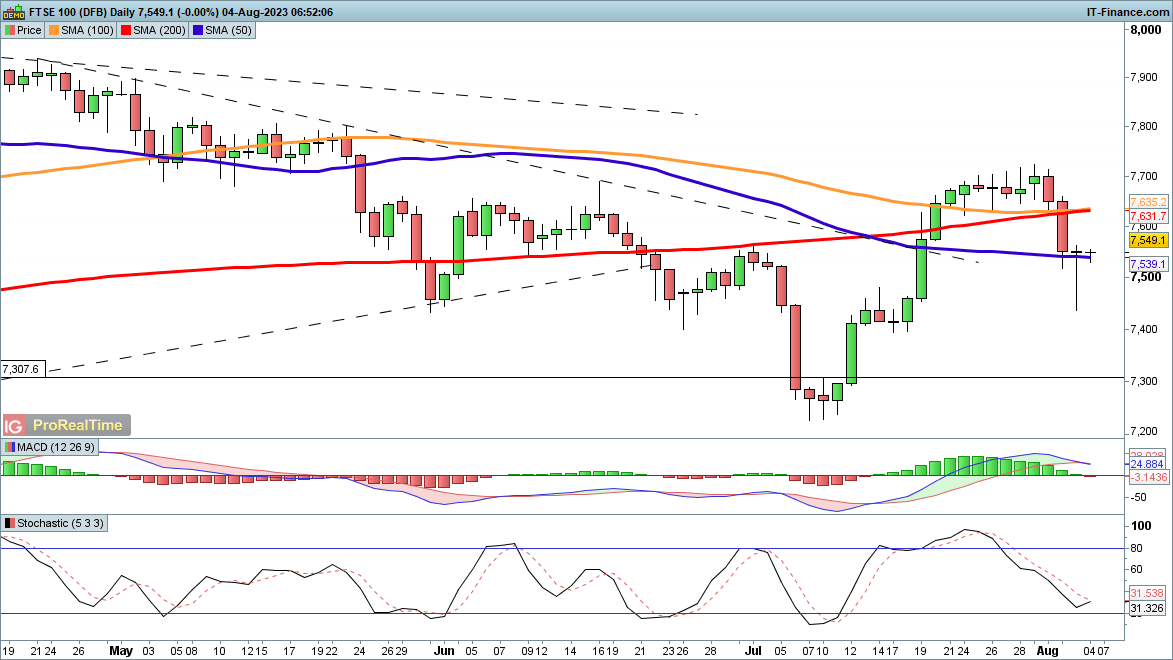

Dax 40 stabilises above 100-day MA

The Dax failed to stage much of a rebound on Thursday, but it did hold above the 100-day SMA.If the price can recover 16,000 and then the 50-day SMA then a new move higher towards 16,500 may result.

A bearish view is contained unless and until the price closes below 15,700 support, and then could push on to 15,500 or down to the 200-day SMA.

DAX 40 Daily Price Chart

Introduction to Technical Analysis

Candlestick Patterns

Recommended by IG

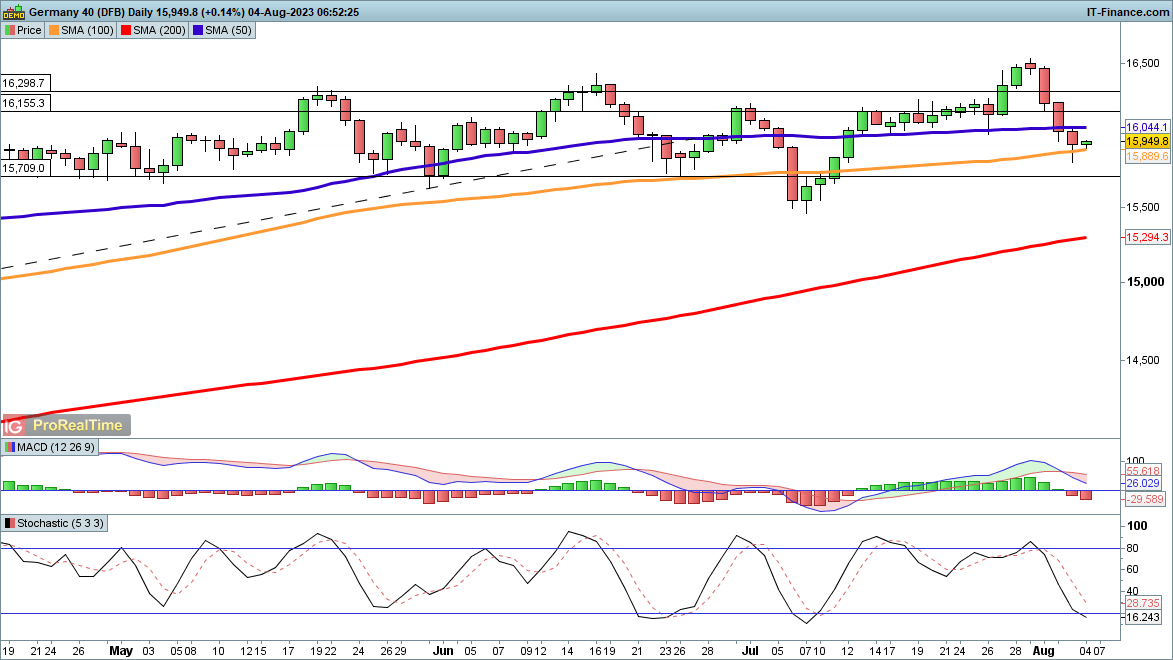

Nasdaq 100 pushes higher

Earnings from Apple and Amazon failed to provide much of a lift, though the index evaded another big down day on Thursday. Early trading today has seen the index make some gains early on Friday.In the short term, bulls will need to see a move back above 15,500 to put the index back on an upward footing to then target the 15,760 and 15,940 highs.

Further declines below trendline support will maintain the bearish view and open the way to 14,920 and 14,690.

Nasdaq 100 Daily Price Chart