WTI Oil Forecast: Neutral

- Saudi Arabia and Russia agree to voluntary production cuts in September

- WTI on track for sixth straight weekly gain

- Daily chart highlights impressive recovery but major resistance lies ahead

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

Recommended by Richard Snow

Get Your Free Oil Forecast

The neutral outlook for the week can be attributed to the major zone of resistance currently in play for oil. Thus far, prices have failed to maintain any sort of bullish momentum above the zone but further oil cuts and better-than-expected US inflation data could prove to be the deciding factors if we are to see a sustained move higher from here.

Oil WTI: Saudi Arabia and Russia Agree to Voluntary Production Cuts

OPEC’s Joint Ministerial Monitoring Committee (JMMC) convened on Friday to discuss the current state of the oil market in the wake of Saudi cuts which came into effect at the beginning of July. With oil prices rising since the voluntary production cuts, the ministerial panel had no reason to call for a wider OPEC + meeting, stating, “the committee will continue to closely assess market conditions”.

Saudi Arabia will extend its voluntary 1 million barrel per day (mbpd) cut in September with the option to extend thereafter. Russia is also set to cut its oil production by 300,000 bpd in the same month. Current OPEC-led oil production cuts excluding voluntary cuts amounts to roughly 3.6% of global oil demand.

WTI On Track for 6th Weekly Gain

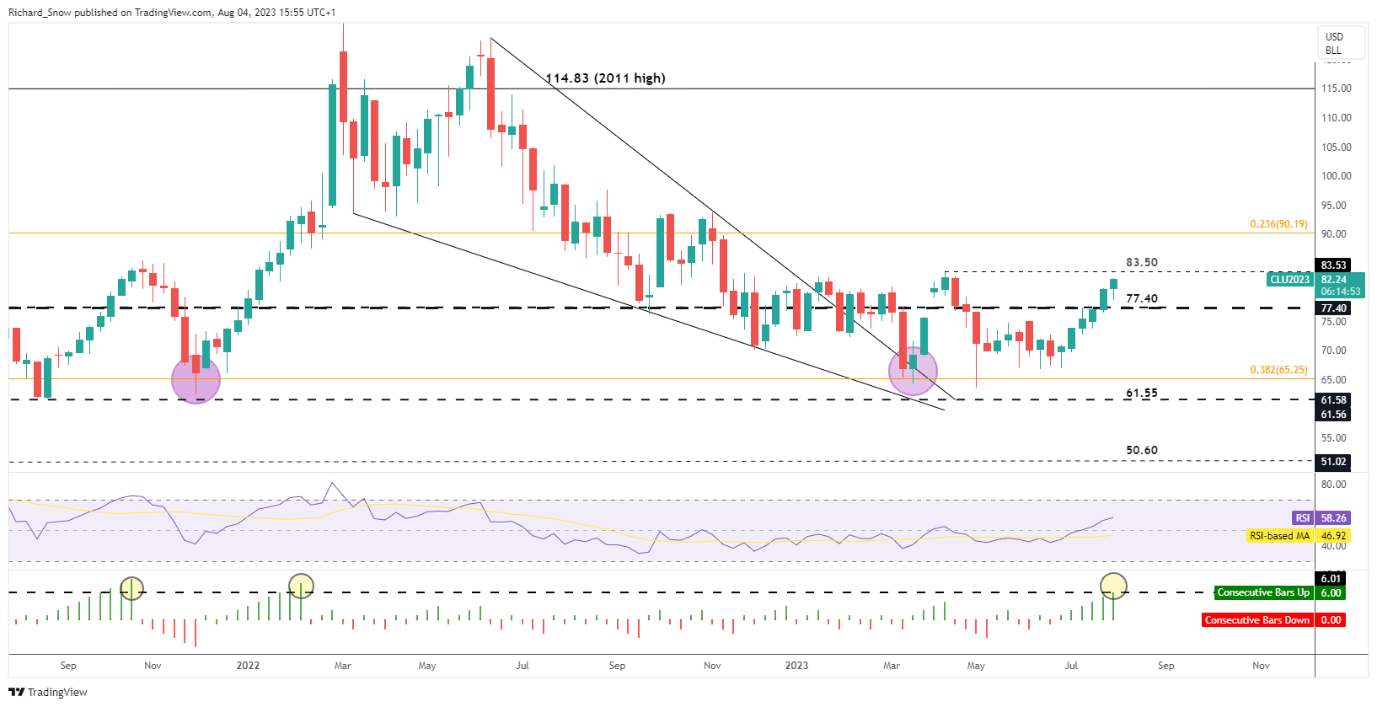

Oil prices are on track for a sixth weekly gain after trading past $77.40 with ease and navigating the US downgrade with consummate ease. The bullish move now reaches a pivotal test at $83.50 – a level that has rejected prior advances at the end of 2022 and in 2023.

WTI Oil (US Oil) Weekly Chart

Source: TradingView, prepared by Richard Snow

Recommended by Richard Snow

Understanding the Core Fundamentals of Oil Trading

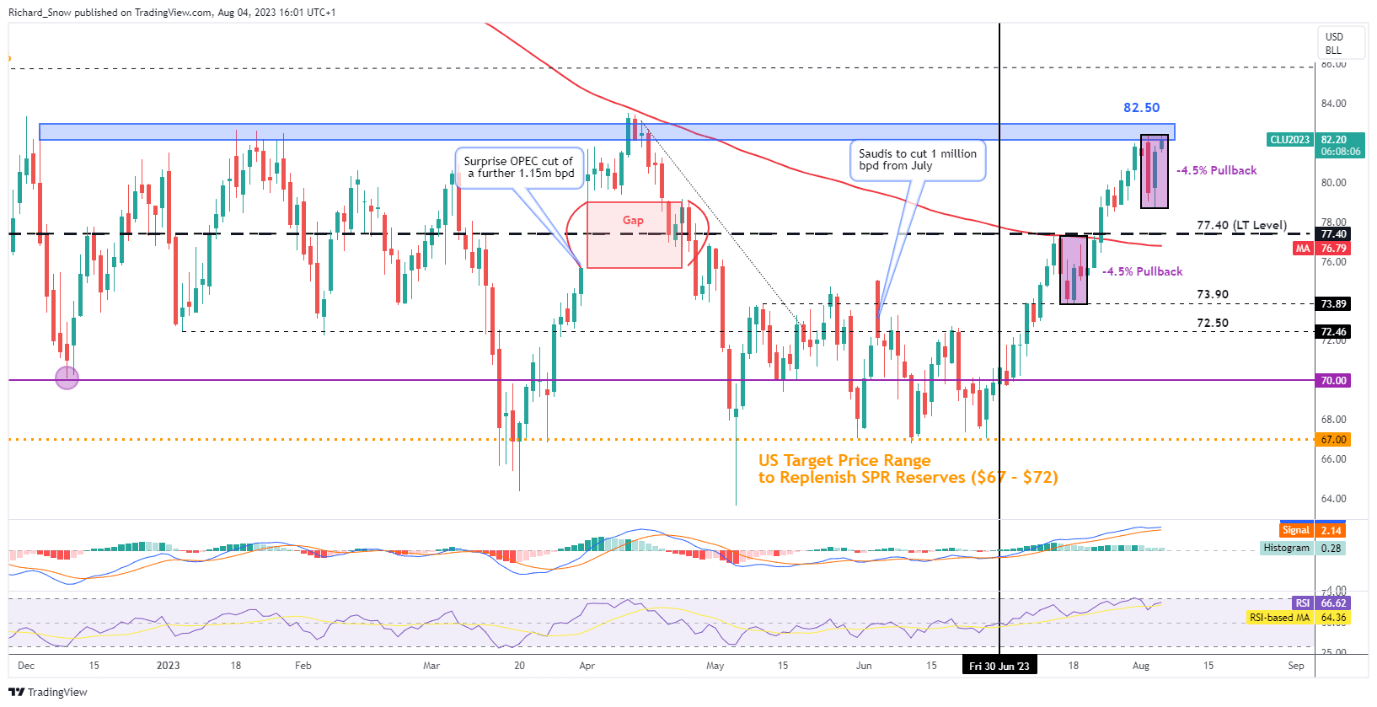

Daily Chart Highlights Impressive Recovery but Major Resistance Lies Ahead

After Fitch downgraded US credit, markets adopted a risk off approach to assess what the potential fallout may look like. WTI oil prices dropped around 4.5% – the same level of decline witnessed mid-July before bulls were able to keep prices rising.

Thus far, not a lot has changed after the downgrade apart from the US 10-year yield soaring again – resulting in a bullish continuation but the ascendency comes under immediate threat now that price tests $82.50. The zone of resistance around $82.50 has proven significant enough to contain bullish momentum on more than one occasion. In addition, the US continues to increase its supply into the broader market, which in theory, counteracts the effect of a loss of supply by the Saudis and Russia but the net effect appears marginal.

Support comes in at the recent swing low of $78.70, followed by $77.40 – a long-term level of interest.

WTI Daily Chart

Source: TradingView, prepared by Richard Snow

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX