Crude Oil, WTI, Brent, API, EIA, LNG, Woodside, USD/JPY, EUR/JPY, Hang Seng – Talking Points

- Crude oil surges on energy market supply concerns around LNG

- Japanese Yen continues to weaken with EUR/JPY eclipsing a recent peak

- Financial markets appear poised for action as they await impending US CPI today

Recommended by Daniel McCarthy

Understanding the Core Fundamentals of Oil Trading

The crude oil price has reclaimed levels not seen since November last year despite inventory data revealing a surge in stockpiles.

The American Petroleum Institute (API) report showed that 4.067 million barrels were added to storage for the week ended August 4th.

It comes after a notable depletion in the week prior of -15.4 million barrels. The US Energy Information Agency (IEA) report later today will be watched for hints on the state of play for oil reserves.

The WTI futures contract is near US$ 84.50 bbl while the Brent contract is oscillating around US$ 87.50 bbl.

Energy markets have caught a bid with liquefied natural gas prices (LNG) surging on the prospect of strike action in Australia at Woodside Energy Group and Chevron. The operations in the northwest of the continent are a large supplier to global markets.

Currency markets have been relatively subdued going into Thursday although the Japanese Yen has struggled again today. USD/JPY is climbing over 144.00 and EUR/JPY has printed a fresh 15-year high above 158.00.

The weaker Yen has Japanese banking stocks take a hit. Other APAC equity markets are mixed with the largest move among the major indices being Hong Kong’s Hang Seng Index (HSI), down around 1%.

Spot gold is languishing near overnight lows at US$ 1,916 at the time of going to print.

US CPI will be the focus for markets ahead and there will also be several Fed speakers crossing the wires that could cause market gyrations.

The full economic calendar can be viewed here.

Recommended by Daniel McCarthy

How to Trade Oil

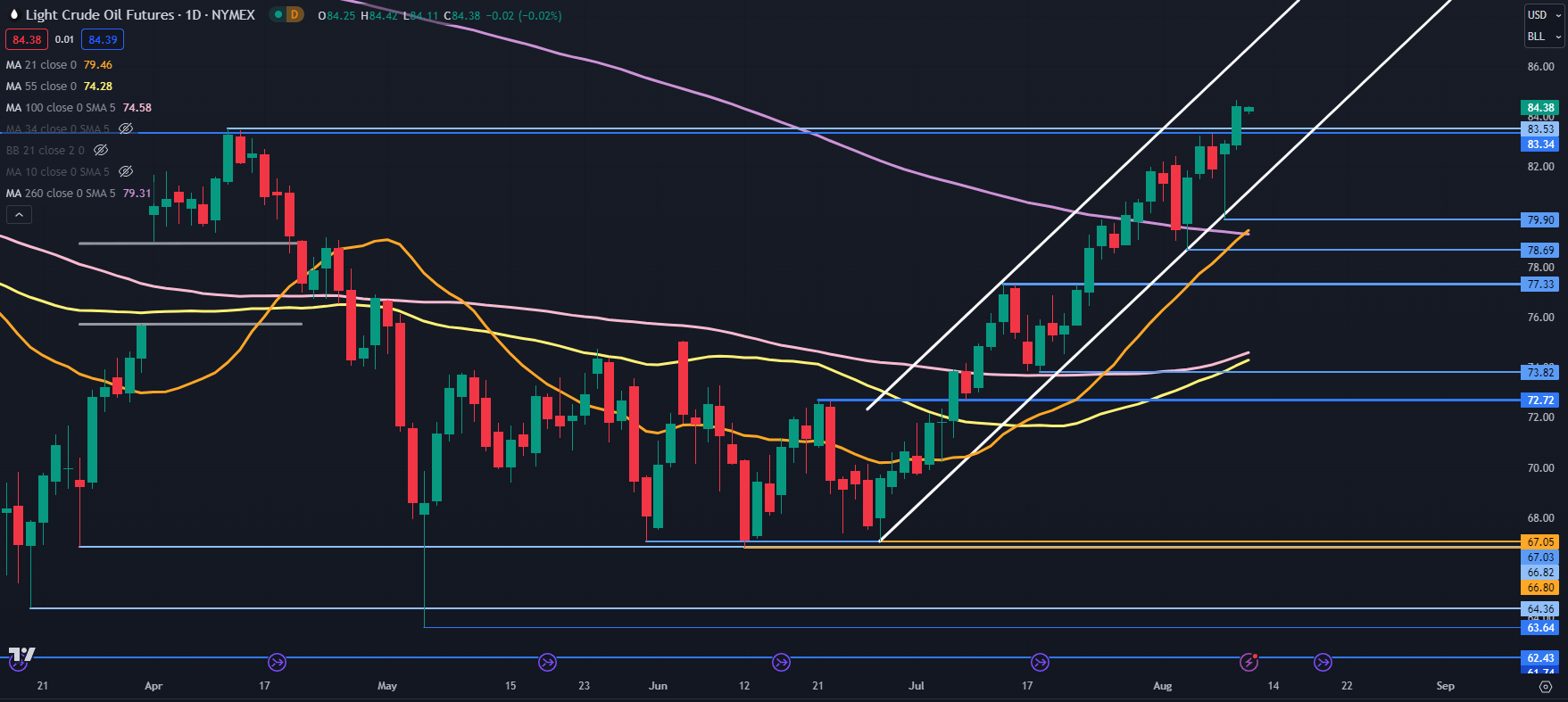

WTI CRUDE OIL TECHNICAL ANALYSIS SNAPSHOT

The WTI futures contract remains in an ascending trend channel after it broke above several resistance levels in the last few sessions.

The price action today this week has seen the 21-day simple moving average (SMA) cross above the 260-day SMA to form a Golden Cross. It might imply that bullishness is still evolving.

On the downside, support may lie at the recent lows of 49.90 and 78.69. Further down, support could be at the breakpoint of 77.33 and the prior low at 73.82.

The latter also has the 55- and 100-day SMA in the vicinity and they may lend support.

Chart created in TradingView

— Written by Daniel McCarthy, Strategist for DailyFX.com

Please contact Daniel via @DanMcCarthyFX on Twitter