Gold, XAU/USD, US Dollar, DXY Index, Treasury Yields, GVZ, Fibonacci – Talking Points

- The gold price has been sidelined in a week of action elsewhere

- The US dollar and Treasury yields have found firmer footing amidst the risk aversion

- Volatility has ticked up a notch. Does it imply a move ahead for XAU/USD?

Recommended by Daniel McCarthy

How to Trade Gold

The gold price appears poised at a crossroads going into the weekend with the US Dollar firming as Treasury yields tick higher.

An eventful week for markets may still have more to play out with non-farm payrolls data due out later today.

The Fitch downgrade of US sovereign debt credit rating to AA+ from AAA got the ball rolling on Tuesday with a risk-off rout permeating through markets.

The reaction unfolded despite Treasury Secretary Janet Yellen lambasting the move, referring to it as ‘arbitrary’ and ‘outdated’.

Adding to concerns for US debt, on Wednesday, the US Department of Treasury announced that they will seek to issue US$ 103 billion next week, up from the US$ 96 billion last time.

The increasing cost of Treasury borrowing has been most acute in the back end of the yield curve as investors demand more reward for term risk against a deteriorating US government balance sheet over time.

The benchmark 10-year note is surging toward 4.20% for the first time since November last year after dipping to 4.73% a fortnight ago.

In contrast, the short end of the Treasury curve seems more firmly anchored with the market now viewing the Federal Reserve as near the end of its tightening cycle. For 2 weeks the 2-year bond has been trading in a range of 4.85% and 4.95%.

The US Dollar has benefitted throughout this run of risk aversion and the DXY (USD) index has continued to climb off the low seen in the middle of July.

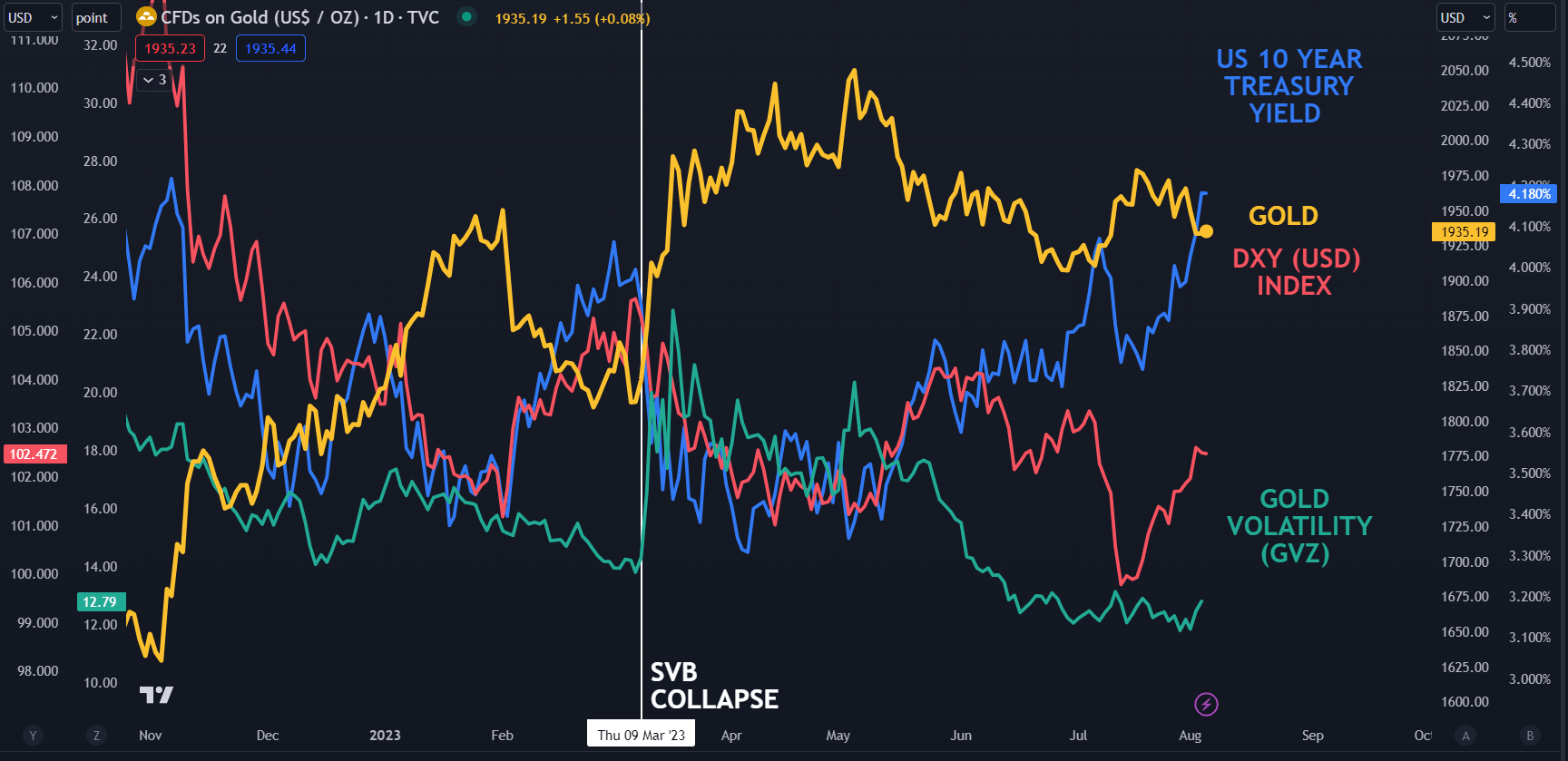

The GVZ index is a measure of implied volatility for gold that is calculated in a similar way to the VIX index’s interpretation of volatility for the S&P 500.

Forward-looking gold volatility has been languishing of late, but it has inched up in the last few trading sessions. This may hint toward some uncertainty within the market and a significant move in price might be in the offing.

Keeping all of this in mind, the yellow metal has held up reasonably well so far, but if these headwinds persist it could be undermined at some point.

{{GUIDE|HOW_TO_TRADE_}}

SPOT GOLD AGAINST US 10-YEAR TREASURY YIELD, DXY (USD) INDEX AND GVZ INDEX

Chart created in TradingView

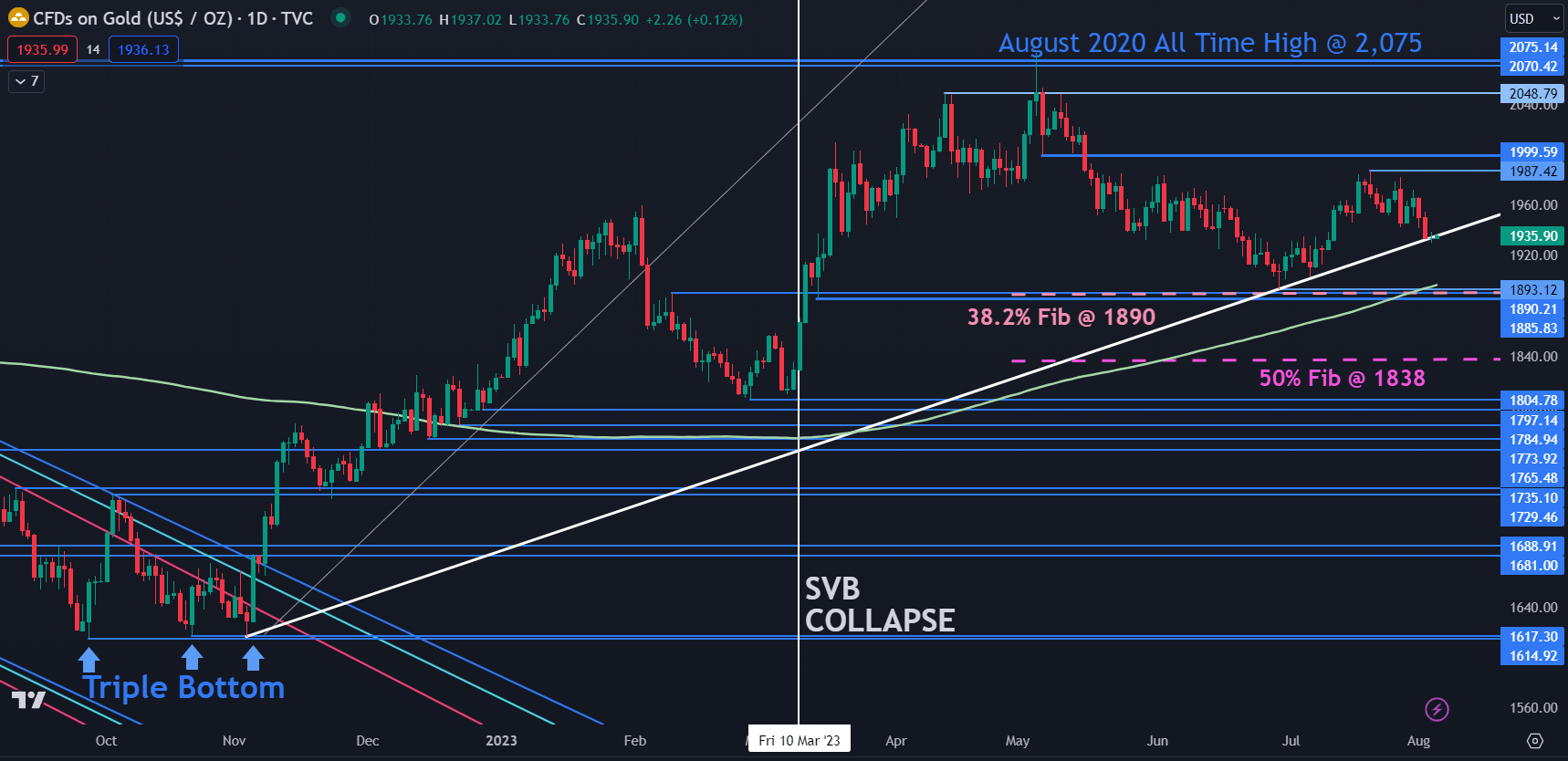

GOLD TECHNICAL ANALYSIS SNAPSHOT

The gold price is currently testing trend line support. Should it break lower, support might lie in the 1885 – 1895 area.

In that zone, there are a series of prior lows, a breakpoint, the 200-day simple moving average (SMA) and the 38.2% Fibonacci Retracement level of the move from 1614 up to 2062.

Further down the 50% Fibonacci Retracement at 1838 might lend support. To learn more about Fibonacci trading, click on the banner below.

On the topside, resistance might be at the recent peak of 1897 or the breakpoint near 2000.

Recommended by Daniel McCarthy

Traits of Successful Traders

Chart created in TradingView

— Written by Daniel McCarthy, Strategist for DailyFX.com

Please contact Daniel via @DanMcCathyFX on Twitter