US Dollar (DXY) Forecast: Neutral

Recommended by Richard Snow

EUR/USD is the largest component of the dollar basket

Dollar Basket Receives a Lift Thanks to Weaker G7 Currencies

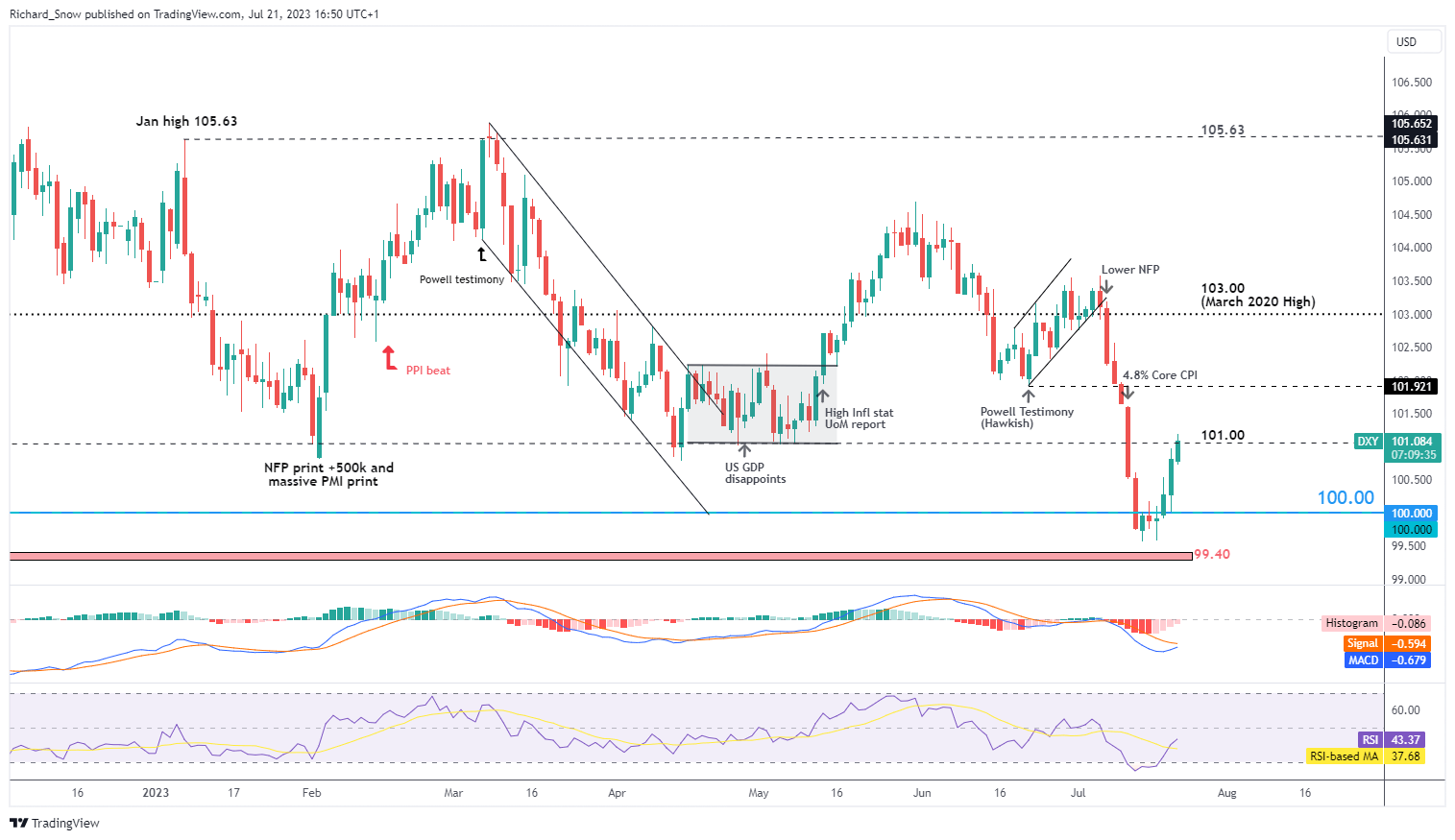

The widely recognized benchmark for US dollar performance, the dollar basket (DXY), witnessed a lift heading into the end of the week as the euro, pound sterling and Japanese yen surrendered recent gains. Renown ECB hawk Klaas Knot admitted an uncertain outlook on future rate hikes, while better-than-expected UK inflation lessened the need for aggressive hikes and finally, Japanese officials continued to voice support of existing ultra-low monetary policy. The dollar basket eyes a close above 101.00 which suggests a bullish continuation at the start of next week.

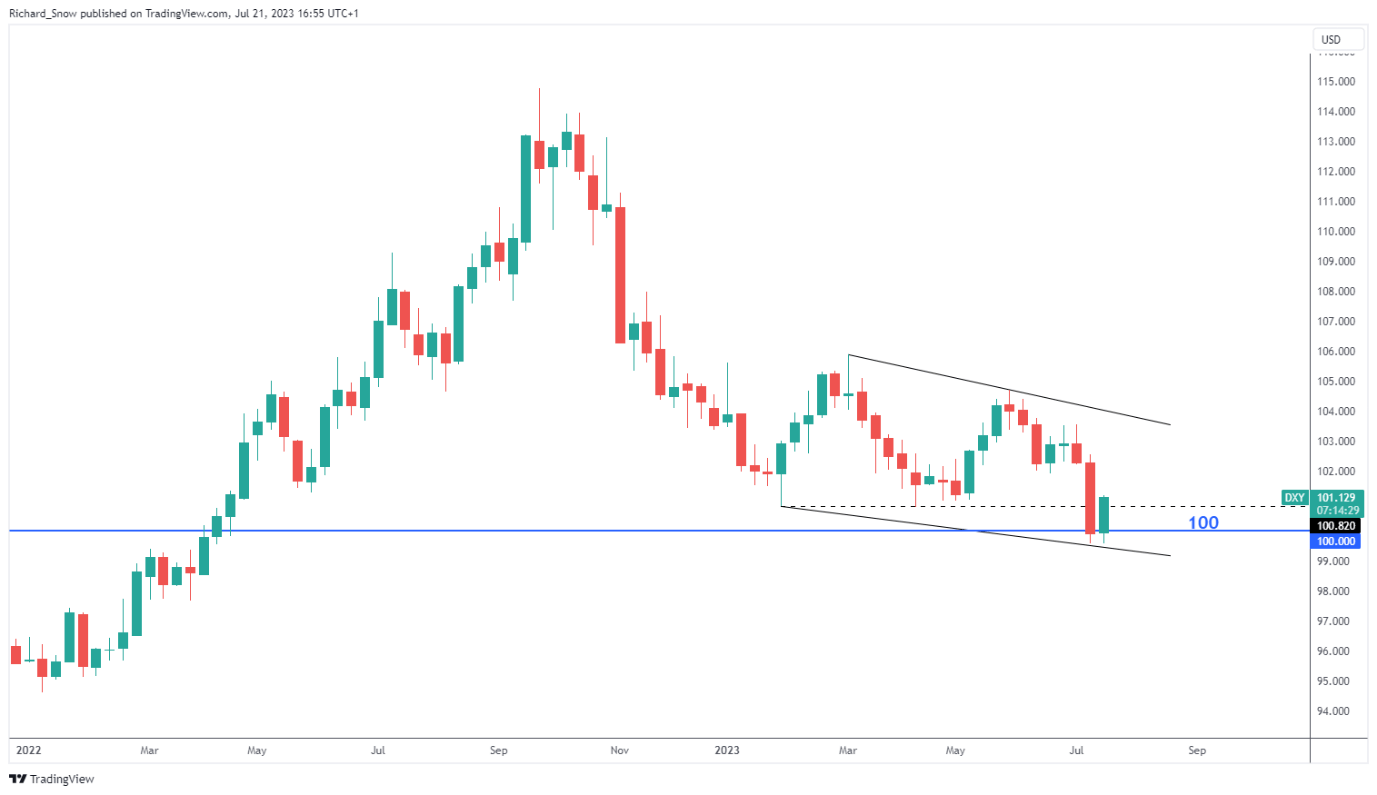

US Dollar Basket (DXY) Weekly Chart

Source: TradingView, prepared by Richard Snow

Dollar Rise Could Continue into the FOMC Meeting

The neutral bias presented at the start of this article relates to the possibility of the dollar continuing to rise at the very start of the week before consolidating ahead of the Fed and potentially heading lower depending on how markets view Jerome Powell’s message.

With inflation making steady progress, the dollar has fewer bullish drivers. Powell may make mention of global food price uncertainty as a result of Vladimir Putin’s withdrawal from the Black Sea Grain Deal and is likely to refer to the committee’s favourite inflation measure, PCE, if there are further concerns over inflation.

The longer-term outlook, as the weekly chart above suggests, is bearish for the dollar but in the interim, there is still scope for further upside. A close above 101.00 see a possible return to the June low of 101.92 before 103 level becomes relevant once again. The MACD nears a bullish crossover with the RSI recovering from oversold territory.

US Dollar Basket (DXY) Daily Chart

Source: TradingView, prepared by Richard Snow

Recommended by Richard Snow

Find out where opportunities lie in Q3

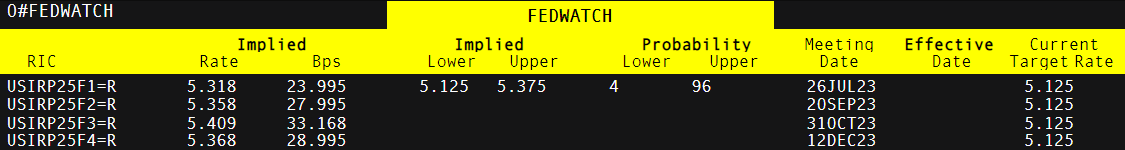

Markets have priced in a 96% chance of a 25-basis point hike on Wednesday and chances of another 25 basis point hike into year end appears unlikely at this stage but is subject to change as the picture becomes clearer and more data filters in, even as soon as Friday’s PCE print. With the consensus so heavily in favour of the hike it wouldn’t be surprising to see the dollar ease off after the rate decision.

Market-Implied Fed Hike Probabilities

Source: TradingView, prepared by Richard Snow

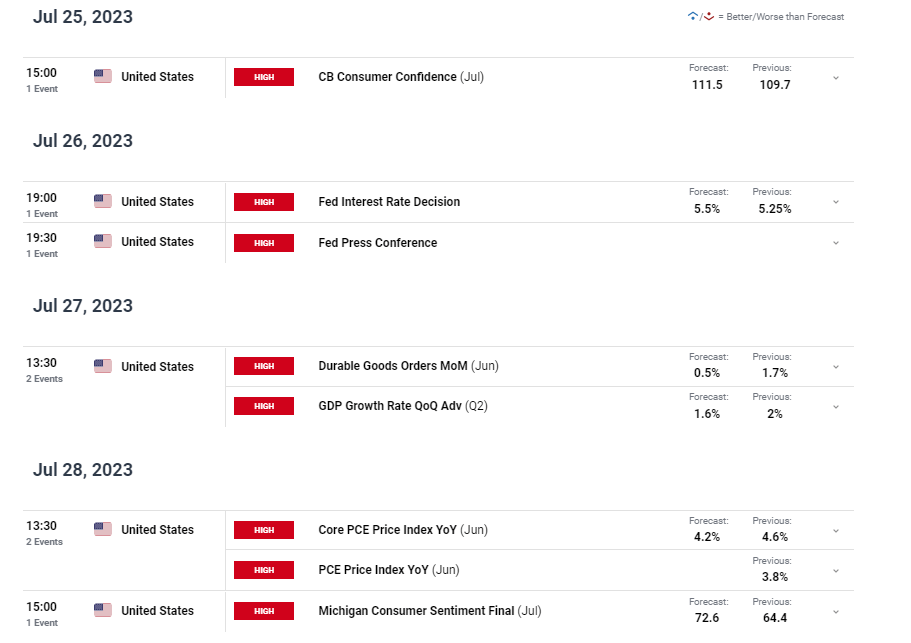

Risk Events for the Week Ahead

In the week to come there is a healthy dose of dollar related data/events with the most important being the FOMC rate setting meeting on Wednesday evening at 19:00 UK time. The Fed have gone to great lengths to pinpoint the July meeting as an opportune moment to continue with the rate hiking cycle after voting to ‘skip’ in June. Markets will be looking for clues on the potential for any hikes beyond July but the recent progress in core inflation could mean we’ve entered into a disinflationary period, potentially seeing a peak in rates this month. However, Powell will most likely look to keep the door open for further hikes to prevent forward-looking markets from getting ahead of themselves.

Apart from the FOMC we get the second revision to Q2 GDP data which is expected to see a notable climb down from the first estimate of 2%, with expectations at 1.6%. A lower revision in Q2 GDP could see some dollar weakness but the US is still operating well relative to its peers so such an effect may be short-lived.

Then on Friday, core PCE data has the potential to advance the disinflationary narrative taking hold since the core CPI print on July the 12th. Again, a move lower here suggests the dollar could be in the firing line once again – depending on the Fed’s tone from Wednesday of course.

Customize and filter live economic data via our DailyFX economic calendar

Trade Smarter – Sign up for the DailyFX Newsletter

Stay up to date with the latest news and market moves

Subscribe to Newsletter

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX