Market sentiments continue to reel in from the US credit rating downgrade by Fitch overnight (DJIA -0.98%; S&P 500 -1.38%; Nasdaq -2.17%), with overbought technical conditions and “extreme greed” sentiments (Fear & Greed Index) potentially exacerbating the profit-taking. Treasury yields largely held firm, with the 10-year yields back above its key 4% level to touch its highest level in eight months, halting the advance in rate-sensitive growth sectors.

Overnight data revealed a significant upside surprise in the US ADP July employment report (324,000 versus 189,000), although one may note that it has historically been a poor predictor of the US non-farm payroll data. The significantly weaker showing in the US ISM manufacturing employment index (44.4 versus 48.0 forecast) suggests that US labour conditions may still turn in soft. All eyes will be on the US ISM services PMI release later today (53 forecast vs previous 53.9). Thus far, resilience in the services sector has been an argument for soft landing hopes, and any signs of the sector caving in could potentially put growth fears back on the radar.

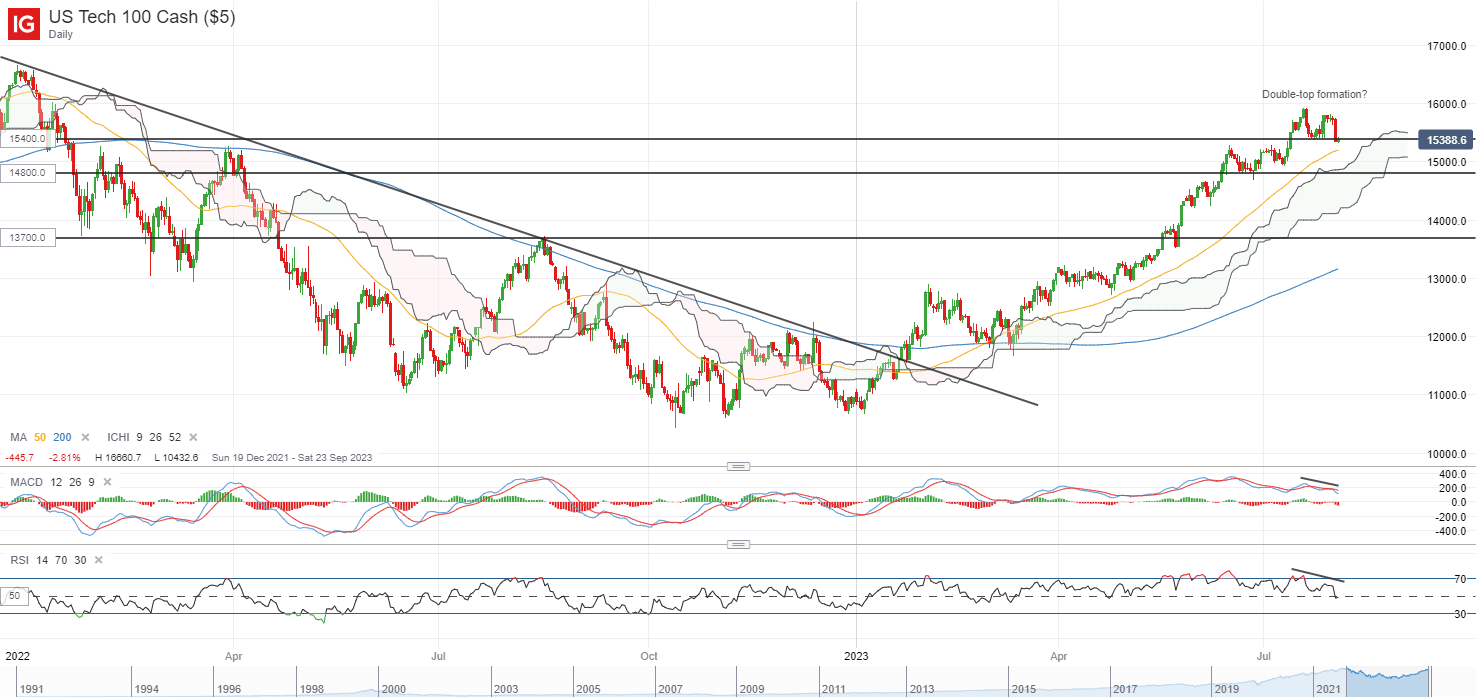

The Nasdaq has displayed some signs of exhaustion lately, with a near-term double-top formation while lower highs on relative strength index (RSI) and declining moving average convergence/divergence (MACD) point towards some moderation in upward momentum. The index is currently attempting to defend the double-top neckline around the 15,400 level. Failure to do so may potentially pave the way towards the 14,800 level next.

Source: IG charts

Asia Open

Asian stocks look set for a downbeat open, with Nikkei -1.54%, ASX -0.87% and KOSPI +0.11% at the time of writing, tracking the negative handover in the overnight US session. The Nasdaq Golden Dragon China Index is down 4.2%, following the weaker session for Chinese indices in yesterday’s session. On another front, despite the Bank of Japan (BoJ) stepping in with government bond purchases earlier this week to convince markets of its still-dovish stance, the Japan’s 10-year government bond yields have remained on the rise, holding above 0.6% with a new nine-year high. That could potentially keep the pressure going for the Nikkei 225, with a higher risk-free rate challenging the risk-return trade-off for equities.

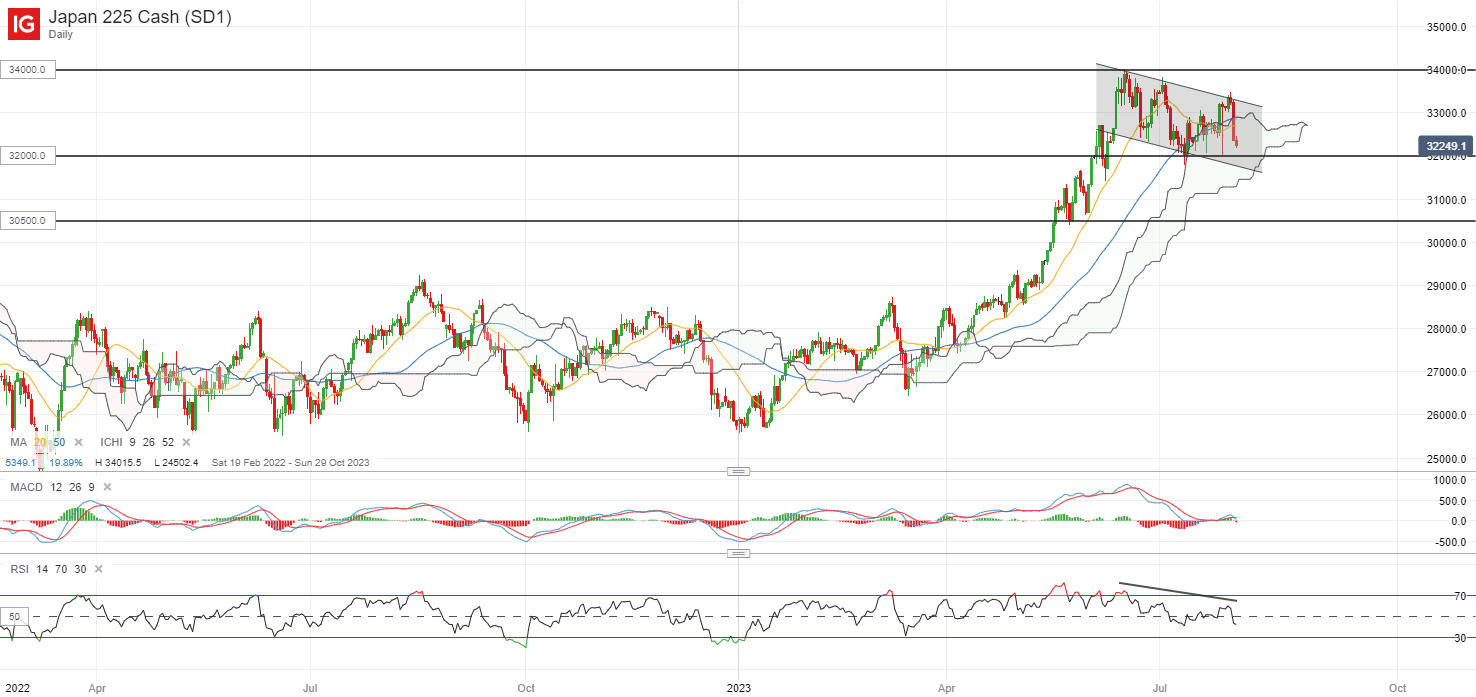

The Nikkei 225 has been displaying a series of lower highs lately, trading within a near-term falling channel pattern. One to watch may be the 32,000 level, where a 23.6% Fibonacci retracement stands from its Jan 2023 low to June 2023 peak, alongside some aggressive dip-buying at this level following the recent BoJ meeting. Any breakdown of the 32,000 level ahead may potentially pave the way to retest the next 30,500 level next.

Source: IG charts

On the earnings front, DBS has delivered an earnings beat this morning, with 2Q profits jumping 48% to a new record. Resilient net interest margin (NIM) is one of the positive takeaways, with the bank forecasting a more positive outlook on that front as well, which suggests that earnings may continue to be supported by its net interest income. Its dividend is raised to $0.48 per share from previous $0.42, potentially giving a forward dividend yield of 5.6%.

On the watchlist: GBP/USD back at support confluence ahead of Bank of England (BoE) interest rate decision

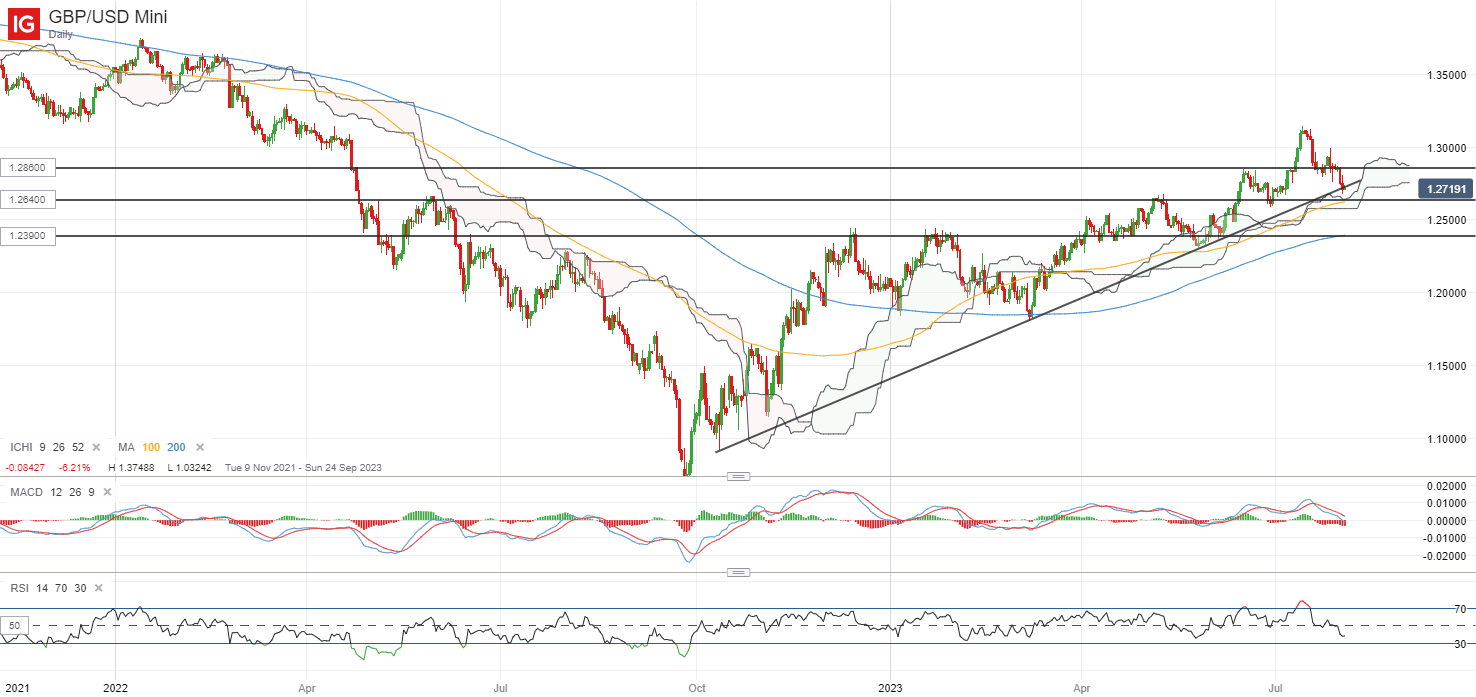

The GBP/USD is down by 3.5% since mid-July this year, weighed by a recovery in the US dollar alongside some moderation from near-term overbought conditions. Several support lines will be on watch for some defending ahead, with the pair currently resting on an upward trendline support while perhaps one of greater significance will be the 1.264 level, where its 100-day moving average (MA) stands alongside its daily Ichimoku cloud support.

The BoE interest rate decision will be a key driver later today. A 25 basis-point (bp) hike has been fully priced by markets, with the question revolving around whether the recent downside inflation surprise and much weaker-than-expected UK PMI data are sufficient to trigger a ‘dovish hike’ guidance from the central bank. For now, rate expectations are still seeing a 36% chance for a larger 50 bp hike at the upcoming meeting, while the terminal rate is priced at 5.75% (current 5%).

Much validation for these relatively aggressive pricing will be sought, with any indications that the BoE is considering a pause or nearing the end of its hiking cycle potentially translating to some downside risks for the GBP/USD. Any breakdown of the 1.264 level may pave the way towards the 1.239 level next.

Source: IG charts

Wednesday: DJIA -0.98%; S&P 500 -1.38%; Nasdaq -2.17%, DAX -1.36%, FTSE -1.36%