US DOLLAR FORECAST:

USD FORECAST: NEUTRAL

- US CPI Data Largely Offset by Hawkish Fed Rhetoric.

- FOMC Minutes Unlikely to Provide Any Further Clarity, with the Hawkish Rhetoric Set to Continue. Markets Continue to Flip-Flop as Economic Data Trickles Through.

- DXY Faces a Barrage of Resistance to Overcome for the Bullish Momentum to Continue.

- To Learn More About Price Action,Chart PatternsandMoving Averages, Check out theDailyFX Education Series.

Recommended by Zain Vawda

Get Your Free USD Forecast

READ MORE: AUD/USD Technical Outlook: Further Pain in Store for the Aussie Dollar?

US DOLLAR INDEX ENJOYS FOURTH SUCCESSIVE WEEK OF GAINS

The US Dollar has enjoyed a positive week once more and this came down largely to hawkish Federal Reserve policymakers coupled with some early week risk-off sentiment. Markets do appear to have bought in to the ‘soft landing’ narrative despite some weakness in US equities this week. The Fed Funds probability has seen little change over the course of the week with markets still at a 88.5% probability that rates will remain at current levels in September with the probability for a December rate hike now at 30%.

The Dollar also benefitted from poor data out of China this week which saw risk off sentiment prevail. The Dollar has benefitted from renewed safe haven demand appeal as market participants remain concerned about the uneven recovery in China.

US inflation data did not give too much away this week as headline inflation ticked higher but came in below forecasts while core inflation fell slightly. This was largely overshadowed by a host of Federal Reserve Policymakers, many of whom stated the Fed still have work to do on inflation. PPI data on Friday ticked slightly higher in July coming in at 0.3% from a previously revised print of 0%. This is likely another reason the Dollar held the high ground at the end of the week as PPI is usually a precursor to rising CPI as price pressures filter through from production to the end consumer.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

Friday also brought the University of Michigan Consumer Sentiment data declined in August, but much lie inflation came in above forecasts. The report revealed a slight improvement in the 1-year inflation expectations which dropped to 3.3% from a previous print of 3.4%. The current conditions improved but the expectations index retreated to 67.3 from 68.3.

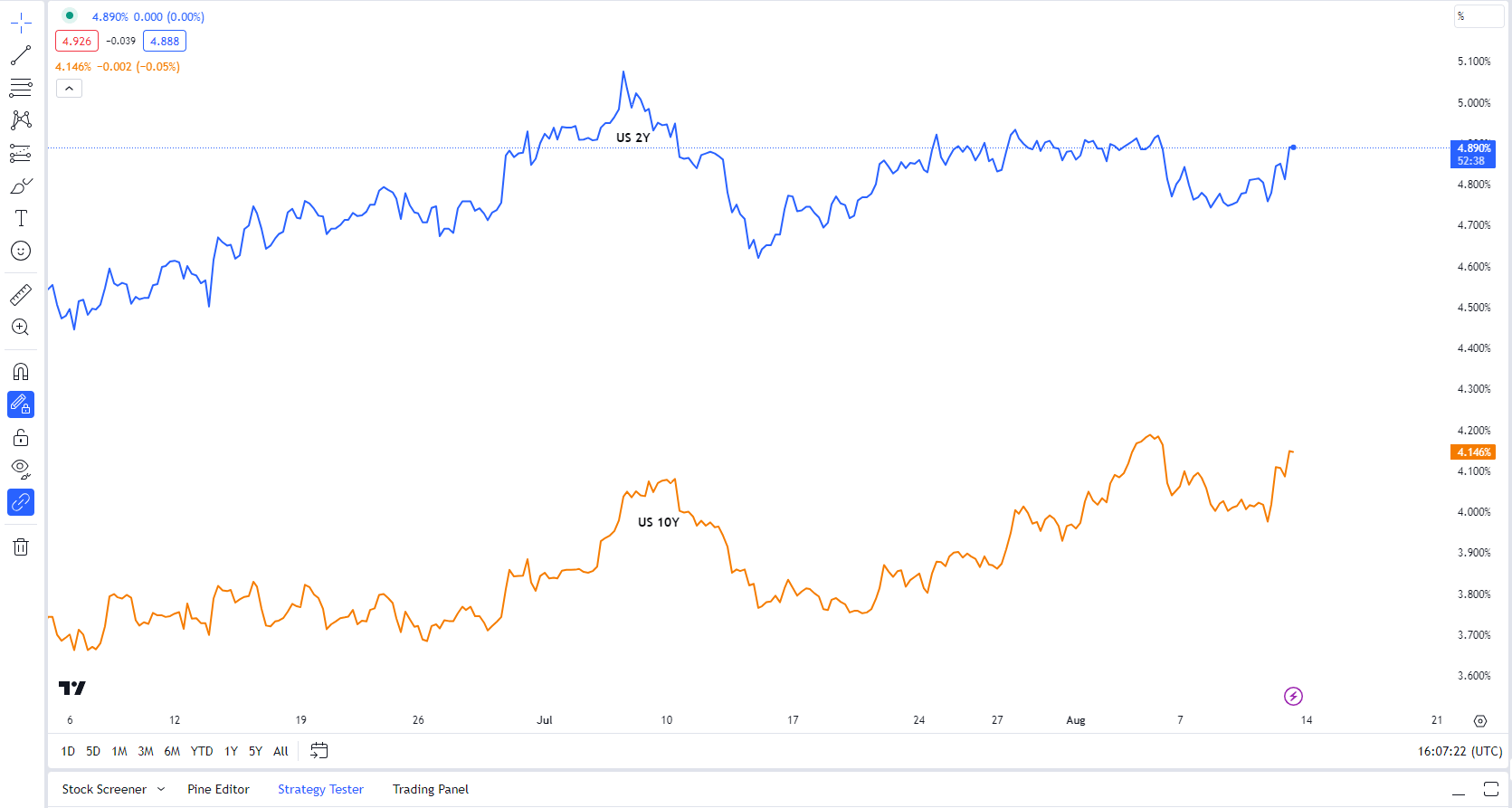

US Treasury Yields also recovered on Friday following a drop off earlier in the week with both the 2Y and 10Y yields on course to finish the week higher. He early part of the week was surprising as Treasury Yields were falling as the USD continued to advance but normality returned following Thursdays US CPI print which inspired a rally in yields.

US 2Y and US 10Y Yields

Source: TradingView, Created by Zain Vawda

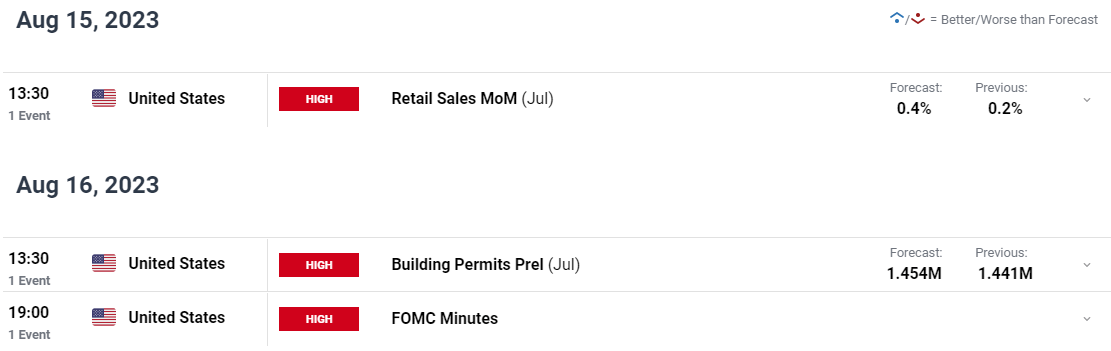

THE WEEK AHEAD: FED MINUTES TO DOMINATE WITH RETAIL SALES DUE AS WELL

Heading into next week and the DXY may come under some selling pressure in the early part of the week. The index has been on a tear for the past four weeks but could be running out of steam. The calendar is a little light next week, but the Federal Reserve minutes could keep the Dollar Index moving higher. Federal Reserve Policymakers stated this week that they haven’t even discussed any timeframe for rate cuts yet as there is still work to do. I expect this to be represented in the minutes with the Fed unlikely to show any significant signs of dovishness.

Retail sales data will give us further insight into the demand side in the US which has shown some moderation over the past few months. A further drop in retail sales could give an indication that a recession may materialize despite being positive from a inflation perspective as less demand should result in a drop in prices.

For all market-moving economic releases and events, see the DailyFX Calendar

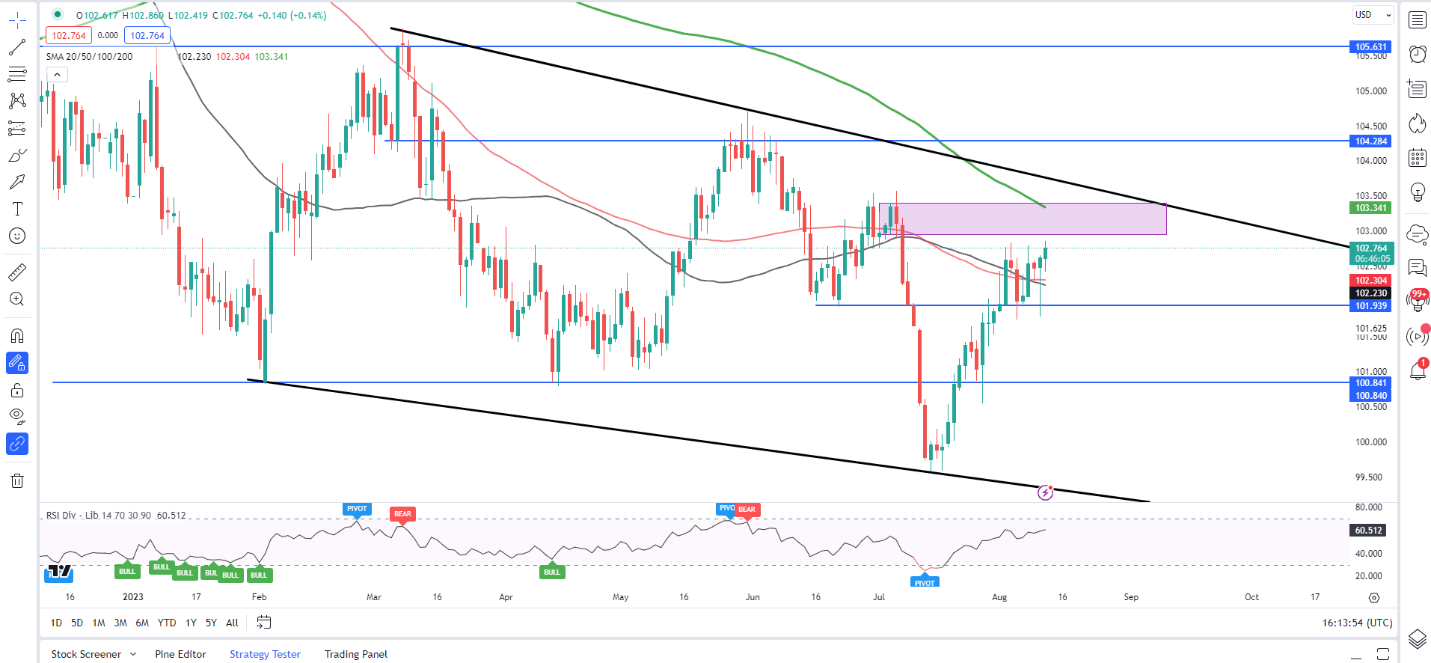

TECHNICAL OUTLOOK AND FINAL THOUGHTS

The Dollar Index has enjoyed further upside this week making it four consecutive weeks of gains. The DXY remains within the descending channel which began in early 2023. There is a key resistance area just ahead around the 103.00-103.50 area with the 200-day MA resting around 103.34 and the top end of the channel around the 103.50 handle. A breakout of this channel would require some form of change in sentiment in my opinion, without which I could see the DXY remaining within this descending channel.

US Dollar Index (DXY) Daily Chart – August 11, 2023

Source: TradingView

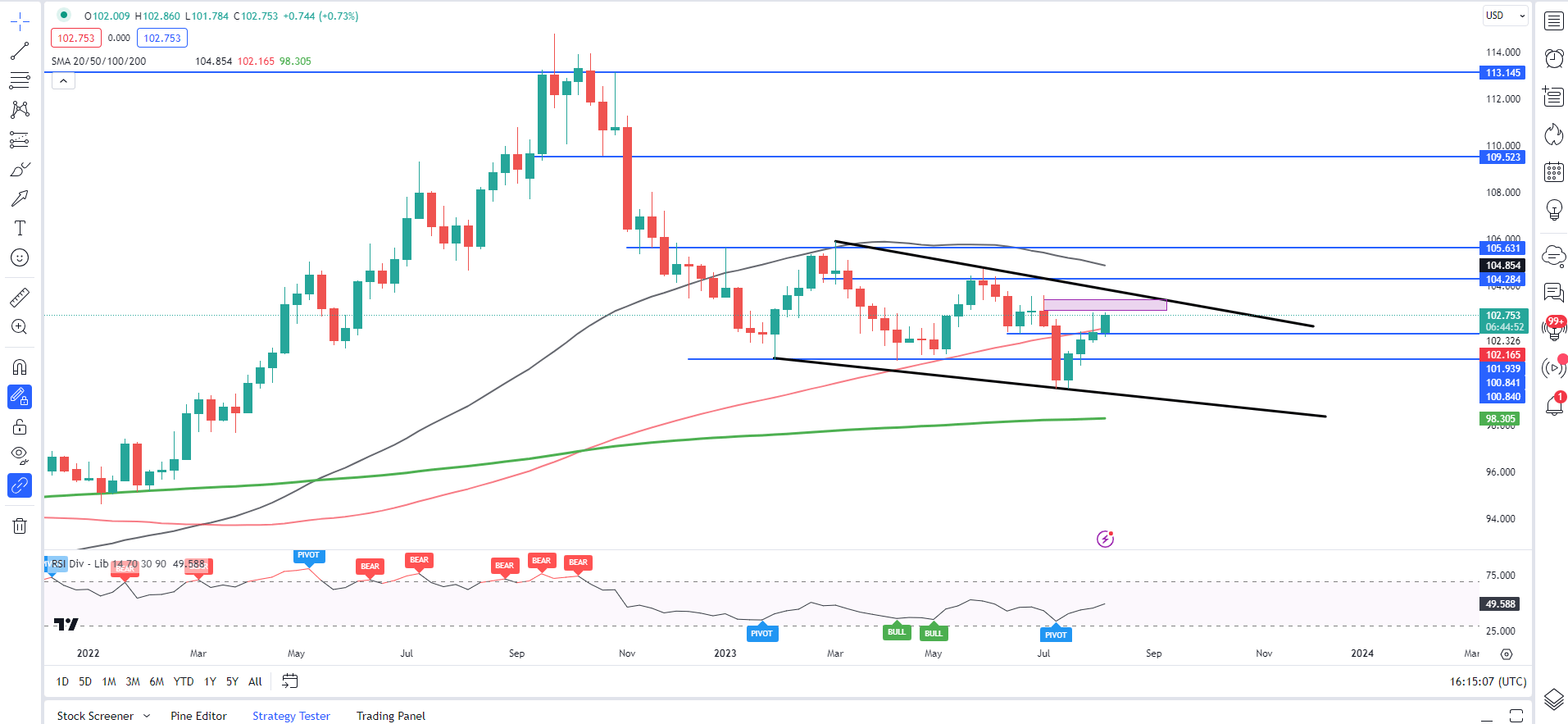

Looking at the weekly timeframe and we can see the overall downtrend remains intact. A weekly candle close above the 102.96 handle will see a change in structure with a bullish trend returning. For now, though this remains a retracement within the larger downtrend keeping bears interested.

US Dollar Index (DXY) Weekly Chart – August 11, 2023

Source: TradingView

Key Levels to Keep an Eye On:

Support Levels

Resistance Levels

- 103.00

- 103.34 (200-day MA)

- 104.28

Written by: Zain Vawda, Market Writer for DailyFX.com

Contact and follow Zain on Twitter: @zvawda