Recommended by Daniel Dubrovsky

Get Your Free USD Forecast

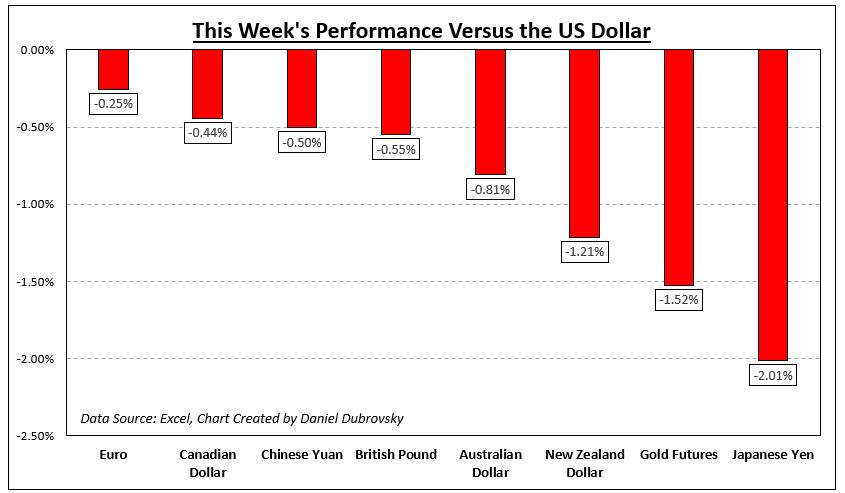

The US Dollar outperformed its major counterparts this past week, with the DXY Dollar Index gaining over 0.8 percent. In fact, the DXY just wrapped up its 4th consecutive weekly gain. The last time the same winning streak occurred was back in February. A 5th push higher would mean the most consecutive performance since May 2022.

Headline US inflation ticked slightly higher in July, although it was slightly lower than expected. Meanwhile, robust growth estimates from the Federal Reserve for the immediate quarter ahead coupled with commentary from policymakers pushed financial markets to continue raising long-term interest rate expectations. That helped the 10-year Treasury yield close at its highest since October.

Meanwhile, WTI crude oil prices just barely managed to pull off another gain, rising 0.5%. At 7 weeks, this is the longest consecutive winning streak for the commodity since January 2022. Meanwhile, rising Treasury yields and a stronger US Dollar dented gold prices. XAU/USD closed at its lowest since March.

As far as sentiment was concerned, the tech-heavy Nasdaq 100 fell 1.7% last week. In fact, the past 2 weeks have been the worst for the index since December. Losses occurred for 2 weeks in a row for the first time this year.

For the week ahead, the RBNZ will be setting monetary policy. A hold is expected. Meanwhile, FOMC meeting minutes are also due. This is as inflation data will cross the wires from Canada and the United Kingdom. What else is in store for markets in the week ahead?

Recommended by Daniel Dubrovsky

Get Your Free AUD Forecast

How Markets Performed – Week of 8/7

Forecasts:

British Pound (GBP) Forecasts: GBP/USD and EUR/GBP Ahead of Key UK Data

The latest UK growth data showed the economy in slightly better health than previously thought. Next week, the latest inflation and jobs releases will be key for Sterling moving forward.

Euro Forecast: EUR/USD Flattens Out, EUR/JPY Rise in Jeopardy at Intervention Levels

A notable step down in high impact EU-related data could lead to sideways price action, EUR/JPY extension at risk as yen depreciation gets to prior intervention levels.

Japanese Yen Forecast: USD/JPY, GBP/JPY Rise to Key Resistance Levels. Will They Hold?

The Japanese Yen extended losses this past week, with USD/JPY and GBP/JPY facing key resistance levels that if broken, open the door to extending their broader uptrends.

US Crude Oil Weekly Forecast: Market May Be Tiring Close to 2023 Highs

The WTI Market has climbed back to its highs for the year but doesn’t look comfortable there.

US Dollar Forecast: Dollar Index Rally Continues with Fundamental and Technical Challenges Ahead

The Dollar Index (DXY) Is on a tear at the moment with its fourth successive week of gains. Will the rally continue given that the FOMC minutes and a barrage of resistance lie ahead?

Gold, Silver Forecast: It’s Now or Never for XAU/USD, XAG/USD

Gold and silver are approaching a crucial juncture that could define the trend for subsequent weeks, perhaps months. What is the outlook and what are the key levels to watch in XAU/USD and XAG/USD?

Australian Dollar Forecast: US Dollar Dominates AUD/USD, Undermining AUD/JPY

The Australian Dollar languished lower last week as the US Dollar found support with Treasury yields building despite a soft US CPI read. If the range holds, will AUD/USD mean revert?

— Article Body Written by Daniel Dubrovsky, Senior Strategist for DailyFX.com

— Individual Articles Composed by DailyFX Team Members