Euro Weekly Forecast: Bearish

- Euro confirms a 7-week losing streak against the US Dollar

- Will EUR/USD confirm a breakout under the 200-day MA

- EUR/JPY may also be on the verge of a bearish breakout

Recommended by Daniel Dubrovsky

Get Your Free EUR Forecast

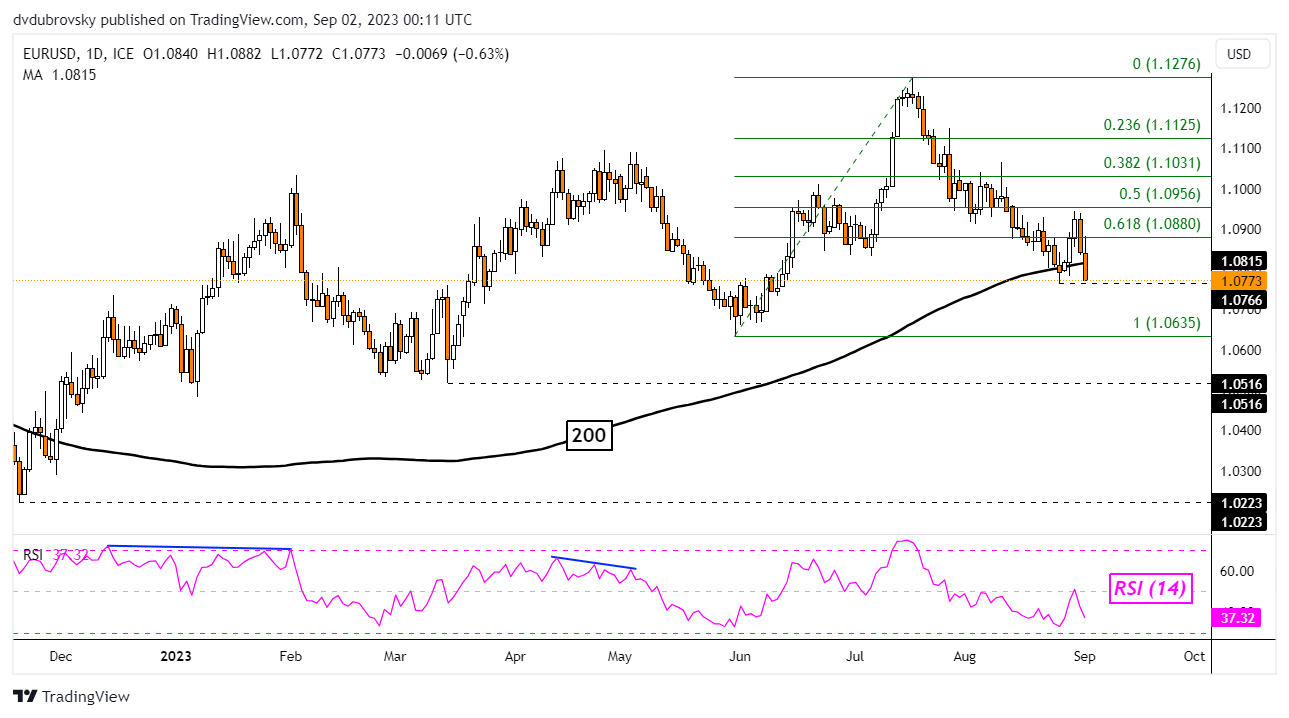

The Euro is now on a 7-week losing streak against the US Dollar after Friday’s -0.63% drop. This means that EUR/USD is on its longest consecutive losing streak since 2014. It will take 9 weeks of losses to match the longest losing streak since 1997.

Friday’s close meant the lowest close since the middle of June, opening the door to extending the downtrend since July. Furthermore, prices also closed under the 200-day Moving Average once more, opening the door to an increasingly bearish technical bias.

Taking out 1.0766 with a confirmatory downside breakout exposes the May low of 1.0635. Otherwise, turning higher has key resistance at 1.0956 which is the midpoint of the Fibonacci retracement.

Recommended by Daniel Dubrovsky

How to Trade EUR/USD

EUR/USD Daily Chart

Chart Created in TradingView

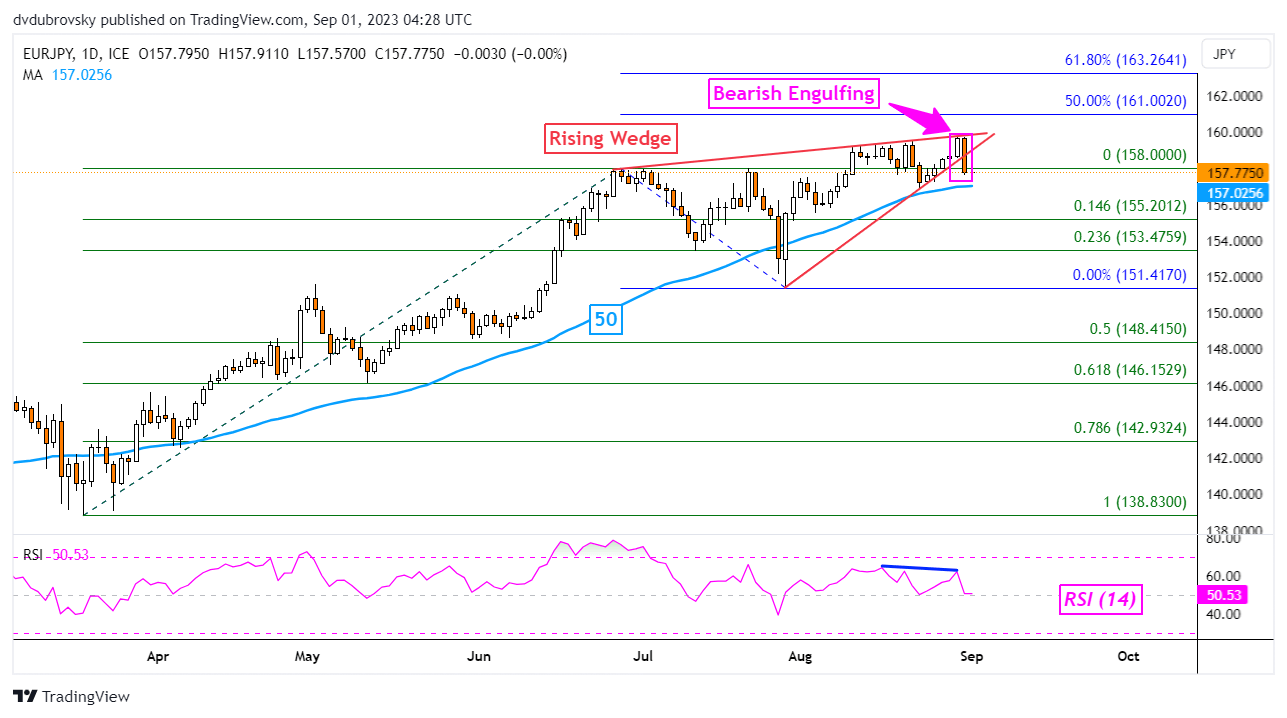

Meanwhile, the Euro could be readying to reverse lower against the Japanese Yen. Since June, EUR/JPY has been consolidating higher within the boundaries of a Rising Wedge chart formation. Not only have prices broken under the wedge, but a Bearish Engulfing formed as this happened. Given further downside confirmation, that may open the door to a reversal.

Immediate support is the 50-day Moving Average, which could reinstate the broader upside focus. Otherwise, clearing lower would offer an increasingly bearish technical conviction. That places the focus on the 14.6% and 23.6% Fibonacci retracement levels of 155.20 and 153.47, respectively. Otherwise, extending higher exposes the midpoint of the Fibonacci extension at 161, followed by the 61.8% level at 163.26.

EUR/JPY Daily Chart

Chart Created in TradingView

— Written by Daniel Dubrovsky, Senior Strategist for DailyFX.com