Japanese Yen Weekly Forecast: Bearish

- Japanese Yen showed some resilience this past week

- Still, the currency remains in a bearish posture overall

- USD/JPY and GBP/JPY remain focused to the upside

Recommended by Daniel Dubrovsky

Get Your Free JPY Forecast

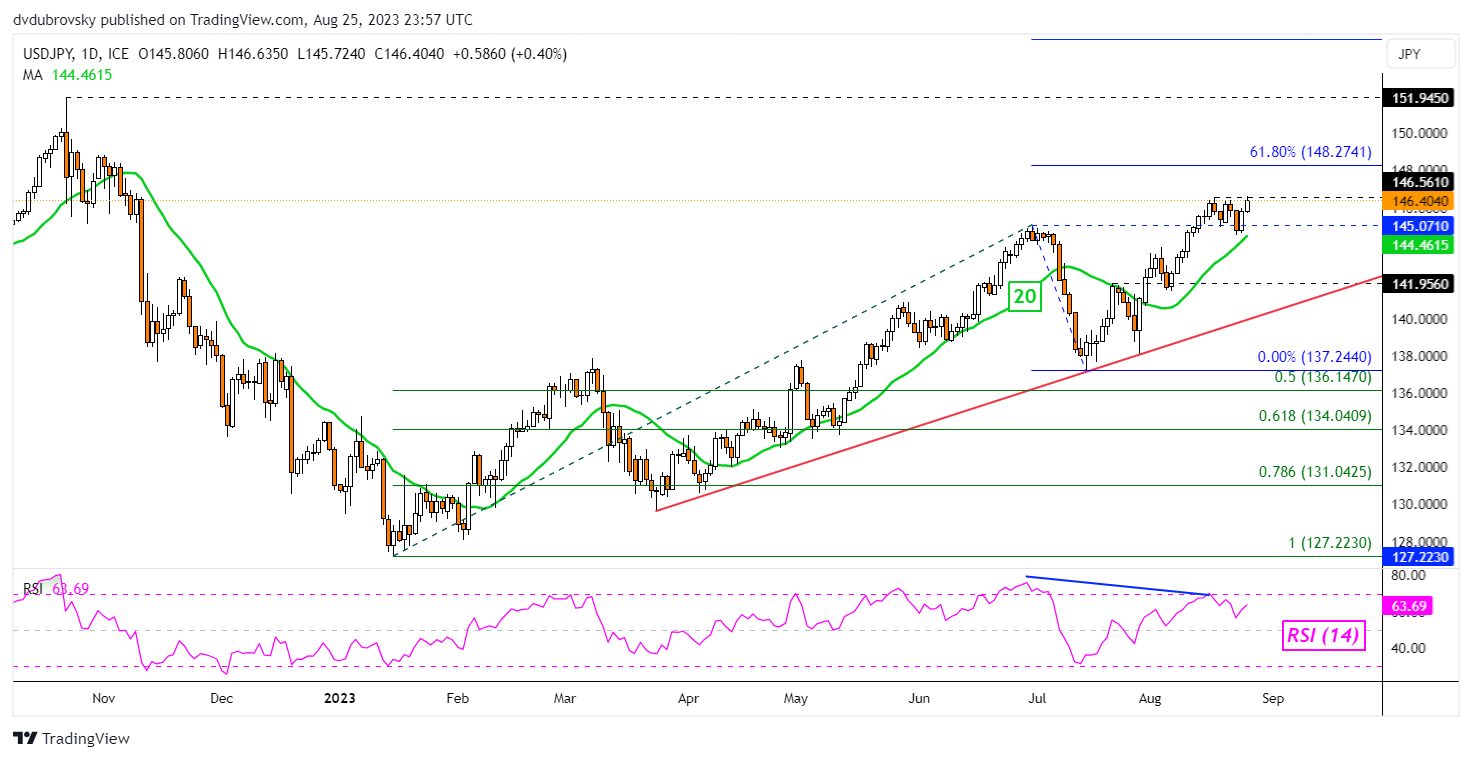

The Japanese Yen weakened slightly against the US Dollar this past week, but a closer look reveals that USD/JPY struggled to extend the broader uptrend. Not long ago, the exchange rate left behind resistance at 146.56. This followed a breakout above the June high of 145.07, opening the door to uptrend resumption.

Since then, prices have somewhat idled and negative RSI divergence emerged. The latter shows fading upside momentum, which can at times precede a turn lower. USD/JPY also remains above the 20-day Moving Average (MA), and the long-term rising trendline from March. As such, despite near-term price action, the Japanese Yen still broadly remains in a bearish position against the US Dollar.

USD/JPY Daily Chart

Chart Created in TradingView

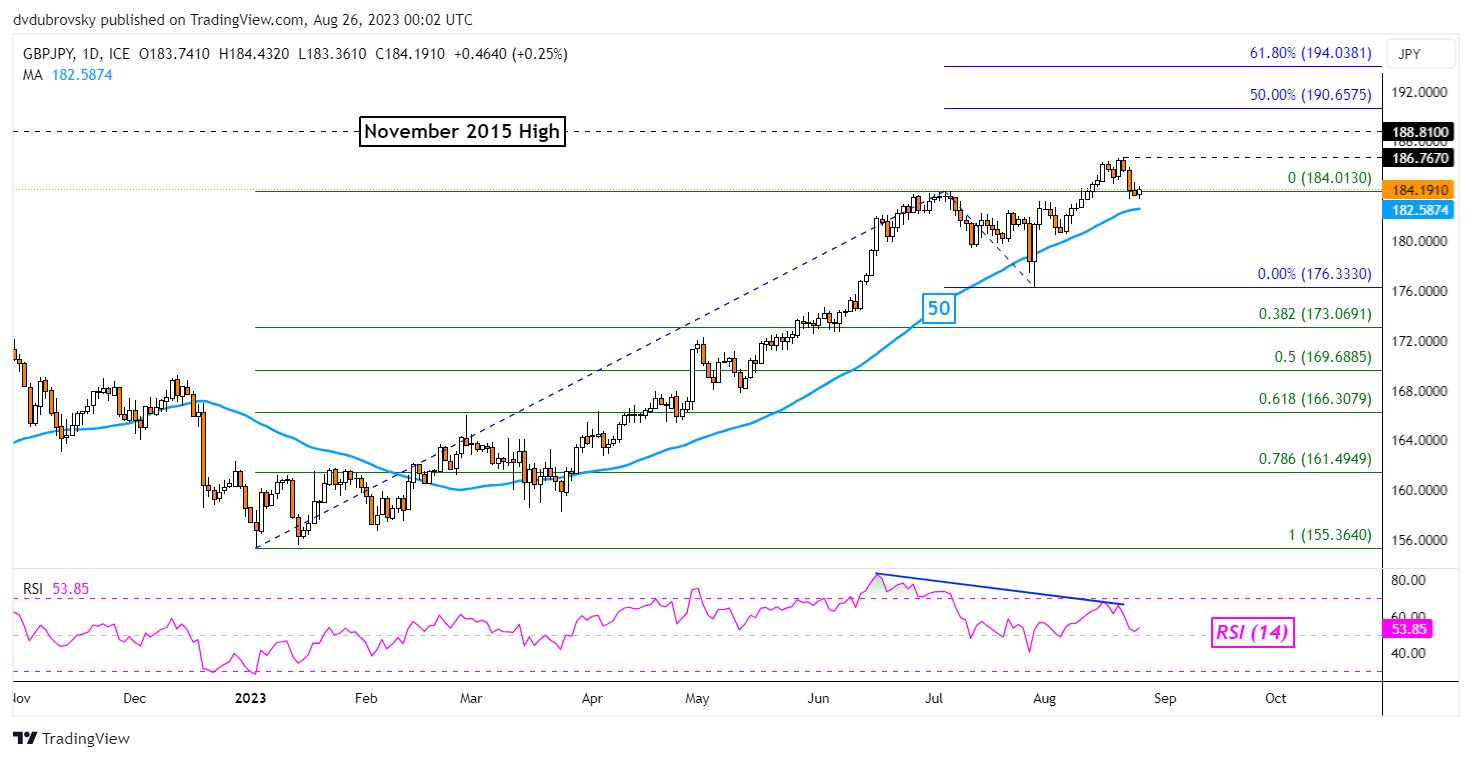

The British Pound faces a somewhat similar position against the Japanese currency. GBP/JPY broke above the June high of 184.01, only to rise slightly and establish new resistance at 186.76. Then, the pair turned lower towards June highs. This also followed the emergence of negative RSI divergence, warning that momentum was not being sustained.

Now, the pair faces the 50-day Moving Average as near-term support. The latter is helping maintain the broader bullish GBP/JPY technical bias. Breaking under it may open the door to revisiting the July low of 176.33. Otherwise, extending higher places the focus on the November 2015 high of 188.81. After that sits the midpoint of the Fibonacci extension at 190.65.

Recommended by Daniel Dubrovsky

The Fundamentals of Breakout Trading

GBP/JPY Daily Chart

Chart Created in TradingView

— Written by Daniel Dubrovsky, Senior Strategist for DailyFX.com