USD/CAD PRICE, CHARTS AND ANALYSIS:

- The Loonie Arrests Slump Largely Thanks to Weak US PMI Data. More Weakness Ahead for the Canadian Dollar?

- Core Retail Sales Data Paints a Worrying Picture for the Canadian Economy.

- Market Participants Are Now Pricing in a Chance of Steeper Rate Cuts in 2024 from the US Federal Reserve.

- To Learn More About Price Action, Chart Patterns and Moving Averages, Check out the DailyFX Education Series.

For Beginner Traders, Please Download Your Free Forex Guide Below

Recommended by Zain Vawda

Forex for Beginners

Read More: The Bank of Canada: A Trader’s Guide

The loonie is on a 5-week losing streak against the Greenback with a 6th week of losses very much a possibility. We have seen a slight pullback in todays US session as mixed retail sales data from Canada was accompanied by lackluster PMI data from the US with USDCAD surrendering the 1.3600 level which may prove to be temporary.

READ MORE: EUR/USD Slides as Euro Area PMI Gives ECB Reason to Pause

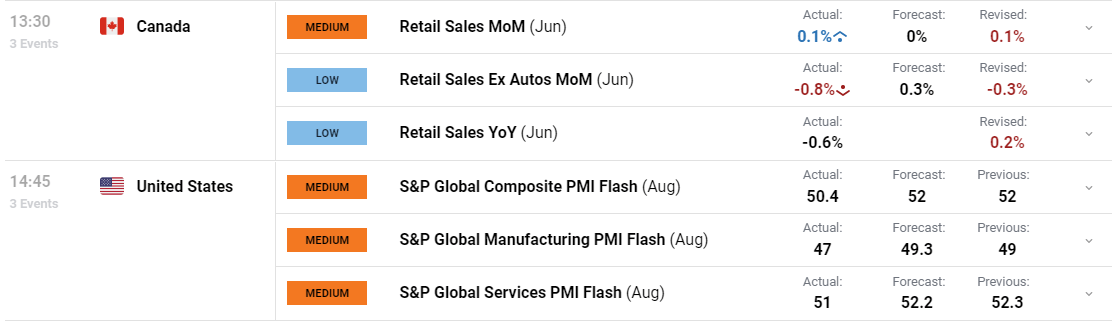

CANADA RETAIL SALES AND US PMI DATA

Canadian retail sales increased 0.1% in June and were led by increases at motor vehicles and parts dealers with an increase of 2.5%. Core retail sales, which exclude gasoline stations, fuel vendors, motor vehicles and parts dealers were down0.9% in June. The core print coming in well below market forecasts of 0.3% growth. On a yearly basis, retail sales sank 0.6% in June, the first decline since the pandemic-drive slump in May 2020.

For all market-moving economic releases and events, see the DailyFX Calendar

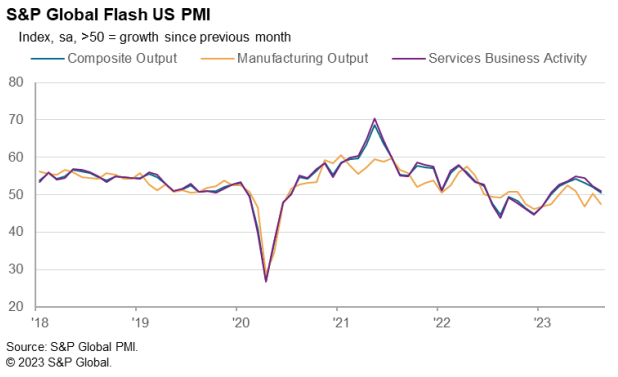

The Mixed retail sales data in Canada did not have as large a impact as the miss by US PMI data which weighed on the US Dollar. The US private sector is near stagnation amid a renewed fall in demand as the S&P Global US Composite PMI declined to 50.4 in August 2023, falling short of market expectations of 52.0, according to a preliminary estimate. This is now the weakest upturn in private sector activity since February as the service sector joined manufacturing with a slowdown in output. New orders fell for the first time in 6 months with the pace of job creation slowing to a 3 year low. Another blow came from an increase in input costs which accelerated in part thanks to greater fuel, wage, and raw material costs. US firms were more upbeat in their outlook for output over the coming year in August. Although weaker than the series average, the degree of confidence picked up from July with businesses also planning to invest in marketing initiatives. The immediate effect on markets has seen the US Dollar and Dollar Index weaken significantly following a bullish run toward the 104 handle in the European session.

The PMI picture globally today painted a grim picture with market expectations for rate cuts heading into 2024 seeing stark changes. Market participants are now pricing in the probability of rate cuts in the first and more likely second quarter of 2024. Obviously now this is continuously changing and at the moment rate hike probabilities appear more sensitive than ever to data releases as Central Banks have reiterated the need for data to drive future decisions.

Trading Requires Constant Improvement, See What Traits Successful Traders Share and Download the Guide Below

Recommended by Zain Vawda

Traits of Successful Traders

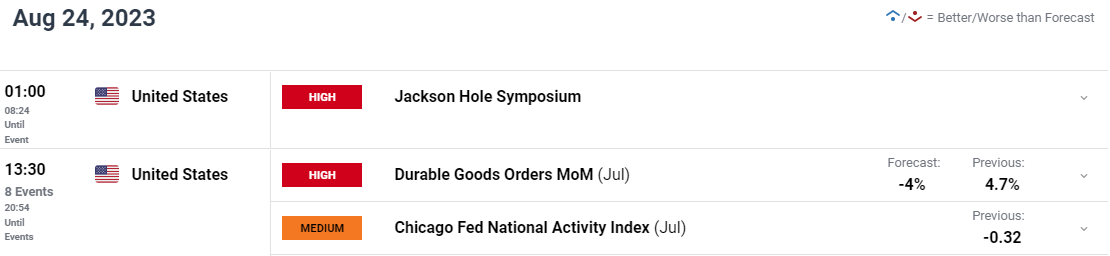

ECONOMIC CALENDAR AND EVENT RISK AHEAD

The Jackson Hole Symposium will now be key to market moves for the rest of the week as Central Bankers take the podium. Comments could have a knock-on effect on overall sentient while in the case of USDCAD the speech by Fed Chair Jerome Powell will hold added significance.

Durable goods orders is another high impact event on the calendar tomorrow and could stoke volatility around its release and will defintely be worth keeping an eye on as well.

For all market-moving economic releases and events, see the DailyFX Calendar

TECHNICAL ANALYSIS AND FINAL THOUGHTS

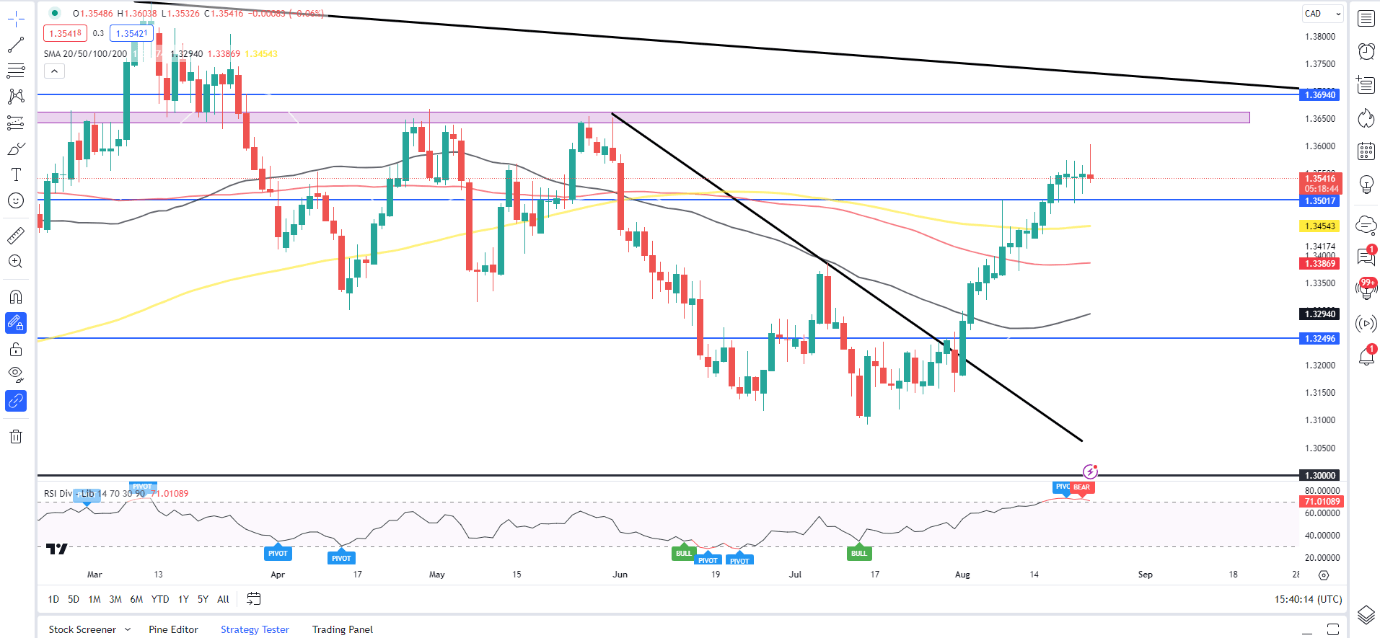

USDCAD

USDCAD has rallied with conviction from recent lows to post 5 successive weeks of gains and eyeing a 6th. USDCAD has a tendency to trend for quite some time before reversing but usually puts in significant moves when it does. The pair has already risen +-500 pips from the lows and falling just short of the key resistance area around the 1.3650 handle. The daily candle from being extremely bullish has now morphed into a shooting star which should we close that way would hint at further downside ahead.

The downside faces many hurdles with immediate support at the 1.3500 handle with the 200-day MA resting just 45 pips lower at 1.3455. Should USDCAD have the legs to take these initial levels of support out then attention may turn to the 100 and 50-day MAs resting at 1.3387 and 1.3294 levels respectively.

Looking at the alternative and if this is a temporary pause, a continuation of the upside rally faces resistance at 1.3650 and then the long-term descending trendline around 1.3700 becomes the focus for USDCAD bulls and may prove a difficult nut to crack. A lot to consider and no doubt and interesting few days and weeks ahead for USDCAD heading toward the September Central Bank meetings.

USD/CAD Daily Chart

Source: TradingView, prepared by Zain Vawda

Taking a look at the IG client sentiment data and we can see that retail traders are currently net SHORT with 69% of Traders holding short positions.

For Full Breakdown of the Daily and Weekly Changes in Client Sentiment as well Tips on How to use it, Get Your Free Guide Below

of clients are net long. of clients are net short.

| Change in | Longs | Shorts | OI |

| Daily | 8% | -11% | -7% |

| Weekly | 20% | 7% | 10% |

— Written by Zain Vawda for DailyFX.com

Contact and follow Zain on Twitter: @zvawda