EUR/USD ANALYSIS

- EUR struggles to capitalize on recent Fed speak.

- US CPI and ECB rate decision the key risk events for next week.

- Falling wedge breakout could bring some hope for euro bulls.

Recommended by Warren Venketas

Get Your Free EUR Forecast

EURO FUNDAMENTAL BACKDROP

The euro is back on the defensive this Friday after relatively dovish Fed comments yesterday overshadowed the euro area GDP miss that highlighting growth concerns within the region. These concerns were supplemented by Citi Bank revising growth forecast down to 0.4% vs 0.8% previously, The German DIW Institute added to the bearish outlook, cutting German GDP projections to -0.4% from -0.2%. Being the largest economy in the euro area, German pessimism will weigh heavily on the European Central Bank (ECB) and their interest rate cycle as stagflation and recessionary fears gain traction.

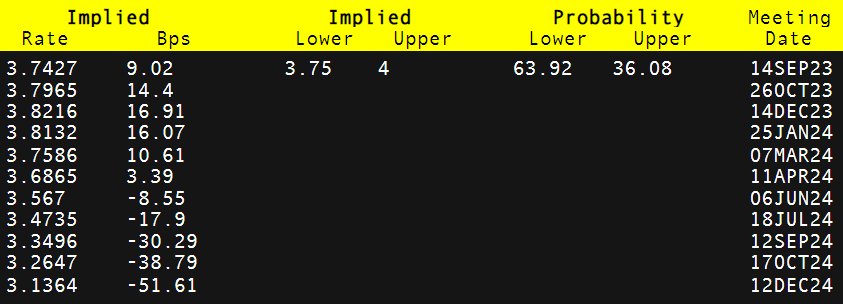

Currently, money markets (refer to table below) are divided between a rate hike or pause for next week’s announcement. Although pricing is skewed towards a rate pause, this could be the last opportunity for the ECB to hike considering the deteriorating economic conditions. The decision could go either way in my view which leaves the door open for bulls and bears next week.

ECB INTEREST RATE PROBABILITIES

Source: Refinitiv

Introduction to Technical Analysis

Candlestick Patterns

Recommended by Warren Venketas

TECHNICAL ANALYSIS

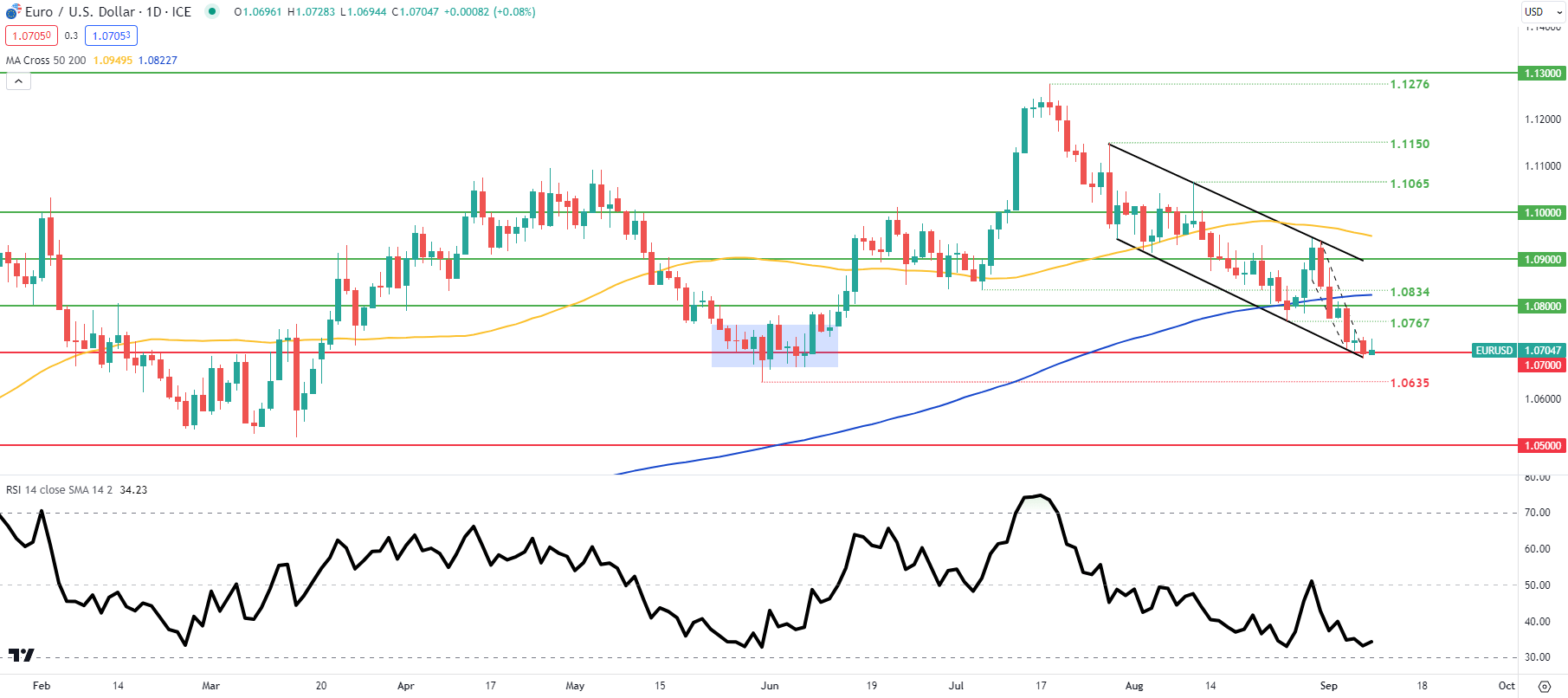

EUR/USD DAILY CHART

Chart prepared by Warren Venketas, IG

The daily EUR/USD chart above is trading at a key inflection point around the psychological 1.0700 handle that has previously been met with resistance (blue) from bulls in May/June this year. Bulls have managed to break above the short-term falling wedge pattern (dashed black line) but without any real conviction just yet. An ECB hike next week could see this pattern unfold as expected, exposing subsequent resistance zones.

From a bearish perspective, an ECB pause may see bears breach the downward trending channel support zone and push EUR/USD lower. It is important to note that US CPI is also scheduled next week before the ECB’s announcement which could provide some short-term volatility.

Resistance levels:

- 1.0800

- 1.0767

- Wedge resistance

Support levels:

IG CLIENT SENTIMENT DATA: BEARISH

IGCS shows retail traders are currently neither NET LONG on EUR/USD, with 67% of traders currently holding long positions (as of this writing). Download the latest sentiment guide (below) to see how daily and weekly positional changes affect EUR/USD sentiment and outlook.

Introduction to Technical Analysis

Market Sentiment

Recommended by Warren Venketas

Contact and followWarrenon Twitter:@WVenketas