Australian Dollar Forecast: Neutral

- The Australian Dollar is caught in global crosswinds for now

- Markets have been buying risk assets elsewhere but not AUD/USD

- Volatility is low. If there’s a Fed surprise this week, will AUD/USD kick-off?

Recommended by Daniel McCarthy

How to Trade AUD/USD

The Australian Dollar eased into the weekend after firming earlier in the week. Overall, the US Dollar made larger gains against most other major currencies last week.

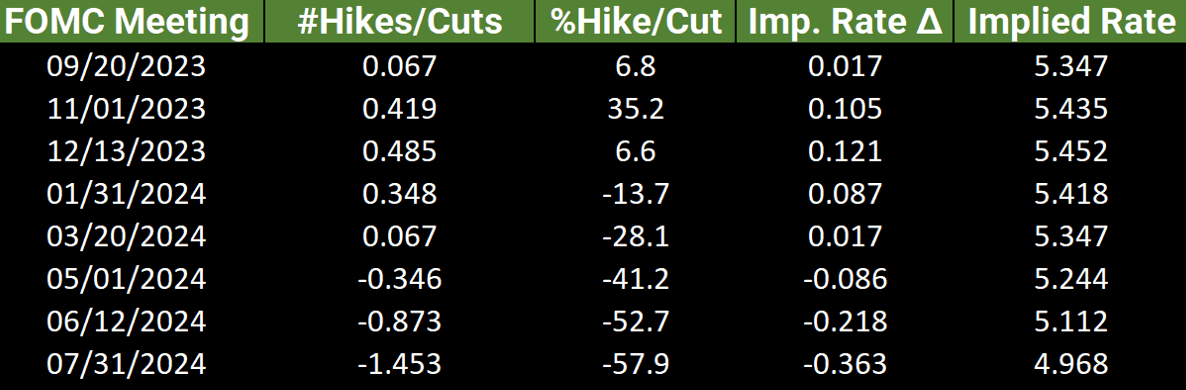

Interest rate markets have been paring back expectations of rate hikes at this week’s Federal Open Market Committee (FOMC) meeting on Wednesday.

Interest rate markets are not expecting any change but ascribe around a 50/50 chance of a 25 basis-point hike by the end of the year before an easing in the middle of 2024.

Source; Bloomberg, tastytrade

Last Thursday the European Central Bank (ECB) hiked its target rate again by 25 basis points to 4.00%.

The commentary in the aftermath was less optimistic about the growth outlook for the Eurozone. Consequently, the markets perceive a potentially less hawkish ECB going forward.

A feature of the market of late has been the decrease in volatility in many asset classes.

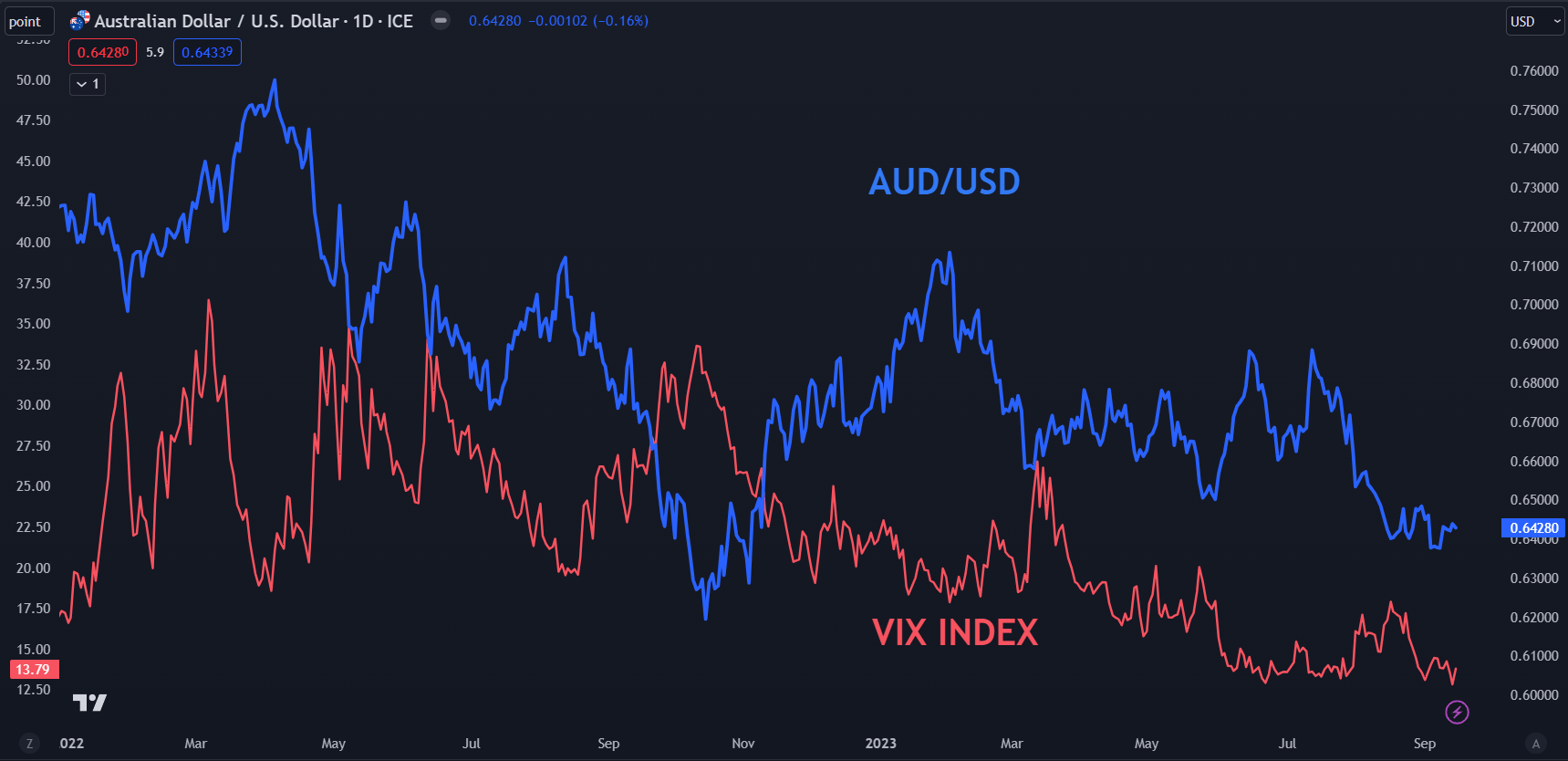

The widely watched VIX index continues to trade close to its lowest level since February 2020, just prior to the pandemic. Although on Friday it did tick up slightly.

The VIX and growth-orientated assets, such as the Aussie, often display a negative correlation.

The recent rally of equity indices such as the Nasdaq reflects a healthy appetite for risk-related assets of late. In such an environment, the demand for insurance, seen through the price of volatility, is less.

By historical standards, the Aussie is underperforming relative to where the VIX index is trading.

CHART – AUD/USD AND VIX INDEX

Chart created in TradingView

Last week saw Australia’s unemployment rate came in at 3.7% in August as anticipated and previously. 65k Australian jobs were added in the month, which was notably above forecasts of 25k.

Unfortunately, 62k of the jobs added were part-time rather than full-time. The participation rate picked to 67.0% from 66.7%.

Looking ahead, the RBA meeting minutes for its meeting from earlier this month will be released on Tuesday. The key events for markets though will be the FOMC meeting on Wednesday.

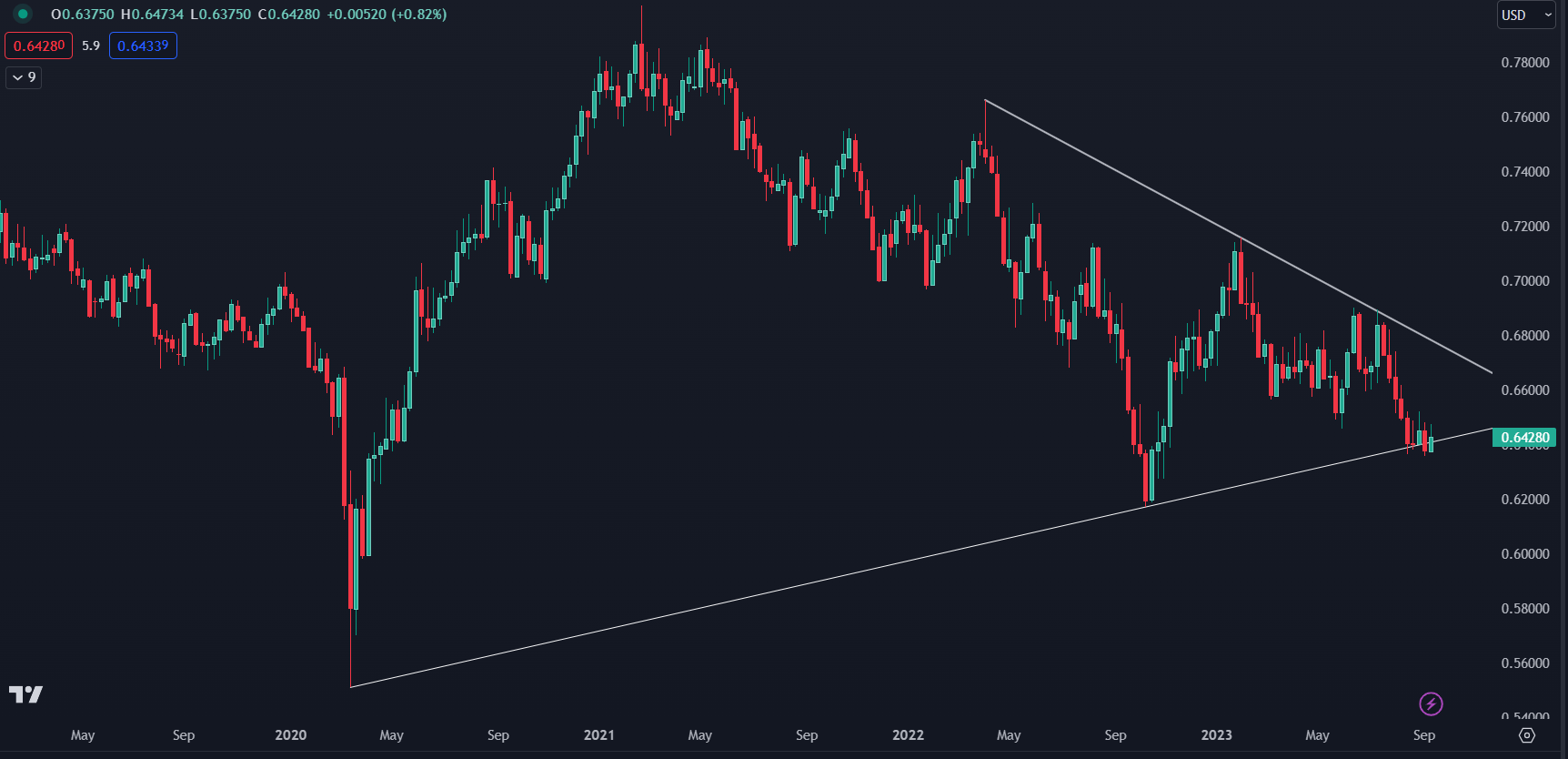

AUD/USD WEEKLY CHART – THE BIGGER PICTURE

Looking at the weekly AUD/USD chart, the price has dipped below a long-term ascending trend line that is part of a Symmetrical Triangle.

On Friday it closed above the ascending trend line but had closed below it in the week prior. This may indicate that there is some uncertainty for direction in AUD/USD for now.

A clean break below it might see bearish momentum evolve. Click on the banner below for more information about breakout trading.

Recommended by Daniel McCarthy

The Fundamentals of Breakout Trading

Chart created in TradingView

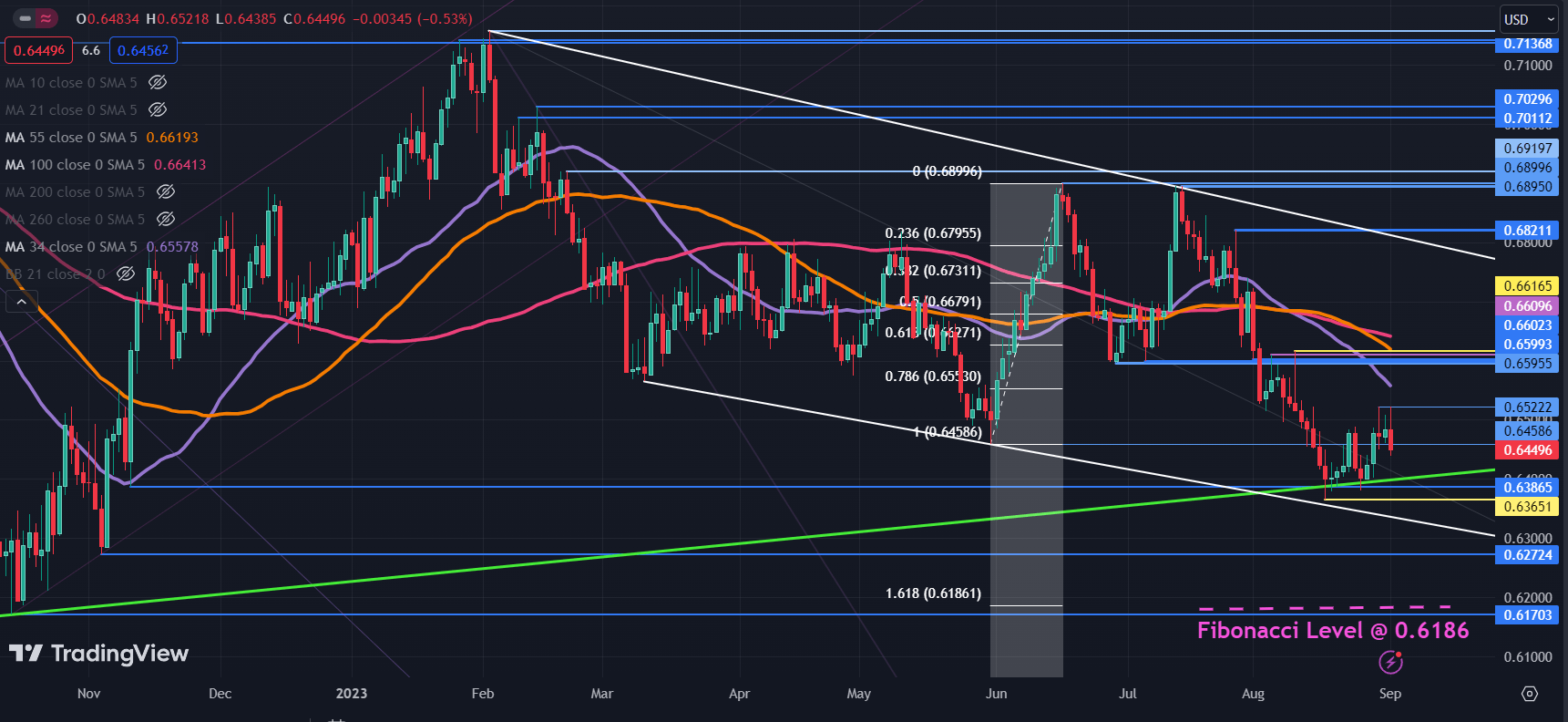

AUD/USD DAILY CHART

AUD/USD remains in a shorter-term descending trend channel after rallying last week to retreat back into the recent range.

It briefly traded above a historical breakpoint at 0.6458 but was unable to sustain the move and it may offer resistance. The 34-day Simple Moving Average (SMA) is also in the vicinity and might assist in offering resistance.

The price remains below the 34-, 55- and 100-day Simple Moving Averages (SMA) and they have negative gradients, which may suggest that bearish momentum is intact for now.

Resistance could be at the recent high near 0.6520. Further up, the 0.6600 – 0.6620 area might be a notable resistance zone with several breakpoints and prior peaks there, as well as the 100-day SMA.

On the downside, support may lie at the breakpoints and previous lows near 0.6360, 0.6270 and 0.6170.

The latter might also be supported at 161.8% Fibonacci Extension level at 0.6186. To learn more about Fibonacci techniques, click on the banner below.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

Chart created in TradingView

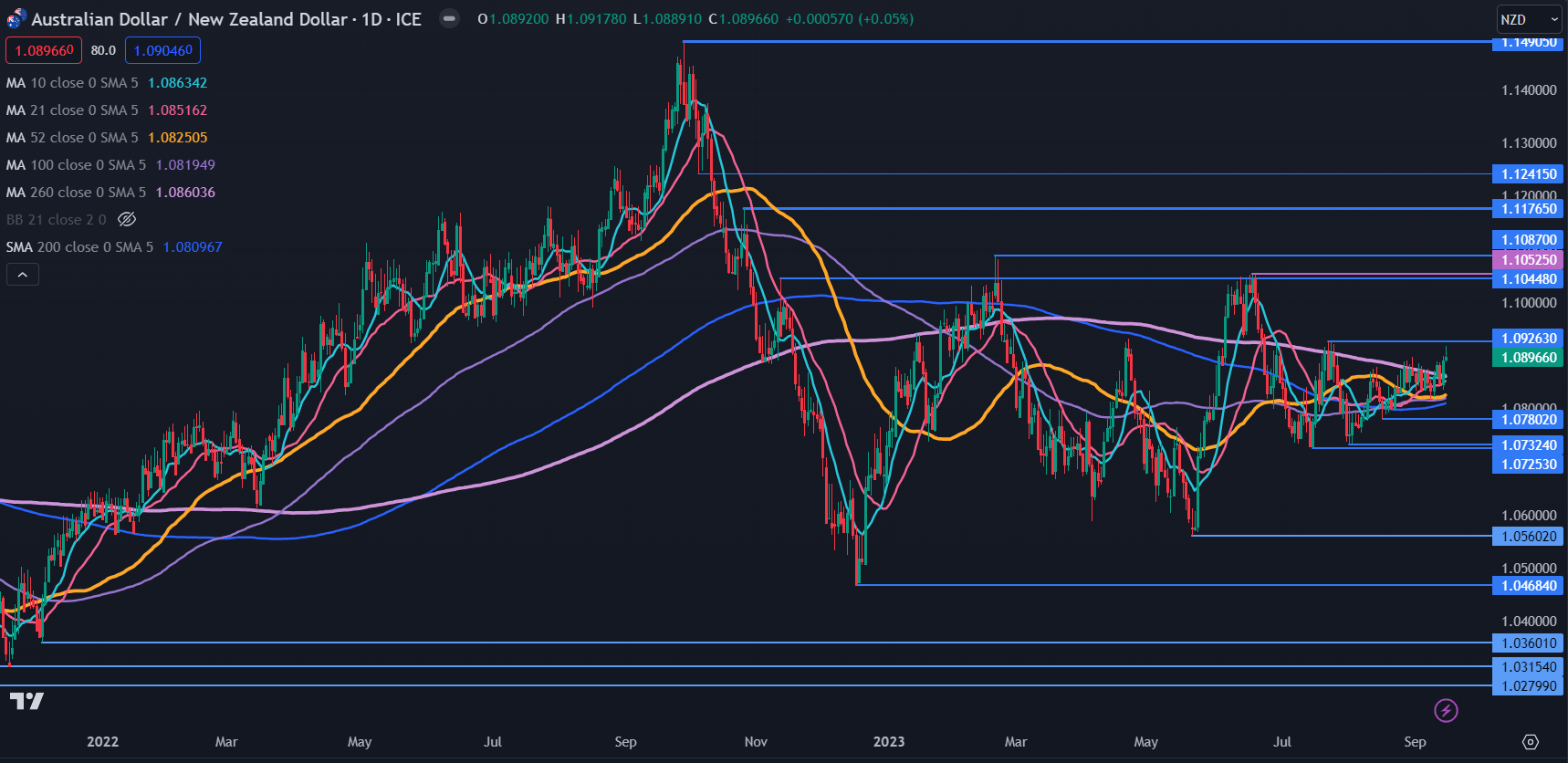

AUD/NZD DAILY CHART

AUD/NZD is range bound for now and this is typified by the clustering of the 10, 21, 34-, 55-, 100-, 200- and 260-day Simple Moving Averages (SMA). They all lie in the narrow window of 1.0810 – 1.0860.

Historically, this bunching typically only lasts a month, or two before directional price action unfolds. It should be noted though that past performance is not indicative of future results.

Friday’s rally saw the price move above all the SMAs and might be the start of a bullish run. A move below any SMA in the near term would negate that perspective.

Friday’s peak of 1.0918 was just shy of the July high of 1.0926 and a move above the potential resistance there may encourage AUD/NZD bulls.

Further up, resistance might be at the breakpoint and prior peaks near 1.1050 and 1.1090.

On the downside, if the price is able to break below all the daily SMAs, support may lie at the recent lows of 1.0780, 1.0732 and 1.0725.

Chart created in TradingView

Recommended by Daniel McCarthy

The Fundamentals of Range Trading

— Written by Daniel McCarthy, Strategist for DailyFX.com

Please contact Daniel via @DanMcCarthyFX on Twitter