Spot gold made headway today with China’s property sector revisiting its debt profile as markets contemplate central bank actions this week. Will XAU/USD break the range?

Gold, XAU/USD, US Dollar, China, HSI, Crude Oil, Fed, BoE, BoJ – Talking Points

- Gold is challenging the US$ 1,930 level again today

- Problems for China’s developers soured the mood for equities

- Central bank meetings are the focus for now. Where to for XAU/USD?

Recommended by Daniel McCarthy

Trading Forex News: The Strategy

The gold price added to last Friday’s gain to start the week with risk aversion creeping into markets on Monday ahead of several central bank meetings this week.

China property woes continue with Country Garden looking to renegotiate its debt obligations for CNY bonds and is due to pay a coupon on its USD note today.

The Evergrande shemozzle continues to unfurl with Chinese police detaining some staff from the wealth management unit over the weekend.

As a result, Chinese companies listed in Hong Kong fell with the Hang Seng Index (HSI) down over 1% today. Australia’s S&P ASX 200 also dropped but to a lesser degree.

Japan is on holiday today so the cash market there is closed, but Nikkei 225 futures found higher ground with the Yen continuing to trade near its lowest level since November last year, just shy of 148.

Other currencies have had a quiet start to the week so far after the US Dollar notched up gains last week against CHF, EUR, GBP and JPY.

Futures markets are pointing to a steady start to the Wall Street cash session.

APAC bonds are generally lower as yields tick higher. The benchmark 10-year Treasury bond finished last week at 4.33% after trading at a 16-year high of 4.36% on Thursday.

Crude oil prices are close to the 10-month peak seen on Friday. The WTI futures contract is near US$ 91.50 bbl while the Brent contract is around US$ 94.50 bbl.

Saudi Energy Minister Prince Abdulaziz bin Salman will be speaking at the 24th World Petroleum Congress in Canada later today.

A plethora of central banks will be meeting this week to decide on monetary policy. The Federal Reserve and the Bank of Japan are anticipated to hold policy steady on Wednesday and Friday respectively.

The market is pricing in a 25 basis point hike by the Bank of England on Wednesday.

The full economic calendar can be viewed here.

GOLD TECHNICAL ANALYSIS SNAPSHOT

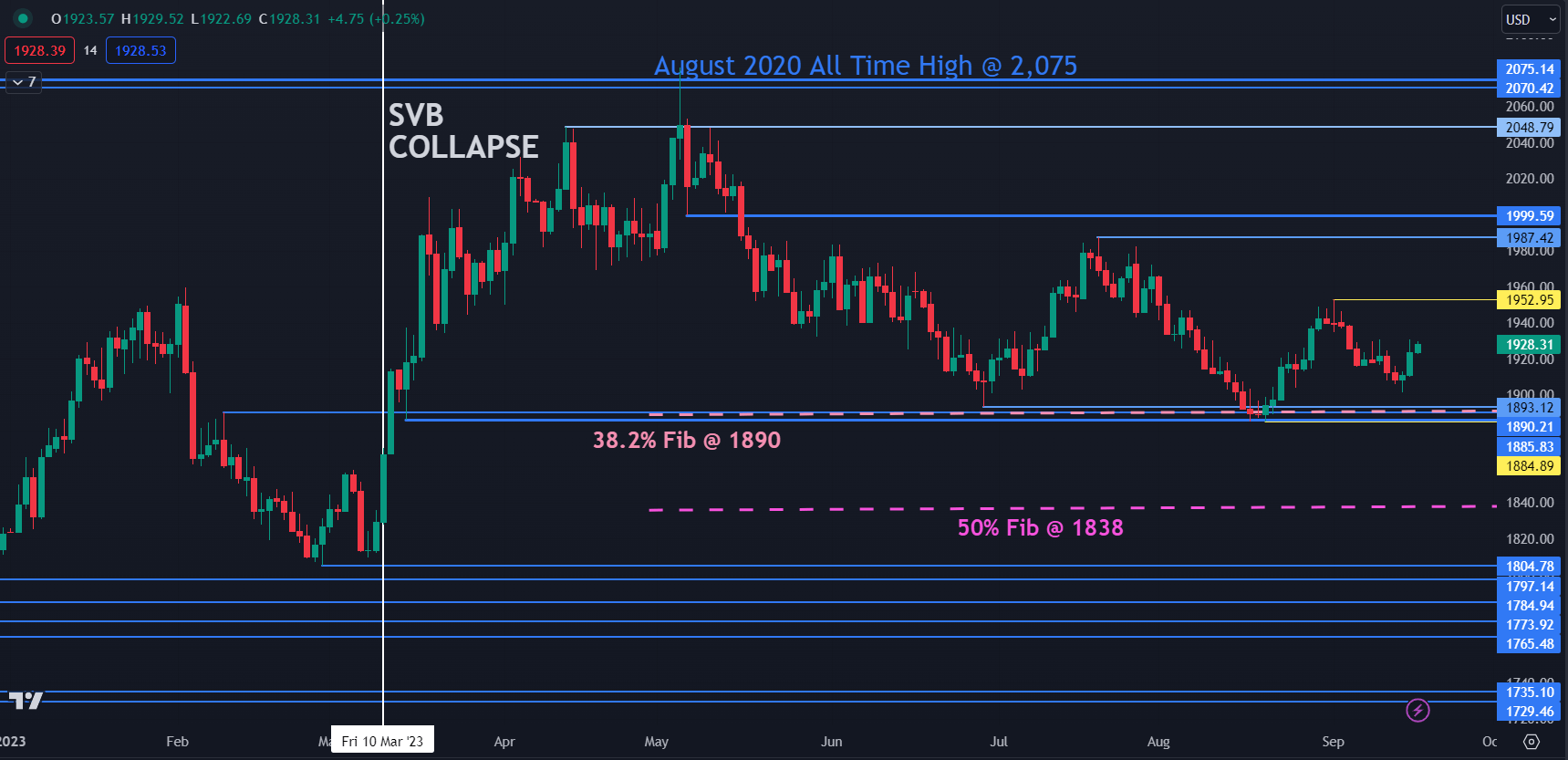

Spot gold had seen a range of US$ 1,885 – 1,997 over the past 4 months.

A break on either side could be the catalyst for momentum to unfold in that direction. Click on the banner below to learn more about range trading.

Recommended by Daniel McCarthy

The Fundamentals of Range Trading

Support could be in the 1885 – 1895 area where there are a series of prior lows, a breakpoint, and the 38.2% Fibonacci Retracement level of the move from 1614 up to 2062.

Further down the 50% Fibonacci Retracement at 1838 might lend support.

On the topside, resistance might be at the recent peaks of 1953 and 1987 or the psychological level of 2000 where there is also the breakpoint nearby.

SPOT GOLD CHART

Chart created in TradingView

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

— Written by Daniel McCarthy, Strategist for DailyFX.com

Please contact Daniel via @DanMcCarthyFX on Twitter