Australian Dollar Forecast: Neutral

- The Australian Dollar lost ground after the RBA stood still

- The US Dollar is back on the march, battering the Aussie and the Yen

- Commodities are a mixed bag. If China slows, will it sink AUD/USD?

Recommended by Daniel McCarthy

Introduction to Forex News Trading

The Australian Dollar is battling to fend off a stronger US Dollar from sending it to the cellar as markets contemplate central bank posturing, debt market gyrations and the outlook for global growth.

The RBA left its cash unchanged at 4.10% last Tuesday as widely anticipated. The accompanying statement noted, “Some further tightening of monetary policy may be required to ensure that inflation returns to target in a reasonable timeframe, but that will continue to depend upon the data and the evolving assessment of risks.”

This has become a theme for several central banks of late as they make it clear that future rate moves will be data-dependent.

The Federal Reserve are in this camp and they went into a media blackout period last weekend ahead of the Federal Open Market Committee (FOMC) meeting on September 20th.

The last few days saw many Fed speakers hit the hustings but none of them said anything to rock the boat. The possibility of a soft landing for the US economy might be in sight and it seems to be a ‘steady as she goes’ approach evolving.

Overall, data from the US has been on the strong side and this has helped to underpin Treasury yields, which appears to have boosted the US Dollar.

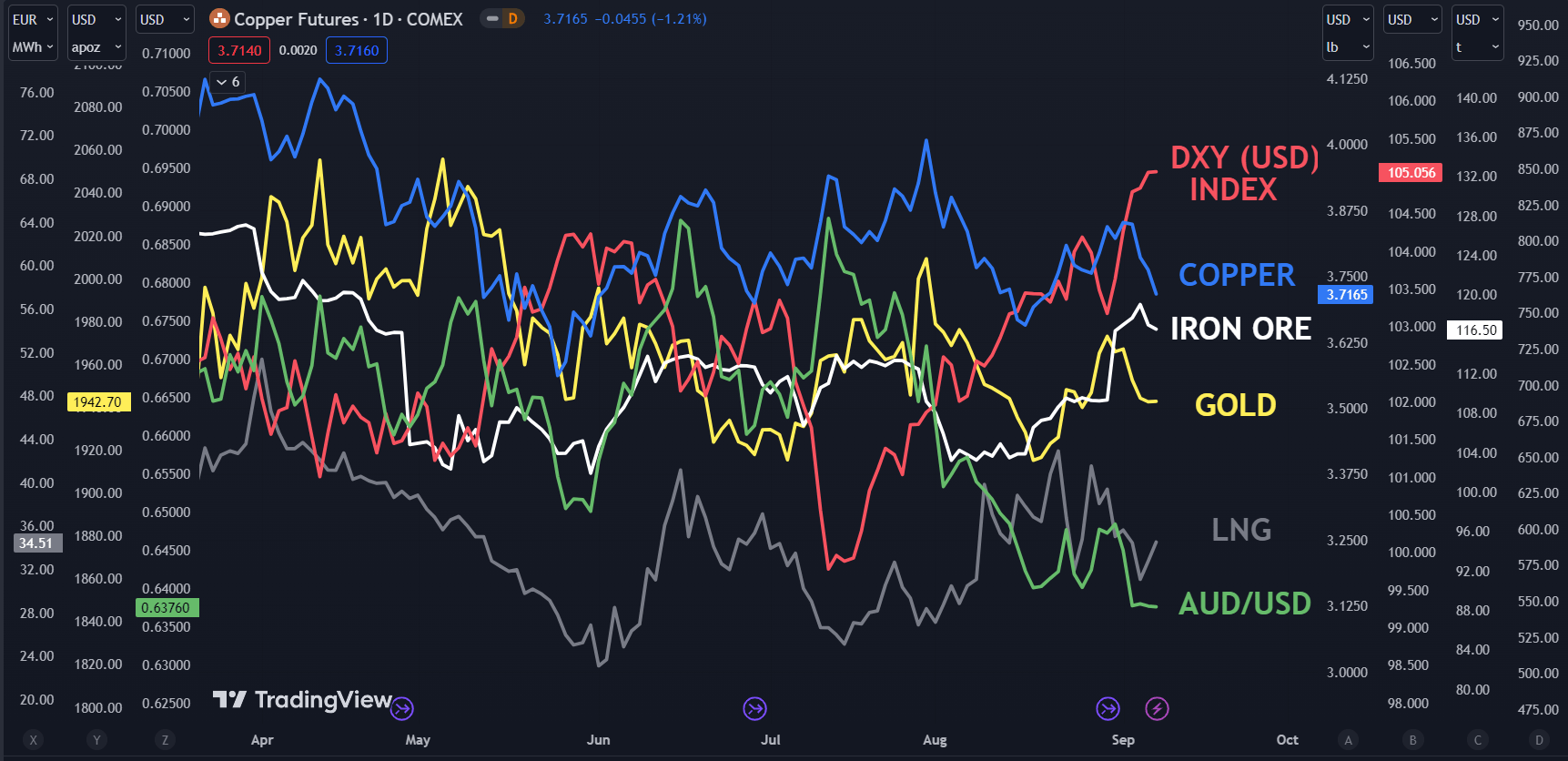

The stronger American Dollar saw most commodities take a hit with several of Australia’s key exports of iron ore, copper and gold sliding. An exception to the weaker commodity complex has been the energy sector.

Crude oil prices had already been shooting north on Saudi Arabia and Russian production cuts but then it was announced last Friday that Chevron was unable to cut a deal with unions in Western Australia.

Partial strikes have been announced for the Gorgon and Wheatstone facilities that supply around 7% of seaborne liquefied natural gas (LNG) trade globally.

CHART – AUD/USD, DXY (USD) INDEX, COPPER, IRON ORE, GOLD, LNG

Chart created in TradingView

The challenges for commodity prices have been compounded by the prospect of slowing economic growth in many pockets of the world, in particular, China.

While the property sector there is facing several hurdles, trade data released last Thursday showed that both export and import volumes shrunk significantly in August.

This points toward a slowing in the world’s second-largest economy and less demand from the rest of the world for their goods and services.

Australia’s trade surplus was also smaller than estimated, printing at AUD 8.04 billion for July, below forecasts of AUD 10 billion.

For the Aussie Dollar, it could remain the case that the US Dollar might dominate direction in the near term.

Crucial data in the week ahead will be US CPI on Wednesday and Australian jobs numbers on Thursday.

Recommended by Daniel McCarthy

How to Trade AUD/USD

AUD/JPY

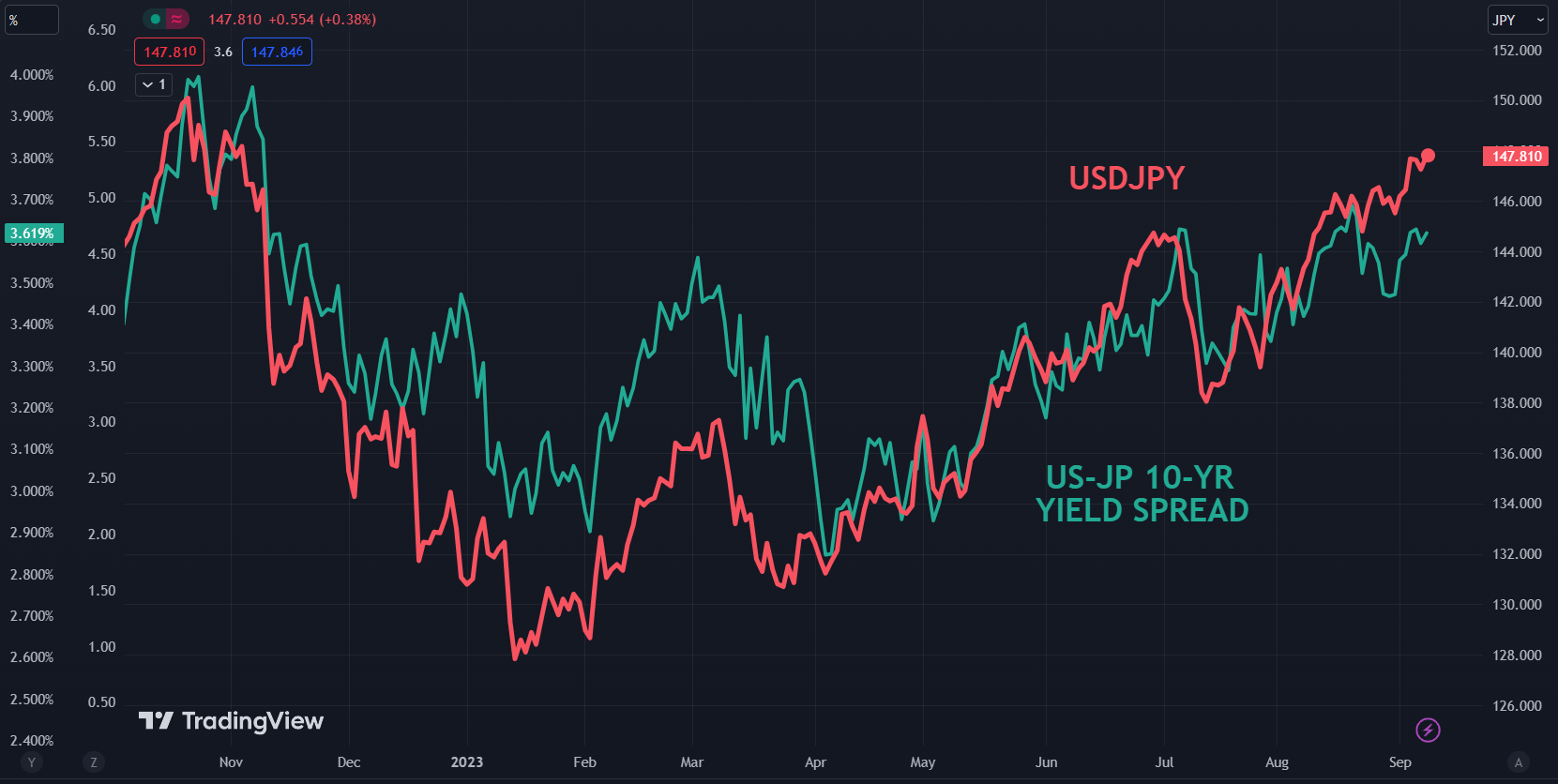

Elsewhere, the Japanese Yen continues to deteriorate with USD/JPY closing the week at a 10-month high with widening yield differentials seemingly playing its part.

The benchmark 10-year Treasury note had a look over 4.30% last week but settled on Friday back near 4.25%. The 16-year high of 4.36% seen last month appears to be a target.

At the same time, Japanese Government Bonds (JGB) yields remain steady near 0.65%.

As a result, the yield spread between Treasuries and Japanese Government Bonds (JGB) has been widening but not to the same extent that occurred when USD/JPY hit its peak in October last year.

With the Aussie lagging against the US Dollar, this has led to AUD/JPY being caught in a range trading environment of 93.00 – 95.00 that it has mostly been in for 2 months. It closed on Friday at 94.25.

USD/JPY AND YIELD SPREAD BETWEEN 10-YEAR TREASURIES AND JGBS

Chart created in TradingView

AUD/USD DAILY CHART

AUD/USD might be vulnerable after sinking below a long-term ascending trend line and remaining in a shorter-term descending trend channel.

The price remains below the 34-, 55- and 100-day Simple Moving Averages (SMA) and they have negative gradients, which may suggest that bearish momentum is intact for now.

Resistance could be at the recent high near 0.6520. Further up, the 0.6600 – 0.6620 area seems to be shaping up as a notable resistance zone with several breakpoints and prior peaks there.

On the downside, support may lie at the breakpoints and previous lows near 0.6350, 0.6270 and 0.6170.

The latter might also be supported at 161.8% Fibonacci Extension level at 0.6186.

Chart created in TradingView

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

— Written by Daniel McCarthy, Strategist for DailyFX.com

Please contact Daniel via @DanMcCarthyFX on Twitter