GOLD, SILVER FORECAST:

GOLD, SILVER FORECAST: NEUTRAL

- Dollar Index (DXY) Could Remain Supported Thanks to the Narrative of Higher for Longer.

- US PCE Ahead May Give Further Insight into the Recent Uptick in Inflation.

- IG Client Sentiment Has Retails Traders Overwhelmingly Long on Gold, with 71% of Traders Holding Long Positions.

- To Learn More About Price Action,Chart Patterns and Moving Averages, Check out the DailyFX Education Series.

Gold prices had a topsy-turvy week with an excellent start followed by a mid-week selloff before a recovery to end the week marginally higher on course for gains of around 0.1% (at the time of writing).

For Tips and Tricks to Navigate Economic Data Releases, Download Your Complimentary Guide Below.

Recommended by Zain Vawda

Introduction to Forex News Trading

US FED UPGRADE ECONOMIC PROJECTIONS

The US Fed meeting was the focus this week and the Fed certainly did not disappoint. An upgrade to the Fed projections saw the Central Bank send a hawkish message as it changed its forecast for rate cuts in 2024, 100bps priced in June down to 50bps at this week’s meeting. At the same time growth forecast were upgraded while the Fed also see the labor market remaining robust.

The whipsaw price action and volatility hit Gold prices hard with a +-$30 decline to a weekly low print of $1913. However, Thursday and Friday did bring a recovery as US Yields finally fell and the DXY ran into a key resistance area. As the DXY has stalled it is important to note that we have seen this before while the idea of higher rates for longer could see the Dollar remain supported as with a rate of above 5% may be seen as a good investment as the equity markets come under increasing pressure.

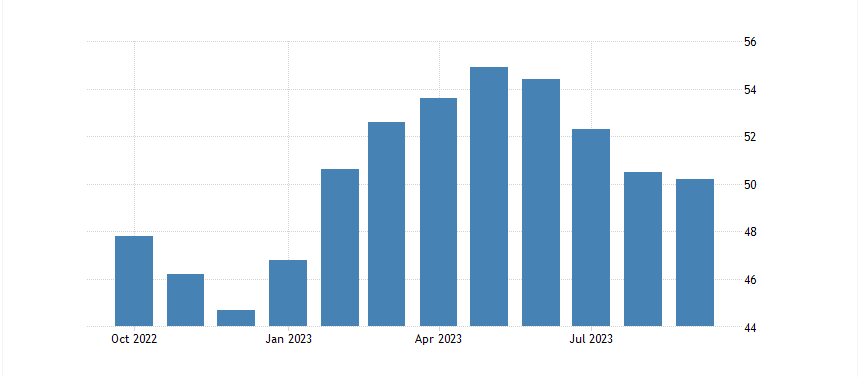

The final data release of the week from the US came on Friday in the form of the S&P Global Composite PMI which edged lower to 50.1. According to Sian Jones, Principal Economist at S&P added to concerns around the trajectory of demand conditions in the US economy. This is something I expect to continue moving forward as US households continue to see a deterioration in savings and with student loan repayments set to resume in October, this will only add further pressure on US Households.

Source: TradingEconomics

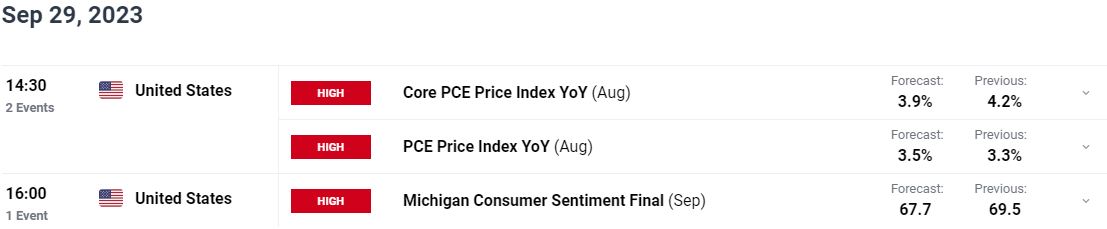

THE WEEK AHEAD: US PCE DATA REMAINS KEY

Heading into next week and it may seem like a slow one after the action-packed week of Central Bank meetings. We have US Durable Goods Ordered which is usually not a leading indicator but following the 5.2% contraction could add to concerns about the state of the US economy. This could also dent market hopes for a ‘soft landing’ and weigh on the US dollar giving gold further impetus for a move higher.

The second half of the week we have GDP numbers which is expected to be revised slightly higher toward 2.2% from the previous estimate of 2.1%. However, the main event for next week will be the Fed’s preferred gauge of inflation the US PCE data which will give a better idea of the inflation picture. This one will be particularly intriguing given the uptick in headline inflation in the US. It would take a significantly higher or lower print than the estimated 0,2% MoM print to have any material impact on the direction of the US Dollar.

We do also have a couple of Fed speakers on the docket which could stoke some short-term volatility. Without any material change there is a real chance we could see Gold and Silver prices remaining rangebound for the foreseeable future.

For all market-moving economic releases and events, see the DailyFX Calendar

Learn from the Best and Take a Look at What Traits Successful Traders Share in the Free Guide Below.

Recommended by Zain Vawda

Traits of Successful Traders

TECHNICAL OUTLOOK AND FINAL THOUGHTS

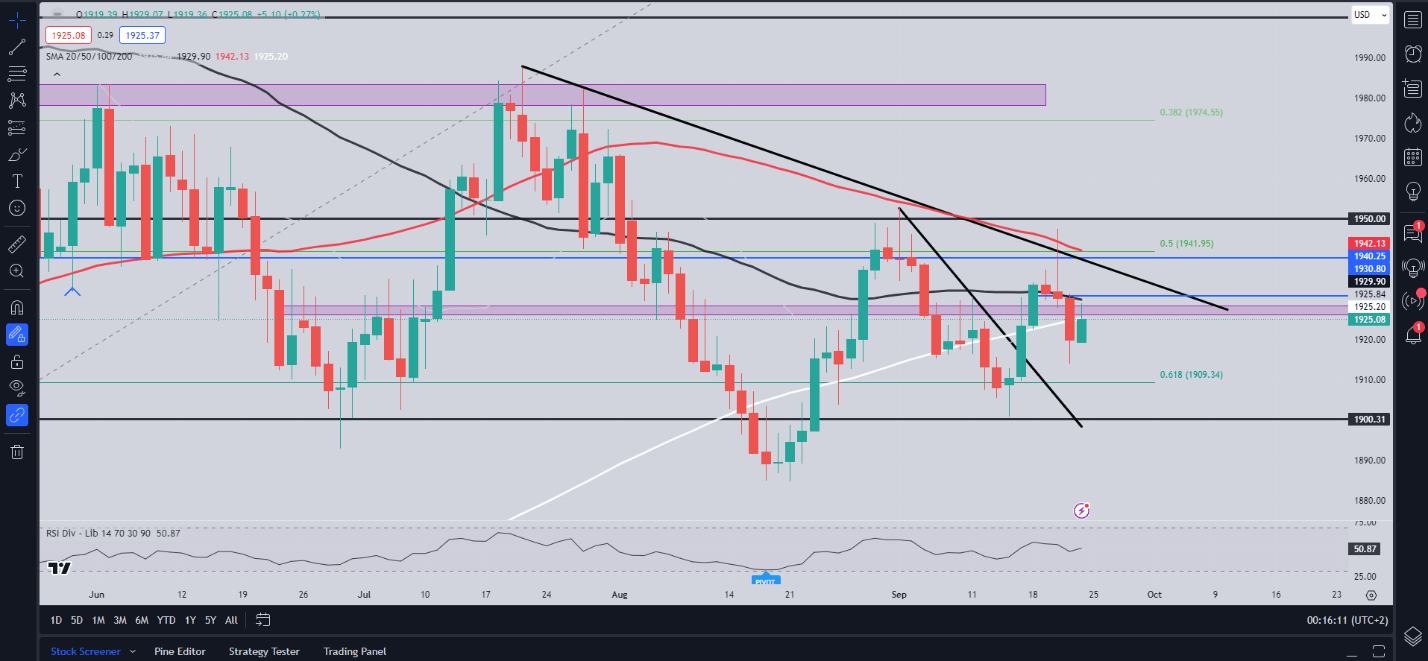

Looking at the technical perspective and Gold is on course for a doji candle close on the weekly timeframe following the whipsaw price action this week. Looking at the daily timeframe and Friday’s rally ran into resistance provided by the 200-day MA with the 50-day MA slightly higher.

Gold may remain confined to a range for the foreseeable future between the $1913-$1947 (this week’s high). However, in order for a move higher Gold faces significant challenges around the $1925-$1930 with a daily candle close above opening the opportunity for a run toward the weekly high and the $1950 psychological level.

A break to the downside will run into support around $1913 before the $1900 handle comes into focus.

Gold (XAU/USD) Daily Chart – September 22, 2023

Source: TradingView

Key Levels to Keep an Eye On:

Support Levels

- 1913 (weekly low)

- 1900 (Psychological Level)

- 1885

Resistance Levels

- 1929 (50-day MA)

- 1942 (100-day MA)

- 1947-1950

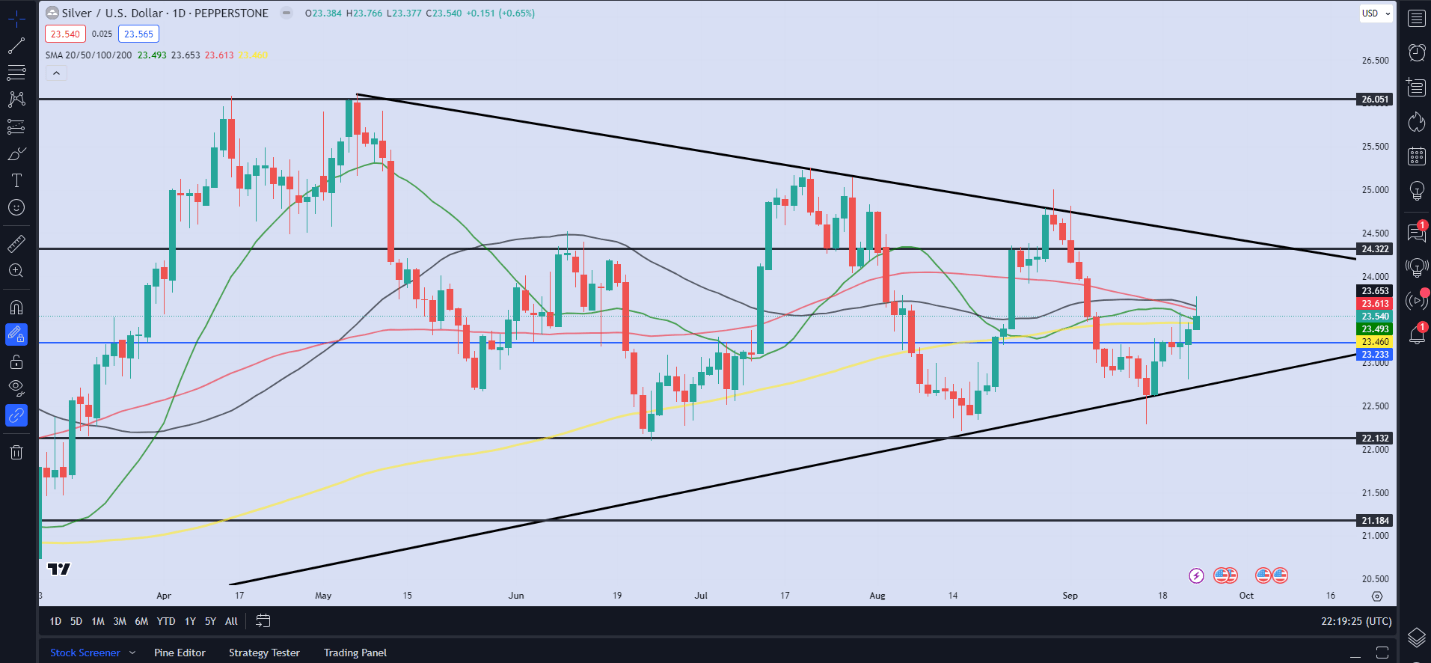

Silver (XAG/USD) Daily Chart – September 22, 2023

Source: TradingView

Silver is facing many of the challenges Gold is from a technical perspective. Silver has seen whipsaw price action this week as well running into firm resistance provided by the MAs which have grouped together around the 23.40-23.60 mark. This will prove an interesting area at the start of the week as Silver makes an attempt to move higher.

The bigger picture from silver has the commodity trading in a triangle pattern with a move to the top end of the triangle pattern looking most likely if the immediate resistance can be overcome.

Key Levels to Keep an Eye On:

Support Levels

Resistance Levels

- 23.60 (50 and 100-day MA)

- 24.00

- 24.30-24.50

For a more in-depth look at client sentiment and ways to use it, download the complimentary guide below.

of clients are net long. of clients are net short.

| Change in | Longs | Shorts | OI |

| Daily | -1% | -16% | -2% |

| Weekly | 6% | -33% | 1% |

Written by: Zain Vawda, Market Writer for DailyFX.com

Contact and follow Zain on Twitter: @zvawda