US Dollar, Gold, Japanese Yen Analysis and Charts

- Chair Powell plays down any US rate hikes.

- Yen surges on official buying before gains being to evaporate.

- Apple’s earnings and US Jobs Report are now key for sentiment.

Download our complimentary Q2 Technical and Fundamental USD Forecasts

Recommended by Nick Cawley

Get Your Free USD Forecast

For all economic data releases and events see the DailyFX Economic Calendar

The Federal Reserve left interest rates unchanged last night, in line with market expectations, but announced that it would slow its pace of bond sales. Starting on June 1, the Fed will reduce the amount of US Treasuries it allows to roll of its balance sheet from $60 billion a month to $25billion, while $35 billion of mortgage-backed securities will continue to mature. At the post-FOMC decision press conference Chair Powell suggested that rate cuts are still on the table if inflation slows further and that it was unlikely that the Fed would raise interest rates.

The mildly dovish outtake from yesterday’s FOMC has buoyed risk markets in early turnover, although a sustained follow-through is unlikely with the latest US Jobs Report (NFP) set for release on Friday at 13:30 UK. Recently announced US JOLTs data disappointed the market as job openings fell to a three-year low.

In the equity space, Apple and Coinbase are among a clutch of US companies announcing their latest earnings today.

Keep informed of all earnings releases with the DailyFX Earnings Calendar

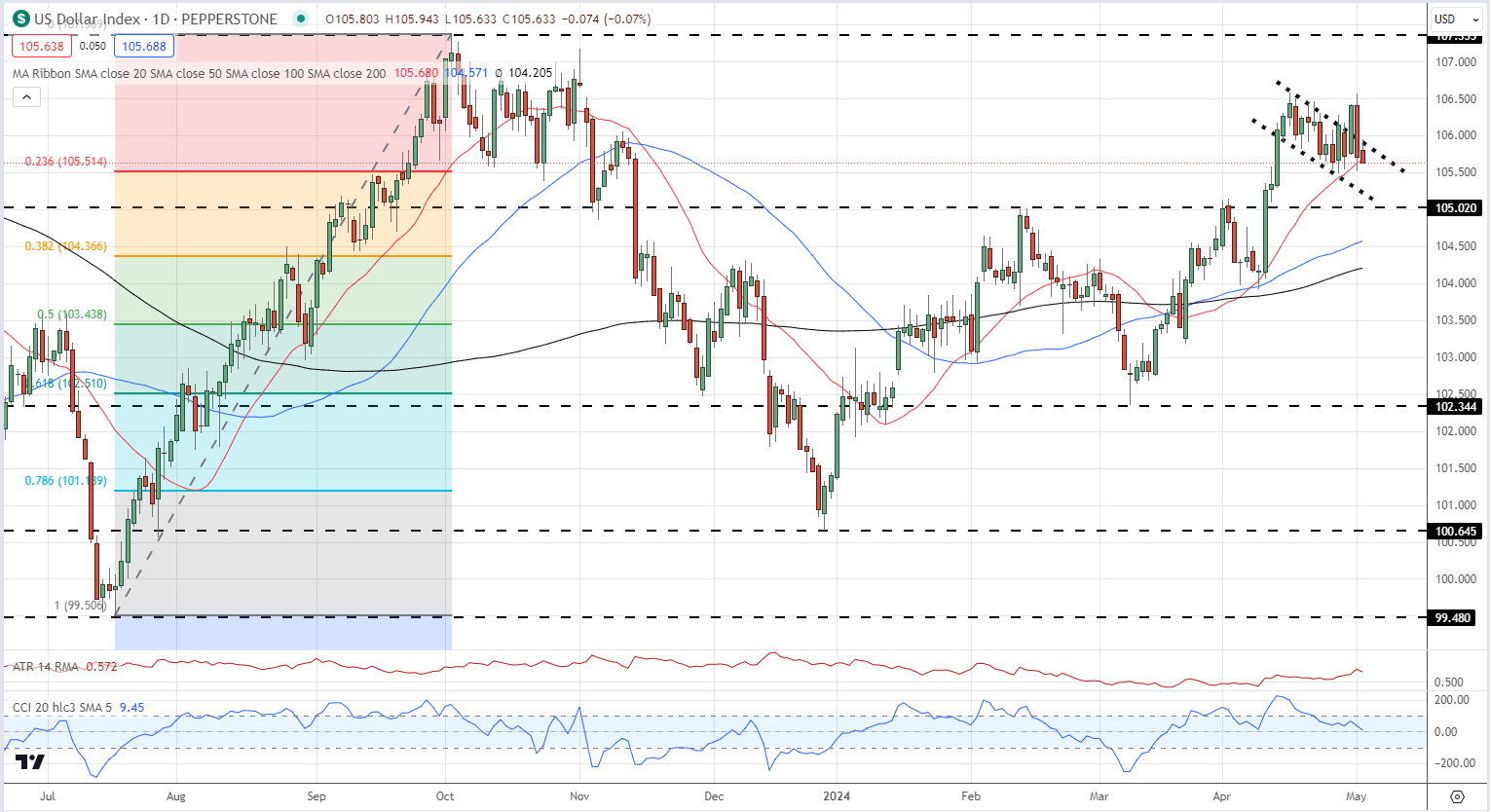

The US dollar fell post-FOMC and is back in a potential bullish flag structure made over the last two weeks.

US Dollar Index Daily Chart

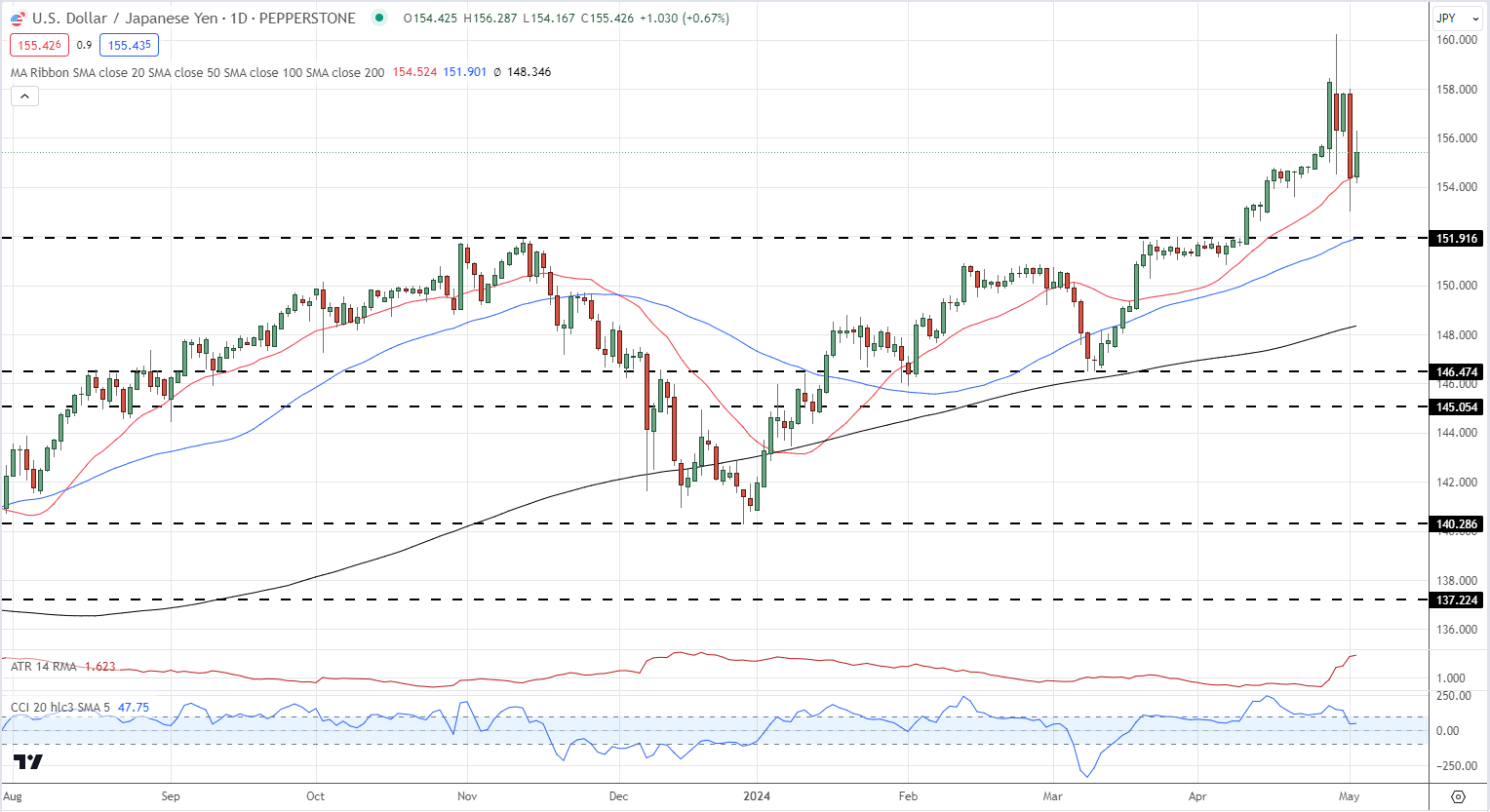

The US dollar also came under pressure after heavy buying of the Japanese Yen sent USD/JPY tumbling from a high of 158.00 to around 153.00. The effect of the buying, heavily rumored to be the Bank Of Japan, however, dissipated fairly quickly as USD/JPY moved back into the mid-155s.

Learn how to trade USD/JPY with our expert guide

Recommended by Nick Cawley

How to Trade USD/JPY

USD/JPY Daily Price Chart

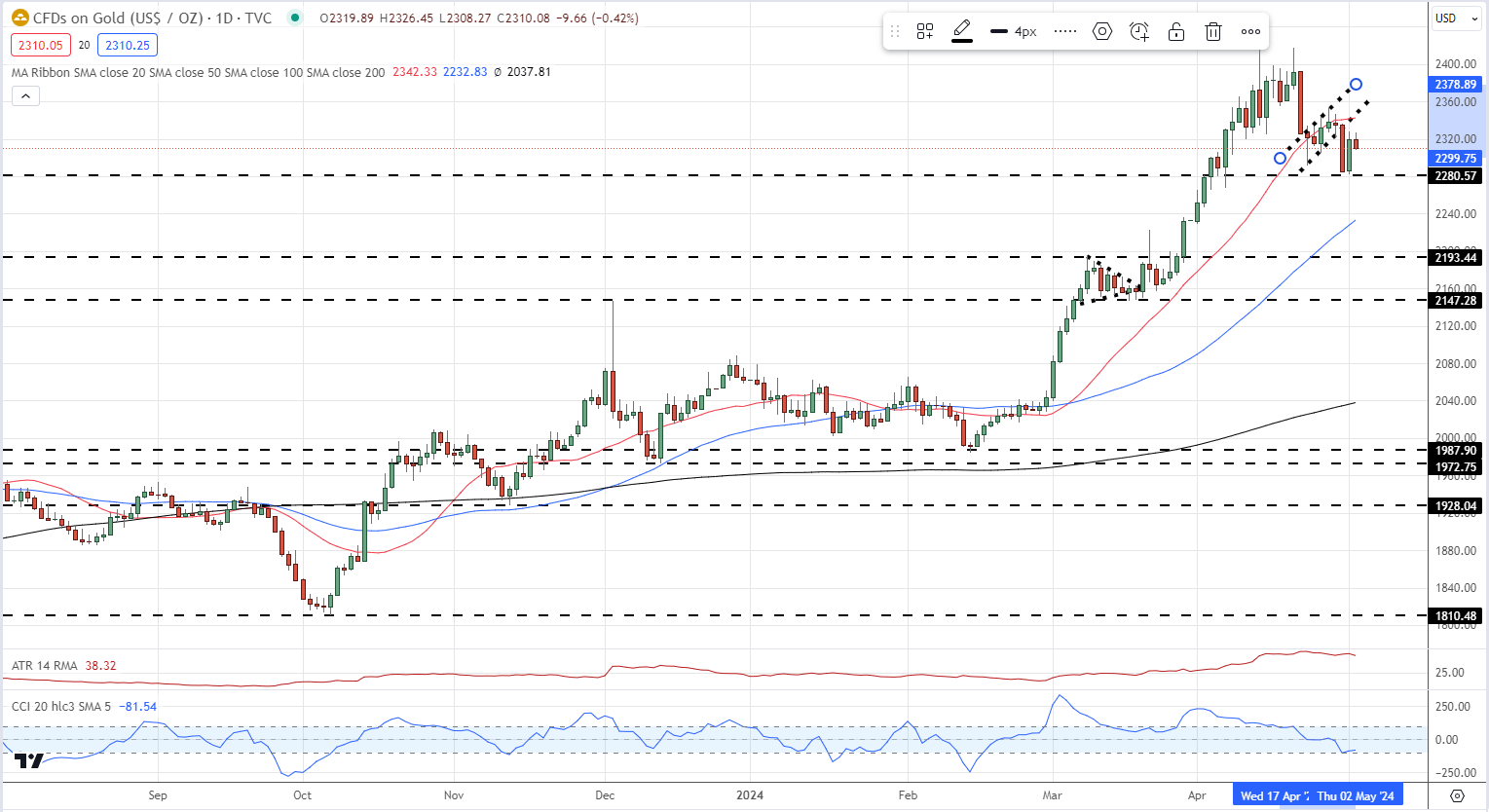

Gold picked up a bid on the back of a weaker dollar and lower US Treasury yields. The precious metal slipped to support around the $2,280/oz. level, before moving higher, but yesterday’s move does not look convincing, especially ahead of tomorrow’s US NFPs. Short-term resistance at $2,342/oz. – trend and 20-day sma – while $2,280/oz. should hold until tomorrow’s Jobs Report.

Gold Daily Price Chart

All charts using TradingView

IG Retail Sentiment 53.94% of traders are net-long with the ratio of traders long to short at 1.17 to 1.The number of traders net-long is 10.91% lower than yesterday and 7.70% lower than last week, while the number of traders net-short is 4.01% higher than yesterday and 0.42% lower than last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Gold prices may continue to fall.

of clients are net long. of clients are net short.

| Change in | Longs | Shorts | OI |

| Daily | 15% | -22% | 0% |

| Weekly | 7% | -13% | 0% |

Are you risk-on or risk-off ?? You can let us know via the form at the end of this piece or contact the author via Twitter @nickcawley1.