Euro Weekly Forecast (EUR/USD, EUR/GBP, EUR/JPY)

- Bullish drivers remain scarce for the euro – ZEW Sentiment and US CPI next

- EUR/USD (Neutral): Long-term trend meets stern resistance

- EUR/GBP (Bearish): Sterling may claw back recent losses

- EUR/JPY (Neutral): Yen depreciation offers up a ticking time bomb

- Get your hands on the euro Q2 outlook today for exclusive insights into key market catalysts that should be on every trader’s radar:

Recommended by Richard Snow

Get Your Free EUR Forecast

Bullish Drivers Remain Scarce for the Euro – ZEW Sentiment and US CPI Next

The euro has held its value well over the past few weeks against a number of major currencies, mainly due to weakness in those respective currencies themselves. Examples include EUR/GBP and EUR/USD. The dollar has eased in light of softer jobs data (NFP and initial jobless claims this week coming in on the hotter side of things), while the pound has surrendered ground since April when Deputy Governor Dave Ramsden issued his dovish comments regarding falling inflation.

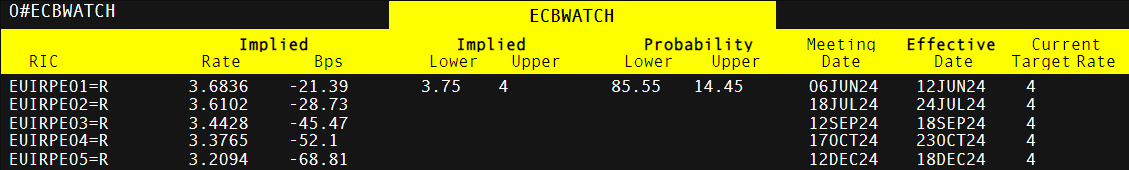

Between the ECB, the Bank of England and the Fed, it’s the ECB that appears most likely to cut interest rates first and deliver the greatest number of cuts in 2024 with the potential for 3 cuts, most likely to start in June. In addition, the ECB policy rate has peaked at 4%, a long way short of the 5.25% in the UK and 5.25% – 5.5% in the US which naturally created a negative interest rate differential for the Euro, placing the single currency on the back foot.

When considering economic growth, the euro zone fares worst despite a welcomed rise of 0.3% in Q1 this year following a technical recession at the end of 2023. On Friday, UK GDP surprised estimates on all measures but most notably rising 0.6% quarter on quarter and US GDP holds strong above 1% but has moderated.

Implied ECB Rate and Basis Point Movement into the end of 2024

Source: TradingView, prepared by Richard Snow

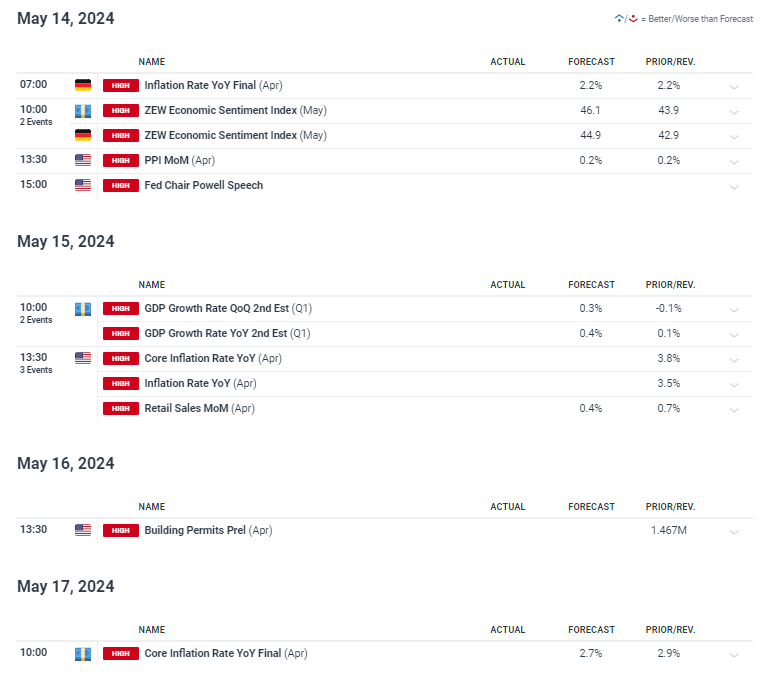

Major Risk Events Ahead: US CPI, ZEW Economic Sentiment

The major risk event for next week in undoubtedly US CPI. US core CPI has exceeded the 0.2% monthly rise in each of the last three prints, coming in at 0.4% after rounding up. If inflation continues in this vain, EUR/USD may ease into the backend of next week. A softer print however may add to the euro’s upward drift as more dovish sentiment gets priced into the greenback.

In Europe, Final German inflation and German ZEW sentiment will be due alongside the ZEW figure for the broader EU. Sentiment has been rising since Q4 of last year as analysts correctly projected a departure from dismal economic conditions. Powell is also due to speak on Tuesday with markets likely to hang onto every word ahead of the CPI data.

Customize and filter live economic data via our DailyFX economic calendar

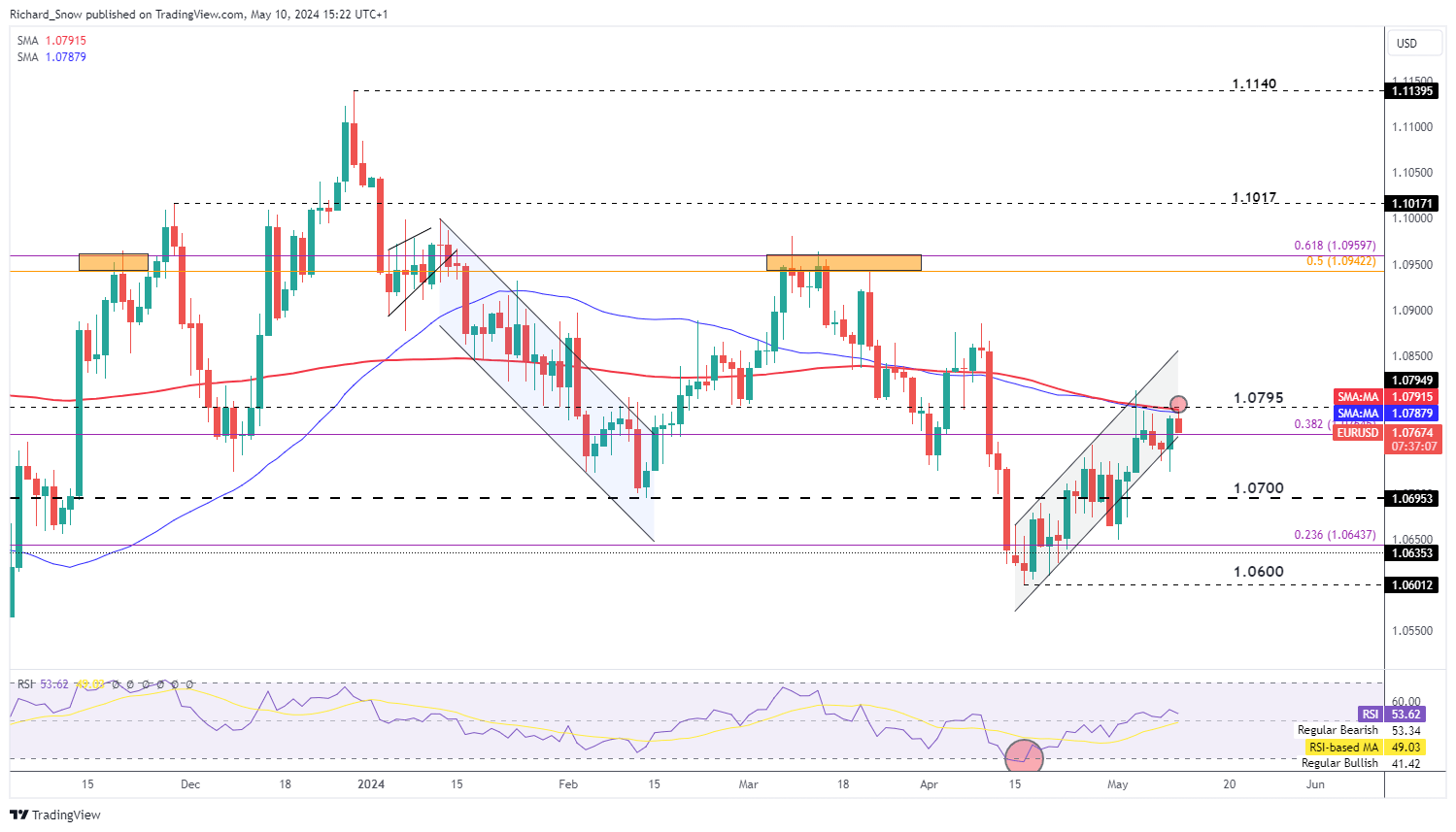

EUR/USD (Neutral): Long-Term Trend Meets Stern Resistance

EUR/USD has enjoyed a recovery since the middle of April but now tests an area of confluence resistance ahead of 1.0800. The confluence zone comprises of the 1.0795 level and the crossing of the 50 and 200-day simple moving averages. Late on Friday the confluence zone appeared to repel higher prices as we close out the week.

1.0800 is the marker to watch for a bullish continuation, which may see a retest of channel resistance if successful. The RSI is far from overbought meaning there is potential for a bullish continuation before a pullback becomes necessary.

With US CPI such a major factor for the pair, a more reactionary approach may be prudent in the coming week. Markets have proven to be extremely reactionary to high importance inflation data as it has the potential to move markets like it did on April 10th when the March inflation figures were released.

EUR/USD Daily Chart

Source: TradingView, prepared by Richard Snow

Learn the ins and outs of trading the worlds most liquid currency pair whilst grasping fundamental and unique determinants of the pair that all traders should know:

Recommended by Richard Snow

How to Trade EUR/USD

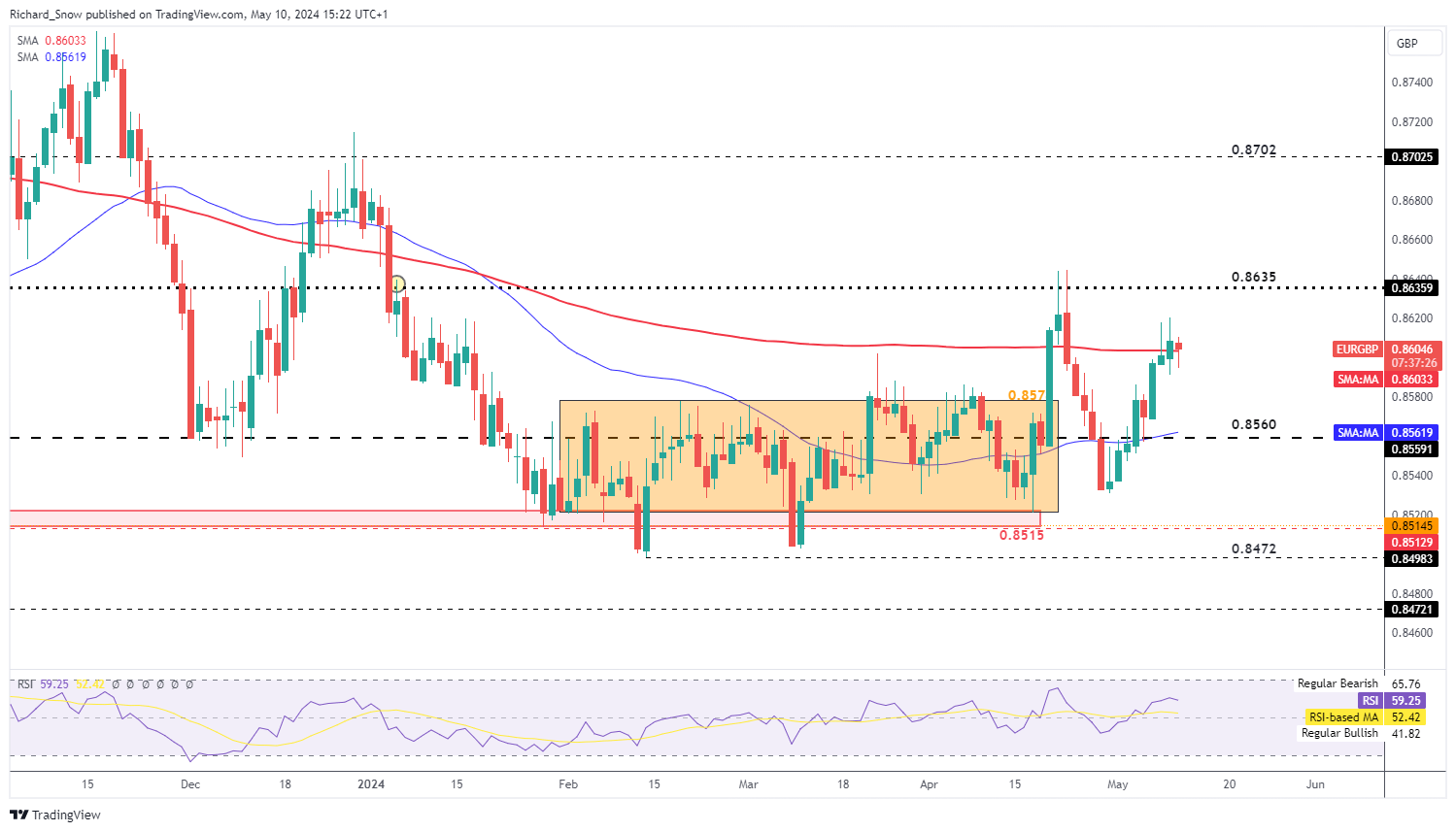

EUR/GBP (Bearish): Sterling May Claw Back Recent Losses

EUR/GBP has risen this week but has revealed a reluctance to trade higher, evidenced by the longer upper candle wicks on the daily chart. On Friday, prices were moderately lower after UK GDP surprised estimates, launching the UK economy out of a technical recession.

The 200 SMA appears to be limiting upside potential of the pair and will be something to look out for at the start of the coming week. UK unemployment data and wage growth figures are due on Tuesday and can influence the pair. The labour market has softened and the BoE will be hoping for further declines in average earnings but this has emerged as less of a concern for the BoE compared to the broader ‘services inflation’ data that will be released later in the month.

EUR/GBP Daily Chart

Source: TradingView, prepared by Richard Snow

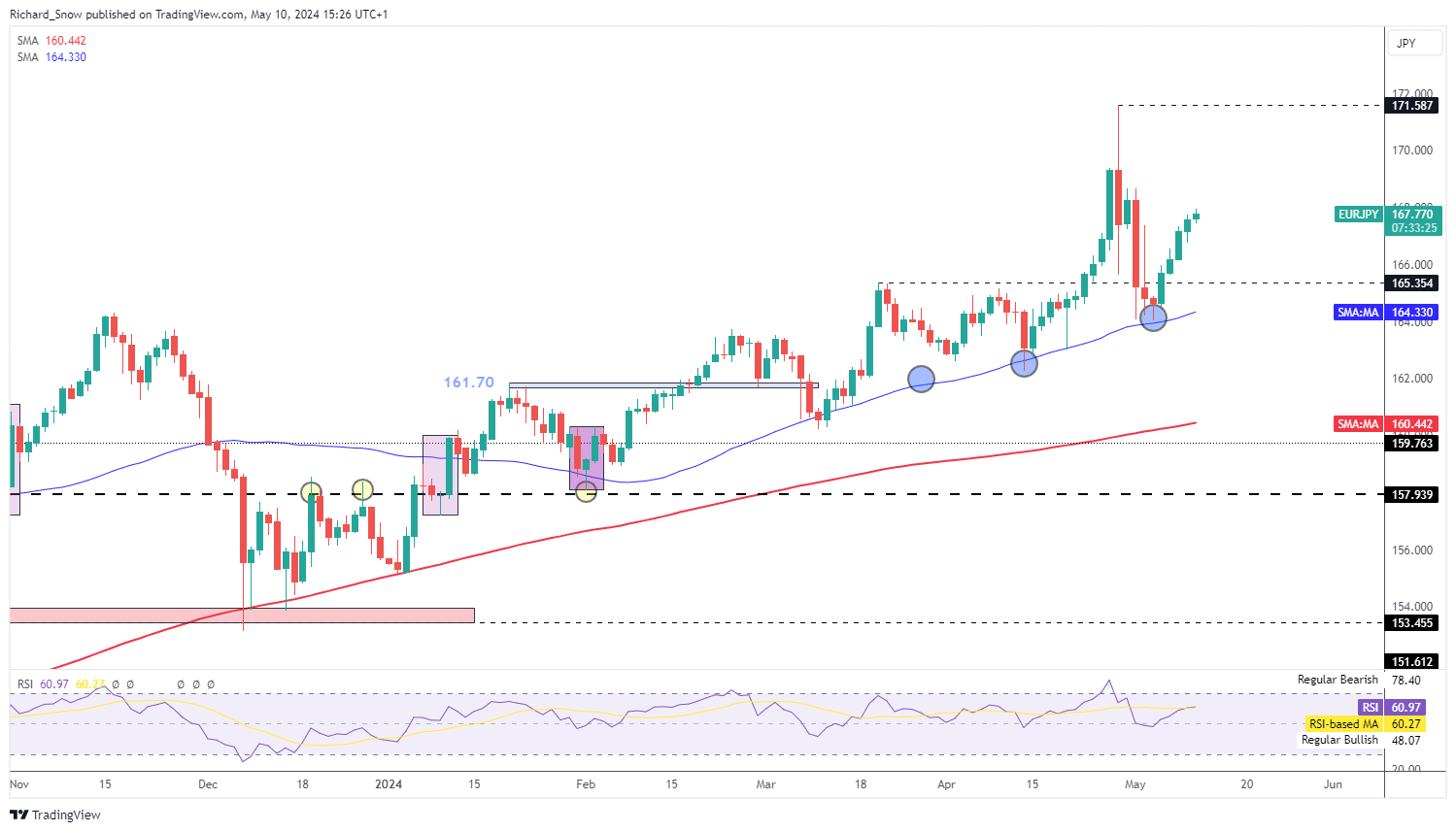

EUR/JPY (Neutral): Yen Depreciation Offers up a Ticking Time Bomb

The yen has continued to rise despite what has largely been accepted as FX intervention on the part of Japanese officials. The yen appreciated in a short space of time after the event but it has not taken long for the market to sell yen once again. As long as the BoJ fails to meaningfully reduce the interest rate gap between it and major economies with much higher interest rates, this reaction is likely to continue.

Japanese officials are hoping their efforts have coincided with a turn in US economic conditions, something that may send the dollar lower on its own as markets would likely start to price in a stronger probability of rate cuts once more.

Resistance appears at the high of 171.58 with the prior swing high at 165.35 the nearest level of support. Either way, trading yen pairs remains fraught with risk as Japanese officials may go in for another attempt to strengthen the local currency, which could result in another massively volatile adjustment. Prudent risk management techniques ought to be deployed when analysing yen pairs.

EUR/JPY Daily Chart

Source: TradingView, prepared by Richard Snow

Looking for actionable trading ideas? Download our top trading opportunities guide packed with insightful tips for the second quarter!

Recommended by Richard Snow

Get Your Free Top Trading Opportunities Forecast

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX