Commodity Analysis: Gold Silver and Oil

- Commodities start the week on the backfoot with US jobs in focus

- Gold consolidates within narrow range, silver continues its decline

- Oil market takes a hit after OPEC+ plans to steadily reintroduce supply

- Discover the nuances behind trading gold and oil, two complex markets which remain sensitive to macro and geopolitical events

Recommended by Richard Snow

Recommended by Richard Snow

How To Trade Commodities

Commodities Start the Week on the Backfoot with US Jobs in Focus

Markets appear to have leaned towards a more cautious stance at the start of the week, with equities trading lower, bonds rising (yields falling) and the dollar struggling to show any signs of bullish potential.

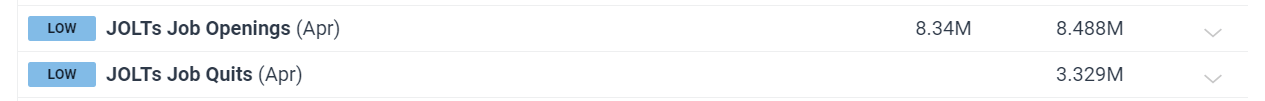

Therefore, appetite for precious metals has waned despite a softer dollar and gold buyers appear to be sat on the sidelines awaiting crucial jobs data this week. Today, JOLTs data will get things underway as markets eagerly await further insight on the US labour market. Job openings, hires and the quitting rate will inform speculative bets on the dollar, inflation and by extension gold.

The quitting rate has links to inflation; if fewer people are quitting each month, this implies that workers are less optimistic in finding another suitable position and decide to stay in their current job. The result is there if less turnover in the job market which workers used to their advantage after the pandemic to secure higher salaries. In short, fewer quits means less inflationary pressure from salaries/wages which could see the dollar consolidate or even ease further.

Customize and filter live economic data via our DailyFX economic calendar

However, the main event of the week remains NFP on Friday which is likely to have the greatest market impact.

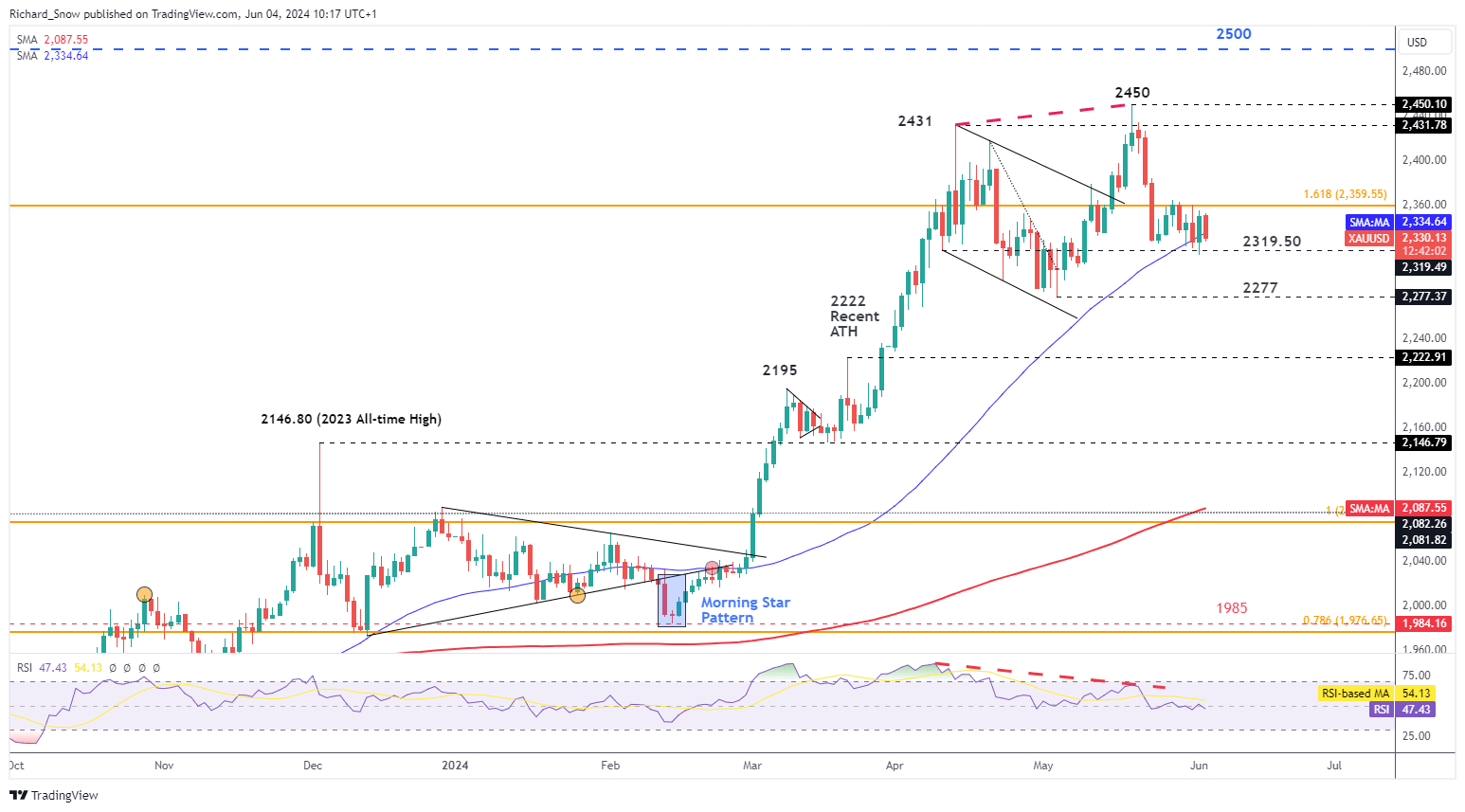

Gold Consolidates within its Narrow Range

Gold prices have come off the most recent spike high after revealing negative divergence in May. More recently, gold has been stuck in a narrow range formed by the $2,320 support and $2,360 resistance which is the 1.618 extension of the major 2020 – 2022 decline.

The 50 day simple moving average has appeared to provide dynamic support and will also need to watched for a close beneath it if a bearish breakout is brewing. $2,277 is the next level of support with $2,431 the next upside level of resistance.

Gold (XAU/USD) Daily Chart

Source: TradingView, prepared by Richard Snow

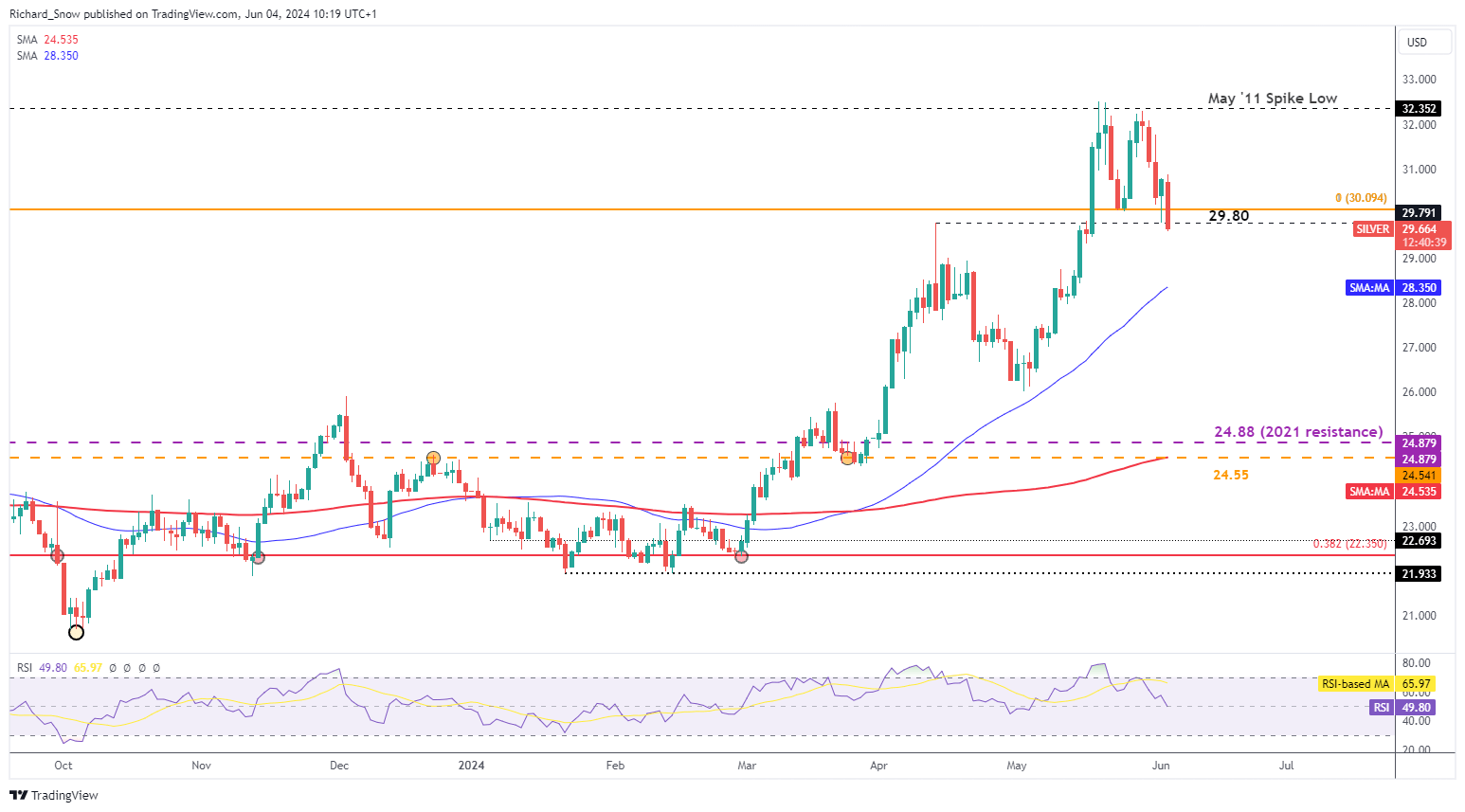

Silver Drops Lower after Solid Rejection at Spike High

Silver has dropped more significantly over the past few trading sessions, ever since failing to retest the May spike high. Prices have been coming off overbought territory and exhibiting a pullback which may turn into a retracement but $29.80 is holding strong for now. Further weakness from here opens up the 50 SMA and prior swing low at $26.00. Upside levels of interest include 32.00 and the spike high at $32.50.

Silver (XAG/USD) Daily Chart

Source: TradingView, prepared by Richard Snow

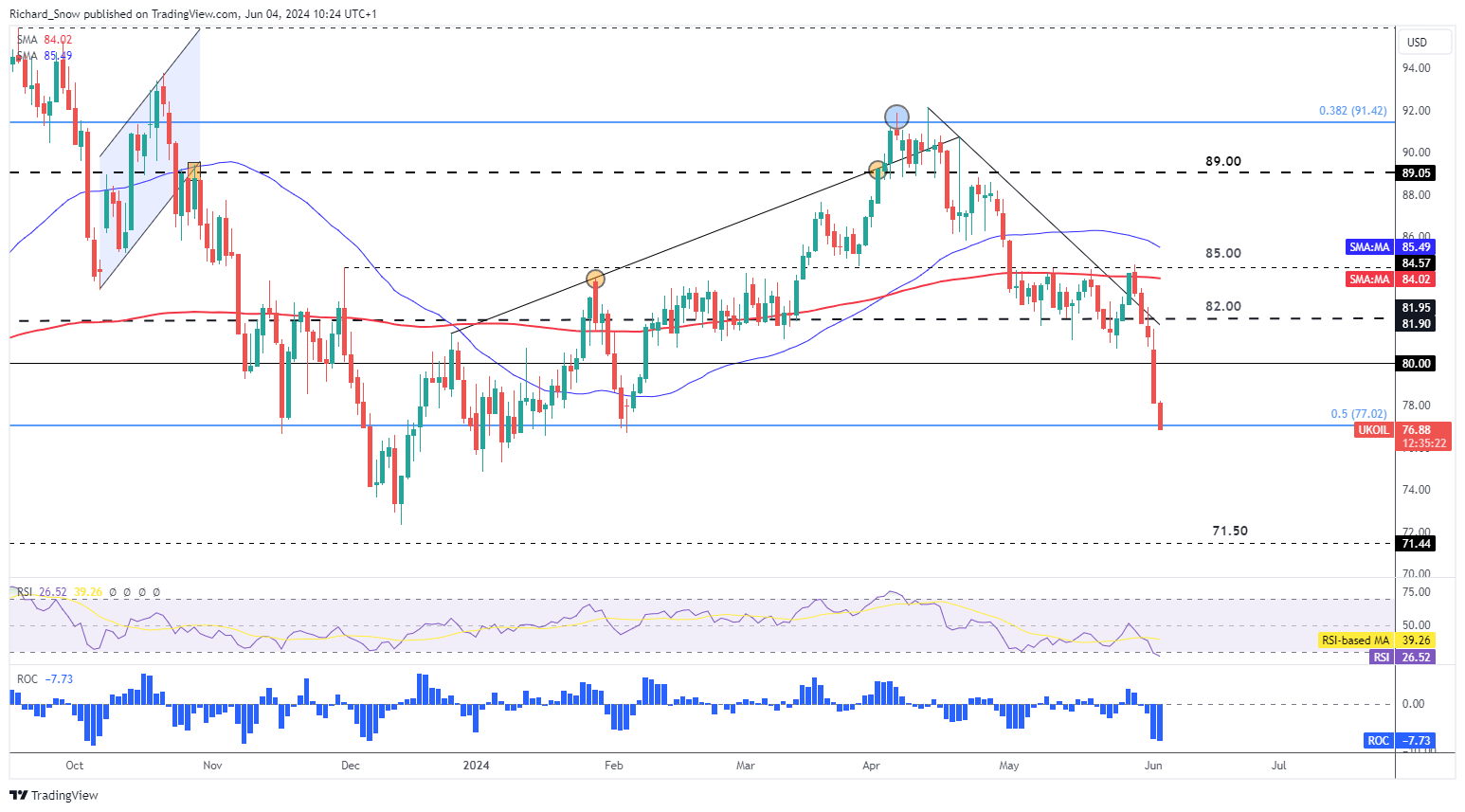

Oil Market Takes a Hit after OPEC+ Plans to Steadily Reintroduce Supplies

Oil began to selloff yesterday afternoon as markets came to grips with the reality that OPEC+ intends to slowly unwind supply restrictions. Despite OPEC+ announcing that the majority of supply cuts will remain in force until the end of 2025, markets decided to concentrate on the fact that a smaller portion of voluntary cuts would slowly be unwound from October this year.

OPEC+ plan to reintroduce oil back into the market at a modest pace but the quotas for such are yet to be decided as this is likely to be the topic of much debate. The news helped extend the bearish move which ensued after a rejection around the 200 SMA at $85 a barrel.

Prices have dipped slightly below the 50% retracement of the 2020 – 2022 major advance with little in the way of an extended move towards the swing low of $72.33 and $71.50 – an influential level of support that held between March and July last year. The commodity has entered oversold territory however, meaning a partial pullback may soon emerge. Much later tonight (21:30) US API crude oil stock changes will be released for the week ending 31 May.

Brent Crude Oil Daily Chart

Source: TradingView, prepared by Richard Snow

Are you new to commodities trading? The team at DailyFX has produced a comprehensive guide to help you understand the key fundamentals of the oil market and accelerate your learning:

Recommended by Richard Snow

Understanding the Core Fundamentals of Oil Trading

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX