Market Snapshot Ahead of the FOMC Meeting

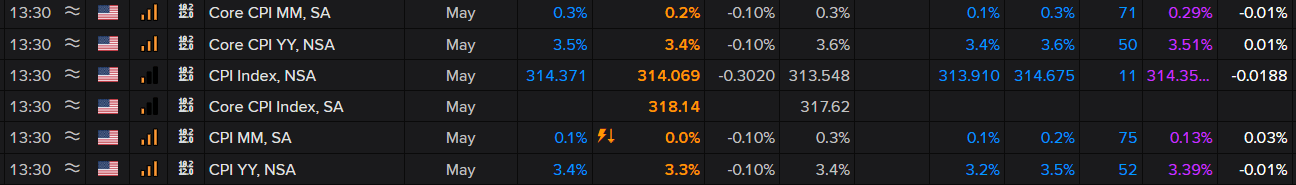

US CPI for the month of May cooled, sending the dollar sharply lower ahead of the FOMC statement and updated forecasts due for release at 19:00 (UK). For the real-time coverage, read our US CPI report from senior strategist Nicholas Cawley.

On the face of it, it was a good report, seeing headline measures of core and headline inflation come in below expectations on a yearly and monthly basis. Fed officials look to services inflation and super core inflation (services excluding housing and energy) as key gauges of inflation momentum. More recently, officials have been interested to see monthly core cpi breaking the trend of successive 0.4% prints which has now materialized after April’s 0.3% and now May’s 0.2% .

Source: Refinitiv, Prepared by Richard Snow

Learn how to prepare for high impact economic data or events:

Recommended by Richard Snow

Introduction to Forex News Trading

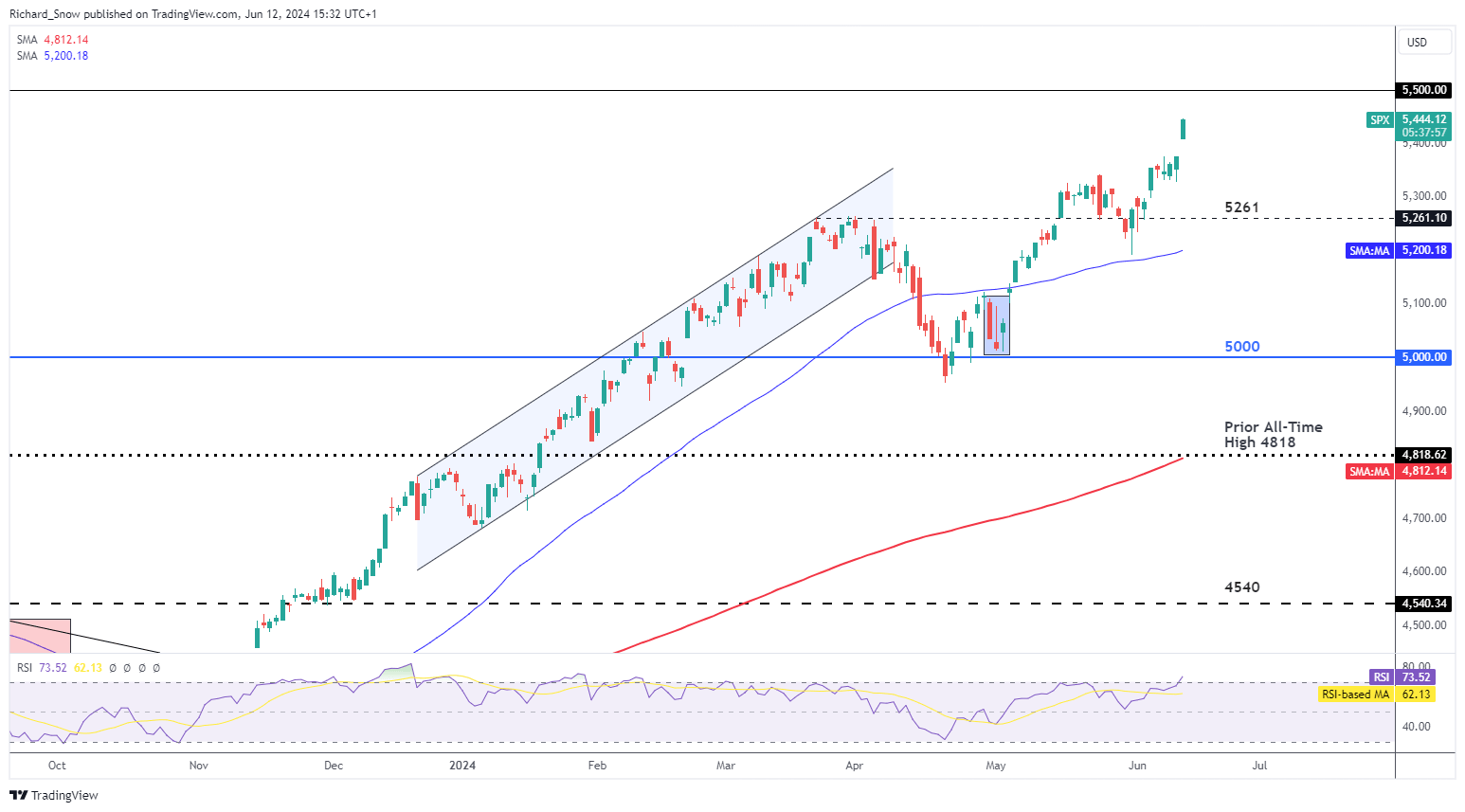

S&P 500 Gets Another Excuse to Break New Ground

In the lead up to the inflation print, it is fair to say US equity markets were tentative, consolidating around the recent high. Now, with inflation heading in the right direction again, markets have put a second rate cut back on the table – providing stocks with new vigor.

The Fed is due to update their dot plot projection of the likely Fed funds rate for 2024. In March, officials projected three quarter-point rate cuts but May’s inflation data could see that revised to just two or in an extreme case, one. Nevertheless, the prospect of lower future rates has stocks trading higher with 5,500 the next level of interest to the upside.

S&P 500 Daily Chart

Source: TradingView, prepared by Richard Snow

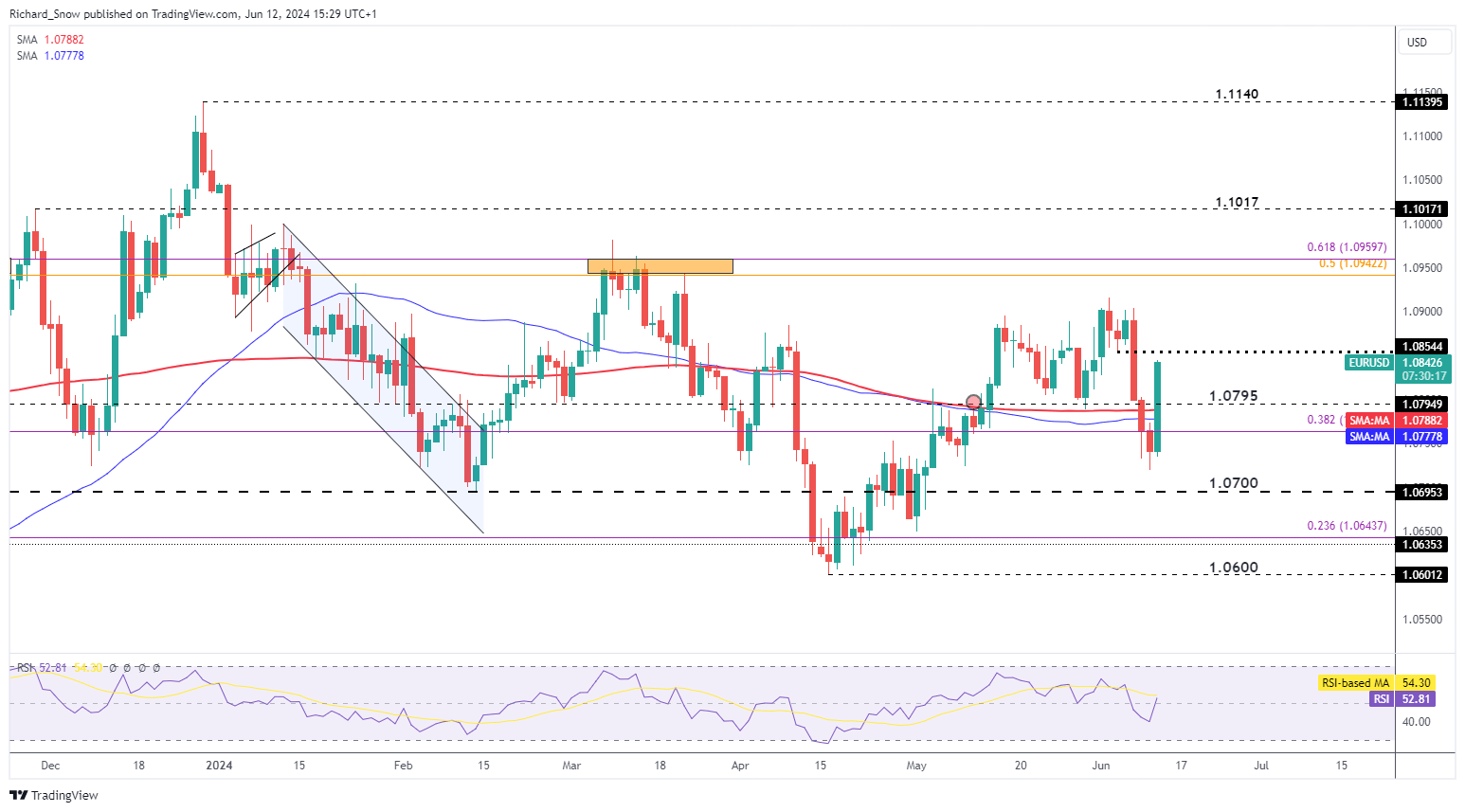

What Happened to the Euro Woes amid the Shock Political Developments?

The euro has recovered against the dollar despite weakness presenting itself at the start of the week when markets got wind of French President Macron’s snap election announcement.

The Euro frailties remain despite the reactionary move but are very much in the background and are likely to resurface the closer we get to the first round of the French parliamentary elections on the 30th of June. For now, markets are focused on US data and the upcoming FOMC meeting.

EUR/USD has shot up from yesterday’s close, almost engulfing the post-NFP sell-off. 1.0855 is the nearest level of resistance followed by the swing high of 1.0916 and the zone of resistance around 1.0950 – however this may only be attainable in the event the Fed shave not one but two rate cuts from their March outlook. Support sits at 1.0795.

EUR/USD Daily Chart

Source: TradingView, prepared by Richard Snow

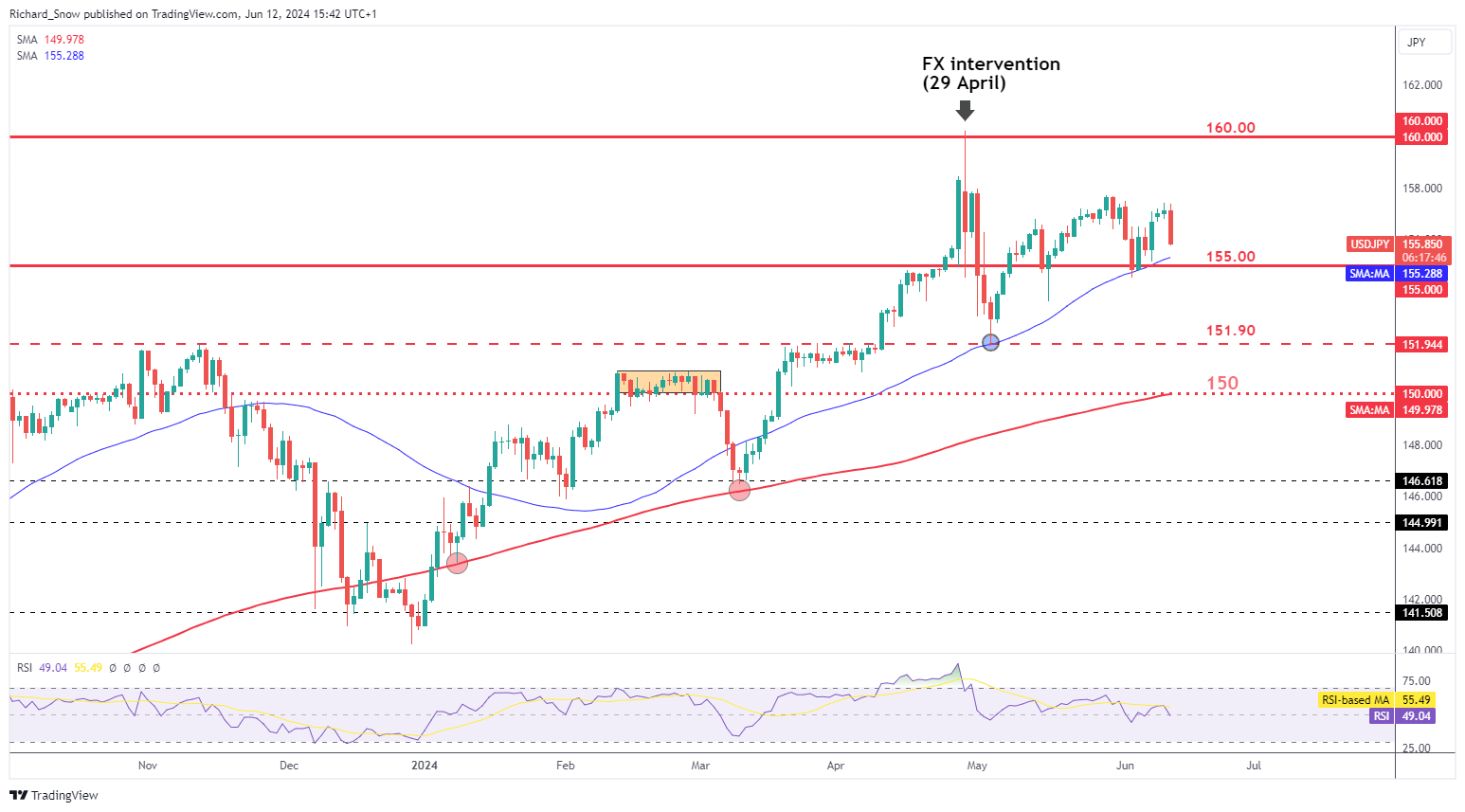

USD/JPY Pulls Back Ahead of the BoJ Meeting

Yen depreciation and undesirable volatility has plagued Japanese officials for some time now but the latest US CPI data provided some breathing room. The Bank of Japan (BoJ) is due to meet in the early hours of Friday morning where there is likely to be more focus on easing up on aggressive bond buying, allowing the Japanese Government bond yield to rise freely above 1%. This can be viewed as the next step in the Bank’s path to normalisation in a manner that is unlikely to destabilise markets.

Japan’s economy has revealed hardships, complicating a faster rate hiking cycle than what we are experiencing. Some doubts remain about the sustainability of inflation beyond 2% over the medium-term and officials have communicated their desire for wage pressures to continue outside of annual negotiations/reviews. A commitment to slowing the pace of bond purchases is potentially supporting of the yen however, this all depends on whether the market view any reductions from the BoJ as being sufficient to illicit such a response.

USD/JPY heads lower with the 50 SMA and the psychological 155.00 level in focus. Resistance at 157.70.

USD/JPY Daily Chart

Source: TradingView, prepared by Richard Snow

Learn the ins and outs of trading USD/JPY – a pair crucial to international trade and a well-known facilitator of the carry trade. In addition, this collection of guides provide valuable insights that all traders must have when trading the most liquid markets:

Recommended by Richard Snow

Recommended by Richard Snow

How To Trade The Top Three Most Liquid Forex Pairs

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX