AUD/USD Analysis and Charts

- RBA leaves rates unchanged, and discussed moving rates higher.

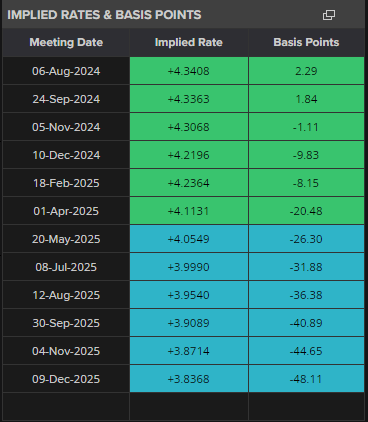

- First RBA rate cut is now seen in April next year.

Recommended by Nick Cawley

Get Your Free AUD Forecast

Easing Australian Inflation: Progress Slows, Target Still Distant

The Reserve Bank of Australia (RBA) left all monetary settings unchanged earlier today, but warned that ‘the economic outlook remains uncertain and recent data have demonstrated that the process of returning inflation to target is unlikely to be smooth.’ RBA governor Michele Bullock later said that the central bank ‘needs a lot to go our way to bring inflation back to range’ and that the board had discussed the case for a rate hike at today’s meeting.

Australia has made strides in curbing elevated inflation levels since the peak in 2022. However, consumer prices remain well above the Reserve Bank’s 2-3% target band. According to the monthly CPI indicator, annual headline consumer price growth came in at 3.6%. When excluding volatile items and holiday travel costs, the core inflation rate was 4.1% – virtually unchanged from December 2023 readings.

The latest rates forecast shows a very small chance of a rate hike in Q3, while rate cuts are not expected until the start of Q2 2025.

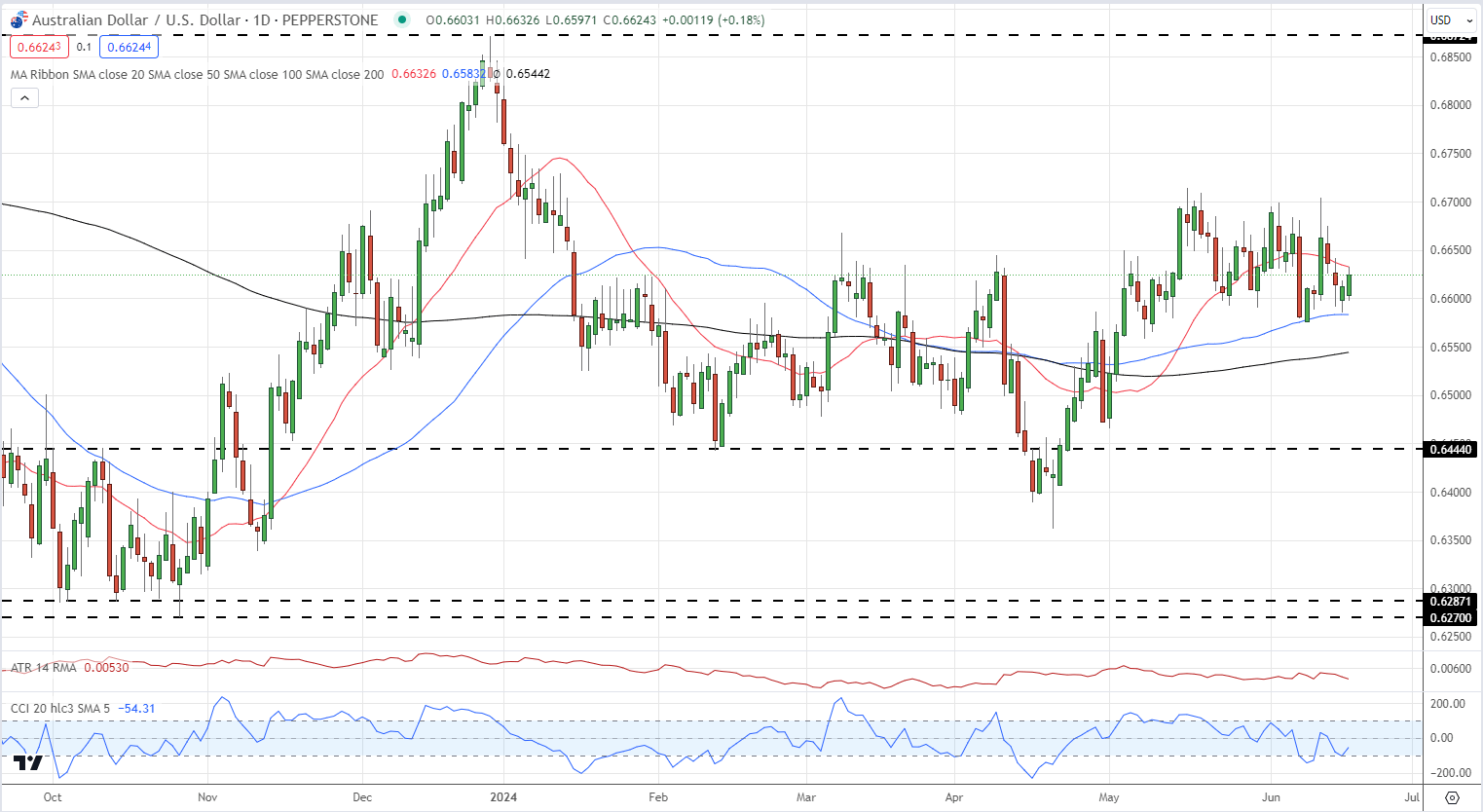

The Australian dollar has been pushing marginally higher against the US dollar since the RBA announcement. AUD/USD has traded in a narrow range for the last 6 weeks and looks set to remain rangebound in the short term. The CCI indicator shows the pair in oversold territory, while the 20-day sma is currently being tested. Initial support is around 0.6575 with resistance starting around 0.6650.

AUD/USD Daily Chart

IG retail client sentiment shows 65.54% of traders are net-long with the ratio of traders long to short at 1.90 to 1.The number of traders net-long is 5.11% higher than yesterday and 1.01% higher than last week, while the number of traders net-short is 4.10% higher than yesterday and 3.92% lower than last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests AUD/USDprices may continue to fall.

Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger AUD/USD-bearish contrarian trading bias.

of clients are net long. of clients are net short.

| Change in | Longs | Shorts | OI |

| Daily | -20% | 31% | -3% |

| Weekly | -18% | 17% | -5% |

What are your views on the Australian dollar – bullish or bearish?? You can let us know via the form at the end of this piece or contact the author via Twitter @nickcawley1.