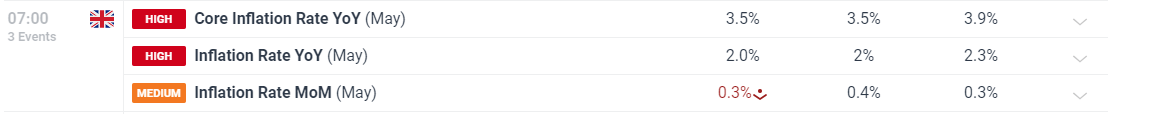

- UK CPI hits BoE target – both core and headline figures print in line with expectations

- Why the Bank of England won’t be eager to cut interest rates as early as tomorrow

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

UK CPI Hits Bank of England Target

Headline CPI drops to the Bank of England’s target of 2% for the first time in nearly 3 years. This is an impressive feat given how high inflationary pressures rose at their peak. The decline has been led by falling goods inflation and markedly lower energy prices.

Customize and filter live economic data via our DailyFX economic calendar

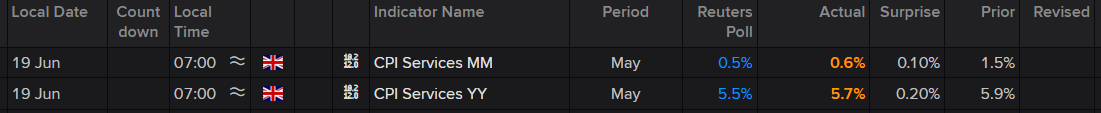

With inflation seemingly under control, why isn’t the Bank of England’s Monetary Policy Committee (MPC) falling over themselves to lower the bank rate? The answer lies mostly within a subset of the broader inflation print – services inflation – which remains uncomfortably high.

Source: Refinitiv

Learn how to prepare for high impact economic data or events with this easy to implement approach:

Recommended by Richard Snow

Trading Forex News: The Strategy

The chart below shows how other contributors to the CPI headline figure have fallen with some measures like fuel and electricity/gas turning negative (deflationary) on a year-on-year basis. However, services inflation (grey histograms) have shown little progress and remain at elevated levels – threatening the overall inflation outlook.

Source: Macrobond, ING

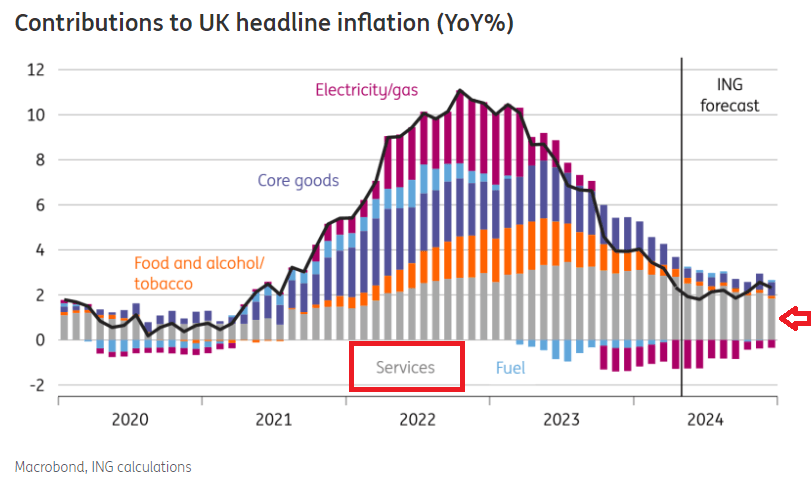

The chart below shows the little progress made in the services sector with both average wages and services CPI having made tiny inroads but appear to be heading in the right direction. Therefore, ahead of tomorrow’s Bank of England rate decision, there may be a nod to a future rate cut but the committee is likely to point to this stubborn stickiness of services inflation for its lack of urgency to alter interest rates.

Source: Refinitiv, Fathom Consulting

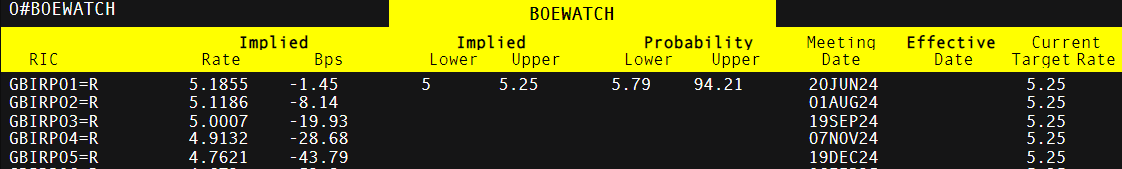

Markets assign around 5% chance of a cut after tomorrow’s BoE statement, with a greater chance of a move in September.

Implied Interest Rate Path in Basis Points

Source: Refinitiv, prepared by Richard Snow

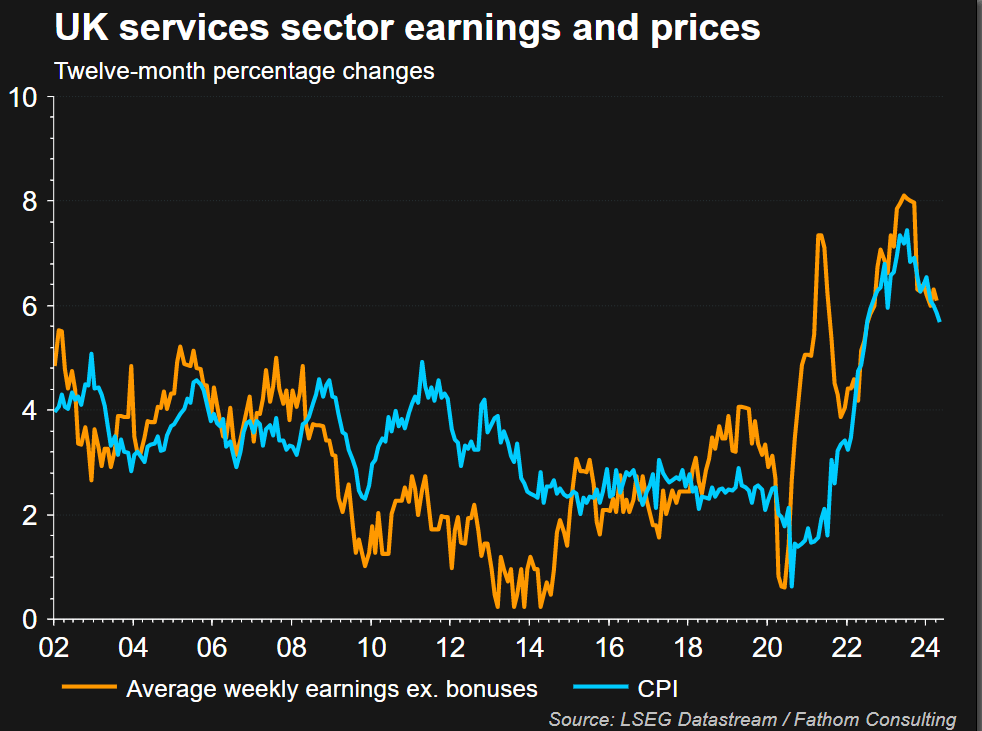

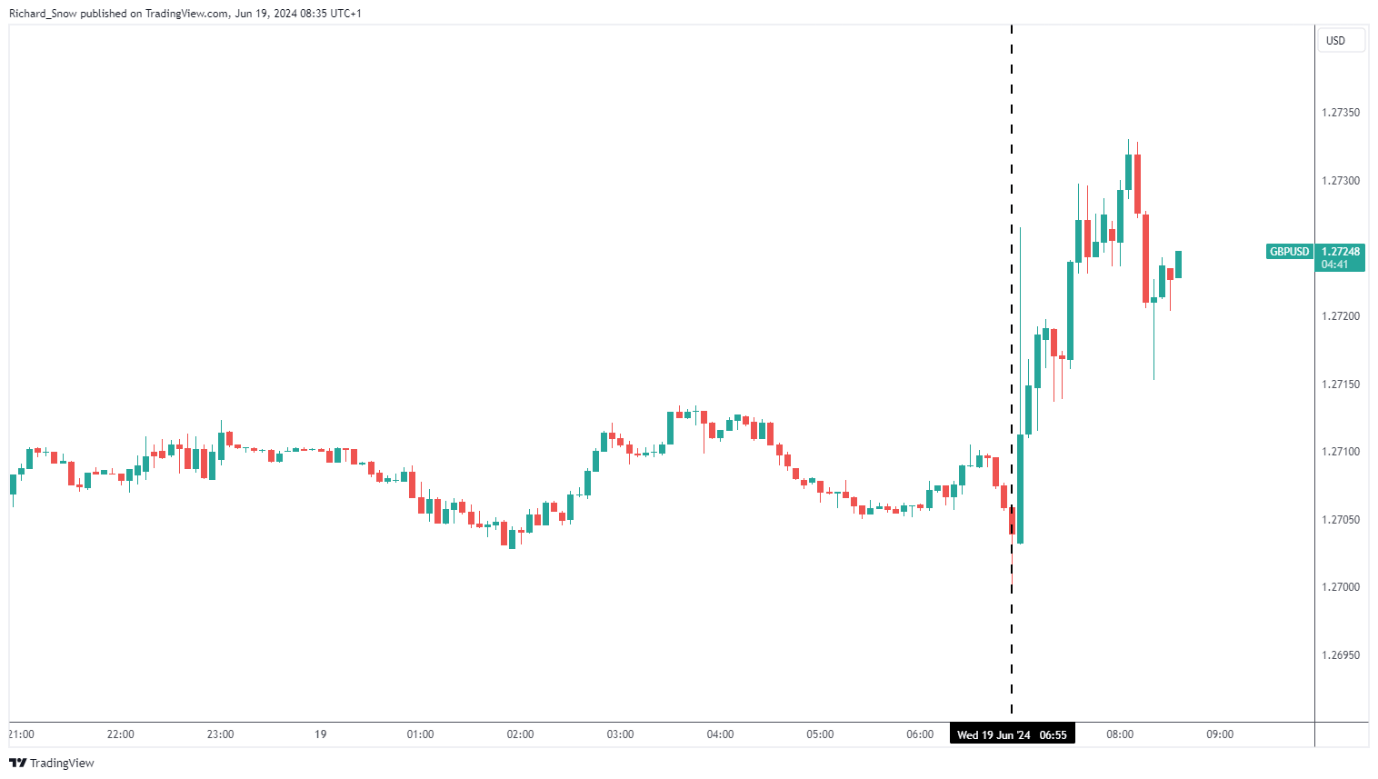

On the back of the stubborn services inflation print, GBP/USD rose a tad in the minutes after the release.

GBP/USD 5-Minute Chart

Source: TradingView, prepared by Richard Snow

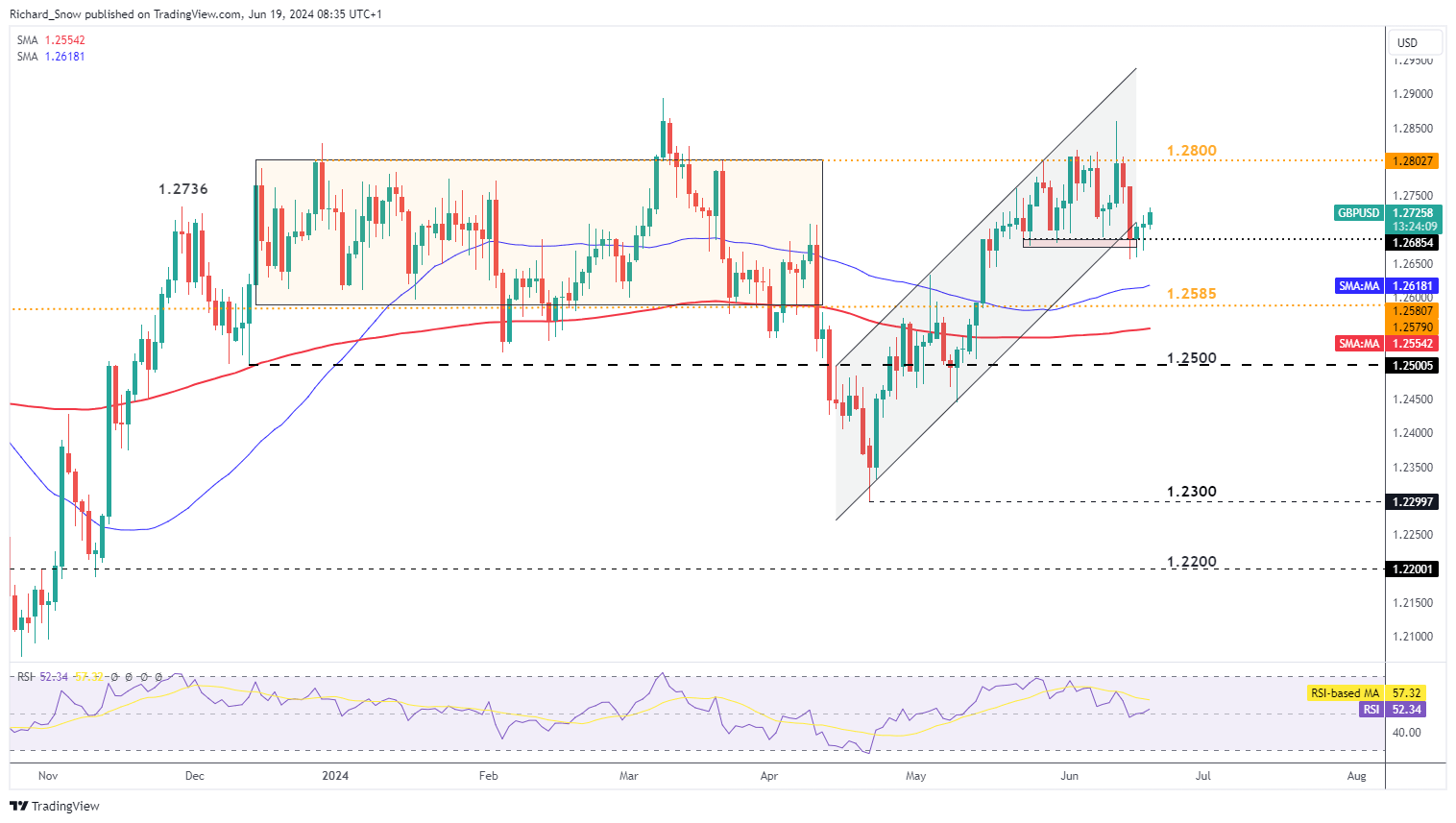

GBP/USD continues to edge higher after hawkish revisions to last week’s Fed projection for inflation and growth jolted the dollar back into life. The pair appears to have found support around 1.2685 ahead of the BoE meeting with 1.2800 the next notable level of resistance.

GBP/USD Daily Chart

Source: TradingView, prepared by Richard Snow

Recommended by Richard Snow

How to Trade GBP/USD

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX