The second quarter saw relatively subdued price movements for Bitcoin as demand from spot ETF buyers was counterbalanced by selling from cash holders. As we approach the end of Q2 and the beginning of Q3, Bitcoin is trading slightly lower around the $65,000 level. However, the cryptocurrency is poised for potential upside over the next three months, fueled by expectations of increasing institutional adoption.

Spot Bitcoin ETFs

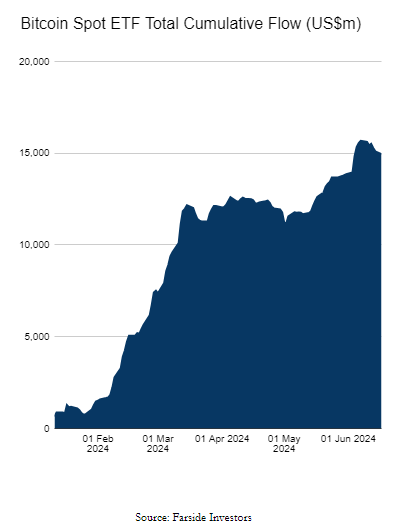

Since the launch of various spot Bitcoin ETFs, these products have collectively attracted over $60 billion in inflows. A diverse range of investors, spanning retail and hedge funds, have entered the cryptocurrency market through these regulated investment vehicles. Spot Bitcoin ETFs provide mainstream investors with a convenient way to gain exposure to Bitcoin through their brokerage accounts, albeit with associated management and brokerage fees. Unlike Bitcoin futures ETFs, spot Bitcoin ETFs directly invest in bitcoins as the underlying asset.

The recent Bitcoin Halving event, which occurred on April 20th, resulted in a reduction of mining rewards from 6.25 Bitcoins per block to 3.125 Bitcoins. With an average of 144 blocks mined daily, the new supply of Bitcoin entering the system stands at approximately 450 coins per day. As of mid-June, spot Bitcoin ETFs had collectively accumulated nearly 15,000 Bitcoins, significantly overshadowing the mining supply.

Bitcoin Mining Cuts Rewards

The recent Bitcoin Halving event, which occurred on April 20th, resulted in a reduction of mining rewards from 6.25 Bitcoins per block to 3.125 Bitcoins. With an average of 144 blocks mined daily, the new supply of Bitcoin entering the system stands at approximately 450 coins per day. As of mid-June, spot Bitcoin ETFs had collectively accumulated nearly 15,000 Bitcoins, significantly overshadowing the mining supply.

Bitcoin Halving – Supply and Demand

While existing holders of Bitcoin, including the prominent Grayscale investment firm, have been instrumental in bridging the supply gap, a potential supply-demand mismatch looms if demand remains constant. The halving event has effectively reduced the rate at which new Bitcoin enters circulation, and if demand persists at current levels or increases, a shortage of available Bitcoin could arise.

This supply-demand imbalance, exacerbated by the diminished mining rewards, poses a challenge for the market. Unless existing holders continue to provide liquidity or demand wanes, the scarcity of new Bitcoin could potentially drive prices higher due to the limited supply.

Bitcoin Spot EFT

Source: Farside Investors

After acquiring a thorough understanding of the fundamentals impacting Bitcoin (BTC) in Q3, why not see what the technical setup suggests by downloading the full Bitcoin forecast for the third quarter?

Recommended by Nick Cawley

Get Your Free Bitcoin Forecast

Ethereum ETFs – Ready to Roll

Towards the end of May, the U.S. Securities and Exchange Commission (SEC) granted approval for key regulatory filings associated with spot Ethereum ETFs. Specifically, the SEC green-lighted the 19b-4 forms related to these ETFs, which represent a crucial step in the approval process. However, before these investment products can become available to investors, the SEC must still provide its blessing for the accompanying S-1 filings.

While the approval of the 19b-4 forms is a significant milestone, the final authorization for the spot Ethereum ETFs is contingent upon the SEC’s review and approval of the S-1 filings. Market participants anticipate that the SEC will complete this final stage of the approval process in early June, paving the way for investors to gain exposure to Ethereum through these regulated investment vehicles.

The impending launch of spot Ethereum ETFs is being closely watched by market participants, as it would provide mainstream investors with a regulated means to gain exposure to the world’s second-largest cryptocurrency by market capitalization.

Bitcoin & Ethereum – Basic Differences

Bitcoin and Ethereum, while both being prominent cryptocurrencies, serve distinct purposes within the broader digital asset ecosystem. Bitcoin was primarily conceived as an alternative to traditional fiat currencies, functioning as a decentralized medium of exchange and store of value, while Ethereum is a programmable blockchain that extends beyond the realm of digital currencies. The approval of Ethereum ETFs will give investors a different avenue, and investment angle, into the cryptocurrency.

While Bitcoin remains notably below its all-time high, ongoing Bitcoin ETF demand, new Ethereum ETF demand, and lower BTC mining rewards will continue to underpin both Bitcoin and Ethereum and should see them both hit new all-time highs in the coming months.

Recommended by Nick Cawley

Get Your Free Introduction To Cryptocurrency Trading